The market gained back its momentum for the first time in the last five consecutive sessions and clocked one percent gains on March 8. The broader markets also joined the rally with the Nifty Midcap 100 and Smallcap 100 indices rising 1.24 percent and 1.51 percent respectively.

All sectors, barring metal, supported the market to snap the four-day losing streak. The BSE Sensex jumped 581 points to 53,424, while the Nifty50 rose 150 points to 16,013 and formed a bullish candle which resembles a Bullish Engulfing kind of pattern on the daily charts.

"The daily price action formed an 'Engulfing Bullish' pattern as short-term trend reversal formation indicated some bounce-back rally in the short term," says Rajesh Palviya, VP - Technical and Derivative Research at Axis Securities.

From current levels, he says 16,000-16,050 remains a crucial level to watch out for. "Any sustainable close above the same may cause upside towards 16,300-16,500 in the coming sessions," Palviya added.

On the other hand, 15,650-15,600 will be a crucial support zone. He advised short-term traders to buy and accumulate stocks with a stop-loss of 15,500.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 15,780, followed by 15,547. If the index moves up, the key resistance levels to watch out for are 16,138 and 16,262.

The Nifty Bank climbed 287 points to 33,158. The important pivot level, which will act as crucial support for the index, is placed at 32,454, followed by 31,751. On the upside, key resistance levels are placed at 33,563 and 33,967 levels.

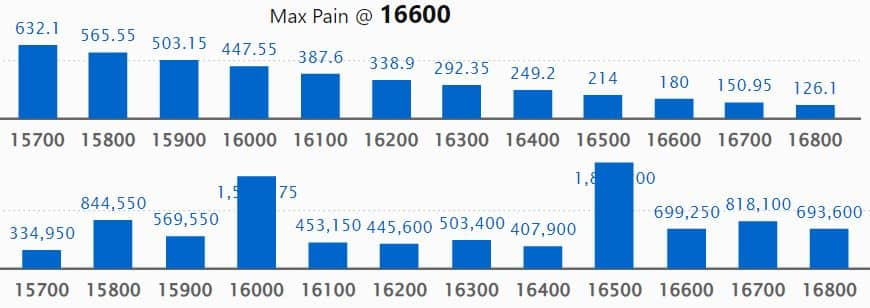

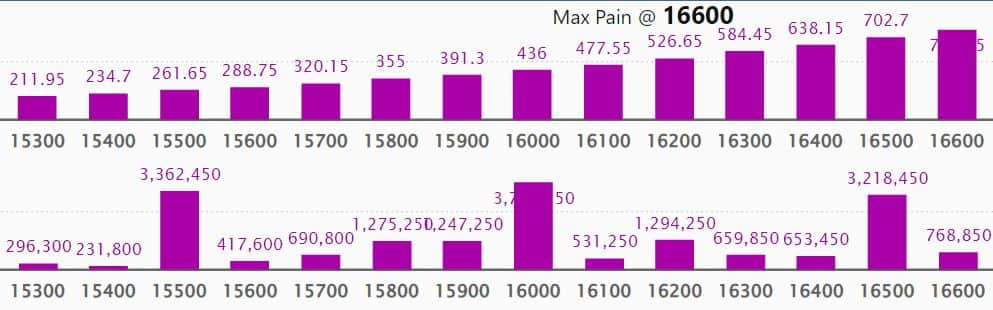

Maximum Call open interest of 19.79 lakh contracts was seen at 17,000 strike, which will act as a crucial resistance level in the March series.

This is followed by 16,500 strike, which holds 18.07 lakh contracts, and 16,000 strike, which has accumulated 15.85 lakh contracts.

Call writing was seen at 16,100 strike, which added 3.14 lakh contracts, followed by 16,000 strike which added 2.52 lakh contracts, and 15,700 strike which added 2.38 lakh contracts.

Call unwinding was seen at 16,600 strike, which shed 48,600 contracts, followed by 15,500 strike which shed 16,850 contracts.

Maximum Put open interest of 37.23 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the March series.

This is followed by 15,500 strike, which holds 33.62 lakh contracts, and 16,500 strike, which has accumulated 32.18 lakh contracts.

Put writing was seen at 15,700 strike, which added 2.51 lakh contracts, followed by 15,500 strike, which added 2.36 lakh contracts, and 15,800 strike which added 1.22 lakh contracts.

Put unwinding was seen at 15,200 strike, which shed 3.76 lakh contracts, followed by 16,500 strike which shed 2.95 lakh contracts, and 16,300 strike which shed 73,700 contracts.

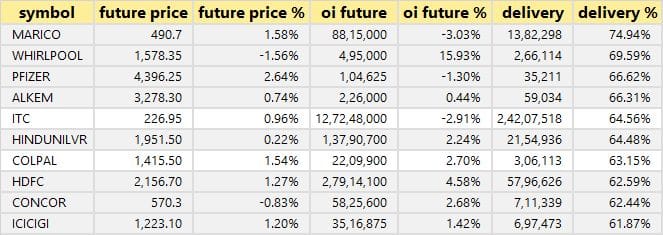

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Marico, Whirlpool, Pfizer, Alkem Laboratories, and ITC among others on Tuesday.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen including GSPL, Bank Nifty, Bajaj Auto, ICICI Bank, and SBI.

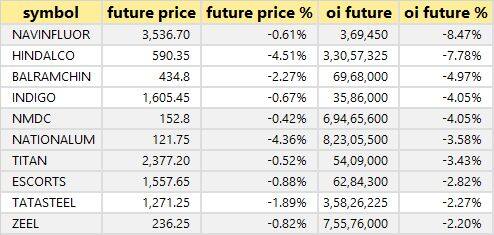

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen including Navin Fluorine International, Hindalco Industries, Balrampur Chini Mills, InterGlobe Aviation, and NMDC.

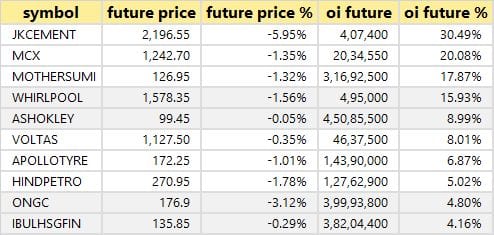

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the 10 stocks in which a short build-up was seen including JK Cement, MCX India, Motherson Sumi Systems, Whirlpool, and Ashok Leyland.

81 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen including Nifty Financial, Indraprastha Gas, AU Small Finance Bank, SBI Card, and Dalmia Bharat.

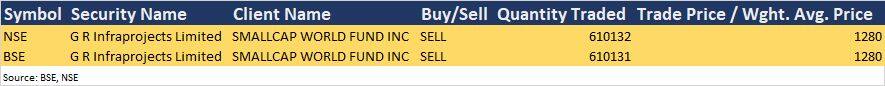

GR Infraprojects: Smallcap World Fund Inc sold 12,20,263 equity shares in the company via open market transactions. These shares were sold at an average price of Rs 1,280 per share.

(For more bulk deals, click here)

Analysts/Investors Meetings

UltraTech Cement: The company's officials will meet MAN Group, and Kotak Mahindra Asset Management Company on March 9.

Shoppers Stop: The company's officials will meet Sharekhan on March 9.

Poonawalla Fincorp: The company's officials will meet Amansa Capital Pte Ltd on March 9.

UPL: The company's officials will meet Aditya Birla Mutual Fund, Envision Capital Services, Helios Capital, ICICI Prudential Life Insurance, Kotak Life Insurance, Max Life Insurance, Old Bridge Capital Management, Tata AIA Life Insurance, Tusk Investments, Value Quest Investment Advisors on March 9.

Sapphire Foods India: The company's officials will meet New Horizon Investments on March 9; and Nirmal Bang on March 11.

Crompton Greaves Consumer Electricals: The company's officials will meet Mirae Asset Global Investments, and ICICI Prudential AMC on March 9; Fidelity International on March 10; and MFS International & Sundaram Mutual Fund on March 11.

Jindal Stainless: The company's officials will attend Investec Capital Services' investor meeting on March 9.

CRISIL: The company's officials will meet Quantum Advisors on March 10.

SMC Global Securities: The company's officials will attend Valorem Advisors' Investor Conference on March 10.

Voltas: The company's officials will meet Nirmal Bang, and Enam Asset Management on March 10; FSSA Investment Managers on March 11; and IIFL Capital & Dolat Capital Market on March 14.

Fortis Healthcare: The company's officials will participate Goldman Sachs India Pharma and Healthcare Tour 2022 on March 10; and Jefferies India Mid-Cap Summit on March 15.

KEC International: The company's officials will meet HDFC Securities on March 10; and Prabhudas Lilladher on March 14.

Escorts: The company's officials will attend Credit Suisse Asian Investment Conference on March 24.

Stocks in News

Yasho Industries: The company said its board on March 16 will consider capital expenditure for a new greenfield project with a capacity of 15,500 metric tonne per annum at Bharuch, Gujarat.

Zydus Lifesciences: Zydus' US-based biopharmaceutical arm Sentynl Therapeutics Inc has executed an asset purchase agreement for the sale of BridgeBio's Nulibry (Fosdenopterin) for injection. Nulibry is approved by the US Food and Drug Administration (USFDA) to reduce the risk of mortality in patients with molybdenum cofactor deficiency (MoCD) Type A, an ultra-rare, life-threatening paediatric genetic disorder.

ISGEC Heavy Engineering: The company has bagged a large order for cement waste heat recovery boilers from Shree Cement in Nawalgarh, Rajasthan. The scope of work includes designing, manufacturing, and supplying of PH boiler in the pre heater exhaust and AQC boiler in the cooler exhaust. The current order for the Nawalgarh site will be the third project that Isgec has received from Shree Cement.

Bafna Pharmaceuticals: Promoter SRJR Life Sciences LLP will sell 99,357 equity shares or 0.42 percent stake in the company through open market transactions. The purpose of this stake sale, which will start from March 9, is to achieve minimum public shareholding.

Bharat Forge: The auto ancillary company said its subsidiary Kalyani Strategic Systems (KSSL) has incorporated a joint venture company - Sagar-Manas Technologies (SMTL), with open joint stock company Dastan Transnational Corporation. The joint venture will help the company to participate in joint upgradation and manufacturing/ providing solutions for marine and defence products. Dastan, a Kyrgyzstan entity, is a leading multipurpose enterprise engaged in the development, manufacturing, sale of defence equipment, electronic devices, medical centrifuges, etc. KSSL will hold a 51 percent stake and the balance 49 percent will be held by Dastan in SMTL.

Sun Pharmaceutical Industries: Subsidiary Taro Pharmaceuticals USA Inc has completed the acquisition of subsidiary companies of Galderma. The acquired subsidiaries of Galderma included Galderma Holdings Inc which was incorporated in Delaware, Proactiv YK which was incorporated in Japan, and The Proactiv Company Corporation which was incorporated in Canada. These subsidiaries sold products under the Proactiv, Restorative Elements and In Defense of Skin brands. The company paid $99.279 million for the entire transaction.

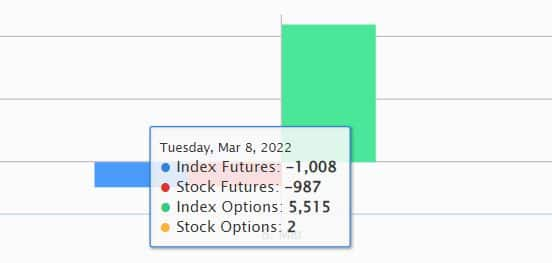

Fund Flow

The relentless selling pressure continues at foreign institutional investors (FIIs) desk as they have net sold shares worth Rs 8,142.60 crore. However, domestic institutional investors (DIIs) have bought shares worth Rs 6,489.59 crore on March 8, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Not a single stock is under the F&O ban for March 9. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Trade setup for Wednesday: Top 15 things to know before Opening Bell - Moneycontrol

Read More

No comments:

Post a Comment