The heavy sell-off in the market continued for yet another session on March 7 as the benchmark indices as well as broader markets corrected more than 2 percent, dented by growth and inflation concerns. In commodities market, oil prices jumped to a 13-year high amid a fear of possible ban by US and allies on Russian oil and natural gas.

The BSE Sensex tanked 1,491 points or 2.74 percent to 52,843, while the Nifty50 corrected 382 points or 2.35 percent to 15,863 and formed Doji candle on the daily charts.

"Normally, a formation of such Doji patterns after a reasonable upmoves or down moves could be considered as an impending reversal pattern post confirmation. Hence, there is a possibility of an upside bounce in the short term," says Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He further says the short term trend of Nifty continues to be weak. "The last hour upside recovery of Monday could bring some hopes of pullback rally in the short term. A sustainable upside bounce is expected from there or from the lows of 15,700-15,500 levels in the next few sessions."

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 15,735, followed by 15,607. If the index moves up, the key resistance levels to watch out for are 15,968 and 16,073.

Bears tightened their grip over banking stocks on March 7 as the Nifty Bank plunged 1,536 points or 4.5 percent to 32,871. The important pivot level, which will act as crucial support for the index, is placed at 32,317, followed by 31,763. On the upside, key resistance levels are placed at 33,484 and 34,097 levels.

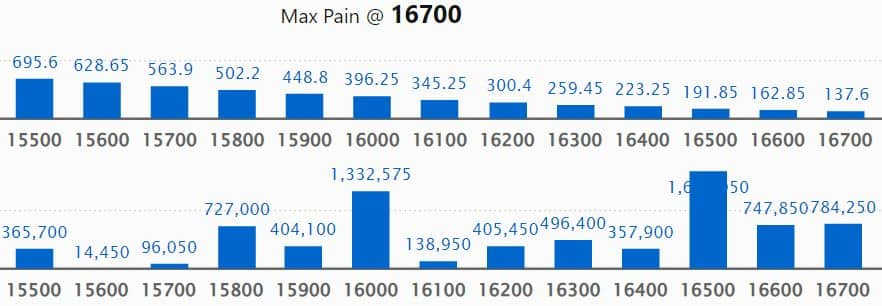

Maximum Call open interest of 19.65 lakh contracts was seen at 17,000 strike, which will act as a crucial resistance level in the March series.

This is followed by 16,500 strike, which holds 16.72 lakh contracts, and 16,000 strike, which has accumulated 13.32 lakh contracts.

Call writing was seen at 16,000 strike, which added 7.66 lakh contracts, followed by 15,800 strike which added 7.14 lakh contracts, and 15,900 strike which added 3.88 lakh contracts.

Call unwinding was seen at 16,300 strike, which shed 1.32 lakh contracts, followed by 17,000 strike which shed 48,200 contracts, and 16,700 strike which shed 39,600 contracts.

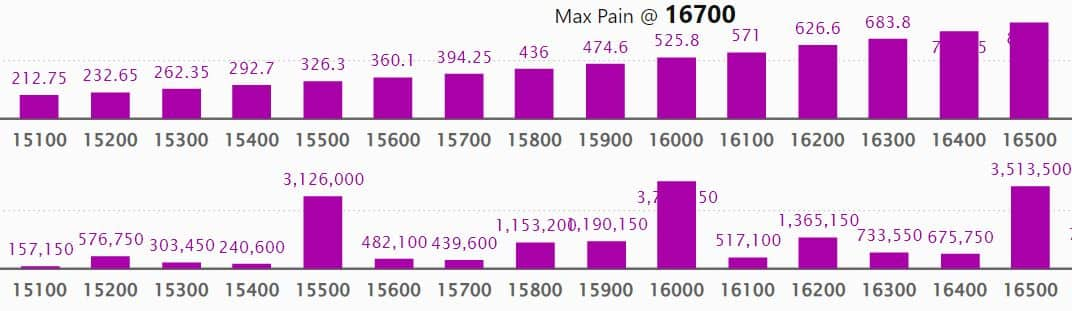

Maximum Put open interest of 37.48 lakh contracts was seen at 16,000 strike. This is followed by 16,500 strike, which holds 35.13 lakh contracts, and 15,500 strike, which has accumulated 31.26 lakh contracts.

Put writing was seen at 15,200 strike, which added 3.94 lakh contracts, followed by 15,800 strike, which added 3.61 lakh contracts, and 15,000 strike which added 2.58 lakh contracts.

Put unwinding was seen at 16,500 strike, which shed 7.82 lakh contracts, followed by 16,000 strike which shed 5.04 lakh contracts, and 15,500 strike which shed 3.45 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Oracle Financial Services Software, Nestle India, Sun TV Network, Page Industries, and Berger Paints among others on Monday.

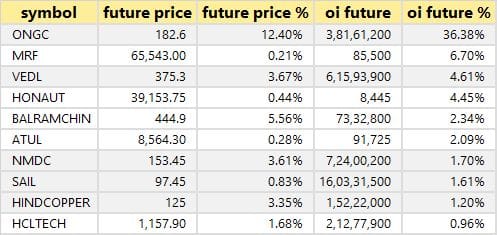

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen including ONGC, MRF, Vedanta, Honeywell Automation, and Balrampur Chini Mills.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen including ICICI Lombard General Insurance Company, Navin Fluorine International, Indian Hotels, ITC, and Bata India.

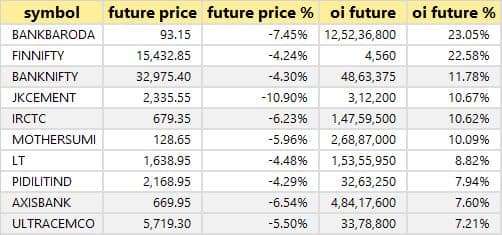

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the 10 stocks in which a short build-up was seen including Bank of Baroda, Nifty Financial, Bank Nifty, JK Cement, and IRCTC.

23 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen including GNFC, UPL, Bharti Airtel, Zee Entertainment Enterprises, and GAIL India.

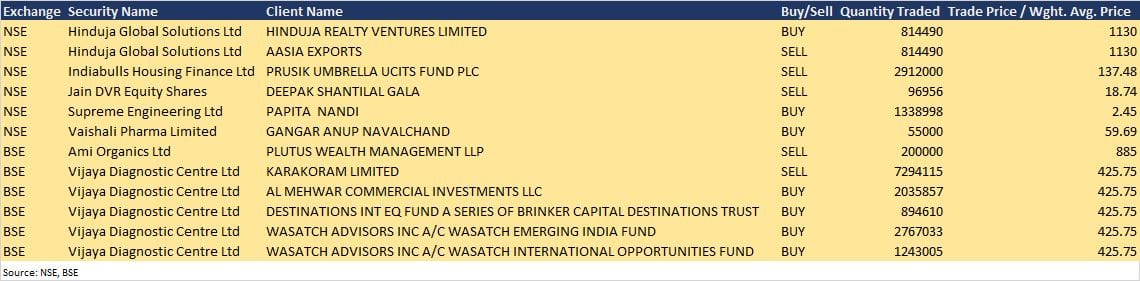

Ami Organics: Investor Plutus Wealth Management LLP has sold 2 lakh equity shares in the company via open market transactions. These shares were sold at Rs 885 per equity share on the BSE.

Vijaya Diagnostic Centre: Investor Karakoram has offloaded 72,94,115 equity shares in the company via open market transactions at an average price of Rs 425.75 per share. This is a 7.1 percent stake of the total paid up capital. However, AL Mehwar Commercial Investments LLC acquired 20,35,857 equity shares, Destinations Int EQ Fund A Series of Brinker Capital Destinations Trust bought 8,94,610 equity shares, and Wasatch Advisors Inc through its funds (Wasatch Emerging India Fund and Wasatch International Opportunities Fund) purchased 40.1 lakh equity shares in the company. These shares were bought at an average price of Rs 425.75 per share.

(For more bulk deals, click here)

Analysts/Investors Meetings

Tata Consumer Products: The company's officials will meet JP Morgan Asset Management on March 8.

UltraTech Cement: The company's officials will meet Bajaj Allianz Life Insurance on March 8.

Cipla: The company's officials will participate Goldman Sachs India Pharma and Healthcare Tour 2022 on March 8.

Manappuram Finance: The company's officials will meet Myriad Asset Management on March 8.

Eicher Motors: The company's officials will attend Credit Suisse Investor Conference on March 8.

Mahindra Holidays & Resorts India: The company's officials will meet IIFL on March 8; and Trident Capital on March 9.

Gland Pharma: The company's officials will meet Kotak Securities on March 8; and Motilal Oswal Financial Services & Wellington Management on March 9.

Hindustan Aeronautics: The company's officials will meet analysts on March 9.

Gujarat Themis Biosyn: The company's officials will meet JMP Capital, and Omkara Capital on March 9.

eClerx Services: The company's officials will meet Blackstone on March 10.

CARE Ratings: The company's officials will meet FSSA Investment Managers, and Goldman Sachs Asset Management (India) on March 11.

Stocks in News

Great Eastern Shipping Company: The firm said its subsidiary Greatship (India) has contracted to sell its 2010 built R-class Platform supply vessel 'Greatship Rohini' for scrapping. Greatship Rohini had suffered damage due to a fire incident on board in February 2021. The vessel is expected to be delivered to the buyer in Q4 FY22.

Natco Pharma: The pharma company launched its first generic version of Revlimid (Lenalidomide capsules), in the US market. These capsules are available in 5mg, 1Omg, 15mg, and 25mg strengths. The drug is used for the treatment of multiple myeloma in combination with the medicine dexamethasone, certain myelodysplastic syndromes, and mantle cell lymphoma following specific prior treatment.

Metro Brands: The company has approved an interim dividend of Rs 1.50 per equity share on its face value of Rs 5 each for FY22. The record date has been fixed as March 19 for ascertaining the eligibility of shareholders for payment of interim dividend.

NLC India: The company has declared an interim dividend of Rs 1.50 per equity share for the financial year 2021-22.

Arihant Superstructures: Deepak Lohia has resigned as Chief Financial Officer of the company. The company has already searched Rajendra Pawar to take the position of CFO. The proposal will be kept in next board meeting for CFO appointment.

Dodla Dairy: The dairy company said the board has approved purchase of asset, business, and plant & machinery up to Rs 55 crore. It has also approved funding for subsidiaries Orgafeed, and Dodla Dairy Kenya, up to Rs 40 crore each.

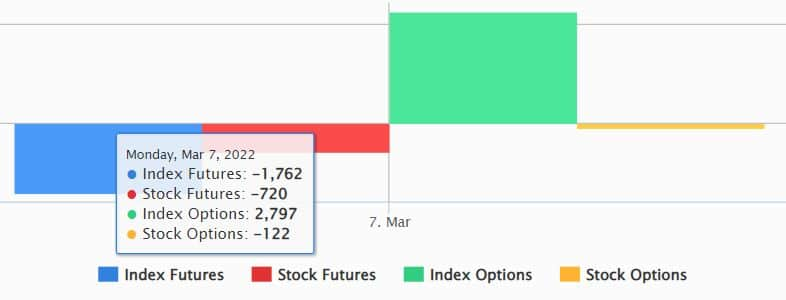

Fund Flow

The selling by foreign institutional investors (FIIs) remains strong as they have net offloaded shares worth Rs 7,482.08 crore. However, domestic institutional investors (DIIs) have bought shares worth Rs 5,331.03 crore on March 7, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Not a single stock is under the F&O ban for March 8. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Trade setup for Tuesday: Top 15 things to know before Opening Bell - Moneycontrol

Read More

No comments:

Post a Comment