Nifty may take support at 21,300 if it breaks 21,500

The market fell nearly a percent and again reached the crucial support of the 21,500 mark while breaking the 10-day EMA (exponential moving average of 21,569) within a week. Overall, it still seems to be in the range of 21,500-21,850, but in case of breaking the said support, the 21,350-21,300 zone will be key to watch out for on the downside, while on the higher side, the 21,800-21,850 zone will remain a the hurdle, said experts.

On January 8, the BSE Sensex plunged 671 points to 71,355, while the Nifty 50 dropped 198 points to 21,513 and formed a long bearish candlestick pattern, which resembles a Bearish Engulfing kind of candlestick pattern on the daily charts, indicating the possibility of a trend reversal.

"The market reacting down sharply after a small rise is signalling a presence of strong overhead resistance around 21,750-21,800 levels," Nagaraj Shetti, senior technical research analyst at HDFC Securities said.

The positive chart pattern like higher tops and bottoms is intact, but he feels the formation of a new lower top at 21,763 could be an alarming signal for bulls at the higher levels.

"The next lower supports to be watched at 21,350 (20-day EMA). Immediate resistance is placed at 21,650 levels," he said.

Kunal Shah, senior technical & derivative analyst at LKP Securities also said the above chart pattern formation indicates a change in market sentiment. "The support of 21,500 if held can see recovery towards 21,650 which is the immediate hurdle zone."

The volatility also increased sharply, making the bulls uncomfortable at Dalal Street. The India VIX jumped 7.06 percent to 13.46, from 12.63 levels.

The broader markets were also under pressure with the Nifty Midcap 100 and Smallcap 100 indices falling 1 percent and 0.6 percent, respectively.

Story continues below Advertisement

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

The pivot point calculator indicates that the Nifty is likely to see immediate resistance at 21,538 followed by 21,758 and 21,861 levels, while on the lower side, it can take support at 21,486 followed by 21,422 and 21,319 levels.

On January 8, the Bank Nifty bears staged a strong comeback as the index has decisively broken the 48,000 mark and closed 709 points or 1.5 percent lower at 47,450. The banking index has formed a long bearish candlestick pattern on the daily charts breaking not only the 10-day EMA but also the 20-day EMA, indicating the possibility of further selling pressure.

Selling pressure was evident across the banking sector. "Sustained move below 47,700 may result in further declines towards the 47,000 level. To resume the uptrend, the index must surpass the key resistance at 48,300, targeting the 50,000 mark," Kunal Shah of LKP Securities said.

As per the pivot point calculator, the Bank Nifty is expected to see resistance at the 47,521 level followed by 48,138 and 48,431 levels, while on the lower side, it may take support at 47,371 followed by 47,190 and 46,897 levels.

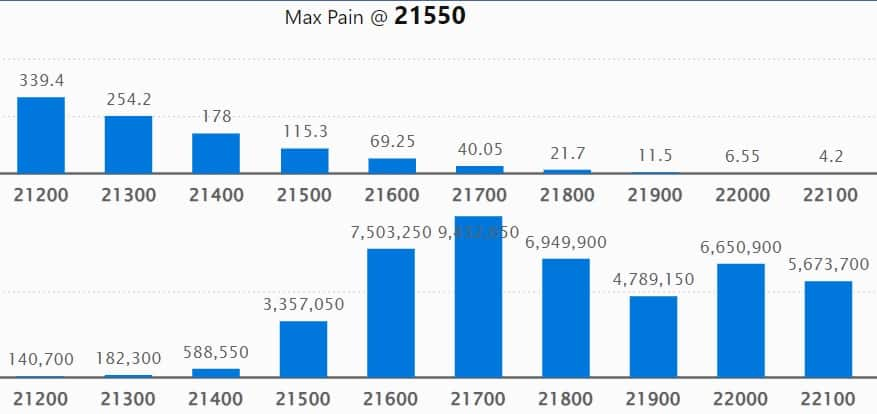

As per the weekly options data, the maximum Call open interest was seen at 21,700 strike, with 94.32 lakh contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 21,600 strike, which had 75.03 lakh contracts, while the 22,200 strike had 71.93 lakh contracts.

Meaningful Call writing was seen at the 21,600 strike, which added 58.88 lakh contracts followed by 22,200 and 21,700 strikes adding 39 lakh and 39.81 lakh contracts, respectively.

The maximum Call unwinding was at the 23,000 strike, which shed 15.1 lakh contracts followed by 22,500 and 22,300 strikes that shed 12.59 lakh and 12.14 lakh contracts.

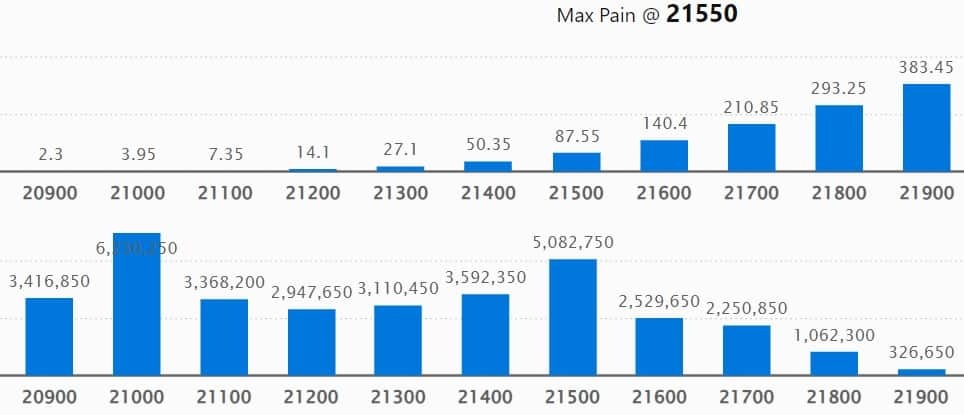

On the Put front, the 21,000 strike owned the maximum open interest, which can act as a key support area for the Nifty with 62.3 lakh contracts. It was followed by 21,500 strike comprising 50.82 lakh contracts and then 21,400 strike with 35.92 lakh contracts.

Meaningful Put writing was at 21,100 strike, which added 13.32 lakh contracts followed by 20,900 strike and 21,400 strike adding 6.17 lakh contracts and 6.02 lakh contracts, respectively.

The Put unwinding was seen at 21,700 strike, which shed 19.2 lakh contracts followed by 21,600 strike and 20,800 strike, which shed 14.18 lakh contracts and 4.69 lakh contracts, respectively.

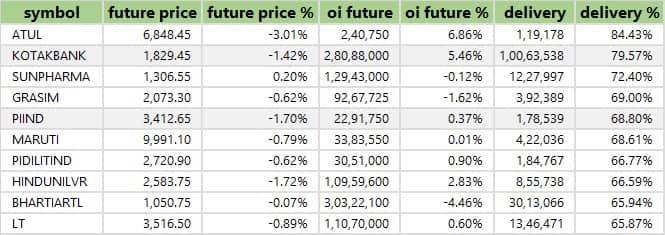

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Atul, Kotak Mahindra Bank, Sun Pharmaceutical Industries, Grasim Industries and PI Industries saw the highest delivery among the F&O stocks.

A long build-up was seen in 16 stocks, which included JK Cement, GMR Airports Infrastructure, AU Small Finance Bank, HCL Technologies and ICICI Prudential Life Insurance Company. An increase in open interest (OI) and price indicates a build-up of long positions.

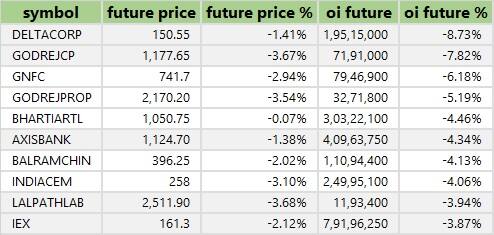

Based on the OI percentage, 67 stocks saw long unwinding, including Delta Corp, Godrej Consumer Products, GNFC, Godrej Properties and Bharti Airtel. A decline in OI and price indicates long unwinding.

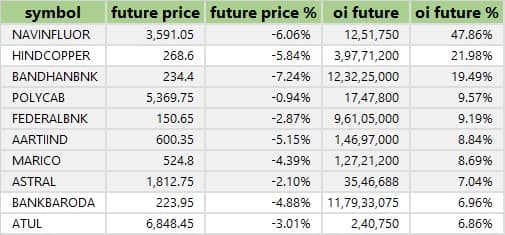

87 stocks see a short build-up

A short build-up was seen in 87 stocks including Navin Fluorine International, Hindustan Copper, Bandhan Bank, Polycab India and Federal Bank. An increase in OI along with a fall in price points to a build-up of short positions.

Based on the OI percentage, 16 stocks were on the short-covering list. This included Chambal Fertilisers and Chemicals, Shriram Finance, TVS Motor Company, Escorts Kubota and Power Grid Corporation of India. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, fell to 0.84 on January 8, from 1.08 levels in the previous session. The below 1 PCR indicates that the traders are buying more Calls options than Puts, which generally indicates an increase in bullish sentiment.

For more bulk deals, click here

Stocks in the news

Lemon Tree Hotels: The hotel chain signed a new hotel in Meerut, Uttar Pradesh. The hotel will be open from FY25 and will be franchised by the company. The hotel will have 75 rooms.

Oil India: The state-owned oil & gas exploration company signed a Joint Venture Agreement (JVA) with Assam Power Generation Corporation to work together in renewable/green energy business. The company will join hands with the public sector company to achieve maximum renewable power generation in the state.

BEML: The company has bagged a Rs 329.87 crore worth order from the Ministry of Defence to supply a Mechanical Minefield Marking Equipment Mark-II.

Brigade Enterprises: The Bengaluru-based real estate developer signed MoUs worth Rs 3,400 crore with the Tamil Nadu government to develop projects in the next 3-4 years as part of the Tamil Nadu Global Investors Meet 2024, Chennai.

Eicher Motors: Royal Enfield signed a non-binding MoU with the Tamil Nadu government to invest Rs 3000 crore over 8 years to build greenfield and brownfield projects in the state as part of the Tamil Nadu Global Investors Meet 2024, Chennai.

Cipla: The pharma company has announced a JV in the US with Kemwell Biopharma and Manipal Education & Medical Group to develop and commercialise novel cell therapy products for unmet medical needs in the US, Japan and the EU.

Bajaj Auto: The two-and-three-wheeler maker said the board of directors approved the proposal to buy back shares worth Rs 4000 crore. The company will buy back 40 lakh equity shares at an average price of Rs 10,000 per share.

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) bought shares worth Rs 16.03 crore, while domestic institutional investors (DIIs) purchased Rs 155.96 crore worth of stocks on January 8, provisional data from the NSE showed.

Stock under F&O ban on NSE

The NSE has added Bandhan Bank to its F&O ban list for January 9, while retaining Balrampur Chini Mills, Chambal Fertilisers & Chemicals, Delta Corp, Escorts Kubota, GNFC (Gujarat Narmada Valley Fertilisers & Chemicals), Hindustan Copper, Indian Energy Exchange, India Cements, National Aluminium Company, Piramal Enterprises, SAIL and Zee Entertainment Enterprises to the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Trade setup for Tuesday: 15 things to know before opening bell - Moneycontrol

Read More

No comments:

Post a Comment