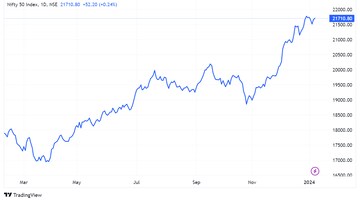

The first week of 2024 turned out to be a volatile one for the Nifty 50. Although the index managed to recoup most of the losses from Tuesday and Wednesday, it could not manage to close above 21,731, which was needed to register a positive weekly close.

After seven back-to-back weeks of gains, the Nifty has now declined in two out of the last three weeks. The 22,000 mark continues to remain elusive as the index continues to face resistance between 21,750 and 21,800. Last week was no different as the Nifty could not sustain above Monday's high of 21,834.

Earnings season begins in the upcoming week with IT heavyweights Infosys, TCS, Wipro and others reporting their December quarter results. That may determine the Nifty trajectory going forward. While the street is not very gung-ho about their prospects for the quarter gone by, the consensus is pricing in a demand recovery from financial year 2025, resulting in the stocks rallying in the month of December.

Friday's session also saw buying from foreign investors in the cash market. However, domestic investors continued to remain heavy sellers, choosing to book profits after the strong rally.

Amol Athawale of Kotak Securities said that the Nifty has formed a doji pattern on the weekly chart, suggesting indecisiveness between the bulls and the bears. 21,800 remains the breakout level for the Nifty and selling pressure may accelerate in case the index drops below 21,600, he added.

The Nifty will continue to find resistance between 21,800 - 21,850, said Nagaraj Shetti of HDFC Securities. A Only a decisive move above 21,850 - 21,900 can open up further upside targets towards 22,200. Dips from these levels will find support at 21,500, he said.

Prevailing sentiment on the Nifty is bullish with initial resistance at 21,750. Immediate downside support is at 21,600, said LKP Securities' Kunal Shah. A conclusive close above 21,750 will lead the index towards 22,000 on the upside, he added.

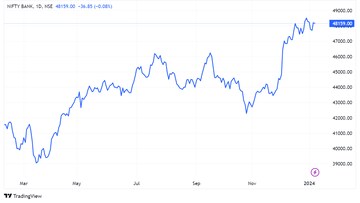

The Nifty Bank also ended lower for the week but the bulls here can take heart from the fact that the index has closed above the mark of 48,000 on a weekly basis in three out of the last four weeks.

LKP's Shah believes that a close above 48,200 is essential for the Nifty Bank for the index to move higher towards levels of 48,500 and 48,800. "A key level to monitor on the downside will be 47,800 for the Nifty Bank," he added.

Athawale of Kotak Securities terms the downside support of 47,500 to be the key for the Nifty Bank in case it has to move towards 48,500 - 48,800. The trend may change if the index happens to fall below the 47,500 mark.

What Are The F&O Cues Indicating?

Nifty 50's January futures added 2% and 2.36 lakh shares in Open Interest. They are currently trading at a premium of 83 points from 127.35 points earlier. On the other hand, Nifty Bank's January futures shed 7.2% and 1.46 lakh shares in Open Interest. Nifty 50's Put-Call Ratio is now at 1.08 from 1.22 earlier.

Piramal Enterprises is in the F&O Ban from Monday's trading session, while Hindustan Copper has exited the ban. Balrampur Chini, Chambal Fertilisers, Delta Corp, Escorts Kubota, GNFC, IEX, India Cements, NALCO, SAIL and Zee Entertainment remain in the F&O ban list.

Nifty 50 on the Call side for January 11 expiry:

For this Thursday's weekly options expiry, the Nifty 50 Call strikes of 21,800 and 21,700 have seen an addition in Open Interest.

| Strike | OI Change | Premium |

| 21,800 | 27.9 Lakh Added | 78 |

| 21,700 | 21.7 Lakh Added | 129 |

Nifty 50 on the Put side for January 11 expiry:

On the Put side, the Nifty 50 strikes of 21,700 and 21,500 have seen addition in Open Interest for this Thursday's expiry.

| Strike | OI Change | Premium |

| 21,700 | 22.1 Lakh Added | 93 |

| 21,500 | 15.5 Lakh Added | 34 |

These stocks added fresh long positions on Friday, meaning an increase in both price and Open Interest:

| Stock | Price Change | OI Change |

| Oracle Financial | 2.34% | 31.98% |

| Biocon | 2.51% | 4.96% |

| Indus Towers | 2.99% | 4.70% |

| Abbott India | 0.73% | 4.68% |

| Hero MotoCorp | 0.74% | 4.36% |

These stocks added fresh short positions on Friday, meaning a decrease in price but increase in Open Interest:

| Stock | Price Change | OI Change |

| Nestle India | -2.17% | 865.21% |

| Shree Cements | -4.93% | 18.17% |

| Kotak Mahindra Bank | -1.18% | 10.18% |

| Alkem Labs | -0.52% | 8.36% |

| Dixon Technologies | -0.49% | 4.24% |

These stocks saw short covering on Friday, meaning an increase in price but decrease in Open Interest:

| Stock | Price Change | OI Change |

| Bosch | 0.43% | -8.23% |

| Godrej Properties | 0.67% | -8.06% |

| Shriram Finance | 1.08% | -7.34% |

| Godrej Consumer Products | 1.12% | -6.17% |

| IPCA Labs | 0.70% | -5.78% |

These stocks saw unwinding of long positions on Friday, meaning a decline in both price and Open Interest:

| Stock | Price Change | OI Change |

| GNFC | -5.62% | -12.72% |

| Chambal Fertilisers | -3.91% | -11.57% |

| Oberoi Realty | -1.48% | -10.23% |

| Gujarat Gas | -0.29% | -9.10% |

| India Cements | -3.20% | -8.97% |

These are the stocks to watch out for ahead of Monday's trading session:

First Published: Jan 7, 2024 6:35 PM IST

Trade Setup for Jan 8: IT earnings to be the Nifty 50's focal point this week - CNBCTV18

Read More

No comments:

Post a Comment