Although IT companies showed little improvement in market confidence following the US Federal Reserve's announcement of potential interest rate cuts in 2024, analysts anticipate a turnaround in the coming quarters based on management's comments on the demand environment.

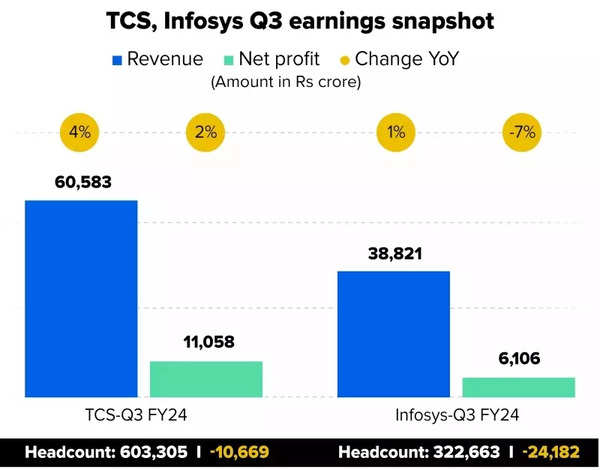

During the fiscal third quarter ending in December, Tata Consultancy Services (TCS), India's largest IT firm, reported a 4% increase in revenue and a 2% growth in profit compared to the same period last year.On the other hand, Infosys, the second largest IT services company, revised its revenue growth guidance for the fiscal year 2024 to 1.5-2.0% after experiencing a 7.3% decline in profit and a 1% increase in revenue.

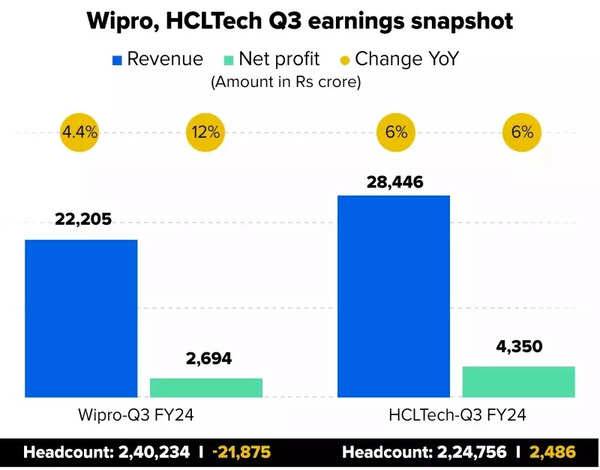

Wipro's profit declined by 12%, marking the fourth consecutive quarter of lower profits. Additionally, its revenue dropped by 4.4%. In contrast, HCLTech witnessed a 6.5% rise in revenue and a 6.2% growth in profit.

TCS, Infosys Q3 earnings snapshot

However, IT sector’s reported deal bookings excited investors, resulting in a surge in IT stocks.

Peter Bendor-Samuel, the chief of IT industry research firm Everest Group, predicts a demand revival by the second quarter of 2024 (April-June) based on the current guidance from these IT companies. He stated that the next two quarters might be challenging due to hesitation in discretionary spending and new initiatives. However, he believes a modest recovery will likely begin by the end of the second quarter (which is the first quarter of FY 2024-25 for Indian firms).

Phil Fersht, the CEO of HfS Research, is optimistic about the companies benefiting from upcoming deals in the market and growth in the UK. Fersht mentioned that there are discussions regarding significant deals in the market, and there is a positive outlook on the realization of these deals in the next few quarters. He also noted increased activity in Europe, particularly in the UK, which could result in substantial engagements.

Wipro, HCLTech earnings snapshot

Despite a one-time provision of $125 million, Tata Consultancy Services continued to report industry-leading margins at 23.4%. Kumar Rakesh, an analyst at BNP Paribas, highlighted that recent strong deal wins have started to drive TCS' revenue growth after a few stagnant quarters. Additionally, the company's margin expansion is exceeding expectations. Rakesh found comfort in TCS' optimistic stance on demand recovery, as the company is witnessing pent-up demand for new technologies and expects the BFSI sector to recover in the coming quarter.

After TCS, Infosys, Wipro & HCL Tech results, experts suggest Indian IT sector rebound likely in FY25 - Times of India - IndiaTimes

Read More

No comments:

Post a Comment