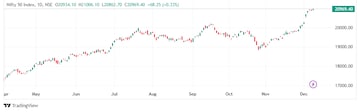

With a 3.5% surge last week, the Nifty 50 not only had its best week of 2023, but also the best one since July 2022. It also crossed the 21,000 mark on an intraday basis on Friday, but failed to sustain above those levels.

The Nifty scaling 21,000 also led to some profit booking in the broader markets with the Nifty Midcap index snapping a 25-day gaining streak, although it managed to recover substantially from the lowest point of the day.

Nifty 50's reversal from the day's high and some profit booking in the Midcap index on Friday may have prompted the question across the street as to whether the indices have made a near-term top for the time being?

That may not be the case if buying from the FPIs continue as it has over the last few sessions. Friday's session also saw heavy buying from them, with Adani-Group investor GQG Partners acquiring a stake in the GMR Airports block deal. Although the FPI participation will reduce as the year draws to a close, a buy figure on most days will keep the market's spirit higher.

Amol Athawale of Kotak Securities said that the market texture is bullish and any meaningful correction should be used as a buying opportunity. For the index traders, Athawale said that 20,800 will act as a meaningful support, while 21,200 - 21,300 will be a profit booking zone.

The level of 21,000 will act as a crucial level for the Nifty as call writers have built their maximum positions at that strike, said Rupak De of LKP Securities. A resumption of the current uptrend will be seen above 21,000, with a potential for the index to reach 21,550. De also said that there are significant Put positions at 20,900 and 20,800, below which, profit booking may increase.

A minor weakness or consolidation may result in the Nifty eventually resuming its further upside in the short-term, according to HDFC Securities' Nagaraj Shetti. He said that the next overhead resistance is at 21,550, while the near-term support is at 20,850.

A last hour surge on the Nifty Bank ensured that the index closed above the 47,000 mark and also had its best week since July 2022. The index has now gained 5,000 points from the lows of October 26. The banking index has now gained in five out of the last six trading sessions.

LKP's De said that a sustained and significant move above 47,200 will trigger a rally in the Nifty Bank, which may push it towards 48,000 in the short-term. Support on the downside is placed at 46,500.

Athawale of Kotak Securities said that the short-term texture is bullish with a key support zone between 46,500 - 46,200 and sustaning above these levels can take the index towards 47,800 - 48,000.

What Are The F&O Cues Indicating?

Nifty 50's December futures shed 3.2% and 3.9 lakh shares in Open Interest on Friday. They are trading at a premium of 105.6 points from 129.65 points earlier. On the other hand, Nifty Bank's December futures added 5.6% and 1.07 lakh shares in Open Interest. Nifty 50's Put-Call Ratio is now at 1.2 from 1.34 earlier.

Hindustan Copper has entered the F&O ban list from today's session, while India Cements is out of the ban. Balrampur Chini, NALCO, Delta Corp, Indiabulls Housing Finance, Zee Entertainment and SAIL remain in the ban list.

Nifty 50 on the Call side for December 14 expiry:

For this Thursday's weekly expiry, the Nifty 50 call strikes between 21,000 and 21,150 saw Open Interest addition, with the former seeing the maximum addition in Open Interest.

| Strike | OI Change | Premium |

| 21,000 | 16.17 Lakh Added | 110.4 |

| 21,100 | 15.07 Lakh Added | 67.85 |

| 21,150 | 10.73 Lakh Added | 51.8 |

Nifty 50 on the Put side for December 14 expiry:

On the Put side, the Nifty 50 strikes between 20,800 and 20,900 have seen Open Interest addition for this Thursday's weekly expiry.

| Strike | OI Change | Premium |

| 20,900 | 14.16 Lakh Added | 57.2 |

| 20,850 | 12.3 Lakh Added | 43.25 |

| 20,800 | 11.89 Lakh Added | 32.4 |

These stocks added fresh long positions on Friday, meaning an increase in both price and Open Interest:

| Stock | Price Change | OI Change |

| GMR Airports | 11.90% | 52.33% |

| Hindustan Copper | 0.70% | 18.14% |

| Coforge | 1.33% | 10.15% |

| UltraTech | 0.65% | 7.53% |

| Bank of Baroda | 0.45% | 5.93% |

These stocks added fresh short positions on Friday, meaning a decrease in price but increase in Open Interest:

| Stock | Price Change | OI Change |

| ITC | -1.89% | 6.17% |

| Bajaj Finance | -0.97% | 5.55% |

| Tata Steel | -0.54% | 5.00% |

| BPCL | -1.02% | 4.64% |

| Aditya Birla Capital | -1.70% | 4.36% |

These stocks witnessed some short covering on Friday, meaning an increase in price but decrease in Open Interest:

| Stock | Price Change | OI Change |

| India Cements | 4.08% | -9.35% |

| L&T Technology Services | 0.33% | -8.74% |

| Zee Entertainment | 3.26% | -6.92% |

| MRF | 0.15% | -4.76% |

| Interglobe Aviation | 0.78% | -4.05% |

Here are the stocks to watch out for ahead of Monday's trading session:

First Published: Dec 10, 2023 6:10 PM IST

Trade Setup for December 11: Has the Nifty made a near-term top after crossing 21,000? - CNBCTV18

Read More

No comments:

Post a Comment