Nifty at 24700: Shifting orbit on election thrust; ICICI Direct bets big on RIL, PNB, Hindalco and 6 others (Pic: iStock/ET NOW News)

TOPICS COVERED:

The brokerage said that its prognosis is a culmination of triangulation model which projected Nifty 2024 target of 24,700 while key support is placed at 18,900.

The sectoral leadership and bottom up stock analysis indicate glaring resemblance with 2004-07 bull run, it said.

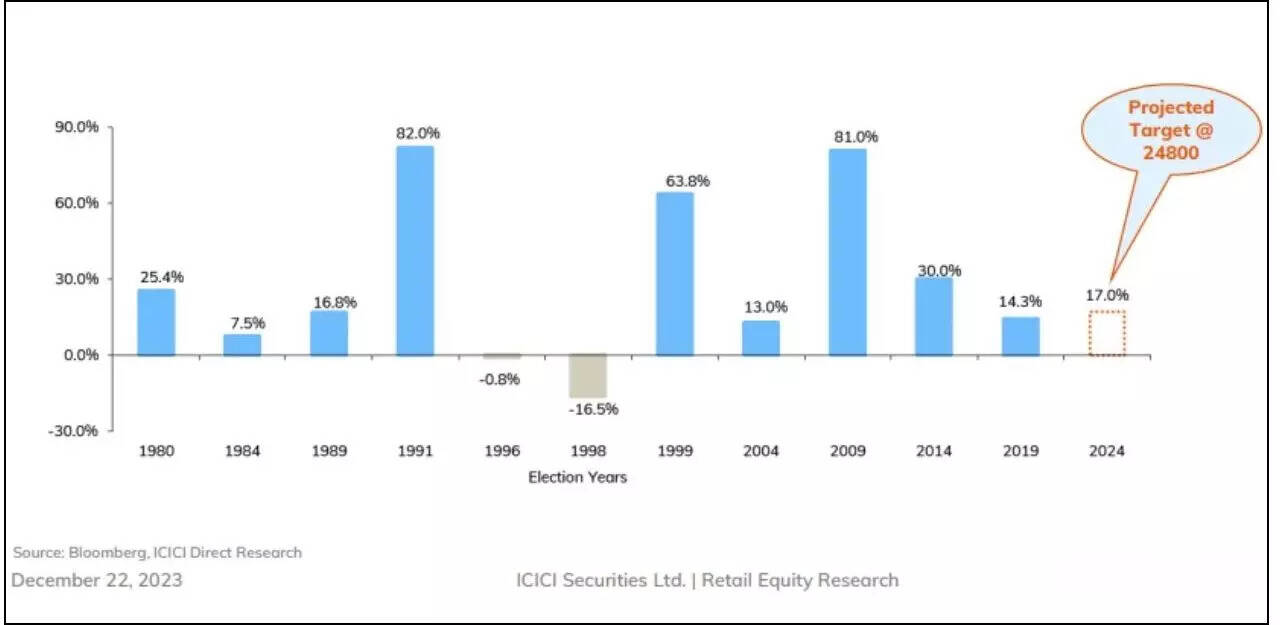

"Going by four decade history, median returns in election year has been 17 per cent. Therefore, one should use volatility during election year as a buying opportunity," the report said.

Nifty Performance In Election Years

Nifty In 2024: 5 Themes

1. Historically, equity returns in general election year has been positive on nine out of eleven occasions (median 17%).

2. Empirically (since past four decades) fourth year of a decade has always been rewarding with median 15% returns.

3. Large caps, which have been laggards, to catchup post couple of years underperformance.

4. Capital Goods & Infra, PSU, Metal, Energy turning to be leaders after decadal underperformance, while BFSI and IT would maintain their upward trajectory.

5. Technically, global market setups becomes more supportive as US and European indices are coming out of two years of hiatus.

ICICI Direct has recommended 9 stocks that with an average potential gain of of 21 per cent in 2024:

Reliance Industries Share Price Target 2024: Buy: Rs 2500-2575; Target: Rs 3030; Support: Rs 2220; Upside: 18%

Hindalco Share Price Target 2024: Buy: Rs 545-575; Target: 675; Support: Rs 456; Upside: 19%

Tech Mahindra Share Price Target 2024: Buy: Rs 1220-1285; Target: 1500; Support: Rs 1096; Upside: 18%

PNB Share Price Target 2024: Buy: Rs 85-92, Target: Rs 112; Support: Rs 78; Upside: 26%

Glaxo Pharma Share Price Target 2024: Buy: Rs 1690-1770; Target: Rs 2180; Support: Rs 1540; Upside: 25%

LIC Housing Finance Share Price Target 2024: Buy: Rs 490-525; Target: Rs 670; Support: Rs 450; Upside: 30%

CESC Share Price Target 2024: Buy: Rs 115-123; Target: Rs 160; Support: Rs 101; Upside: 36%

Tega Industries Share Price Target 2024: Buy: Rs 1050-1120; Target: Rs 1350; Support: Rs 905; Upside: 24%

Arvind Fashion Share Price Target 2024: Buy: Rs 390-420; Target: Rs 525; Support: Rs 335; Upside: 29%

Web Stories

Nifty at 24700: Shifting orbit on election thrust; ICICI Direct bets big on RIL, PNB, Hindalco and 6 others - ET Now

Read More

No comments:

Post a Comment