Unlock detailed analysis of business news only on our App

5M+ Downloads

App Exclusive Features

1/10

D-Street Outlook

As we enter into 2024, the bulls are holding the strings tight, but analysts expect overall returns to moderate in the next year.

Here’s how 2024 is set to look like for Dalal Street, according to a survey by ETMarkets:

2/10

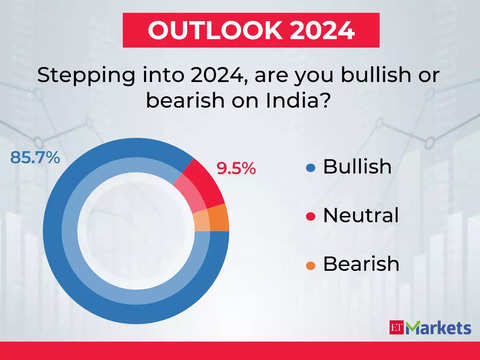

Bullish or Bearish

Stepping into 2024, around 86% of the 24 analysts that participated in ETMarkets survey are bullish on Indian equities.

3/10

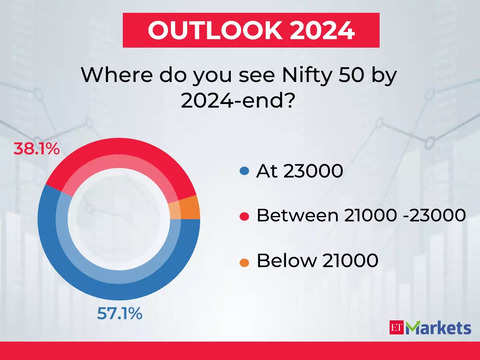

Nifty 50 Target

About 57% of the respondents see benchmark Nifty 50 at 23000 odd levels by the end of 2024. This implies an upside of around 6% from the current levels.

4/10

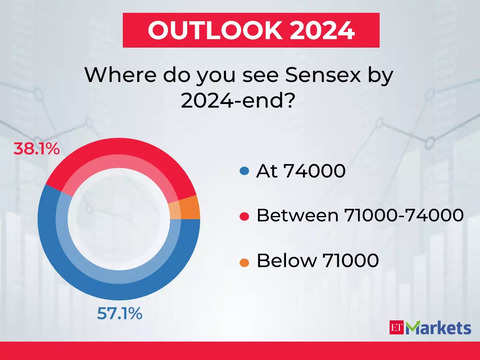

Sensex Target

About 57% of the respondents see benchmark Sensex at 74000 odd levels by the end of 2024. This implies an upside of over 2% from the current levels.

5/10

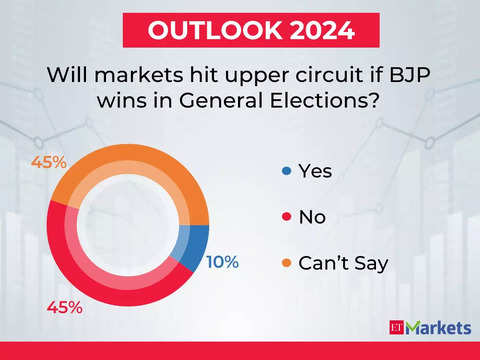

Election Impact

Analysts are divided on whether equity indices will hit upper circuit if the incumbent government attains victory for the third straight time in the upcoming general elections in 2024. Around 45% of the respondents don’t see indices hitting upper circuits, while an equal number of analysts aren’t able to predict.

6/10

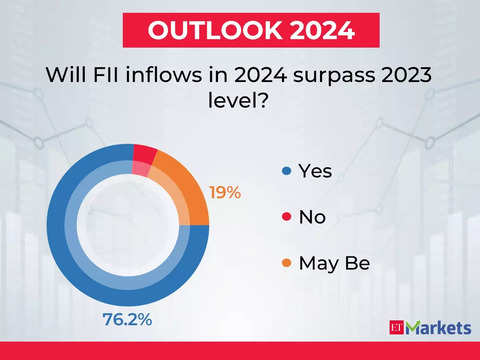

FII Flow Picture

7/10

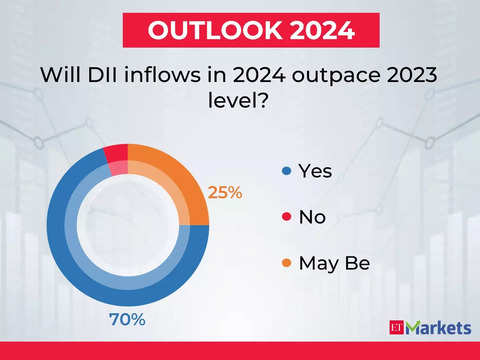

DII Flows

8/10

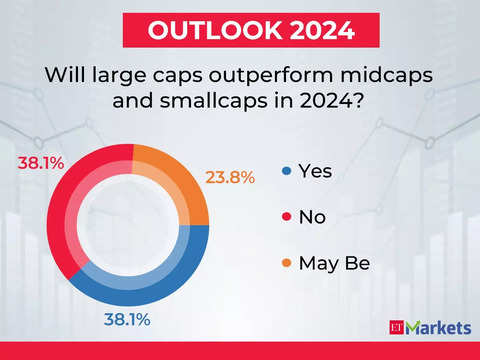

Largecap vs Smallcap

After the stellar run in 2023, experts remain divided about returns in smallcap stocks in 2024. Around 38% of the analysts expect largecap stocks to outperform midcap and smallcap stocks in 2024, while an equal amount of the respondents don’t see that happening.

9/10

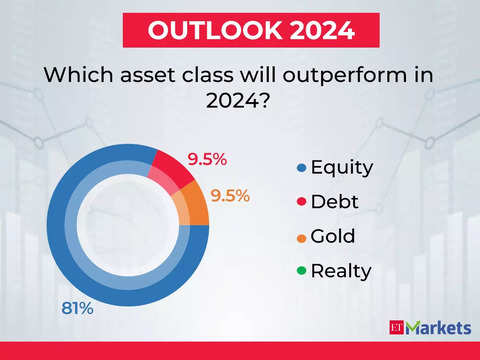

Asset Class Performance

Even though returns could moderate in 2024, about 81% of the analysts expect equity as an asset class to outperform debt, gold, and real estate.

10/10

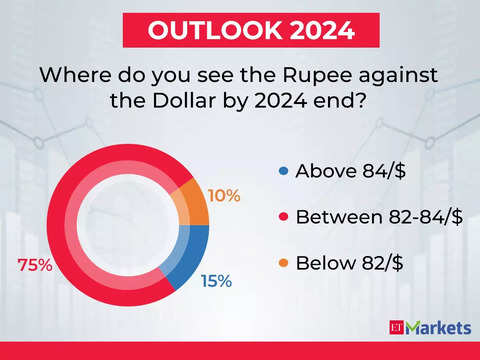

Rupee Movement

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of Economic Times)

READ MORE:

Success

This article has been saved

New Year Outlook: 9 things you need to know about Dalal Street action in 2024 - D-Street Outlook - The Economic Times

Read More

No comments:

Post a Comment