The market extended its northward journey for the third consecutive session, with the Nifty50 decisively surpassing the 19,250-19,300 area on November 6. Will it continue the uptrend further?

Now all eyes are on the 50-day EMA (exponential moving average of 19,450), which if it crosses then 19,550-19,600 can't be ruled out, with support at the 19,300 mark, experts said.

The BSE Sensex rallied 595 points to 64,959, tracking positive Asian cues and buying in all key sectors barring PSU Bank, while the Nifty50 jumped 181 points to 19,412 and formed a bullish candlestick pattern on the daily charts surpassing 100 as well as 21-day EMA.

"The opening upside gap of the last three sessions remains intact. This market action signals a decisive upside bounce in the market after the formation of an important bottom reversal at 18,837 levels on October 26," Nagaraj Shetti, technical research analyst at HDFC Securities said.

With the sharp taking out of an immediate resistance of 18,250 on the upside on Monday, the market is now advancing towards the next overhead resistance of around 19,550-19,600 levels in the short term, he said, adding immediate support is placed at 19,320 levels.

The market breadth also remained in favour of bulls, while the Nifty Midcap 100 and Smallcap 100 indices gained 0.9 percent and 1.4 percent respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty may take support at 19,338, followed by 19,311 and 19,268. On the higher side, 19,425 can be the immediate resistance followed by 19,452 and 19,495.

On November 6, the Bank Nifty also traded higher for the third straight session but continued to form a Doji candlestick pattern on the daily charts with higher highs, and higher lows formation. The Doji candle indicates the indecisiveness among bulls and bears for future market trends.

The Bank Nifty stayed positive throughout the session and jumped 301 points to 43,619.

"On the higher side, the index closed above the 21-day moving average (21DMA). The trend is expected to remain sideways to positive in the near term," Rupak De, senior technical analyst at LKP Securities said.

Support on the lower end is located at 43,300 points, he said, adding on the higher end, a move above 43,700 could trigger a rally towards 44,500 points.

As per the pivot point calculator, the index is expected to take support at 43,472, followed by 43,417 and 43,328. On the upside, the initial resistance is at 43,650 then at 43,705 and 43,795.

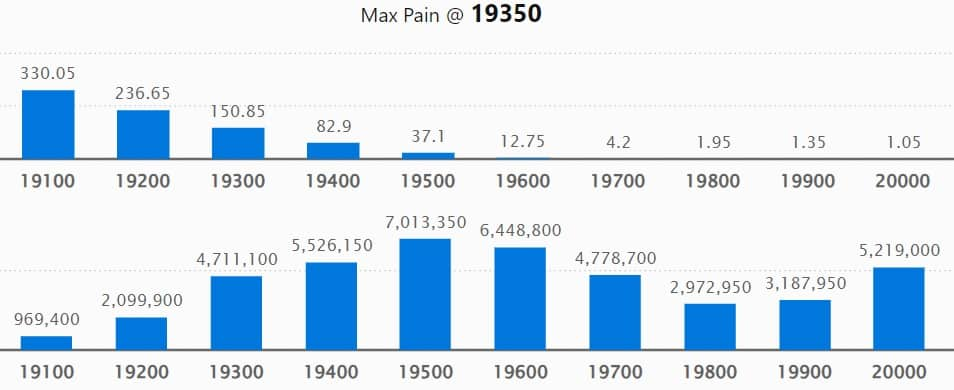

On the weekly options data front, the maximum Call open interest (OI) was seen at 19,500 strike, with 70.13 lakh contracts, which can act as a key resistance for the Nifty. It was followed by the 19,600 strike, which had 64.48 lakh contracts, while the 19,400 strike had 55.26 lakh contracts.

The maximum Call writing was seen at 19,600 strike, which added 17.43 lakh contracts followed by 19,500 and 19,700 strikes, which added 11.51 lakh and 10.4 lakh contracts.

Maximum Call unwinding was at 19,200 strike, which shed 23.17 lakh contracts followed by 19,300 and 19,800 strikes, which shed 20.22 lakh and 8.85 lakh contracts.

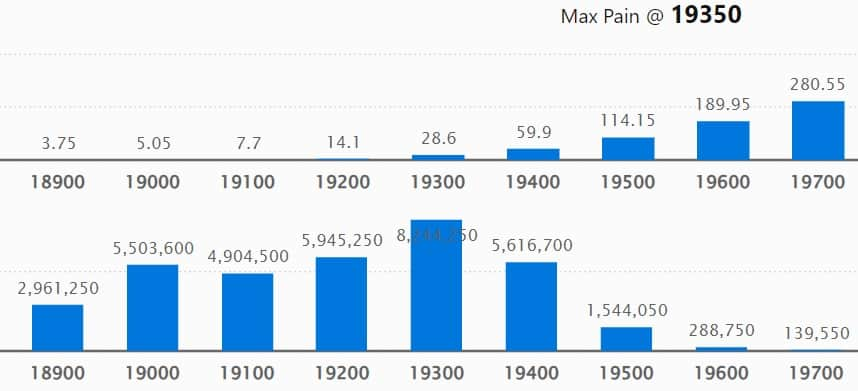

On the Put side, the maximum open interest was seen at 19,300 strike with 82.44 lakh contracts, which can act as key support for the Nifty. It was followed by 19,200 strike comprising 59.45 lakh contracts and 19,400 strike with 56.16 lakh contracts.

Meaningful Put writing was at 19,300 strike, which added 57.8 lakh contracts followed by 19,400 strike and 18,800 strike, which added 49.4 lakh and 20.63 lakh contracts.

Put unwinding was at 18,500 strike, which shed 6.01 lakh contracts followed by 18,300 strike and 18,600 strike which shed 4.13 lakh and 2.72 lakh contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Hindustan Unilever, Tata Consultancy Services, ICICI Prudential Life Insurance Company, Reliance Industries, and Coromandel International saw the highest delivery among the F&O stocks.

A long build-up was seen in 68 stocks, including JK Cement, Ramco Cements, ONGC, Bharat Forge, and Deepak Nitrite. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 10 stocks saw long unwinding including Crompton Greaves Consumer Electricals, Power Finance Corporation, Titan Company, DLF, and Shriram Finance. A decline in OI and price indicates long unwinding.

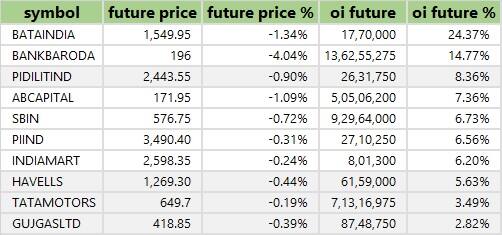

19 stocks see a short build-up

A short build-up was seen in 19 stocks, including Bata India, Bank of Baroda, Pidilite Industries, Aditya Birla Capital, and State Bank of India. An increase in OI along with a fall in price points to a build-up of short positions.

Based on the OI percentage, 90 stocks were on the short-covering list. These include Muthoot Finance, Dr Lal PathLabs, Bajaj Finance, Max Financial Services, and Polycab India. A decrease in OI along with a price increase is an indication of short-covering.

For more bulk deals, click here

Power Grid Corporation of India, Shree Cement, Alkem Laboratories, Anupam Rasayan India, Alembic Pharmaceuticals, Apollo Tyres, Balrampur Chini Mills, Cochin Shipyard, CRISIL, Cummins India, Dilip Buildcon, Devyani International, Ideaforge Technology, Indian Railway Catering and Tourism Corporation, Jyothy Labs, Info Edge (India), Updater Services, Zaggle Prepaid Ocean Services, and Zydus Lifesciences will be in focus ahead of July-September period earnings on November 7.

Stocks in the news

Honasa Consumer: The beauty and personal care products brand Mamaearth's parent is set to debut on the bourses on November 7. The final issue price has been fixed at Rs 324 per share.

Bajaj Finance: The leading non-banking finance company launched the qualified institutions placement (QIP) on November 6, for fund raising. The floor price has been fixed at Rs 7,533.81 per share. The firm may offer a discount of up to 5 percent on the floor price.

FSN E-Commerce Ventures: The Nykaa operator has recorded consolidated profit at Rs 5.85 crore for quarter ended September FY24, growing 42.3 percent over a year-ago period, driven by healthy operating and topline performance. Consolidated revenue from operations grew by 22.4 percent YoY to Rs 1,507 crore despite the festive season witnessing a delay this year, moving into October versus commencing in September last year.

Hindustan Petroleum Corporation: The oil marketing company has registered a 17.5 percent sequential decline in standalone profit at Rs 5,118.2 crore for the July-September period of FY24, dented by a lower topline. Standalone revenue from operations dropped 14.5 percent quarter-on-quarter to Rs 95,701 crore and EBITDA declined 14.9 percent to Rs 8,217 crore in Q2FY24.

Gujarat State Petronet: The gas transmission company has reported consolidated profit at Rs 590.4 crore for the quarter ended September FY24, growing 36 percent QoQ driven by strong operating performance. Revenue from operations grew by 3.8 percent sequentially to Rs 4,265.2 crore for the quarter.

Gland Pharma: The pharma company has recorded consolidated profit at Rs 194.1 crore for the July-September period of FY24, falling 20 percent despite a healthy topline, impacted by weak EBITDA margin performance. Consolidated revenue increased by 32 percent YoY to Rs 1,373.4 crore in Q2FY24.

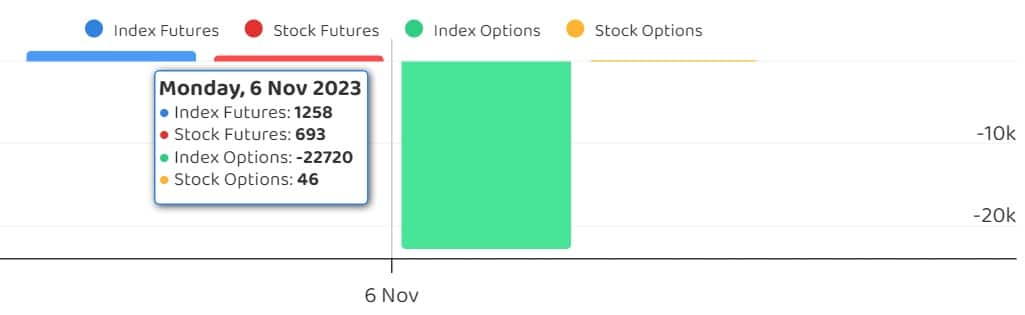

Fund Flow (Rs Crore)

Foreign institutional investors offloaded shares worth Rs 549.37 crore, while domestic institutional investors bought Rs 595.70 crore worth of stocks on November 6, provisional data from the National Stock Exchange showed.

Stock under F&O ban on NSE

The NSE has retained GNFC (Gujarat Narmada Valley Fertilizers and Chemicals) on its F&O ban list for November 7.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Trade setup for Tuesday: 15 things to know before opening bell - Moneycontrol

Read More

No comments:

Post a Comment