19,300 to be important for Nifty on higher side

The market extended an uptrend for the second consecutive session on November 3, but considering it is at the crucial hurdle of the 19,200-19,300 area, which had acted as a strong support area in August before getting into a sharp rally in September, and also there is a continuation of tug-of-war between bulls and bears for firm direction, will it be able to extend uptrend from here on?

Yes, it is possible only if the index surpasses and holds the 19,300 mark, then 19,500-19,600 can be the next possible resistance area for the index, whereas, on the downside, 19,000-18,900 seems to be the key support zone, experts said.

On November 3, the BSE Sensex jumped 283 points to 64,364 while the Nifty50 was up 97 points at 19,231 and formed a Spinning Top kind of candlestick pattern on the daily charts, indicating indecisiveness among buyers and sellers about future trends.

"Nifty is likely to trade in the range of 19,000 to 19,300 with sideways to positive bias. A decisive breakthrough of upper range value will take such advance for 19,500, while on the downside, a sustainable fall below the psychological mark 19,000 will trigger more selling for 18,800-18,700," Arvinder Singh Nanda, Senior Vice President at Master Capital Services said.

The index has reached closer to the resistance zone of multiple moving averages now (20, 100 and 50-day EMA). "We need a decisive close above 19,500 to negate the bearish tone and inch towards 19,850 levels. On the downside, the 18,800-19,000 zone would offer support in case the decline resumes," Ajit Mishra, SVP - Technical Research at Religare Broking said.

The broader markets also continued an uptrend, with the Nifty Midcap 100 and Smallcap 100 indices rising 0.7 percent and 1.2 percent respectively, on positive breadth. About two shares advanced for every falling share on the NSE.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty may take support at 19,214, followed by 19,199 and 19,174. On the higher side, 19,264 can be the immediate resistance followed by 19,280 and 19,305.

On November 3, the Bank Nifty continued the formation of the Doji candlestick pattern on the daily charts for the third consecutive session, indicating the fight between bulls and bears for firm direction, though there was higher high, higher low formation for yet another day. The index rose 301 points to 43,318.

The index climbed above the 200-day EMA (exponential moving average - 43,236) and now 42,500 (20-day EMA) seems to be the next hurdle on the higher side, experts said.

"The Bank Nifty encountered difficulty surpassing the immediate resistance level of 43,500 where a significant amount of Call writing was observed. The lower-end support for the index is situated at 42,800 and a breach below this level could intensify selling pressure," Kunal Shah, senior technical & derivative analyst at LKP Securities said.

As per the pivot point calculator, the index is expected to take support at 43,244 followed by 43,198 and 43,123. On the upside, the initial resistance is at 43,393 then at 43,439 and 43,514.

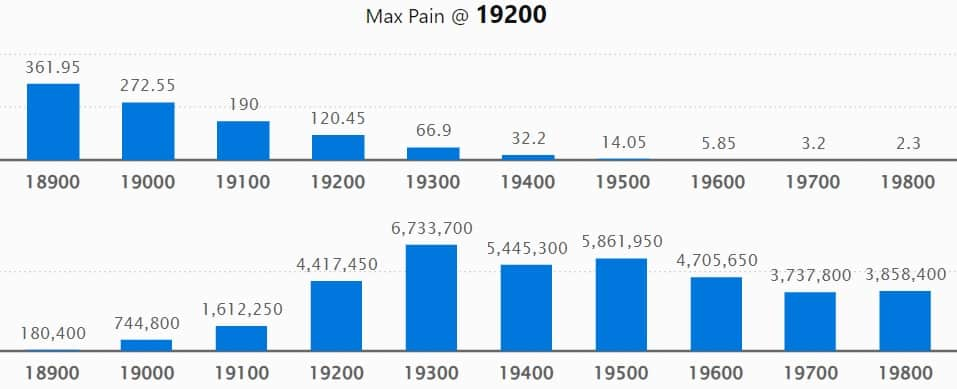

On the weekly options data front, the 19,300 strike has the maximum Call open interest (OI) with 67.33 lakh contracts, which can act as a key resistance for the Nifty. It was followed by the 19,500 strike, which had 58.61 lakh contracts, while the 19,400 strike had 54.45 lakh contracts.

The maximum Call writing was seen at 19,300 strike, which added 33.01 lakh contracts followed by 19,400 and 19,500 strikes, which added 21.94 lakh and 19.63 lakh contracts.

Maximum Call unwinding was at 19,100 strike, which shed 19.37 lakh contracts followed by 19,000 and 18,900 strikes, which shed 5.09 lakh and 2.74 lakh contracts.

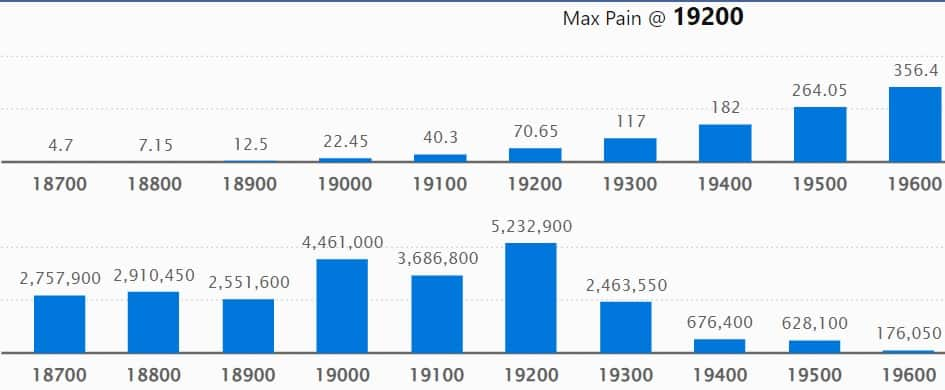

On the Put side, the maximum open interest was seen at 19,200 strike with 52.32 lakh contracts, which can act as key support for the Nifty. It was followed by 19,000 strike comprising 44.61 lakh contracts and 18,500 strike with 37.59 lakh contracts.

Meaningful Put writing was at 19,200 strike, which added 35.32 lakh contracts followed by 19,300 strike and 18,700 strike, which added 18.54 lakh and 9.37 lakh contracts.

Put unwinding was at 18,300 strike, which shed 2.03 lakh contracts followed by 18,400 strike and 19,100 strike which shed 1.49 lakh and 1.29 lakh contracts.

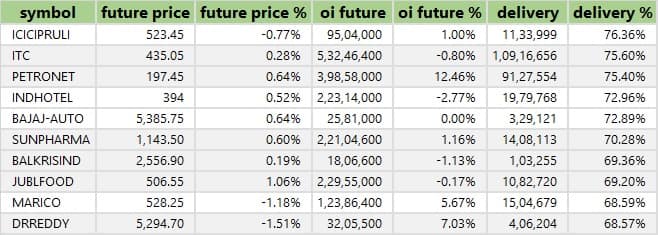

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. ICICI Prudential Life Insurance, ITC, Petronet LNG, Indian Hotels and Bajaj Auto saw the highest delivery among the F&O stocks.

A long build-up was seen in 55 stocks, including MCX India, Alkem Laboratories, Petronet LNG, Dr Lal PathLabs and Godrej Properties. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 18 stocks saw long unwinding including Indus Towers, India Cements, Grasim Industries, GNFC (Gujarat Narmada Valley Fertilizers and Chemicals) and Reliance Industries. A decline in OI and price indicates long unwinding.

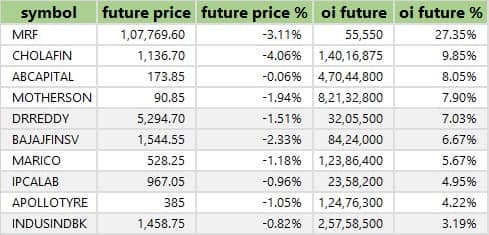

35 stocks see a short build-up

A short build-up was seen in 35 stocks, including MRF, Cholamandalm Investment and Finance, Aditya Birla Capital, Samvardhana Motherson International and Dr Reddy's Laboratories. An increase in OI along with a fall in price points to a build-up of short positions.

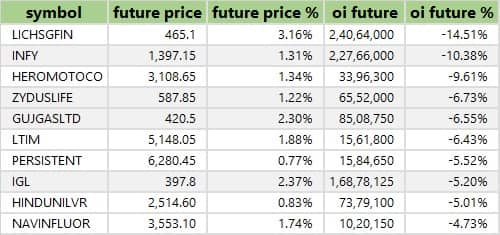

Based on the OI percentage, 73 stocks were on the short-covering list. These include LIC Housing Finance, Infosys, Hero MotoCorp, Zydus Lifesciences and Gujarat Gas. A decrease in OI along with a price increase is an indication of short-covering.

For more bulk deals, click here

Divis Laboratories, Bharat Forge, Hindustan Petroleum Corporation, FSN E-Commerce Ventures (Nykaa), Adani Energy Solutions, Bajaj Electricals, Emami, Exide Industries, Gland Pharma, NHPC, Sobha, Sun Pharma Advanced Research Company, TVS Supply Chain Solutions and Varun Beverages will be in focus ahead of quarterly earnings on November 6.

Stocks in the news

State Bank of India: SBI recorded an 8 percent on-year growth in standalone profit at Rs 14,330 crore on lower provisions and higher other income, but pre-provision operating profit dropped 8 percent. Net interest income grew by 12.3 percent year-on-year to Rs 39,500 crore during the quarter.

Bank Of Baroda: The public sector lender has registered a 28.4 percent on-year growth in standalone net profit at Rs 4,253 crore for the July-September period of FY24 despite a spike in provisions, driven by healthy other income and pre-provision operating profit. Net interest income grew by 6.5 percent year-on-year to Rs 10,831 crore in Q2.

PB Fintech: The Policybazaar & Paisabazaar platform operator has recorded a consolidated loss of Rs 21.1 crore for the quarter ended September FY24, narrowing sharply from a loss of Rs 186.64 crore in the year-ago period. Consolidated revenue grew by 42 percent YoY to Rs 812 crore and core online revenue increased by 46 percent YoY to Rs 597 crore.

Cello World: The consumer products company will list its equity shares on the bourses on November 6. The final issue price has been fixed at Rs 648 per share.

InterGlobe Aviation: The low-cost airline IndiGo operator has reported a profit of Rs 188.9 crore for the quarter ended September FY24, against a loss of Rs 1,583.3 crore in the year-ago period. Revenue from operations increased by 19.6 percent YoY to Rs 14,944 crore.

Bank Of India: The public sector lender has recorded a standalone profit of Rs 1,458 crore for the quarter ended September FY24, increasing by 52 percent over a year-ago period. Net interest income grew by 13 percent on-year to Rs 5,740 crore for the quarter, with deposits increasing 8.68 percent and advances rising 10 percent YoY.

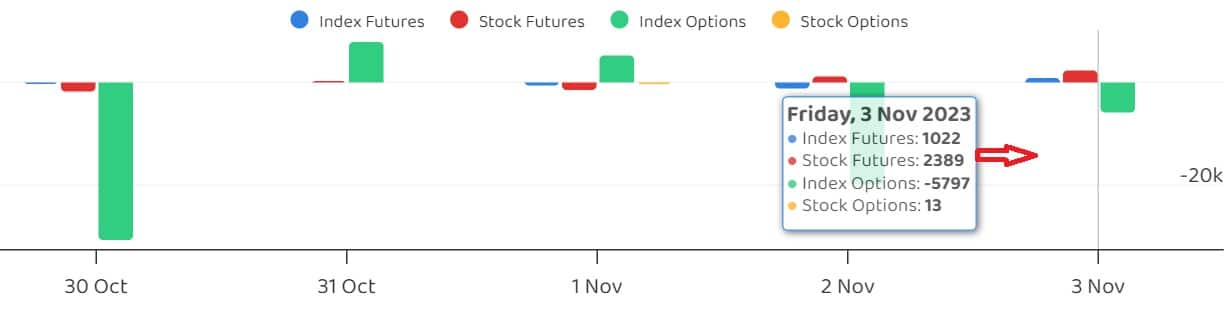

Fund Flow (Rs Crore)

Foreign institutional investors offloaded shares worth Rs 12.43 crore, while domestic institutional investors bought Rs 402.69 crore worth of stocks on November 3, provisional data from the National Stock Exchange showed.

Stock under F&O ban on NSE

The NSE has retained GNFC (Gujarat Narmada Valley Fertilizers and Chemicals) to its F&O ban list for November 6.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Trade setup for Monday: 15 things to know before opening bell - Moneycontrol

Read More

No comments:

Post a Comment