The IPO of Tata Motors’ ER&D subsidiary — Tata Technologies (Tata Tech) — hits the bourses on November 22. The offer size of ₹3,042 crore consists entirely of an offer for sale by promoter (Tata Motors) and a few other investors. Post issue, Tata Motors will continue to own a little over 53 per cent stake in the company.

ER&D or Engineering Research and Development is an emerging and faster growing segment within the larger IT outsourcing space. ER&D service is defined as enterprise IT services relating to designing and developing a device, equipment, assembly, platform, or application, such that it may be produced as a product for sale or development

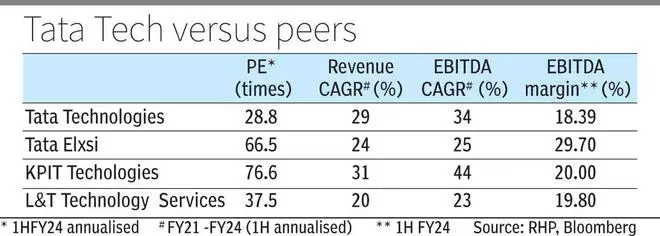

While all large players such as TCS already have presence in this segment, pure-play companies currently listed are Tata Elxsi, KPIT Technologies and L&T Technology Services. Tata Technologies will be the new entrant in the listed space.

Within the ER&D segment, Tata Tech has high reliance on the automotive segment, which tends to be cyclical. However, there are offsets to cyclicality risks, given the ongoing faster phase of transition to electric vehicles warranting partnership with ER&D companies for compressing product development timelines and saving costs. These projects are multi-year in nature and delaying contracts can result in delays in product launches as well.

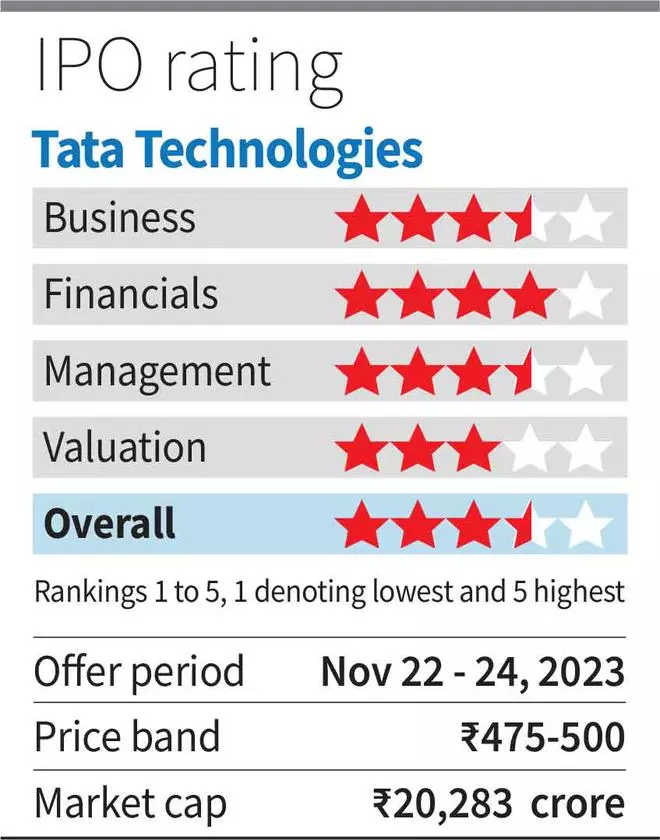

Thus, while definitely not immune, the impact to ER&D segment from the current persisting cyclical slowdown in Indian IT services is likely to be lower as compared to the broader IT services sector. Given good long-term business prospects and reasonable valuation (PE of 29; see table), investors with a 3-5 year perspective can subscribe to the issue.

Business and prospects

Tata Tech is amongst the leading pure-play global ER&D companies offering product development and digital solutions to global original equipment manufacturers. The ER&D services industry usually focusses on the design, development, testing, rollout and maintenance aspects of the product and process development chain and not on mass manufacturing. ER&D players partner either end-to-end or at different stages with OEMs in the product development cycle. They also provide process engineering services that assist in manufacturing, such as plant design engineering and implementing process control systems.

At present, global ER&D spending is primarily in-house (units within OEM companies), with an accelerating shift towards outsourcing to either captive global capability centres (GCC) in ‘high talent-lower cost locations’ such as India/Eastern Europe or to third party players with strong domain expertise (large IT service players such as TCS and pure-play players such as Tata Tech).

At present, global ER&D spending is estimated at around $1.8 trillion, out of which ER&D services addressed market (GCC and third party players) caters to $170-180 billion. Out of this, third party players cater to $105-110 billion or a little over 60 per cent of the ER&D services addressed market and 6 per cent of global ER&D spending. Estimates in the RHP indicate CY2022-26 CAGR of 10 per cent in global ER&D spending, and the business addressed by third party players such as Tata Tech is estimated to grow at a CAGR of 11.5 per cent. Out of this potential growth of 11.5 per cent (in dollar terms), the growth of Tata Tech will depend on how it builds upon its existing capabilities, client relationships and domain expertise to gain market share.

Third party ER&D players bring to OEMs benefits of cost savings, flexibility in investments and reducing product development timelines (with their domain expertise and enhanced workforce). On the flip side, the risks are sometimes outsourcing crucial product-related work to a third party player who may also be working with a competitor. According to Tata Tech management, this is not a barrier as there are processes and checks to protect client confidentiality.

Within this broader ER&D segment, Tata Tech operates under two main segments — Services (80 per cent of revenue) and Technology Solutions Segment (20 per cent).

The automotive sector is the major revenue contributor, accounting for bulk of revenue in the services segment, with Tata Motors/Jaguar Land Rover being the key anchor clients. The anchor clients contributed around 34 per cent of total revenue from operations in FY23, while automotive sector accounted for 69 per cent overall. The balance contribution in services segment comes from industries such as aerospace and a few other manufacturing verticals, representing areas where the company aims to tap opportunities over a longer time horizon.

Out of the 69 per cent contribution from the automotive segment, around 26 per cent of revenue was from new energy vehicle companies (EV related). Business from new energy vehicle companies is likely to be the major driver of growth for Tata Tech in the foreseeable future.

The Technology Solutions segment consists of, one, revenue from reselling software (primarily product life cycle management software) and related valued added services such as implementation/support); and two, providing education solutions in imparting/enhancing manufacturing skills in relation to latest technologies. The company owns and runs the iGetIT e-learning platform that leverages its domain expertise to impart skills. This service is used by private/public sector enterprises and education institutions.

Financials

Tata Tech has reported strong performance in recent years. If 1H FY24 performance is annualised, the FY21-24 revenue, EBITDA and net profit CAGR work out to a solid 29, 34 and 43 per cent respectively. The performance in 1H FY24 over 1H FY23 has also been quite good with revenue, EBITDA and net profit growing by 34, 29 and 35 per cent respectively. From FY22 onwards, EBITDA margin has stayed in the 18-20 per cent range. This growth is better than that of the broader IT services players and comparable with that reported by other ER&D players. The company also has a strong balance sheet with no debt.

Risks to watch out for are impact of global economic slowdown and customer concentration risks. Tata Tech derived 60 per cent of revenue from top 5 clients in FY23. This risk is, to some extent,minimised by the close relationship with Tata Motors/JLR.

Tata Technologies IPO: Key things to know and should you subscribe? - BusinessLine

Read More

No comments:

Post a Comment