19,500 likely to be crucial for further downside in Nifty50

The market remained rangebound with a negative bias throughout the session on October 20 and also closed 1 percent down for the week, though the Nifty manages to hold 19,500-19,480, the crucial support area. The sentiment looks weak and if the index breaks the low of last week (19,480), then 19,300 (around the low of the current month) can't be ruled out, but in case of a rebound, the 19,600-19,800 will be the hurdle on the higher side, experts said.

The BSE Sensex fell 232 points to 65,398, while the Nifty50 slipped 82 points to 19,543, forming a Doji candlestick pattern on the daily charts and a long bearish candlestick pattern on the weekly scale.

"Normally, the formation of such patterns (Doji) after a reasonable decline or at the supports alerts bulls for a comeback from the lows. But, the confirmation of said pattern by the way of sustainable upside bounce in the subsequent session signal upside bounce in the underlying," Nagaraj Shetti, technical research analyst at HDFC Securities said.

Further, he said after the formation of a Bullish Hammer-type candle and a follow-through up-move in the last two weeks, the formation of the negative candle for the week (ended October 20) may not be a good sign.

He feels the short-term trend of Nifty remains negative. "A slide below the immediate support of 19,480 could drag Nifty towards another important support of 19,350 levels in the near term. Immediate resistance is placed around 19,650 levels," Nagaraj said.

The broader markets were also under pressure on weak breadth. The Nifty Midcap 100 and Smallcap 100 indices were down 1.1 percent and 0.8 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty may be taking support at 19,523, followed by 19,505 and 19,477. On the higher side, 19,580 can be an immediate resistance followed by 19,598 and 19,627.

On October 20, the Bank Nifty opened lower but managed to cut down significant losses and closed off the day's low at 43,723, falling 31.5 points. The index has formed a bullish candlestick pattern with a long upper shadow on the daily charts by taking support at the previous day's low.

"The index is currently teetering at a crucial "make or break" point. The level of 43,500 is regarded as decisive. A breach below the 43,500 level is anticipated to trigger additional selling pressure in the market," Kunal Shah, senior technical & derivative analyst at LKP Securities said.

On the other hand, he feels if this level manages to hold on a closing basis, it could prompt a substantial short-covering rally. "The potential target for such a move is around 44,500, where there is a notable accumulation of open interest on the Call side, he said.

As per the pivot point calculator, the banking index is expected to take support at 43,604, followed by 43,531 and 43,413. On the upside, the initial resistance is at 43,841, then at 43,914 and at 44,033.

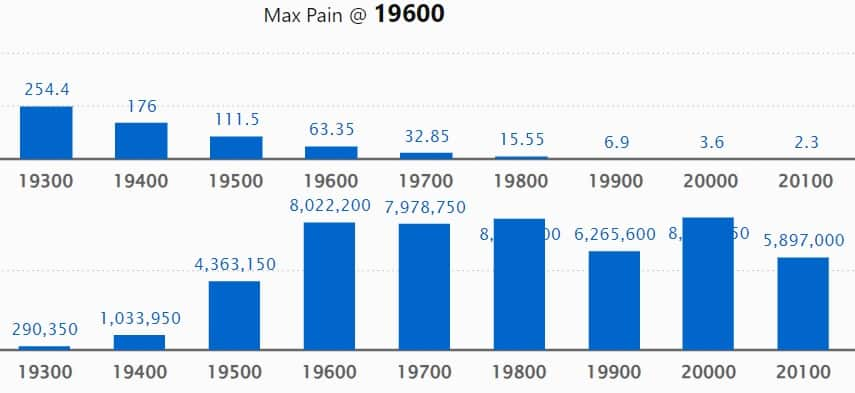

As per monthly options data, the maximum Call open interest (OI) was seen at 20,000 strike with 83.24 lakh contracts, which can act as a key resistance for the Nifty. It was followed by the 19,800 strike, which had 82.45 lakh contracts, while the 19,600 strike had 80.22 lakh contracts.

Meaningful Call writing was seen at 19,600 strike, which added 33.98 lakh contracts followed by 19,700 and 19,500 strikes, which added 22.55 lakh and 19.96 lakh contracts.

Maximum Call unwinding was visible at 20,200 strike, which shed 1.77 lakh contracts followed by 18,500 and 18,300 strikes, which shed 17,550 and 14,900 contracts.

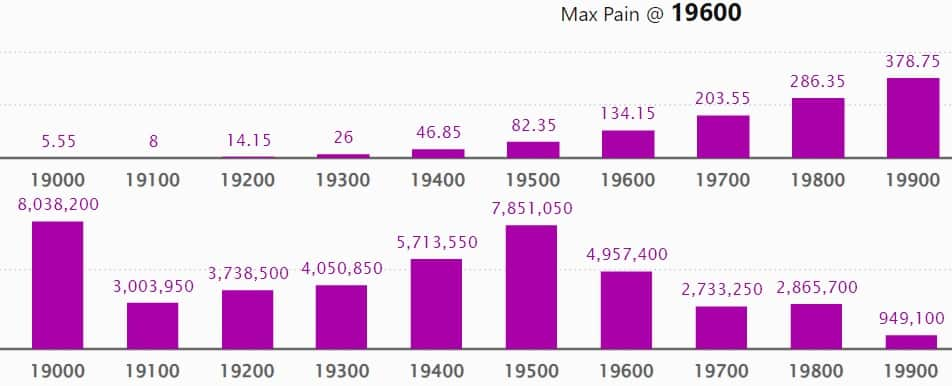

On the Put side, the maximum open interest was seen at 19,000 strike with 80.38 lakh contracts, which can act as a key support for the Nifty50 in coming sessions.

It was followed by 19,500 strike comprising 78.51 lakh contracts and 19,400 strike with 57.13 lakh contracts.

The meaningful Put writing was at 19,400 strike, which added 19.17 lakh contracts followed by 18,700 strike and 19,300 strike, which added 11.52 lakh and 9.8 lakh contracts.

Put unwinding was at 19,700 strike, which shed 7.67 lakh contracts followed by 19,600 strike and 19,800 strike, which shed 6.6 lakh and 2.27 lakh contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. IndiaMART InterMESH, Metropolis Healthcare, Dabur India, Max Financial Services, and Tata Consumer Products saw the highest delivery among the F&O stocks.

A long build-up was seen in 11 stocks including SBI Life Insurance Company, Metropolis Healthcare, Dr Lal PathLabs, Dixon Technologies, and United Breweries. An increase in open interest (OI) and price indicates a build-up of long positions.

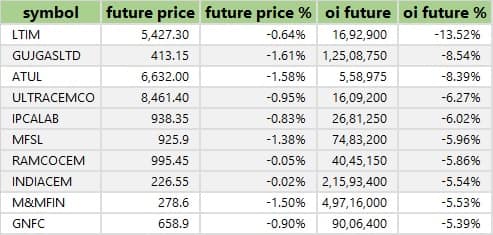

Based on the OI percentage, a total of 87 stocks, including LTIMindtree, Gujarat Gas, Atul, UltraTech Cement, and Ipca Laboratories saw a long unwinding. A decline in OI and price indicates long unwinding.

70 stocks see a short build-up

A short build-up was seen in 70 stocks, including Mahanagar Gas, Indraprastha Gas, Crompton Greaves Consumer Electricals, Dabur India, and Vodafone Idea. An increase in OI along with a fall in price points to a build-up of short positions.

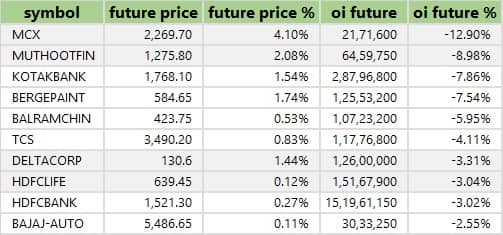

Based on the OI percentage, 19 stocks were on the short-covering list. These included MCX India, Muthoot Finance, Kotak Mahindra Bank, Berger Paints India, and Balrampur Chini Mills. A decrease in OI along with a price increase is an indication of short-covering.

For more bulk deals, click here

Torrent Pharmaceuticals, PNB Housing Finance, Mahindra Logistics, Mahindra Holidays & Resorts India, Lloyds Metals and Energy, Kewal Kiran Clothing, Alok Industries, Aurum PropTech, New Delhi Television, N R Agarwal Industries, and Poddar Housing and Development will release their quarterly earnings on October 23.

Stocks in the news

ICICI Bank: India's second-largest private sector lender has recorded a massive 35.8 percent on-year growth in standalone profit at Rs 10,261 crore for the quarter ended September FY24, driven by a sharp fall in provisions, while asset quality improved on a sequential basis. Net interest income for the quarter at Rs 18,308 crore increased by 23.8 percent over a year-ago period, with net interest margin rising 22 bps YoY to 4.53 percent.

Kotak Mahindra Bank: The private sector lender has recorded a 24 percent on-year growth in standalone profit at Rs 3,191 crore for the quarter that ended September FY24, with operating profit growing 29 percent on-year to Rs 4,610 crore and improvement in asset quality numbers. Net interest income increased by 23 percent to Rs 6,297 crore, with a net interest margin expansion of 7 bps.

One 97 Communications: The mobile payments and financial services company Paytm operator has narrowed its net loss to Rs 290.5 crore for the quarter that ended September FY24, from a loss of Rs 571.1 crore in the same period last year. Revenue for the quarter at Rs 2,519 crore grew by 32 percent YoY, driven by increase in gross merchandise value (GMV), merchant subscription revenues, and growth of loans distributed through the platform.

Ipca Laboratories: The manufacturing facility at Ratlam, Madhya Pradesh has received Establishment Inspection Report from the US Food and Drug Administration (US FDA) classifying it as Voluntary Action Indicated (VAI). The said facility is considered to be in a minimally acceptable state of compliance with regard to current good manufacturing practice (CGMP). The US health regulator conducted an inspection of the Ratlam facility from June 5-13.

RBL Bank: The private sector lender recorded better-than-expected earnings for the July-September period of FY24, with standalone profit growing 46 percent on-year to Rs 294 crore despite sharply higher provisions, led by tax write-back. Net Interest income during the quarter increased by 26 percent year-on-year to Rs 1,475 crore.

Yes Bank: The private sector lender has reported a net profit of Rs 225 crore for quarter ended September FY24, rising sharply by 47.4 percent on-year, with a fall in provisions and higher other income. Net interest income declined 3.3 percent year-on-year to Rs 1,925 crore, net interest margin improving 39 bps YoY to 4.89 percent during the quarter.

JSW Energy: The JSW Group company has registered an 82.6 percent on-year growth in consolidated profit at Rs 850.2 crore for the quarter ended September FY24 driven by robust contribution from the acquired renewable energy portfolio, merchant sales and hydro truing up impact. Revenue from operations grew by 36.5 percent YoY to Rs 3,259 crore for the quarter.

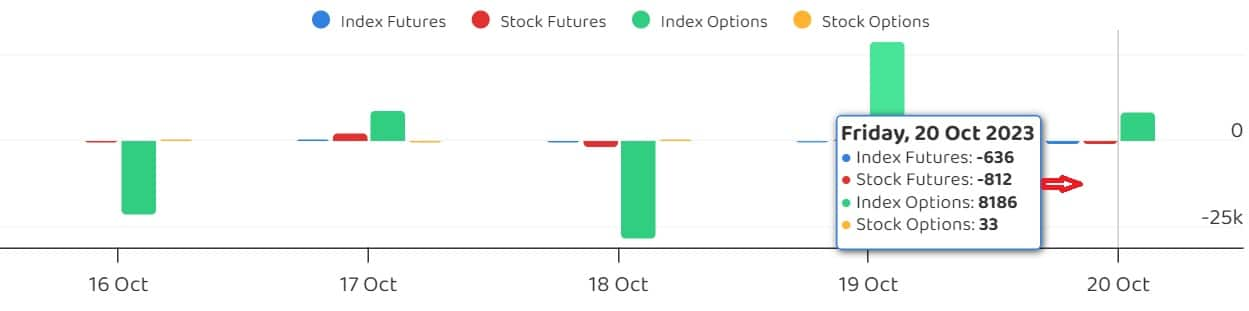

Fund Flow (Rs Crore)

Foreign institutional investors (FII) bought shares worth Rs 456.21 crore, while domestic institutional investors (DII) purchased Rs 8.53 crore worth of stocks on October 20, provisional data from the National Stock Exchange (NSE) showed.

Stocks under F&O ban on NSE

The NSE has retained Indiabulls Housing Finance to its F&O ban list for October 23. Balrampur Chini Mills, Delta Corp, GNFC, India Cements, Manappuram Finance, and MCX India have been removed from the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Trade setup for Monday: 15 things to know before opening bell - Moneycontrol

Read More

No comments:

Post a Comment