19,600 likely to be floor for the Nifty50

The market is expected to take support at 19,600, which somewhat coincides with the 50-day EMA (exponential moving average) in coming sessions as breaking of the same can trigger major correction, while the 19,800-19,850 area is likely to be critical for march upwards towards 19,900-20,000 levels, experts said.

On October 13, the market managed to cut down losses by more than 100 points on the Nifty50 and settled off day's low, holding the 19,750 on closing and taking support at 19,600 intraday.

The BSE Sensex declined 126 points to 66,283, while the Nifty50 fell 43 points to close at 19,751, and formed bullish candlestick pattern on the daily charts.

"The bulls were able to protect the level of 19,600 during the day on last Friday, thanks to the strong open interest (OI) build-up at the 19,600 strike price by Put writers. The strength may continue as long as the index remains above 19,600," Rupak De, senior technical analyst at LKP Securities said.

He feels only a decisive fall below 19,600 might trigger serious long unwinding in the market, till then a buy on dips strategy will favour the market. On the higher end, the resistance is visible at 19,850, and above 19,850, the index might move towards 20,000, he said.

The broader markets also ended moderately lower with the Nifty Midcap 100 and Smallcap 100 indices declining 0.1 percent and 0.4 percent respectively, while the volatility index, VIX, ended flat at 10.62 levels.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty may be taking support at 19,666, followed by 19,625 and 19,561. On the higher side, 19,796 can be an immediate resistance, followed by 19,836 and 19,901.

On October 13, the Bank Nifty, after gap down opening, attempted nice recovery towards previous close in later part of the session, but failed due to selling pressure and finally closed lower as well as below the opening levels (44,322). The index formed small bodied bearish candlestick pattern with long upper shadow and minor lower shadow on the daily charts, indicating pressure at higher levels, as it dropped 311 points to settle at 44,288.

"Bank Nifty witnessed a deeper correction, however, we believe that this dip is likely to be bought into," Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas said.

On the downside, he feels 44,000 – 43,800 is the crucial support zone. "And until that is not breached on the downside we shall expect a recovery till 45,050 – 45,350 in the Bank Nifty from short term perspective," he said.

As per the pivot point calculator, the banking index is expected to take support at 44,214, followed by 44,129 and 43,992. On the upside, the initial resistance is at 44,489, then at 44,574 and at 44,711.

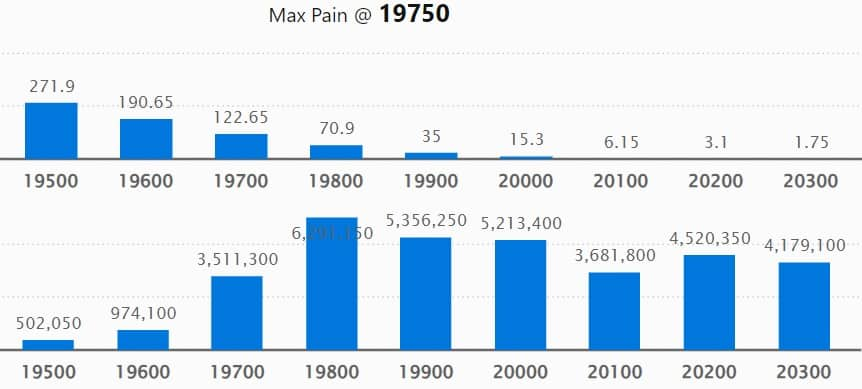

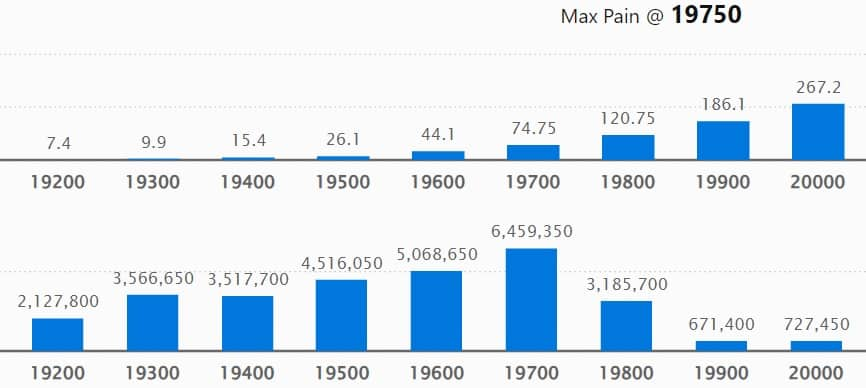

As per weekly options data, the maximum Call open interest (OI) remained at 19,800 strike with 62.91 lakh contracts, which can act as a key resistance for the Nifty. It was followed by the 19,900 strike, which had 53.56 lakh contracts, while 20,000 strike had 52.13 lakh contracts.

Meaningful Call writing was seen at 19,700 strike, which added 24.78 lakh contracts followed by 19,900 and 19,800 strikes, which added 20.82 lakh and 17.27 lakh contracts.

Maximum Call unwinding was seen only at 19,400 strike, which shed 29,200 contracts in the strike band of 18,500-21,100.

On the Put side, the maximum open interest was seen at 19,700 strike with 64.59 lakh contracts, which can act as an immediate support for the Nifty50 in coming sessions.

It was followed by 19,000 strike, comprising 57.52 lakh contracts and 19,600 strike with 50.68 lakh contracts.

The meaningful Put writing was at 19,700 strike, which added 26.2 lakh contracts, followed by 19,600 strike and 19,500 strike, which added 24.11 lakh and 16.69 lakh contracts.

Put unwinding was at 19,800 strike, which shed 16.23 lakh contracts, followed by 19,900 strike and 20,100 strike, which shed 1.98 lakh and 15,600 contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Piramal Enterprises, Samvardhana Motherson International, Britannia Industries, PI Industries, and Coromandel International saw the highest delivery among the F&O stocks.

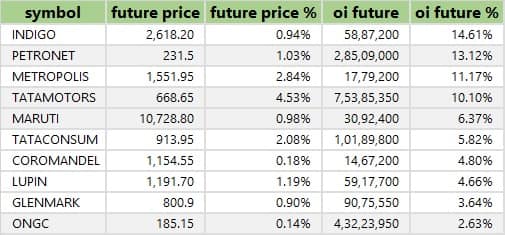

A long build-up was seen in 28 stocks including InterGlobe Aviation, Petronet LNG, Metropolis Healthcare, Tata Motors, and Maruti Suzuki India. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, a total of 41 stocks, including Sun TV Network, Birlasoft, BHEL, ITC, and Escorts Kubota saw a long unwinding. A decline in OI and price indicates long unwinding.

81 stocks see a short build-up

A short build-up was seen in 81 stocks, including Infosys, Syngene International, State Bank of India, Axis Bank, and Bajaj Auto. An increase in OI along with a fall in price points to a build-up of short positions.

Based on the OI percentage, 38 stocks were on the short-covering list. These included HDFC AMC, HCL Technologies, Tata Consultancy Services, Mahanagar Gas, and L&T Technology Services. A decrease in OI along with a price increase is an indication of short-covering.

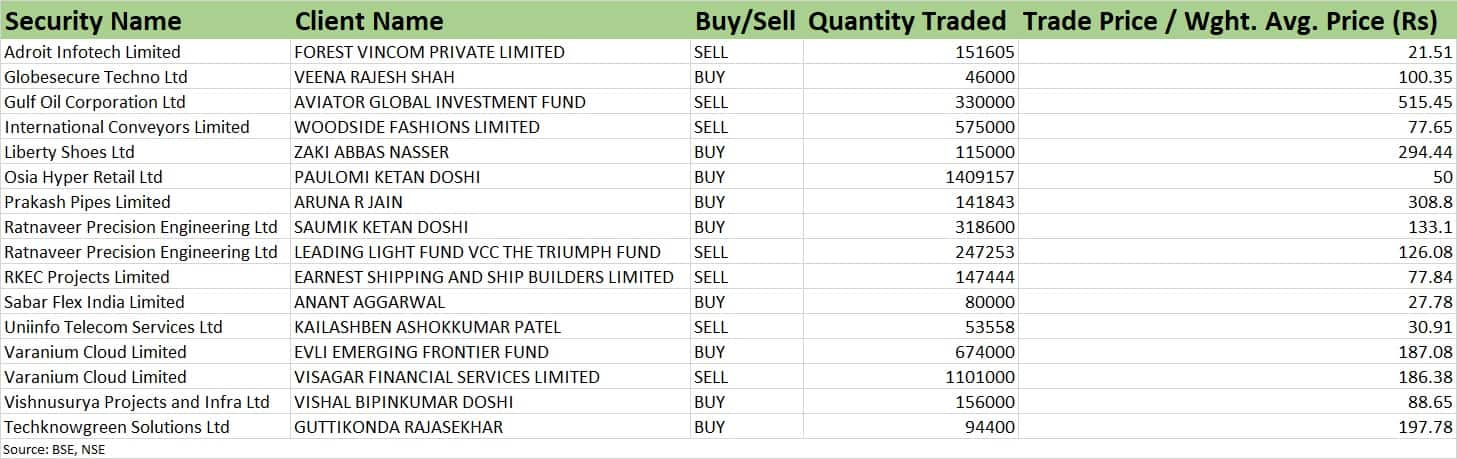

For more bulk deals, click here

HDFC Bank, Jio Financial Services, Federal Bank, CEAT, ICICI Securities, Bank of Maharashtra, NELCO, Yatra Online, Choice International, Cyient DLM, Indbank Merchant Banking Services, Jai Balaji Industries, Nath Bio-Genes, Oriental Hotels, Selan Exploration Technology, and Tinplate Company of India will be in focus ahead of quarterly earnings on October 16.

Stocks in the news

Tata Motors: The commercial vehicle major has entered into share purchase agreements with certain investors for sale of 9.9 percent stake in its subsidiary Tata Technologies for Rs 1,613.7 crore. TPG Rise Climate SF Pte Ltd, a climate focused private equity fund, is buying nine percent stake in Tata Technologies, and Ratan Tata Endowment Foundation acquiring 0.9 percent stake, from Tata Motors.

Avenue Supermarts: The Mumbai-based company that owns and operates D-Mart stores, has recorded a 9.2 percent on-year decline in consolidated profit at Rs 623 crore for quarter ended September FY24, impacted by lower margin and high base. In Q2FY23, the profit was supported by lower tax cost. Revenue from operations grew by 18.67 percent year-on-year to Rs 12,624 crore.

Adani Enterprises: The Ministry of Corporate Affairs, Hyderabad, has initiated investigation of books of accounts and other books and papers of Mumbai International Airport (MIAL) and Navi Mumbai International Airport (NMIAL), step-down subsidiaries of Adani Enterprises. Ministry of Corporate Affairs sought information and documents pertaining to the prior period starting from 2017-18 to 2021-22. Adani Enterprises completed acquisitions of MIAL and NMIAL during the year financial year 2021-22.

Bajaj Electricals: The company has received a supply of services contract worth Rs 564.2 crore from Power Grid Corporation of India for and on behalf of its SPV (special purpose vehicle) Ananthpuram Kurnool Transmission.

Tata Steel Long Products: The Tata Group company's net loss for the quarter ended September FY24 narrowed to Rs 135.8 crore, from Rs 333.4 crore in year-ago period despite lower topline, aided by lower input cost. Revenue from operations fell 9.4 percent YoY to Rs 1,734 crore during the quarter.

Dalmia Bharat: The cement manufacturing company has recorded consolidated profit at Rs 124 crore for quarter ended September FY24, growing 121.4 percent over year-ago period, driven by healthy operating numbers with fall in power & fuel expenses. Revenue from operations for the quarter grew by 6 percent year-on-year to Rs 3,149 crore. Cement volume increased 6.6 percent YoY to 6.2 million tonnes, which was in line with estimates.

Delta Corp: Deltatech Gaming, a subsidiary of the casino gaming company, has received an intimation for payment of shortfall tax under the CGST Act and West Bengal GST Act, from the Directorate General of GST Intelligence, Kolkata. The amount of alleged tax shortfall is Rs 6,236.81 crore for the period between January 2018 and November 2022, and Rs 147.51 crore for July 2017 to October 2022 period.

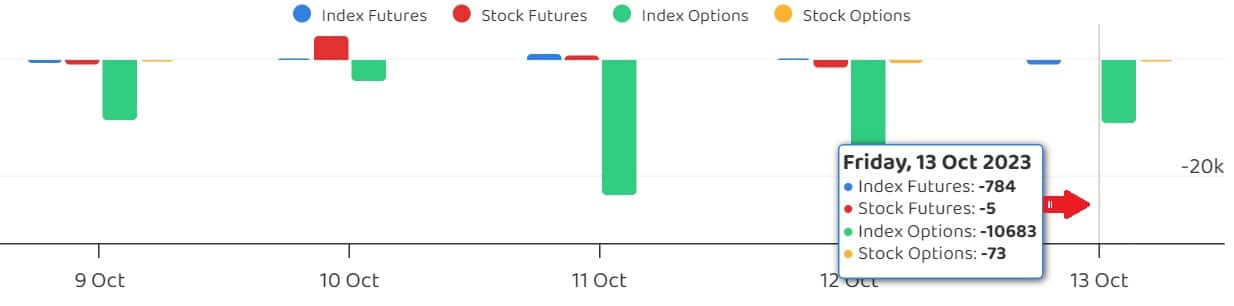

Fund Flow (Rs Crore)

Foreign institutional investors (FII) bought shares worth Rs 317.01 crore, while domestic institutional investors (DII) sold Rs 102.88 crore worth of stocks on October 13, provisional data from the National Stock Exchange (NSE) showed.

Stocks under F&O ban on NSE

The NSE has added SAIL to its F&O ban list for October 16, while retaining Balrampur Chini Mills, BHEL, Delta Corp, Hindustan Copper, Indiabulls Housing Finance, India Cements, L&T Finance Holdings, Manappuram Finance, Punjab National Bank, and Sun TV Network to the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Trade setup for Monday: 15 things to know before opening bell - Moneycontrol

Read More

No comments:

Post a Comment