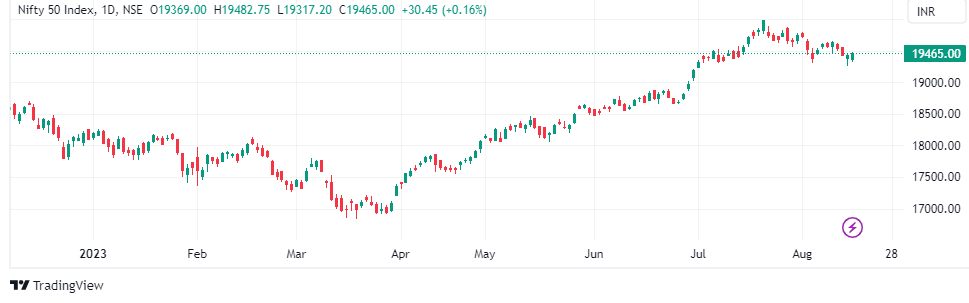

Four chartists have differing views on where the Nifty 50 is headed next. However, they do agree on the fact that the 19,250 - 19,300 level remains a key support zone for the index.

In Wednesday's Trade Setup, we spoke to you about the heavy put writing that the 19,300 strike Put of the Nifty 50 for Thursday's expiry has seen, implying that the bulls are not yet ready to throw in the towel and would fight to defend the 19,300 mark on the downside. The index on Wednesday reversed from its intraday low of 19,317.

It turned out to be another day of recovering from the day's low for the Nifty 50, as the index recovered nearly 150 points from the lowest point of the day to end in positive territory and exactly at Monday's high of 19,465. SAMCO Securities' Ashwin Ramani had mentioned on Tuesday that a close above Monday's high may just ignite some hopes for the bulls.

However, Rupak De of LKP Securities does not agree and believes that the current trend of the Nifty 50 is weak and will remain so until the index does not cross 19,521 on the upside and sustains above it. On the downside, immediate support for the index is at levels of 19,250.

Nagaraj Shetti of HDFC Securities said that the chances of the Nifty 50 forming another lower top could be high in the short-term after having formed a new lower bottom at 19,257 levels. A strong resistance cluster is currently placed around the 19,550 - 19,600 mark and he expects weakness to emerge from the highs for this week. Immediate downside support is between 19,300 - 19,250.

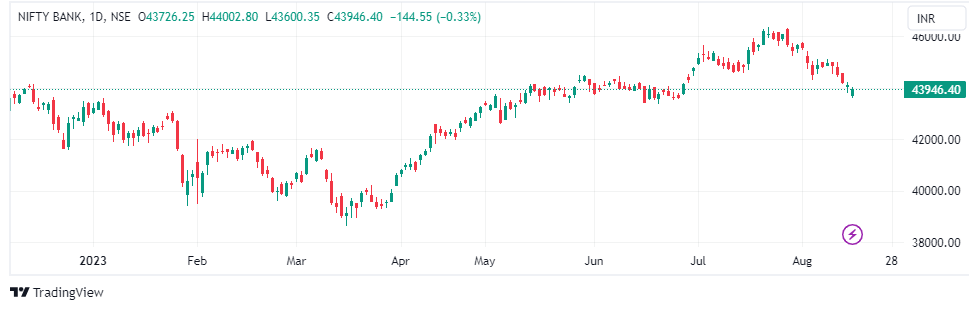

The Nifty Bank index also reversed from close to its key support level between 43,500 - 43,700, recovering over 350 points from the day's low. However, despite the recovery, the index still ended lower for the fifth day in a row. The last time the Nifty Bank index fell five days in a row was between March 9-15 this year. At the day's low, the Nifty Bank had corrected 2,700 points from its peak of 46,369.

Kunal Shah of LKP Securities believes that the ability of the Nifty Bank to see a pullback depends on its 100-Day Moving Average at which it found support on Wednesday. It is imperative that it remains above the 43,600 mark for any potential pullback towards 44,000 where there's am immediate resistance for the index. A break above that can take the index towards 44,300 - 44,500.

"We maintain the sell-on-rise stance on the Nifty Bank considering the death crossover on its hourly charts," said Mehul Kothari of Anand Rathi. However, he expects a bounce in the Nifty Bank considering the oversold setups. Immediate hurdles are seen between 44,100 - 44,350 levels.

Two stocks will be in focus during the weekly options expiry session. One of them is Adani Power. The stock saw sharp swings during the final minutes of trade, when over 8 percent equity exchanged hands in multiple large transactions.

Data from the exchanges showed that Goldman Sachs Trust II - Goldman Sachs GQG Partners International Opportunities Fund acquired 10 crore shares at Rs 279.15 per share, while GQG Partners Emerging Markets bought 4.9 crore shares at Rs 279.15. The stock fell as much as 4 percent post the deal but recovered to end 1 percent lower.

Religare will be the other stock in focus after a CNBC-TV18 exclusive that the Burman family that has a controlling stake in Dabur, has increased its stake in the company. The stock ended 6 percent higher after hitting a 52-week high. CNBC-TV18's exclusive was confirmed by the exchange data later in the evening that the Burman family did acquire 5 percent stake in the company.

What Are the F&O Cues Indicating?

Nifty 50's August futures added 1.5 percent and 1.58 lakh shares in Open Interest. They are now trading at a premium of 19.55 points compared to 43.8 points earlier. On the other hand, the Nifty Bank's August futures added 4 percent or 76,830 shares in Open Interest. Nifty 50's Put-Call Ratio is now at 1.11 from 0.99 earlier.

Hindustan Copper and SAIL have entered the F&O ban list from today's session, joining stocks like Chambal Fertilisers, Delta Corp, Balrampur Chini, Indiabulls Housing Finance, Zee Entertainment, Granules India, Manappuram Finance, India Cements and GNFC, that are already in the ban list.

Nifty 50 on the Call side for today's expiry:

For today's expiry, the Nifty 50 call strikes between 19,400 and 19,600 have seen Open Interest addition, with the 19,400 Call strike seeing the maximum Open Interest addition.

| Strike | OI Change | Premium |

| 19,400 | 28.1 Lakh Added | 82 |

| 19,600 | 27.17 Lakh Added | 6.45 |

| 19,450 | 26.61 Lakh Added | 49.85 |

Nifty 50 on the Put side for today's expiry:

For today's expiry, the Nifty 50 put strikes between 19,300 and 19,400 continue to see Open Interest addition. The maximum Open Interest was seen added in the 19,300 strike, indicating that the bulls continue to defend that level on the downside.

| Strike | OI Change | Premium |

| 19,300 | 55.61 Lakh Added | 8.85 |

| 19,400 | 38.51 Lakh Added | 24.95 |

| 19,350 | 36.04 Lakh Added | 14.5 |

Lets take a look at the stocks which added fresh long positions on Wednesday, meaning an increase in both price and Open Interest:

| Stock | Price Change | OI Change |

| Oracle Financial | 2.70% | 18.83% |

| Escorts Kubota | 4.17% | 11.32% |

| Dr Reddy's Labs | 1.10% | 9.45% |

| Lupin | 2.97% | 8.06% |

| Syngene | 1.57% | 6.45% |

Lets take a look at the stocks that added fresh shorts on Wednesday, meaning an increase in Open Interest but decrease in price:

| Stock | Price Change | OI Change |

| Interglobe Aviation | -3.50% | 60.00% |

| Hindustan Copper | -6.04% | 35.60% |

| Coforge | -3.74% | 12.07% |

| Muthoot Finance | -1.20% | 10.84% |

| Tata Communications | -0.18% | 8.95% |

Here are the stocks to watch out for ahead of Thursday's session:

- Nava: Temporarily suspends production of Silico Manganese at its Odisha plant due to an accidental damage in the raw material handling system. No human casualties due to this accident. Accident has affected the company's captive power consumption of about 20 MW at the Odisha unit. Resumption of production and captive consumption of power will require about two months.

- Adani Power: GQG Partners acquires 31.2 crore shares at an average price of Rs 279.17 in multiple large transactions. This takes GQG's overall investment in Adani Group stocks to $4 billion.

- JSW Energy: Promoter JSW Invsts sells 2.1 crore shares, out of which GQG Fund buys 1 crore shares at Rs 341.70.

- Religare Enterprises: CNBC-TV18 newsbreak confirmed as Burman family buys 5 percent stake in the company through a block deal. As of June, the Burman family held a 14 percent stake in the company.

- Aurobindo Pharma: To launch HIV Triple Combination product for Children living with HIV. To launch the product in low and middle-income countries under voluntary license from ViiV Healthcare.

- Alembic Pharma: BSE returns the company's draft scheme of reorganisation of general reserves between the company and shareholders. Draft scheme returned as the company had adjusted identified impairment of Capital Work in Progress (CWIP) against general reserves in financial year 2023.

What Are Global Cues Indicating?

Asian markets extended their losses on Thursday after the US benchmarks fell for the second day in a row overnight.

The Nikkei 225 is down 0.5 percent at the start of trade, while the Topix is down 0.4 percent as the country's trade balance slipped into a deficit in July from a surplus in June. South Korea's Kospi was down 0.7 percent, while the Kosdaq declined 0.6 percent.

Hang Seng's futures are also pointing towards a negative start to the trading day.

Wall Street fell overnight after the Fed's minutes for the July meeting showed that inflation concerns continued to linger, leading to more rate hikes. The Fed Funds rate is currently the highest in 22 years.

The Dow Jones fell 0.5 percent overnight, while the S&P 500 declined by 0.8 percent. The Nasdaq underperformed its peers, declining by 1.1 percent.

Both foreign and domestic investors were buyers in Wednesday's trading session. The numbers were influenced by multiple block deals that took place through the session, including the ones in Adani Power, Religare, IndiGo and JSW Energy.

Shrikant Chouhan of Kotak Securities expects 19,400 to be a key level for the Nifty 50, expecting the index to rise towards 19,550 - 19,575 levels. Fresh selling is expected only after a break below 19,400, post which the index could fall towards 19,350 - 19,300, he said.

Anand Rathi's Kothari believes that fresh round of panic would begin in the Nifty 50 only once it breaks 19,250 on the downside. On the upside, he expects resistance between 19,500 - 19,600.

First Published: Aug 16, 2023 11:55 PM IST

Trade Setup for August 17: Nifty 50's current trend is weak until it remains below this level - CNBCTV18

Read More

No comments:

Post a Comment