GOLD PRICE OUTLOOK:

- Gold prices fail to mount recovery as bond yields resume their rebound

- Strong U.S. economic data may nudge the Fed to continue hiking rates during the second half of the year, even if policymakers hit the pause button temporarily

- This article looks at key XAU/USD’s levels to watch in the week ahead

Recommended by Diego Colman

Get Your Free Gold Forecast

Most Read: Gold Price Recovery Runs Out of Steam as Red-Hot US Jobs Data Boosts Yields

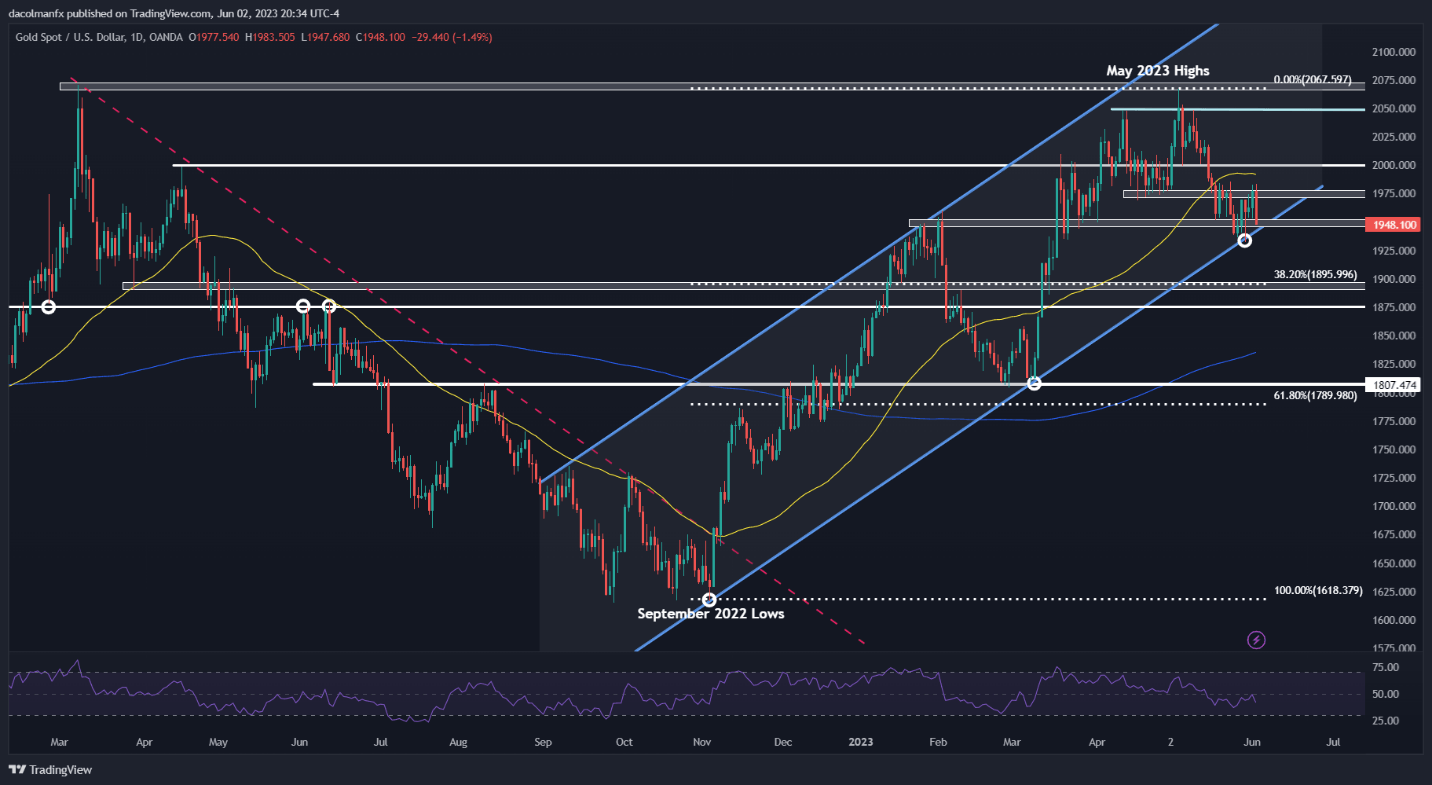

Gold prices (XAU/USD) have undergone a large downward correction from its May highs around $2,070, down nearly 6% from those peak levels in a short period of time. This past week, bullion attempted to recover, briefly reaching $1,983, but quickly reversed course and retreated heading into the weekend to settle slightly below the $1,950 threshold.

The metal’s lack of ability to maintain bullish impetus can be attributed to U.S. interest rate dynamics, specifically their recent upswing. Although yields declined moderately earlier in the week, they rose sharply on Friday following remarkably strong U.S. jobs data, resuming their broader rebound that began around the second week of April.

Focusing on the macro front, the latest payrolls report showed that U.S. employers added 339,000 workers in May, significantly above estimates of 190,000. Strong hiring suggests that the economy is holding up well and is nowhere near a recession yet, despite the Fed’s fast-and-furious tightening campaign that began in 2022.

Recommended by Diego Colman

How to Trade Gold

Related: Gold Prices at Risk of Deeper Correction on Surging Real Yields, USD Strength

The resilience of the economy and the labor market may slow the return of inflation to the 2.0% target. Against this backdrop, policymakers may continue to raise borrowing costs during the second half of the year, even if they temporarily hit the pause button at their June meeting to assess the lagged effects of cumulative tightening.

The possibility that the FOMC will have to take its terminal rate higher and keep it there for longer to restore price stability should keep bond yields elevated, at least in theory, boosting the U.S. dollar in the process. This scenario is likely to weigh non-yielding assets, including precious metals.

For the above reasons, gold’s outlook is starting to turn more bearish from a fundamental standpoint, meaning more losses could be around the corner before some sort of stabilization occurs later in 2023. This also implies that fresh record highs will have to wait and may be out of reach for bullion for the time being.

| Change in | Longs | Shorts | OI |

| Daily | 4% | -22% | -5% |

| Weekly | -4% | -4% | -4% |

GOLD PRICES TECHNICAL ANALYSIS

Gold's recent retrenchment seems to be a corrective move within a medium-term uptrend, but the bias could turn quite negative very quickly if prices break below $1,940. This dynamic support corresponds to the lower bound of a rising channel that has guided the market higher for nearly a year.

In terms of possible scenarios, if XAU/USD falls beneath the $1,940 floor, downside pressure may gather force, emboldening bears to launch an assault on $1,895, the 38.2% Fib retracement of the Sep 2022/May 2023 rally. On further weakness, we could see a move toward $1,875.

Conversely, if gold manages to establish a base around current levels and pivot higher, the first resistance to keep an eye on lies at $1,975. Clearance of this ceiling may spark follow-through buying, setting the stage for rally toward the psychological $2,000 mark.

GOLD PRICES TECHNICAL CHART

Gold Prices Chart Prepared Using TradingView

Gold Price Forecast: Dreams of Fresh Record Shattered for Now as Bears Pounce - DailyFX

Read More

No comments:

Post a Comment