Results on May 17: Jubilant FoodWorks, REC, Deepak Fertilisers & Petrochemicals Corporation, Devyani International, Endurance Technologies, Eris Lifesciences, Glaxosmithkline Pharmaceuticals, Honeywell Automation India, Jindal Saw, JK Tyre & Industries, Jindal Stainless,l MTAR Technologies, Quess Corp, RailTel Corporation of India, Sterlite Technologies, Thermax, Vaibhav Global, and Whirlpool of India will be in focus ahead of quarterly earnings on May 17.

Results on May 17: Jubilant FoodWorks, REC, Deepak Fertilisers & Petrochemicals Corporation, Devyani International, Endurance Technologies, Eris Lifesciences, Glaxosmithkline Pharmaceuticals, Honeywell Automation India, Jindal Saw, JK Tyre & Industries, Jindal Stainless,l MTAR Technologies, Quess Corp, RailTel Corporation of India, Sterlite Technologies, Thermax, Vaibhav Global, and Whirlpool of India will be in focus ahead of quarterly earnings on May 17.  Bharti Airtel: The telecom operator has recorded a massive 89.2 percent sequential growth in consolidated profit at Rs 3,005.6 crore for the quarter ended March FY23 due to lower tax costs. Profit in the previous quarter was impacted by an exceptional loss of Rs 669.8 crore. Revenue from operations for the quarter at Rs 36,009 crore grew by 0.6 percent over the previous quarter. On the operating front, EBITDA grew by 1.1 percent QoQ to Rs 18,806.7 crore with a margin expansion of 20 bps at 52.2 percent, while average revenue per user (ARPU) was flat at Rs 193 on a sequential basis.

Bharti Airtel: The telecom operator has recorded a massive 89.2 percent sequential growth in consolidated profit at Rs 3,005.6 crore for the quarter ended March FY23 due to lower tax costs. Profit in the previous quarter was impacted by an exceptional loss of Rs 669.8 crore. Revenue from operations for the quarter at Rs 36,009 crore grew by 0.6 percent over the previous quarter. On the operating front, EBITDA grew by 1.1 percent QoQ to Rs 18,806.7 crore with a margin expansion of 20 bps at 52.2 percent, while average revenue per user (ARPU) was flat at Rs 193 on a sequential basis.  Bharat Petroleum Corporation: The oil marketing company has received board approval for an ethylene cracker project at Bina refinery including downstream petrochemical plants and expansion of the refinery with capital expenditure of approximately Rs 49,000 crore. The company will also be setting up two 50 MW wind power plants for captive consumption one at Bina Refinery in Madhya Pradesh and another at Mumbai Refinery in Maharashtra, with a total project cost of Rs 978 crore. It will be putting up petroleum oil lubricants (POL) and lube oil base stock (LOBS) storage installations with receipt pipelines at Rasayani in Maharashtra with a project cost of Rs 1,903 crore.

Bharat Petroleum Corporation: The oil marketing company has received board approval for an ethylene cracker project at Bina refinery including downstream petrochemical plants and expansion of the refinery with capital expenditure of approximately Rs 49,000 crore. The company will also be setting up two 50 MW wind power plants for captive consumption one at Bina Refinery in Madhya Pradesh and another at Mumbai Refinery in Maharashtra, with a total project cost of Rs 978 crore. It will be putting up petroleum oil lubricants (POL) and lube oil base stock (LOBS) storage installations with receipt pipelines at Rasayani in Maharashtra with a project cost of Rs 1,903 crore.  Jindal Steel & Power: The steel producer has reported a 69.5 percent year-on-year decline in consolidated profit at Rs 465.66 crore for the March FY23 quarter, impacted by weakness in operating performance and a one-time loss of Rs 153 crore during the quarter. Revenue from operations for the quarter at Rs 13,692 crore declined by 4.5 percent compared to the same period last fiscal.

Jindal Steel & Power: The steel producer has reported a 69.5 percent year-on-year decline in consolidated profit at Rs 465.66 crore for the March FY23 quarter, impacted by weakness in operating performance and a one-time loss of Rs 153 crore during the quarter. Revenue from operations for the quarter at Rs 13,692 crore declined by 4.5 percent compared to the same period last fiscal.  JK Paper: The paper & packaging board company has registered a 15 percent year-on-year decline in consolidated profit at Rs 283.52 crore for the quarter ended March FY23, dented by dismal operating numbers. Revenue from operations for the quarter grew by 4.6 percent to Rs 1,719.4 crore compared to the corresponding period last fiscal. The board has recommended a final Dividend of Rs 4 per share.

JK Paper: The paper & packaging board company has registered a 15 percent year-on-year decline in consolidated profit at Rs 283.52 crore for the quarter ended March FY23, dented by dismal operating numbers. Revenue from operations for the quarter grew by 4.6 percent to Rs 1,719.4 crore compared to the corresponding period last fiscal. The board has recommended a final Dividend of Rs 4 per share.  Redington: The technology solutions provider has reported a 10.88 percent year-on-year fall in consolidated profit at Rs 310.1 crore for the January-March FY23 quarter, impacted by lower operating margin. Revenue from operations was the highest ever for any quarter at Rs 21,848.6 crore, growing 26.3 percent over the same period last year supported by solid execution across businesses and geographies. The board recommended a dividend of Rs 7.20 per share for FY23.

Redington: The technology solutions provider has reported a 10.88 percent year-on-year fall in consolidated profit at Rs 310.1 crore for the January-March FY23 quarter, impacted by lower operating margin. Revenue from operations was the highest ever for any quarter at Rs 21,848.6 crore, growing 26.3 percent over the same period last year supported by solid execution across businesses and geographies. The board recommended a dividend of Rs 7.20 per share for FY23.  MRF: The tyre manufacturer has entered into a purchase agreement with First Energy 4 Private Limited for the purchase of solar power and will be acquiring upto 19.10 percent equity of the company for Rs 13.09 crore. First Energy 4 is a solar power generation company.

MRF: The tyre manufacturer has entered into a purchase agreement with First Energy 4 Private Limited for the purchase of solar power and will be acquiring upto 19.10 percent equity of the company for Rs 13.09 crore. First Energy 4 is a solar power generation company.  Oberoi Realty: The Mumbai-based real estate developer has recorded a 106.7 percent year-on-year growth in consolidated profit at Rs 480.3 crore for the quarter ended March FY23, backed by healthy topline and tax writeback, but the operating margin was weak. Revenue grew by 16.8 percent to Rs 961.4 crore compared to the year-ago period. The board has approved raising upto Rs 1,500 crore via NCDs on a private placement basis.

Oberoi Realty: The Mumbai-based real estate developer has recorded a 106.7 percent year-on-year growth in consolidated profit at Rs 480.3 crore for the quarter ended March FY23, backed by healthy topline and tax writeback, but the operating margin was weak. Revenue grew by 16.8 percent to Rs 961.4 crore compared to the year-ago period. The board has approved raising upto Rs 1,500 crore via NCDs on a private placement basis.  Amber Enterprises India: The air conditioners and its component manufacturer has recorded an 82 percent year-on-year growth in consolidated profit at Rs 104 crore for the quarter ended March FY23. Revenue from operations for the quarter grew by 55 percent to Rs 3,002.6 crore compared to the same period last year.

Amber Enterprises India: The air conditioners and its component manufacturer has recorded an 82 percent year-on-year growth in consolidated profit at Rs 104 crore for the quarter ended March FY23. Revenue from operations for the quarter grew by 55 percent to Rs 3,002.6 crore compared to the same period last year.  CCL Products (India): The instant coffee maker and exporter has reported a 61.8 percent year-on-year growth in consolidated profit at Rs 85.3 crore for the March FY23 quarter, supported by lower tax cost and higher topline. Revenue for the quarter at Rs 520 crore grew by 38.2 percent over the same period last year.

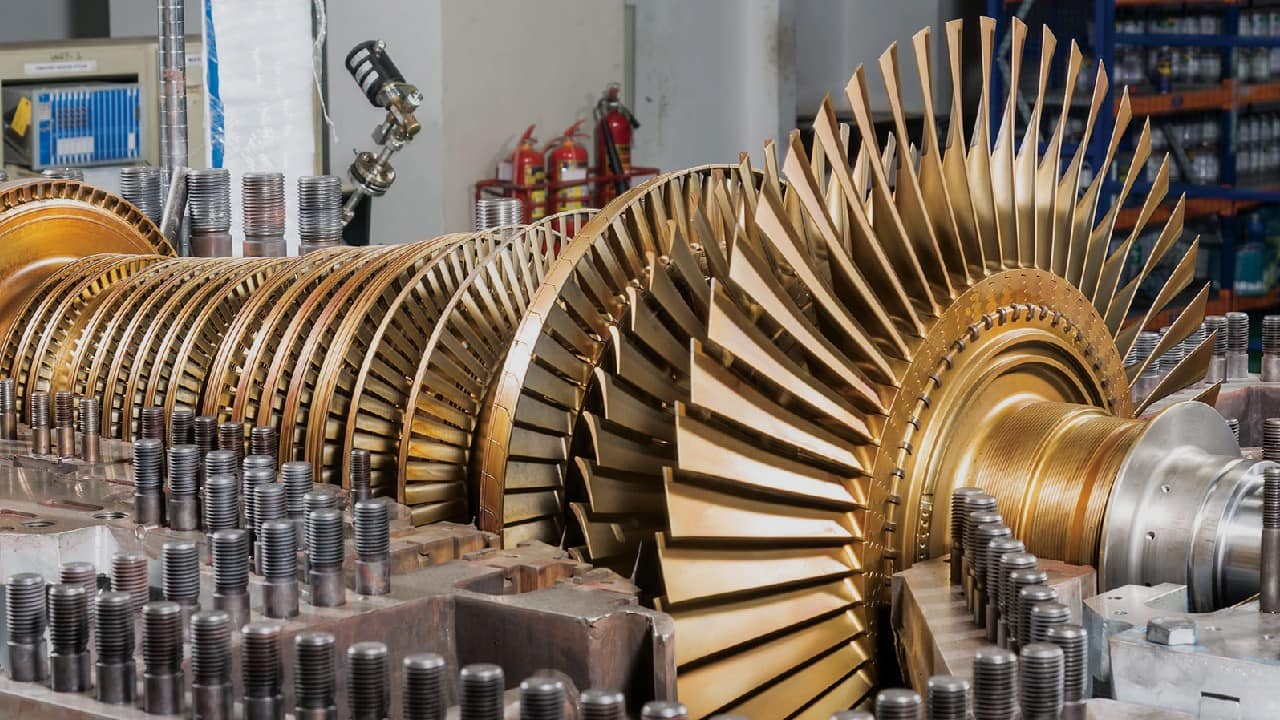

CCL Products (India): The instant coffee maker and exporter has reported a 61.8 percent year-on-year growth in consolidated profit at Rs 85.3 crore for the March FY23 quarter, supported by lower tax cost and higher topline. Revenue for the quarter at Rs 520 crore grew by 38.2 percent over the same period last year.  Triveni Turbine: The steam turbines manufacturer has reported a 68.2% year-on-year growth in consolidated profit at Rs 55.51 crore for quarter ended March FY23 on healthy operating performance and topline growth. Revenue from operations for the quarter at Rs 369.8 crore grew by 56.3% over a year-ago period.

Triveni Turbine: The steam turbines manufacturer has reported a 68.2% year-on-year growth in consolidated profit at Rs 55.51 crore for quarter ended March FY23 on healthy operating performance and topline growth. Revenue from operations for the quarter at Rs 369.8 crore grew by 56.3% over a year-ago period.  Metropolis Healthcare: The diagnostic service provider has recorded a 6.8% year-on-year growth in consolidated profit at Rs 33.35 crore for March FY23 quarter, impacted by lower topline and other income. Revenue for the quarter fell by 1% to Rs 282.5 crore compared to corresponding period last fiscal.

Metropolis Healthcare: The diagnostic service provider has recorded a 6.8% year-on-year growth in consolidated profit at Rs 33.35 crore for March FY23 quarter, impacted by lower topline and other income. Revenue for the quarter fell by 1% to Rs 282.5 crore compared to corresponding period last fiscal.  CreditAccess Grameen: The NBFC-micro finance institution will be in focus as its profit grew by 86.4% year-on-year to Rs 296.6 crore for January-March FY23 quarter on lower impairment of financial instruments. Net interest income increased by 32.7% YoY to Rs 689.8 crore compared to same period last year. Pre-provision operating profit at Rs 503 crore grew by 36.3% YoY.

CreditAccess Grameen: The NBFC-micro finance institution will be in focus as its profit grew by 86.4% year-on-year to Rs 296.6 crore for January-March FY23 quarter on lower impairment of financial instruments. Net interest income increased by 32.7% YoY to Rs 689.8 crore compared to same period last year. Pre-provision operating profit at Rs 503 crore grew by 36.3% YoY.  Chemplast Sanmar: The specialty chemicals company reported a 80% year-on-year decline in consolidated profit at Rs 46.08 crore for quarter ended March FY23 on weak topline, & operating numbers. Consolidated revenue for the quarter fell by 36.5% to Rs 1,147 crore compared to year-ago period.

Chemplast Sanmar: The specialty chemicals company reported a 80% year-on-year decline in consolidated profit at Rs 46.08 crore for quarter ended March FY23 on weak topline, & operating numbers. Consolidated revenue for the quarter fell by 36.5% to Rs 1,147 crore compared to year-ago period.  Paras Defence and Space Technologies: The consolidated profit for quarter ended March FY23 grew by 4.5% to Rs 10.76 crore compared to year-ago period, impacted by lower operating numbers. Revenue from operations increased by 6.3% to Rs 65.1 crore compared to same quarter last fiscal.

Paras Defence and Space Technologies: The consolidated profit for quarter ended March FY23 grew by 4.5% to Rs 10.76 crore compared to year-ago period, impacted by lower operating numbers. Revenue from operations increased by 6.3% to Rs 65.1 crore compared to same quarter last fiscal.  LIC Housing Finance: The housing finance company's profit for March FY23 quarter increased by 5.5% year-on-year to Rs 1,180.3 crore, while net interest income grew by 22 percent to Rs 1,990.3 crore in Q4FY23 compared to Rs 1,630 crore in same period last year. The board has announced final dividend of Rs 8.50 per share for FY23.

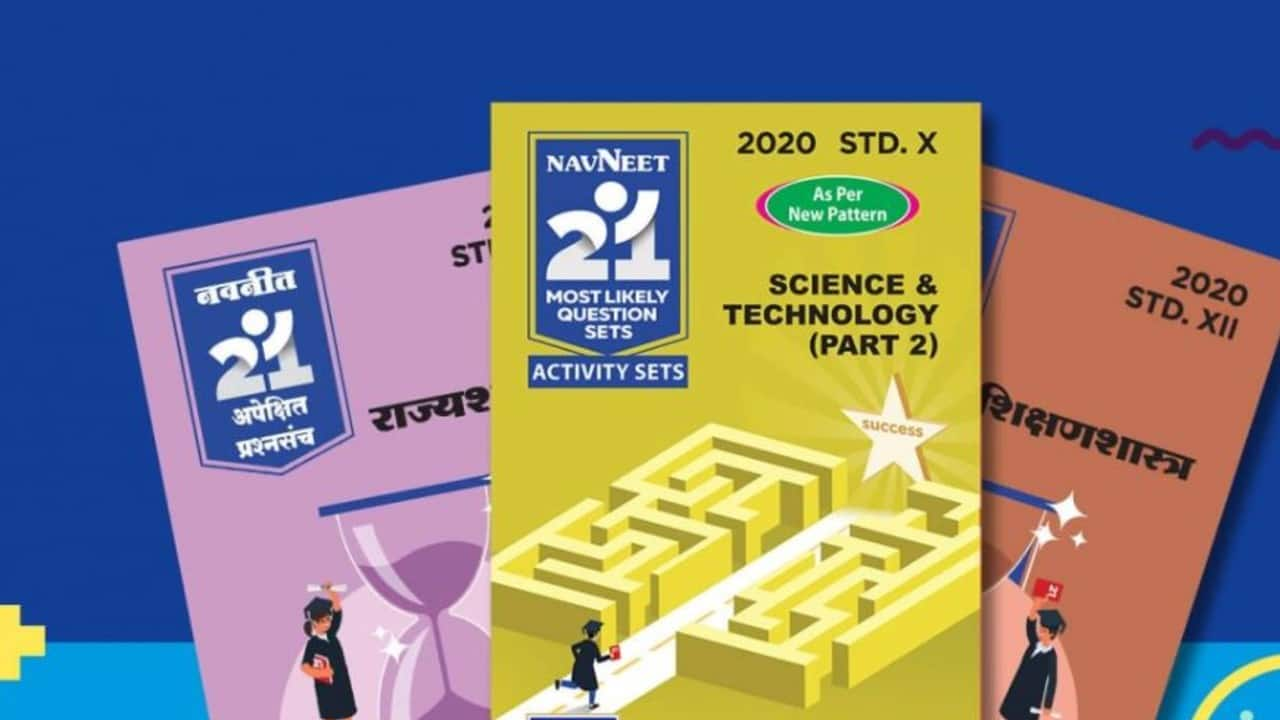

LIC Housing Finance: The housing finance company's profit for March FY23 quarter increased by 5.5% year-on-year to Rs 1,180.3 crore, while net interest income grew by 22 percent to Rs 1,990.3 crore in Q4FY23 compared to Rs 1,630 crore in same period last year. The board has announced final dividend of Rs 8.50 per share for FY23.  Navneet Education: The educational content provider has recorded a 25.25% year-on-year decline in consolidated profit at Rs 22.94 crore for quarter ended March FY23 on high base. In Q4FY22, company had an exceptional income of Rs 64.09 crore. Profitability was supported by healthy topline and operating numbers. Revenue from operations grew by 55% to Rs 409 crore compared to March FY22 quarter.

Navneet Education: The educational content provider has recorded a 25.25% year-on-year decline in consolidated profit at Rs 22.94 crore for quarter ended March FY23 on high base. In Q4FY22, company had an exceptional income of Rs 64.09 crore. Profitability was supported by healthy topline and operating numbers. Revenue from operations grew by 55% to Rs 409 crore compared to March FY22 quarter.  EIH Associated Hotels: The company has reported a 289% year-on-year growth in consolidated profit at Rs 26.2 crore for March FY23 quarter backed by healthy topline and operating performance. Revenue from operations during the quarter at Rs 107.8 crore grew by 77.88% over a year-ago period.

EIH Associated Hotels: The company has reported a 289% year-on-year growth in consolidated profit at Rs 26.2 crore for March FY23 quarter backed by healthy topline and operating performance. Revenue from operations during the quarter at Rs 107.8 crore grew by 77.88% over a year-ago period.

Buzzing Stocks: Bharti Airtel, JSPL, BPCL, Redington, Oberoi Realty & others in news today - Moneycontrol

Read More

No comments:

Post a Comment