During a call with journalists in Sydney, Jain explained that the firm typically initiates a position and then increases its investment based on earnings and performance.

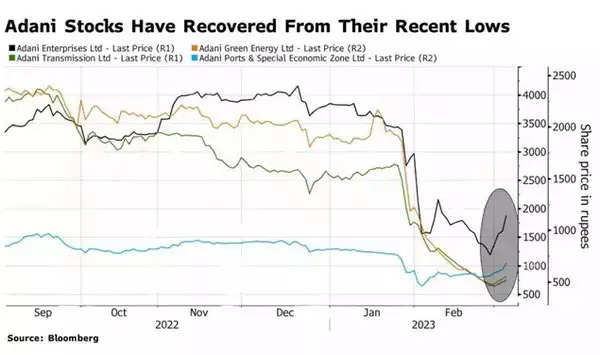

Explaining the group's rationale behind buying into Adani stocks when they were mostly falling, Jain said: "We do our deep dive, and we don't follow the herd,". "The response actually has been, frankly, more positive than I would have anticipated because they feel that's how we differentiate ourselves," Jain said, when asked how the clients have responded to the Adani deal.

Jain said he has not had a conversation with the Adani group since the transaction. "There is nothing to talk about," he said.

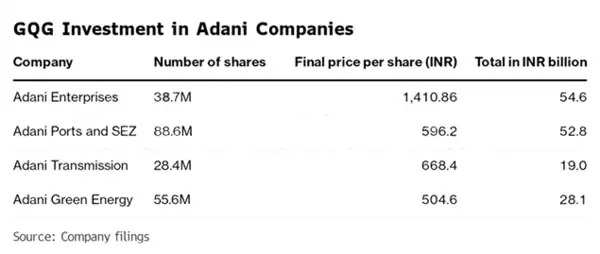

GQG bought 3.4% of Adani Enterprises for about $662 million, 4.1% of Adani Ports and Special Economic Zone for $640 million, 2.5% of Adani Transmission for $230 million and 3.5% of Adani Green Energy for $340 million.

It purchased the stock from the Adani family trust, according to the Indian firms' filings.

GQG, whose investment was seen by some analysts as a sign of investor confidence in Adani, manages equity funds for institutional investors such as mutual funds, private funds, public agencies and sovereign funds in and outside the US.

New York-based short-seller Hindenburg Research accused the Adani group in a January 24 report of stock manipulation and improper use of offshore tax havens that it said obscured the extent of Adani family stock ownership in group firms. The Adani group has denied all the charges.

The billionaire Gautam Adani-led group said on Tuesday it prepaid share-backed financing of 73.74 billion rupees ($897.84 million), as it looks to allay fears over leverage and debt sparked by the report.

(With inputs from agencies)

GQG Partners likely to increase Adani investment, says founder Rajiv Jain - Indiatimes.com

Read More

No comments:

Post a Comment