Manish Jeloka, Co-head of Products & Solutions, Sanctum Wealth

Markets have been extremely volatile on Budget day. The volatility can be attributed to uncertainty on taxation around Market Linked Debentures (MLDs), cap of Rs. 10 crores on capital gains set off against house property and negative policy announcement for the Insurance sector which offset the positives on account of higher-than-expected allocation towards capital expenditure and a better than market expected fiscal deficit number for FY2024.

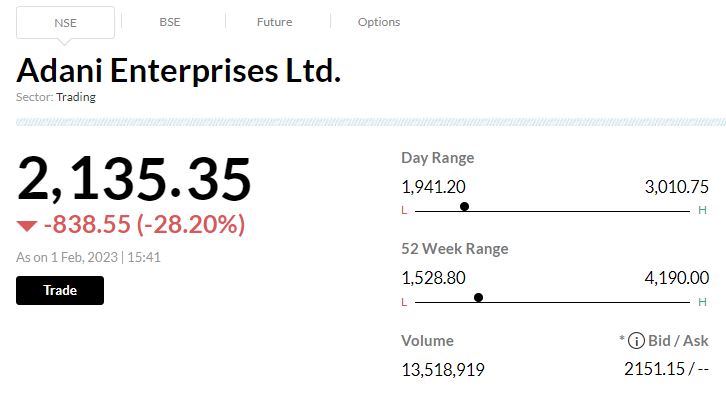

Moreover, continued pressure on Adani group stocks also weighed on market sentiments and contributed to the volatility.

Urmi Shah, Research Analyst, SAMCO Securities on Affordable Housing

Affordable Housing continues to get a boost from this Budget. The government has increased the allocation by 66% this year, to Rs 79,000 crores from Rs 48,000 crores in the previous budget. The year before last, the allocation stood at Rs. 27,500 crore. This consistent increase in the growth of the allocation is the government’s push to the housing sector.

The increase is primarily going to aid companies which have exposure in the affordable housing segment in tier 2/3 cities. Furthermore, cement and construction companies will indirectly benefit from the increased allocation. Realty has shown growth in the past few years. Real Estate companies are penetrating deeper into tier 2 and tier 3 cities which have high demand.

Adani Group stocks remained under pressure with Adani Enterprises falling 34 percent intraday:

Heena Naik, Research Analyst - Currency, Angel One

The USDINR Spot is likely to remain in the bearish arena for some more time and could possibly move towards 80.80 levels in the coming days.

The Union Budget shall allow the middle-class clan (largest spender) to spend more and support the economy in the due course of time.

The next important event is today’s FOMC Policy, and the upcoming RBI policy shall be the game changer for Rupee. For now, USDINR looks bearish.

Rupee Close:

Indian rupee closed flat at 81.93 per dollar against previous close of 81.92.

Market Close: Benchmark indices ended on mixed note in the highly volatile session on February 1.

At Close, the Sensex was up 158.18 points or 0.27% at 59,708.08, and the Nifty down 45.90 points or 0.26% at 17,616.30. About 1241 shares have advanced, 2193 shares declined, and 106 shares are unchanged.

ITC, ICICI Bank, JSW Steel, Tata Steel and Tata Consumer Products were among the top gainers on the Nifty, while losers were Adani Enterprises, Adani Ports, HDFC Life, SBI Life Insurance and Bajaj Finserv.

Among sectors, metal, PSU Bank, oil & gas and power indices down 1-5 percent. However, Information Technology index gained 1 percent.

The BSE midcap and the smallcap indices fell 1 percent each.

Insurance Stocks remained under pressure as insurance buyer need to pay tax for insurance proceeds if the premium paid is more than Rs 5 lakhs.

Cigaratte major ITC top the gainers chart but fell as much as 6.5 percent intraday after the Finance Minister said the National Calamity Contingent Duty on specified cigarettes is proposed to be revised upwards by about 16 percent.

Realty, infrastructure and cement stocks gained on announcement of 66 percent rise in the PMAY outlay, planning to set up 50 additional airports, heliports and with investment of Rs 10,000 crore per year on urban infra development fund.

Defense stocks remains under pressure as there were no major announcement in this Budget.

Also, fertilizers stock fell after Finance Minister Nirmala Sitharaman set aside Rs 1.75 lakh crore for fertilizer subsidies in the budget for the financial year 2023-24, which was 22 percent lower than Rs 2.25 lakh crore for FY23.

Autos, real estate, consumer stocks gained as Finance Minister raised the rebate limit on personal income tax to Rs 7 lakh from Rs 5 lakh under the new regime.

Mohammed Imran, Research Analyst at Sharekhan by BNP Paribas

WTI March prices have buoyed higher in Asia and kept the momentum stronger at the start of European session to trade up 0.5% at $79.28/barrel, following 2% decline on Tuesday, amid demand slowdown worries from Eurozone and US on poor economic data.

The German retail sales dip by5.3% in Dec, while the US Chicago PMI was softer at 44.3, which drifted dxy to finish lower at 102.10. API crude inventory forecast showed yet another build-up in US weekly oil reserves across the product line, trader should remain cautious ahead of the EIA data as another build up in inventory would 4th weekly inventory gains and that could trigger a selloff in oil prices. The Lower ISM mfg. numbers could also weigh on oil prices. The key focus of market remains on the outcome of US FOMC.

We expect oil prices to drift lower as European and US economic numbers are showing slowdown concerns.

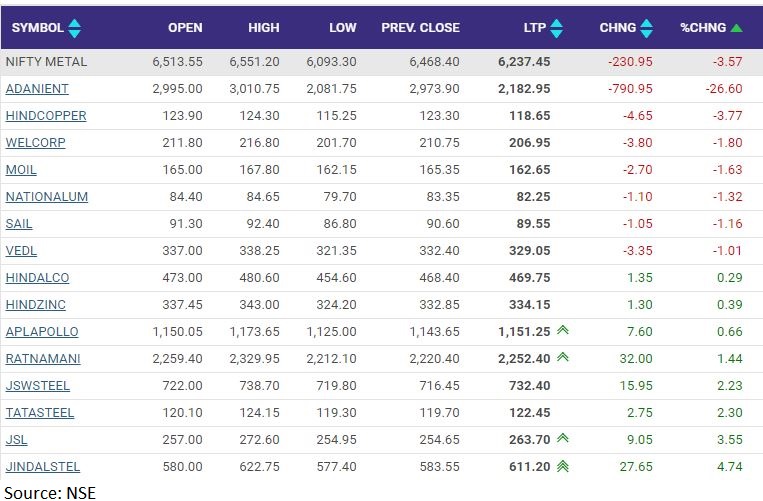

Nifty metal index sheds 3.5 percent dragged by Adani Enterprises, Hindustan Copper, Welspun Corp

Srikanth Subramanian, CEO, Kotak Cherry

The Union Budget was pragmatic, considering that the government has a tight rope between managing fiscal deficit and giving some relief to residents from high inflation. Higher capex spend, road-map to reduce fiscal deficit and boosting consumption will provide a major leg-up to the economy, especially at a time when the global growth has been hit hard by slowdown and recessionary fears.

Finally, the overhauling of the income tax structure should add more money into the hands of the middle-class taxpayers that would give a boost to consumption and increased allocation towards several investment options. Overall it would leave more people with extra money in their hands and a smile on their faces."

Market at 3 PM

Benchmark indices erased all the intraday gains and trading lower with Nifty around 17500.

The Sensex was down 210 points or 0.35% at 59,339.90, and the Nifty was down 170.20 points or 0.96% at 17,492. About 993 shares have advanced, 2288 shares declined, and 95 shares are unchanged.

Closing Bell: Sensex gains 158 pts, Nifty falls on Budget day; metal, PSU Banks take a hit - Moneycontrol

Read More

No comments:

Post a Comment