Speaking at the BFSI Insight Summit 2022 hosted by Business Standard, Das said that cryptocurrencies have no underlying value and pose risks for macroeconomic and financial stability.

The RBI has for long held its view that private cryptocurrencies are a threat to stability and has been against legitimising its usage. To combat the issue, India recently launched its own cryptocurrency, backed by the RBI.

The Reserve Bank of India announced that it would be coming up with their own Central Bank Digital Currency (CBDC) famously known as the "Digital Rupee". From November 1, 2022, the central bank began the pilot project of India's very own digital currency -- Digital Rupee -- for the wholesale market.

RBI Deputy Governor T Rabi Sankar recently said whatever data is available is misleading and called for building all related rules on a clear understanding of what digital currencies are and what they are supposed to do. He also called for a single communication across the board for effective regulation of crypto.

"Data is not available. Whatever data is available is misleading. And making regulations in the absence of adequate information carries a high probability of us ending up with the wrong set of prescriptions," T Sankar said at a virtual conference hosted by the International Monetary Fund (IMF). The deputy governor highlighted the need for gathering "sufficient, trustworthy, and consistent information."

On the regulation front, he called for building all related rules on a clear understanding of what cryptocurrencies are and what they are supposed to do. He also called for a single communication across the board for effective regulation of crypto. As major crypto exchanges like FTX go bankrupt amid high volatility, almost 90 per cent of cryptocurrencies have a low trading volume, with just 2 per cent of crypto coins having a healthy liquidity, a new study has found.There are only 153 crypto coins with high volume that are traded in many exchanges. In contrast, there are 5,886 cryptocurrencies with very low volume that are traded in a very small number of exchanges, according to the report compiled by BitStacker.

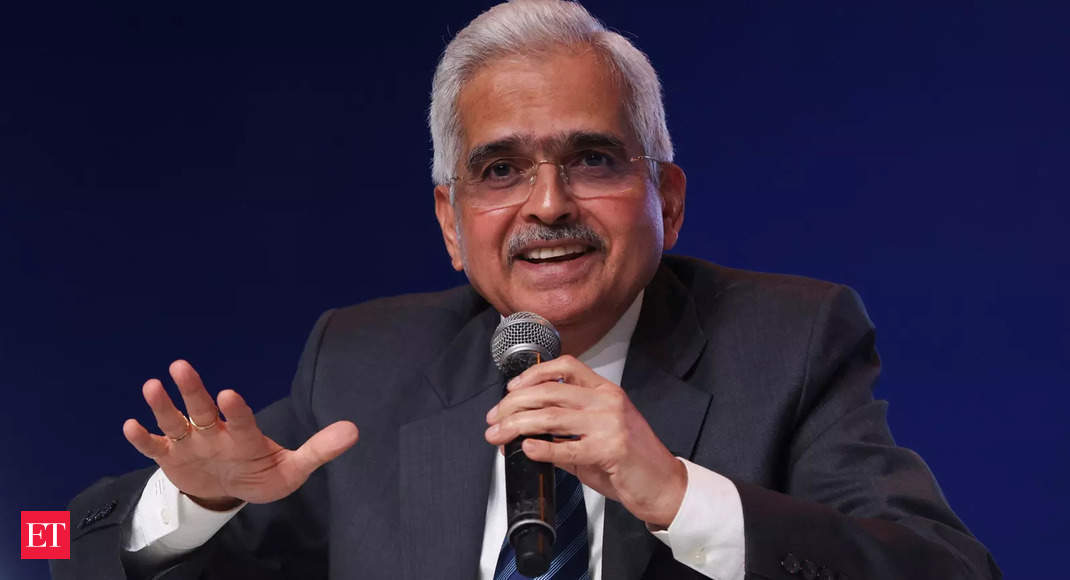

Next financial crisis will come from private cryptocurrencies, says RBI Governor Shaktikanta Das - Economic Times

Read More

No comments:

Post a Comment