The market further succumbed to the selling pressure and lost 2.5 percent for the week ended December 23, and recorded the biggest weekly loss since June. Weak global cues, fear of recession, anticipation of further policy tightening by the US Federal Reserve, and resurgence of Covid cases across countries weighed on investors.

The equity benchmarks settled in the red for third straight week, falling nearly 6 percent from their fresh record highs scaled on December 1.

The BSE Sensex slipped below the psychologically crucial mark of 60,000. During the week, the 30-share index plunged nearly 1500 points to close at 59,845. The Nifty50 retreated 462 points to close the week at 17,807. All sectors, barring healthcare, faced severe selling pressure.

The broader markets were also caught in bear trap as the Nifty Midcap 100 index declined nearly 6 percent and Smallcap 100 index dropped more than 8 percent.

Considering the sharp downfall and lack of major global cues due to Christmas & New Year holiday, the market is expected to consolidate in the coming week, with participants focusing on Covid situation. Besides, experts also feel that the upcoming monthly expiry could add to the volatility, experts said.

"The coming week will mark the end of the calendar year and participants will be eyeing core sector data and current account deficit on December 30. Before that, the scheduled derivatives expiry of December month contracts would keep the participants busy," Ajit Mishra, VP - Technical Research at Religare Broking said.

The performance of the global indices amid the rising fear of COVID cases would further add to the volatility, he added.

The last three weeks of the slide have changed the market structure and indications are pointing toward the decline to extend further, the market expert feels.

Here are 10 key factors that will keep traders busy next week:

1) Covid Concerns

Going ahead, the key factor to watch out for would be resurgence of covid cases. A new new Covid variant, in several parts of the world (including China, United States, Japan, South Korea and France), has been making the market participants cautious since the last week.

Reportedly, surge in Covid cases in China, the world's most populated country, is due to new variant of Omicron - BF.7, which is said to be highly transmissible variant with a shorter incubation period. Even India has reported four Covid cases with the new variant - two in Gujarat and two in Odisha.

2) Macroeconomic Data

On December 30, fiscal deficit and infrastructure output numbers for the month of November will be released.

Besides, data pertaining to bank loan & deposit growth for fortnight ended December 16, and foreign exchange reserves for week ended December 23 will also be released in the coming week on Friday.

Further, current account and external debt numbers for the quarter ended September FY23 will also be released on December 30. Country's current account deficit at $23.87 billion in Q1FY23 (which is 2.8 percent of GDP) was highest since Q3FY13, and even trade deficit was more than doubled to $68.6 billion in the same period compared to year-ago period.

3) Global Macroeconomic Data

Here are key global macroeconomic data points to watch out for next week:

4) Oil Prices

Oil prices rallied for second consecutive week but overall have been moving in a particular range below $85 a barrel on the Brent crude futures for nearly three weeks now, partly due to weak demand outlook amid slowdown fear.

Last week, the international benchmark Brent crude futures rose by nearly 6 percent to $79 a barrel, after Moscow threatened to cut production in response to price cap on Russian exports by European Union, helping the oil market post gains for second week in a row.

Hence, the market participants will keep an eye on the oil price movement, though experts largely do not expect any kind of sharp spike in coming days.

"The severity of new cases of covid across the world is still not that serious to impose lockdowns, hence we are continuing to see jump in crude oil prices over 5 days. But the slowdown fear due to rate hike have dampened investors’ sentiments. We see limited upside in crude oil prices," Mohammed Imran, Research Analyst at Sharekhan by BNP Paribas said.

5) FII Flow

The flows from foreign institutional investors (FIIs) and foreign portfolio investors (FPIs) remained volatile. However, domestic institutional investors (DIIs) seem confident enough about the country's progress going ahead, and provided great support to the market on the lower side.

FIIs net offloaded shares worth nearly Rs 1,000 crore, as per provisional data, for the week ended December 23, taking the total monthly outflow to nearly Rs 8,500 crore, which have been restricting the market upside.

On the other hand, the recent correction ha been smartly utilised by the DIIs, as they have net bought around Rs 8,500 crore worth shares in the week gone by, taking total monthly inflow at Rs 19,000 crore.

6) IPO

Two public issues will open for subscription, along with two listings in the coming week, keeping the primary market busy in last week of December too.

Initial public offering of Radiant Cash Management Services will enter into second day of bidding on December 26 and the closing date would be December 27.

The retail cash management services provider aims to mop up Rs 388 crore from the maiden issue, at the upper end of a price band of Rs 94-99 per share. The company has reduced its offer size to 2.74 crore shares, from 3.91 crore after mobilising Rs 116.38 crore through the anchor book on December 22, a day before the IPO opening.

Sah Polymers will be the last public issue for the current calendar year, opening for subscription from December 30-January 4. It will announce its IPO price band on coming Monday. The 1.02 crore shares IPO is entirely a fresh issue.

Technology-driven financial services platform KFin Technologies will make its stock exchange debut on December 29, while electronics manufacturing services provider Elin Electronics will hit the bourses on December 30.

7) Technical View

The Nifty50 has formed long bearish candle on the daily charts as well as weekly scale, indicating more weakness in short term. Also it has been making lower highs lower lows for second consecutive week as well as second straight session.

Even the index fell way below its 50 DMA (day moving average - 18,174) as well as 50 DEMA (day exponential moving average - 18,180), and slightly below 100 DMA and DEMA (both around 17,840). Hence, unless and until the index gets back above 50-day SMA as well as EMA, the major upside is unlikely in the market, hence till then there could be more consolidation in the range of 17,800-18,000 levels, with support at 17,641, the low of long bearish candle formed on October 25, experts said.

"Technically, Nifty has broken down multiple support levels effortlessly. However, the relative strength index (RSI) is approaching oversold territory, and if Nifty manages to regain its 100-DMA of 17,840, which coincides with a 50 percent retracement of the previous rally from 16,748 to 18,888, then we can expect a short-covering move in the market," Santosh Meena, Head of Research at Swastika Investmart said.

On the upside, he feels the 18,000–18,100 area will act as a supply zone, and Nifty has to cross its 50-DMA for any meaningful strength. On the downside, "17,640, 17,565, and 17,425 will be the next important support levels."

8) F&O Cues

As we will enter into monthly F&O expiry week, the market may witness volatility. The Option data indicated that 17,500-17,800 area is expected to act as a near term support for the Nifty50, whereas the resistance area could be 18,000-18,200 where we have the maximum Call open interest.

The maximum Put open interest was seen at 17,000 strike, followed by 17,500 strike, & 17,800 strike, with Put writing at 17,800 strike, then 17,600 strike.

On the Call side, we have seen the maximum Call open interest at 18,000 strike, followed by 19,000 & 18,200 strikes, writing at 18,000 strike, then 18,100 strike and 18,200 strike.

"For the coming monthly settlement, once again the Call options open interest in the Nifty is significantly higher compared to Put bases. However, the Nifty is trading below its Put base of 18,000. Despite the Nifty closing well below 18,000, there was no closures in 18,000 strike Puts, which keeps hopes intact of some bounce," ICICI Direct said.

9) India VIX

Volatility increases sharply in past few days, making the bears more comfortable and giving discomfort for bulls. India VIX, the fear index surged by 41 percent from 11.43 level seen on December 13, to 16.16 level on December 23, while during the passing week, it jumped nearly 15 percent. Hence, further northward journey in VIX could put more pressure on the market, experts said.

"Volatility across the globe rose sharply as a new strain of the Covid variant is spreading. India VIX also moved towards 16 percent, which is likely to keep traders on their toes coupled with rollover activity due to December settlement," ICICI Direct said.

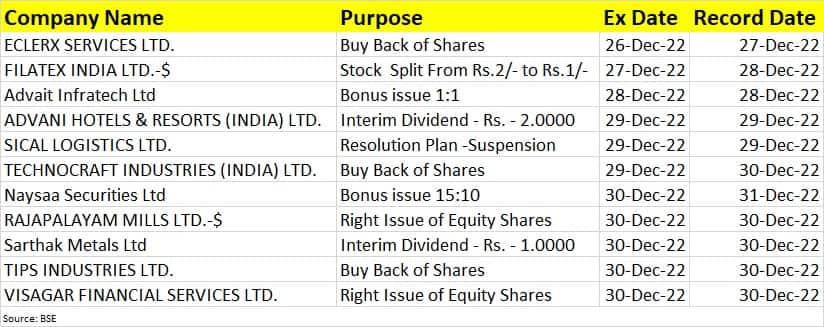

10) Corporate Action

Here are key corporate actions taking place in coming week:

Dalal Street Week Ahead: 10 key factors that will keep traders busy next week - Moneycontrol

Read More

No comments:

Post a Comment