Trading volumes are half of what they were in the last high. (Photo by Vicky Tran/Pexels)

Sensex and Nifty have made record highs after nearly a year. Their last highs were in October 2021, after which the markets began to move sideways and after six months corrected sharply.

Will this high be different? Will it peak again or break into a new bull rally?

This time the macroeconomic picture looks significantly better than the last year, which was beset by inflation and rate hike worries. But technical indicators are a mixed bag, advising caution; more on that later.

First, let’s look at the macro and earnings comparisons.

Also read: Experts line up 10 stocks that may do well if Nifty heads to 19,000

In October 2021, global recovery was stymied by the Delta variant of Covid-19 spreading rapidly across countries, continuing to cause disruptions in supply chains and feeding the inflationary trend. The International Monetary Fund cut its global growth forecast for the calendar year 2021 to 5.9 percent and estimated 4.9 percent for 2022.

In 2021, India’s earnings saw healthy growth. Though that September quarter’s earnings were weighed down by rising energy and commodity prices, they were largely in line with the Street’s expectations. But the market was nervous about the global macro uncertainties. “(In October 2021) the question was more around liquidity because interest rates were going up, inflation was going up and (investors were concerned about) the effect of the US recession on the Indian earnings growth, that was a big concern,” said Vikas Khemani, founder of Carnelian Asset Advisors.

As these worries were brewing, the Ukraine war broke out and the market corrected sharply. This year all these concerns are receding, said Khemani.

“Last year, we had a lot of (FII) outflows from India. This has stopped and it has turned positive,” he added. FIIs turned net buyers in August 2022 after nine months of selling. This reversal will help with better liquidity.

According to him, this time around, three crucial peaks have been reached. “In terms of inflation, interest rates and the dollar, we have made the peaks. Therefore, the expectation of all of them coming down is being built now. That means easy liquidity scenario for emerging markets, with more and more money coming from foreign investors. This is good for India and other emerging markets,” he said.

The September 2022 quarter earnings didn’t disappoint the Street. “Nifty50 continues to see healthy sales growth of 27 percent YoY, driven by strong price growth and moderate volume growth,” wrote India strategists at Elara Capital, in their review note of the quarter. This quarter some of the sectors saw margin contraction — metals from high-cost inventory, and OMC, banks and autos because of marketing expenses. But from the next quarter the margins are expected to recover with raw material prices falling, high-cost inventory declining and companies taking price hikes.

Khemani sees 14-15 percent earnings growth one-year forward. “With inflation coming down, it can only accelerate,” he said.

Given these differences, he does not see a correction from this time’s high, as it happened with the last peak. He expects the market to stay on an uptrend.

The International Monetary Fund has reduced its global growth estimate for 2023 to 2.7 percent from 2.9 percent and Barclays has cut its forecast for the same year to 1.7 percent (lowest in four decades) from 2.2 percent. But Khemani does not see this affecting India’s earnings. “In fact, it will only help India being a growth market,” he said.

However, brokerages such as Nomura believe that weakening global growth will weigh on India’s growth figures too, especially since October’s export-import data was disheartening — export volumes contracted nearly 17 percent and import growth weakened to 5.7 percent from 8.7 percent in September. “October marks the first contraction in exports in the post-pandemic phase – the last time exports contracted was back in February 2021 – attesting to the increasingly challenging global environment, and India’s sensitivity to this global slump,” wrote Nomura in its November 15 report. The IMF has reduced its India’s GDP growth estimate for FY23 from 7.4 percent to 6.8 percent and the Reserve Bank of India (RBI) has reduced its forecast from 7.2 percent to 7 percent. The government itself has estimated a much lower 6.5 percent growth for FY23.

Technical indicators

Rajesh Sriwastava, who has more than 20 years of experience in trading and is an expert in gauging market trends from Open Interest, said, “Trading volumes are half of what they were compared to last life-time high but the market breadth is much better.” Forty stocks, or 80 percent of Nifty, are above 200SMA (simple moving average).

Also read: Here's why Morgan Stanley believes Sensex can climb 80K by December 2023

“This is a good breadth. On a monthly basis, now we have 32 advances and 18 declines while last time (when there was a life-time high) it was 21 advances and 29 declines,” he said.

Even the weak volumes aren’t concerning because there is no visible selling off, he said. “Retail participation has been weak but they (the investors) will return,” said Sriwastava. With volatility also low, which indicates uncertainty in the market, he expected the upward trend to continue.

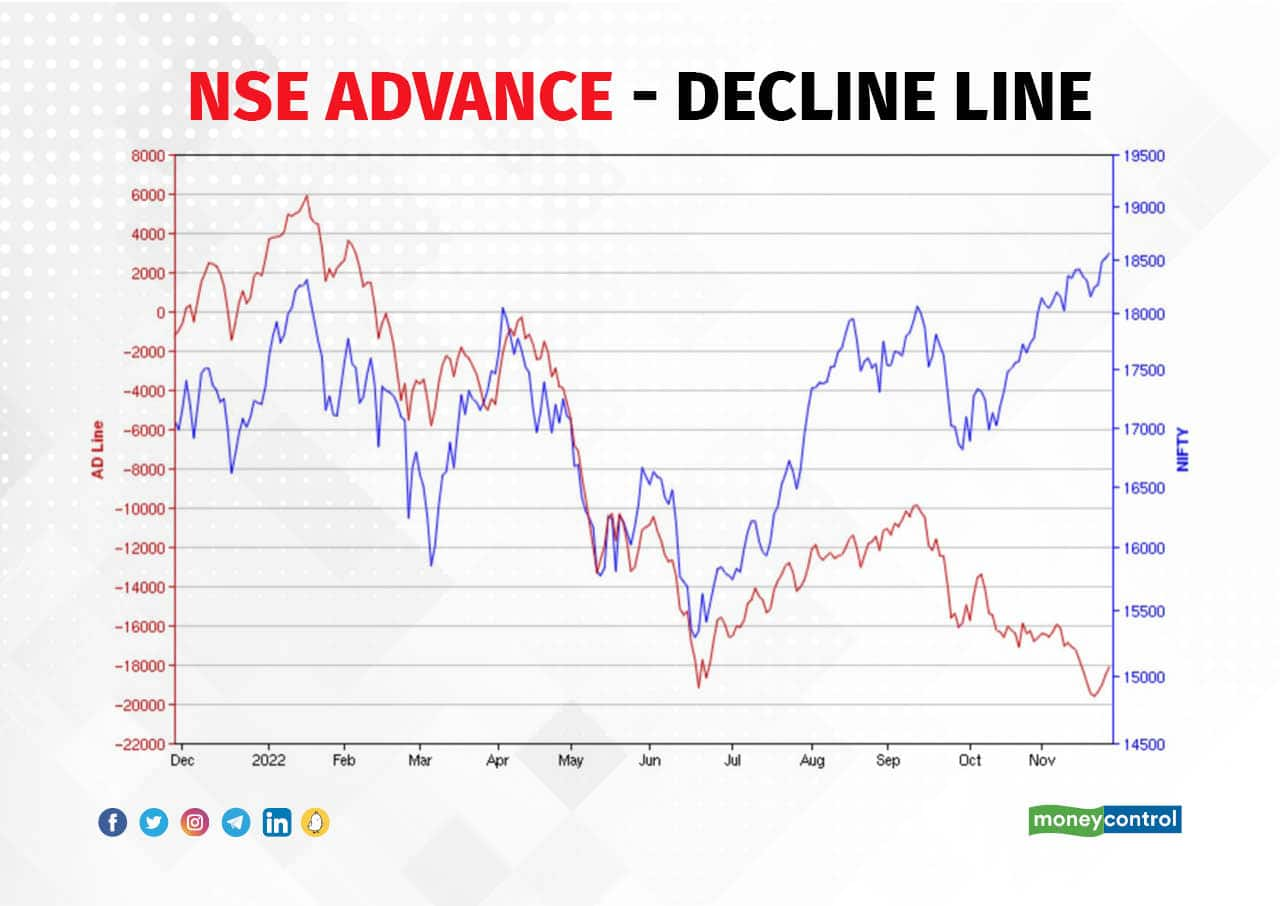

While the advance-decline ratio (AD ratio) looks comforting with 80 percent of the stocks advancing, the advance-decline line (A/D line) doesn’t look so (see chart).

Another veteran trader, trainer and Chartered Market Technician (CMT) Ashish Kyal emphasised looking at the A/D line because it captures a longer time horizon. “The ratio will give only a picture of the past 10 to 14 days while A/D line will give a more historical, cumulative picture,” said the author of Effective Trading in Financial Markets and founder of Waves Strategy Advisors.

“The AD line has deteriorated sharply (since September 2022),” he said.

“The weakening volumes and the market breadth deteriorating (as indicated by the AD line) is a warning. While the overall trend will remain bullish, investors need to be cautious. If the markets break the support level (with a six-month horizon) of 18,000 for Nifty or 59,700 for Sensex, then the trend may reverse to the downside and it is possibly a time to start looking for selling opportunities,” said Kyal.

(Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.)Sensex, Nifty at new highs: How different is this uptrend from the last peak? - Moneycontrol

Read More

No comments:

Post a Comment