After taking a breather in the previous week, the market resumed its uptrend and ended the week at a record closing high with 1 percent gain on November 25, following an up-move in global counterparts amid rising hope that the Federal Reserve may slow down the pace of rate hikes in the upcoming policy meetings. The declining oil prices, buying by FIIs and falling US bond yields, too, lifted the sentiment.

The BSE Sensex rallied more than 600 points to 62,294 and the Nifty50 jumped over 200 points to 18,513, while the broader markets were also in action after recent consolidation, with the Nifty Midcap 100 and Smallcap 100 indices gained more than 2 percent each.

Auto, banks, technology, infrastructure, and oil and gas stocks supported the market, whereas power and realty stocks were under pressure.

In the coming week, too, the momentum along with consolidation is expected to sustain, with the Nifty likely hitting its intraday record high of 18,604, with focus on monthly auto sales numbers and second quarter GDP data on the domestic front, and global cues, experts said. The Bank Nifty as well as the BSE Sensex reclaimed their previous tops.

"Going ahead, the lack of strong fundamental triggers will limit the upside, keeping the market volatile in the short term. The Fed Chair's speech, scheduled for the next week, and the release of other significant macroeconomic data will influence the market's future trajectory," Vinod Nair, Head of Research at Geojit Financial services, said.

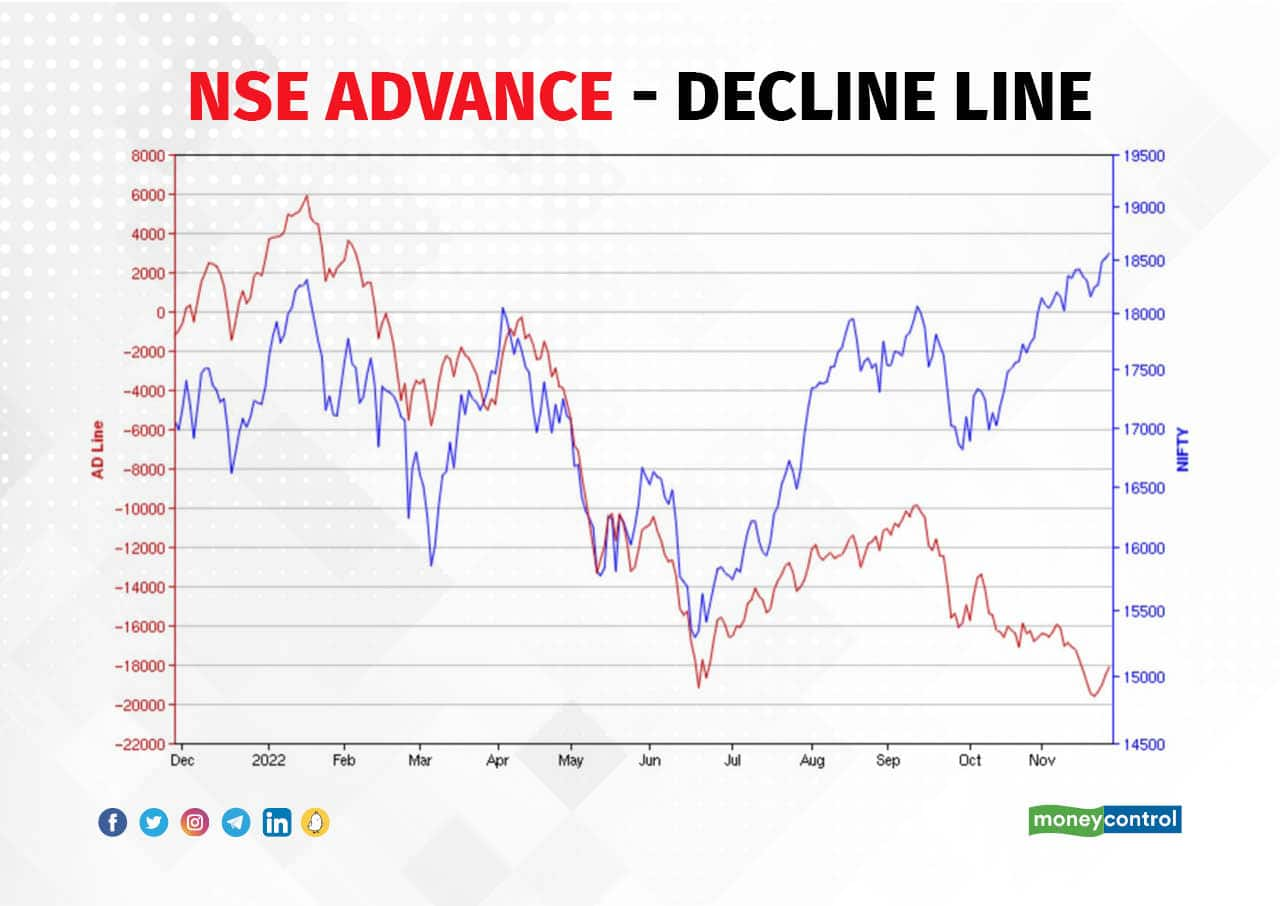

Amid all, Ajit Mishra, VP - Technical Research at Religare Broking said it would important to see how the broader market participation pans out as that would play a critical role in strengthening the trend.

Here are 10 key factors that will keep traders busy next week:

1) Quarterly GDP Numbers

The quarterly economic growth rate scheduled to be released on coming Wednesday is the key factor to watch out for next week. Most of experts expect the economy to grow more than 6 percent in the September FY23 ended quarter (Q2CY22), lower compared to growth rate of 13.5 percent recorded in previous quarter (on a low base due to Covid-led lockdown in Q1FY22), supported by pent-up demand and economic activity normalisation.

"We expect India's Q2FY23 GDP to rise 6.4 percent YoY. We think a resilient domestic backdrop and pent-up demand continued to prop up India’s growth, especially in the tertiary sector, even as external headwinds rose through the quarter," Rahul Bajoria, MD & Head of EM Asia (ex-China) Economics at Barclays said.

He further said the 6.4 percent growth forecast for Q2FY23 is broadly consistent with their expectation that India’s economy will expand by 7.0 percent in FY22-23, although the risks are tilted modestly to the downside.

Along with GDP, fiscal deficit and infrastructure output for October will also be released on Wednesday, while S&P Global manufacturing PMI data for November will be announced on Thursday.

Bank loan and deposit growth for fortnight ended November 18, and foreign exchange reserves for week ended November 25 will be released on Friday.

2) November Auto Sales

Monthly auto sales numbers scheduled to be released in later part of next week will also be watched. Commercial vehicle demand momentum is expected to continue in November, while the passenger vehicle sales are likely to be supported by improving semiconductor supply, experts said, but the sustainability of demand for two-wheeler post festive season is a key to watch.

Hence, automobile companies like Tata Motors, Maruti Suzuki India, Mahindra & Mahindra, Eicher Motors, Hero MotoCorp, Ashok Leyland, TVS Motor, Bajaj Auto etc will be in focus.

The Nifty Auto index fell over 3 percent so far in current month, but overall it has been consolidating in 1,000 points range for last four months.

3) Oil Prices

The correction in oil prices was one of reasons for strengthening market sentiment last week as it raises hope for ease in inflation and fiscal deficit concerns along with improving margin pressure for corporates. Also the RBI may heave a sigh of relief as the rate hike pace may be slowed down, experts said.

International benchmark Brent crude futures settled at $83.63 a barrel on Friday, down 4.5 percent on week-on-week basis as rising Covid cases in China, the world's top oil importer, raised fear over demand outlook. Also the discussion between G-7 and European nations with respect to cap on Russian oil price between $65-70 a barrel also weighed on sentiment.

Oil prices traded at more than 10-month low now, which is really a supportive factor for oil importing country like India.

4) Global Economic Data Points

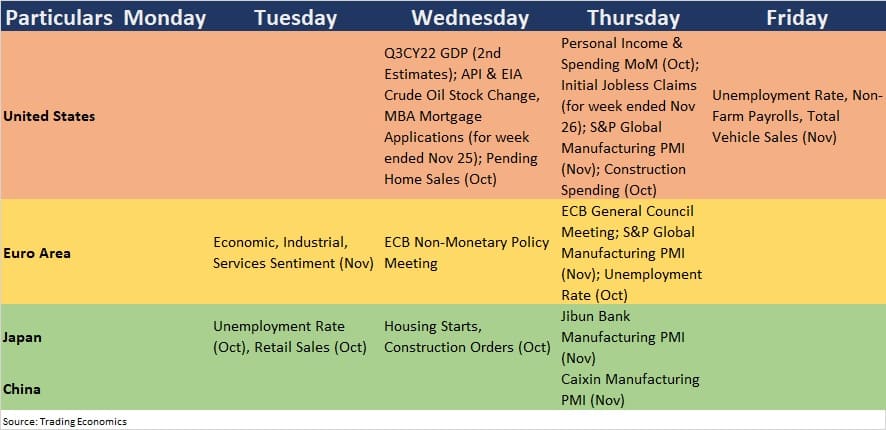

Investors will closely watch the second estimates for third quarter (CY22) US GDP, US unemployment rate for November, monthly manufacturing PMI data due next week.

Here are key global economic data points to watch out for next week:

Apart from that, speech by several Federal Reserve officials including Fed Chair Jerome Powell will also be eyed by investors, especially after FOMC minutes raised hopes for slower pace of rate hikes in upcoming meetings.

5) FII Flow

Healthy buying by foreign investors in November seems to have raised confidence of the market. Experts largely feel the flow is expected to continue in coming weeks with the fall in US dollar index, and bond yields and given the India is the fastest growing economy in the world.

FIIs have net bought more than Rs 24,700 crore worth shares in November, in addition to over Rs 8,400 crore of buying in previous month.

On the other side, DIIs who have been playing supportive role for Indian equities, preferred to take some profits off the table especially may be after FIIs increasing their flow in India.

"FPIs are unlikely to be major sellers, going forward since their earlier policy of continuous selling in banking has cost them heavily. Now the market construct in the US has changed to “rising equity, falling yields and falling dollar". This is favourable for the continuation of FPI flows, going forward," Dr VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services, said.

6) IPO

The primary market will remain active in the coming week too, with more than Rs 1,000 crore worth IPOs getting launched.

Agrochemical company Dharmaj Crop is planning to raise Rs 251 crore via initial public offering, comprising fresh issuance of shares worth Rs 216 crore and an offer for sale of Rs 35.15 crore by its promoters. The price band for the offer is Rs 216-327 per share, and the issue will be opened for subscription between November 28-30.

Uniparts India, the manufacturer of engineered systems, will also open its IPO next week on November 30 and close on December 2.

The company aims to mobilise Rs 836 crore through public issue that comprises only offer for sale of more than 14.4 million shares by promoters and investors. The issue mainly seems to be aimed at offering an exit opportunity to investors Ashoka Investment Holdings, and Ambadevi Mauritius Holding. The price band for the share sale is Rs 548-577 per share.

7) Technical View

The Nifty50 has formed Doji kind of pattern on daily charts as the index ended with moderate gains after consolidation, while there was bullish Engulfing pattern formation on the weekly scale with making higher highs for sixth consecutive week.

The index has closed above 18,500 for the first time in its history. Even the RSI (relative strength index) and MACD (moving average convergence divergence) also indicated positive mood.

Given the optimism, 18,450-18,500 zone is expected to play crucial role for further upside towards record high of 18,604 next week, with key support at 18,100, experts said.

"We expect the prevailing trend to continue and expect Nifty to scale 18,700 first and then to a new milestone of 19,000. On the downside, the 18,100 zone would provide the needed support in case of any dip," Ajit Mishra said.

8) F&O Cues

The option data suggested that for December, market participants may be betting big on 19,000 mark after failure in previous month, with taking crucial support at 18,000 mark.

We have seen maximum Call open interest at 19,000 strike, followed by 20,000 strike, with Call writing at 20,000 strike, then 19,000 strike, and Call unwinding at 18,300 strike, followed by 18,000 strike.

On the Put side, the maximum open interest was seen at 18,000 strike, followed by 17,000 & 17,500 strikes, with writing at 18,500 strike, then 18,200 strike.

"On the data front, both Call and put strikes witnessing heavy open interest build-up suggesting expectations of rangebound market. While the highest Call base is placed at ATM 18,500 strike, Put base is visible at 18,300 strike," ICICI Direct said.

"The Nifty futures open interest at the inception of December remained almost flat vis a vis last series. The FIIs net longs are at one of the highest seen in last few years. Hence one should remain positive till Nifty is holding its Put base," the brokerage added.

9) Volatility Index

The volatility cooled down considerably in November, falling from close to 17 mark to near 13, which is more than a year low. During the week, India VIX fell by 7.37 percent to 13.33 levels, giving more comfort for bulls.

Hence the sustainability of VIX at lower levels could remain supportive for the market going forward, experts said.

"India VIX index, hit a 14-month low of 11.88 points, factoring in that India is better placed in comparison to other global Indices in terms of inflation, economic and corporate earnings growth. Such low reading is suggesting low risk perception among participants," Tirthankar Das of Ashika Stock Broking said.

Going forward two important factors are likely to influence the India VIX i.e. Q3FY23 and Budget expectation. In this context one can expect India VIX to start increasing from December-end onward, he said.

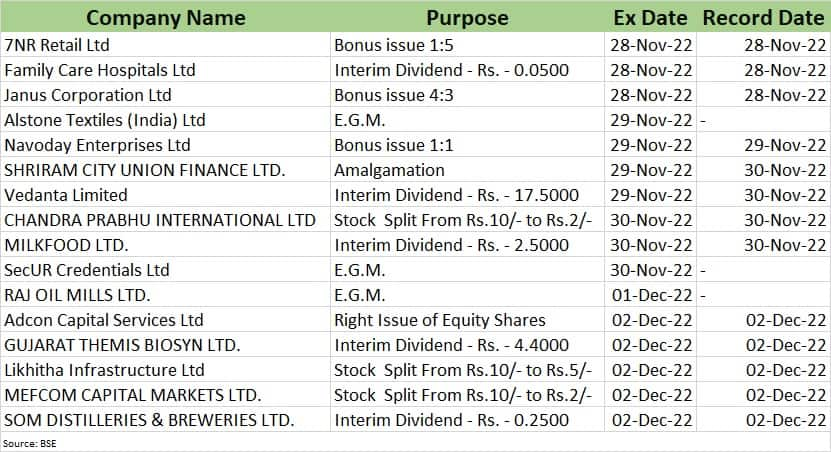

10) Corporate Action

Vedanta will trade ex-dividend on Tuesday next week. It has announced an interim dividend of Rs 17.5 per share.

Here are key corporate actions taking place in the coming week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Adblock test (Why?)

Dalal Street Week Ahead | 10 factors that will keep traders busy - Moneycontrol

Read More