The market extended gains for yet another session and closed near the day's high on October 17, tracking positive mood in global counterparts. Banking and financial services, auto and select IT stocks led the rally.

The BSE Sensex jumped 491 points to 58,411, while the Nifty50 rose 126 points to 17,312 and formed a bullish Piercing Line kind of pattern on the daily charts, indicating the possibility of a bullish reversal.

"A long bull candle was formed on the daily chart, that has placed beside the long negative candle of Friday. Technically, this pattern indicates a comeback of bulls after a consolidation movement of the previous session. The opening upside gap of Friday has been filled and the market bounced back smartly from the support of that gap on Monday. This is a positive indication," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

Having moved above the immediate resistance of 17,260 levels, the Nifty is expected to move towards the next important resistance of 17,425 levels in the short term. Any sustainable upside above 17,450 levels could bring sharp upside momentum in the market.

The immediate support is now placed at 17,100 levels, the market expert said.

The buying was also seen in broader markets but failed to outperform benchmark indices. The Nifty Midcap 100 and Smallcap 100 indices gained 0.16 percent and 0.45 percent respectively.

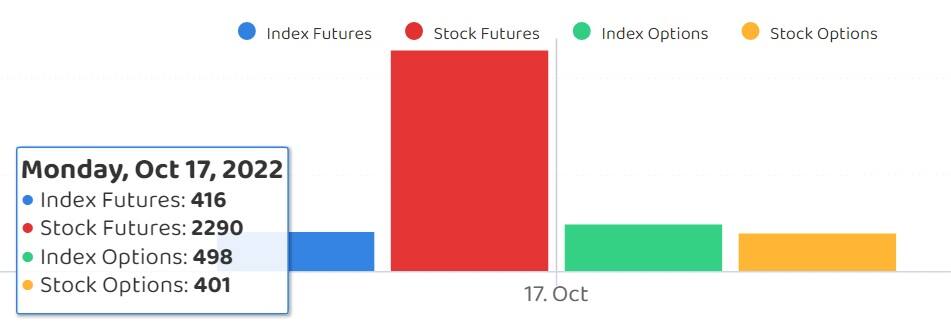

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data, and not just of the current month.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,164, followed by 17,016. If the index moves up, the key resistance levels to watch out for are 17,394 and 17,476.

The Nifty Bank played a supportive role in Monday's trade, rising 615 points or 1.56 percent to 39,920 and formed a bullish candle on the daily scale on October 17. The important pivot level, which will act as crucial support for the index, is placed at 39,386, followed by 38,853. On the upside, key resistance levels are placed at 40,214 and 40,509 levels.

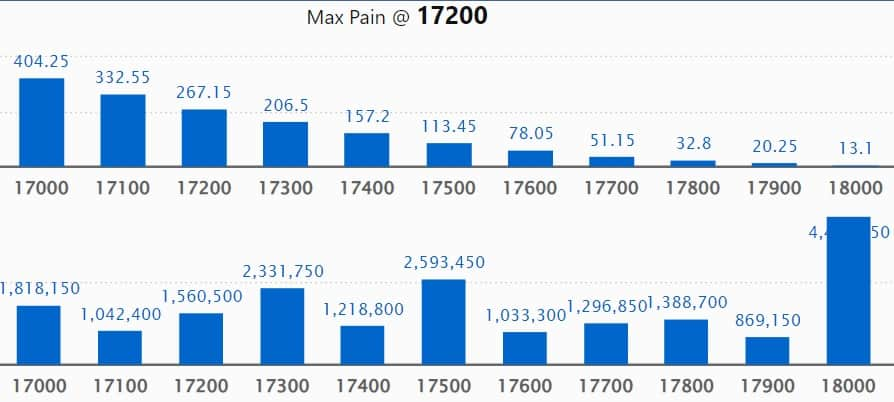

Maximum Call open interest of 44.77 lakh contracts was seen at 18,000 strike, which can act as a crucial resistance level in the October series.

This is followed by 17,500 strike, which holds 25.93 lakh contracts, and 17,300 strike, which has 23.31 lakh contracts.

Call writing was seen at 17,300 strike, which added 6.48 lakh contracts, followed by 18,300 strike which added 3.89 lakh contracts, and 17,800 strike which added 3.01 lakh contracts.

Call unwinding was seen at 17,100 strike, which shed 58,800 contracts, followed by 17,000 strike which shed 43,400 contracts and 18,600 strike which shed 24,900 contracts.

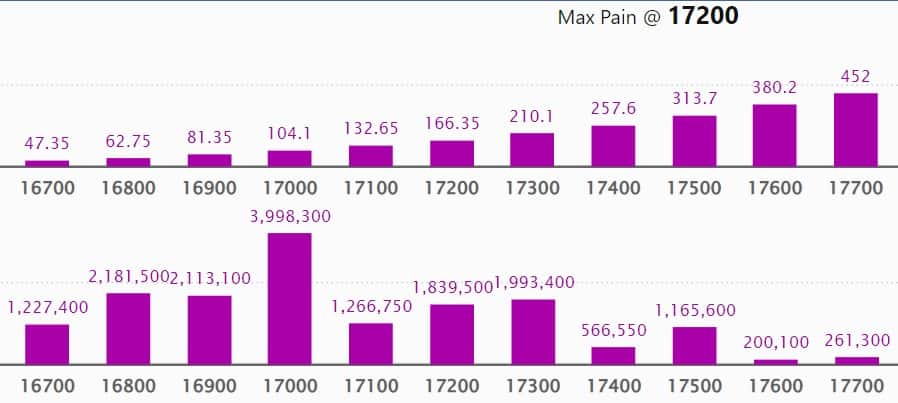

Maximum Put open interest of 39.98 lakh contracts was seen at 17,000 strike, which can act as a crucial support level in the October series.

This is followed by 16,000 strike, which holds 31.65 lakh contracts, and 16,500 strike, which has accumulated 26.48 lakh contracts.

Put writing was seen at 17,300 strike, which added 6.78 lakh contracts, followed by 16,200 strike, which added 5.93 lakh contracts, and 17,000 strike which added 4.41 lakh contracts.

Put unwinding was seen at 16,000 strike, which shed 2.88 lakh contracts, followed by 16,900 strike which shed 24,950 contracts and 16,800 strike which shed 20,350 contracts.

STOCKS WITH A HIGH DELIVERY PERCENTAGE

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Atul, Whirlpool, Ipca Laboratories, Nestle India, and ICICI Lombard General Insurance, among others.

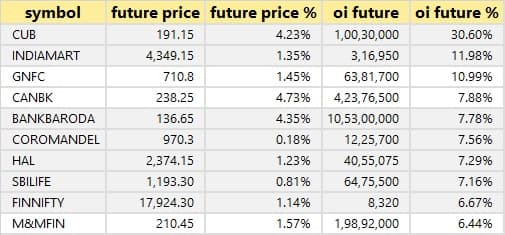

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including City Union Bank, IndiaMART InterMESH, GNFC, Canara Bank, and Bank of Baroda, in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Larsen & Toubro Infotech, Mahindra & Mahindra, Wipro, UPL, and HCL Technologies, in which a long unwinding was seen.

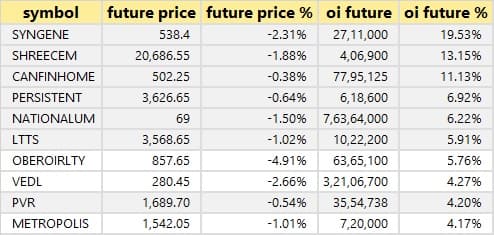

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen including Syngene International, Shree Cement, Can Fin Homes, Persistent Systems, and NALCO.

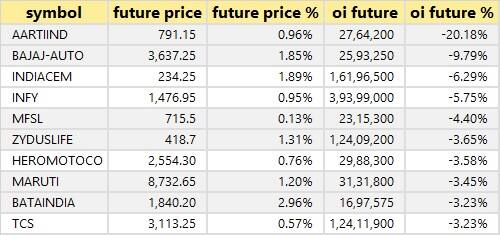

60 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks, in which a short-covering was seen including Aarti Industries, Bajaj Auto, India Cements, Infosys, and Max Financial Services.

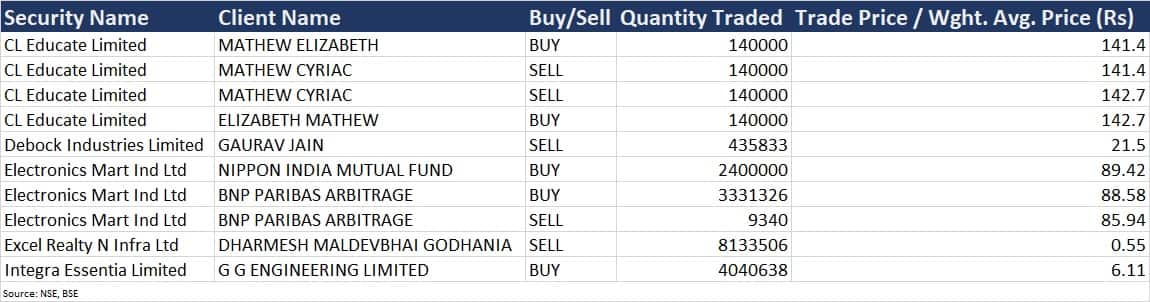

Electronics Mart India: Nippon India Mutual Fund bought 24 lakh equity shares in the company via open market transactions at an average price of Rs 89.42 per share. BNP Paribas Arbitrage acquired 33,21,986 shares at an average price of Rs 88.58 per share.

(For more bulk deals, click here)

Gujarat Fluorochemicals, Gujarat Mineral Development Corporation, Heritage Foods, HFCL, ICICI Lombard General Insurance Company, JSW Ispat Special Products, KPIT Technologies, L&T Technology Services, Mahindra CIE Automotive, Network18 Media & Investments, Newgen Software Technologies, Polycab India, Schaeffler India, Tata Communications, Tinplate Company of India, and TV18 Broadcast will be in focus ahead of quarterly earnings on October 18.

Stocks in News

Tata Coffee: The company recorded a 172 percent year-on-year growth in consolidated profit at Rs 147 crore for the quarter ended September FY23 driven by improved performance of plantation and instant coffee businesses and one-time exceptional income on disposal of a non-core property. Consolidated revenue increased by 31 percent YoY to Rs 718.3 crore during the quarter led by higher realisations in all businesses.

Aster DM Healthcare: Subsidiary Aster Pharmacies Group LLC entered into a joint venture agreement with Abdulmohsen Al Hokair Holding Group to establish, manage and operate a pharmacy chain across the Kingdom of Saudi Arabia to market and commercialise pharmaceutical products under the 'Aster Pharmacy' brand.

SJVN: Subsidiary SJVN Green Energy and Assam Power Distribution Company (APDCL) has signed a Memorandum of Understanding (MoU) to develop 1,000 MW floating solar power projects in Assam.

Star Housing Finance: The company said the board of directors approved the sub-division of one share (face value Rs 10) into two fully paid-up shares (face value Rs 5), and the issue of one bonus equity share for every fully paid-up equity share.

Indowind Energy: The company reported consolidated profit at Rs 3.91 crore for the quarter ended September FY23, up 587 percent on strong topline. Revenue during the quarter grew by 65 percent to Rs 14.7 crore compared to the corresponding period last fiscal. In the half year ended September FY23, consolidated profit increased by 249 percent to Rs 5.61 crore and revenue rose by 48 percent to Rs 22.5 crore compared to the same period last year.

Maharashtra Seamless: The company has appointed Sarat Kumar Mohanty as Chief Financial Officer and recommended the issue of bonus shares in the ratio of one bonus equity share against one existing share, subject to the approval of shareholders. Its consolidated profit for the quarter ended September FY23 grew by 86 percent to Rs 176.6 crore compared to the year-ago period and revenue increased by 49 percent to Rs 1,414.2 crore during the same period.

Spandana Sphoorty Financial: The non-banking finance company has turned profitable with Q2FY23 net at Rs 49.5 crore against a loss of Rs 222.68 crore in the previous quarter and a loss of Rs 58.87 crore in Q2FY22. Revenue fell 24.5 percent year-on-year to Rs 281 crore, but grew by 21 percent sequentially.

Fund Flow

Foreign institutional investors (FIIs) have net sold shares worth Rs 372.03 crore, whereas domestic institutional investors (DIIs) net bought shares worth Rs 1,582.24 crore on October 17, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks - Delta Corp, Indiabulls Housing Finance, and India Cements - are under the NSE F&O ban list for October 18. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Trade setup for Tuesday: Top 15 things to know before the opening bell - Moneycontrol

Read More

No comments:

Post a Comment