The market lost around half a percent in the week ended October 7 amid volatile but rangebound trade, as fears of a recession in the developed countries, mixed corporate earnings and weak economic data at home affected sentiment.

The Sensex fell 271 points to 57,920, and the Nifty slipped 129 points to 17,186 in the week. The broader market took a bigger hit. The Nifty Midcap 100 index declined 2.8 percent and the smallcap 100 index was down 1.7 percent.

Buying in banking (after provisional numbers for Q2FY23) and technology stocks, after big IT players released their Q2 earnings, limited losses for the market. Auto, energy, FMCG, infra, metal, and oil & gas stocks were under pressure.

In the coming week, the market will first react to HDFC Bank earnings even as volatility is expected to continue amid corporate earnings and global cues, experts said.

HDFC Bank on October 15 reported a consolidated net profit of Rs 11,125 crore for the September quarter, up 22.3 percent from the year-ago period. The private lender reported a 23 percent loan growth and pristine asset quality during the July-September period.

"Amid all, volatility will remain high due to scheduled earnings and erratic swings in the global market. Participants should align their positions accordingly and we suggest focusing more on risk management," Ajit Mishra, VP-Research, Religare Broking, said.

Here are 10 key factors that will keep traders busy next week:

The key focus area during the week would be corporate earnings and the management commentary on trends across sectors, which could give the market some kind of direction. There could be more stock-specific actions.

More than 300 companies will release their quarterly earnings scorecard next week. Prominent among those are ACC, HDFC Asset Management Company, IndusInd Bank, Nestle India, UltraTech Cement, Asian Paints, Axis Bank, Bajaj Finance, ITC, Tata Consumer Products, Bajaj Finserv, Hindustan Unilever, JSW Steel, Reliance Industries, SBI Life Insurance Company, ICICI Bank, and Kotak Mahindra Bank.

HDFC Life Insurance Company, Can Fin Homes, HeidelbergCement India, PVR, Spandana Sphoorty Financial, Tata Coffee, ICICI Lombard General Insurance Company, KPIT Technologies, L&T Technology Services, Mahindra CIE Automotive, Polycab India, Tata Communications, Havells India, Metro Brands, Persistent Systems, Canara Bank, Coforge, Colgate-Palmolive, Happiest Minds Technologies, L&T Finance Holdings, Nazara Technologies, Union Bank of India, Ambuja Cements, Bajaj Finserv, CSB Bank, DLF, IDBI Bank, IRB Infrastructure Developers, United Spirits, IDFC First Bank, RBL Bank, MCX India and Yes Bank will also announce quarterly earnings.

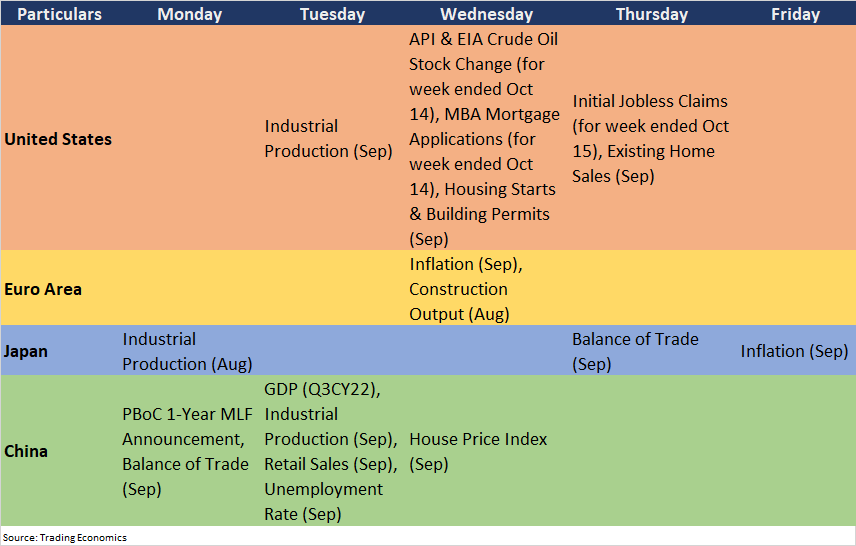

2) US industrial production, China Q3CY22 GDP

The US industrial production and manufacturing data for September will be released on October 18, which will give an indication of the factory activity in the world's largest economy as the Federal Reserve continues to aggressive policy tightening.

Also read: Seven sectors likely to receive Rs 35,000 crore in the next PLI round

The United States Industrial Production in August declined 0.2 percent from the previous month, missing expectations.

The Chinese economic growth for the quarter ended September 30, 2022 (Q3 CY22), industrial production and retail sales for September will also be important, indicating the health of the world's second largest economy.

China's economy contracted 2.6 percent in the June quarter, the first quarterly contraction in the economy since Q1CY20.

3) Other global economic data points

Here are other global economic data points to watch out for next week:

4) Indian rupee

The Indian rupee remained under pressure due to a strengthening dollar, closing the week at 82.36 levels, slipping from 82.33 in the previous week. It remained below the 82 mark through the week and amid a weakening global environment. The Federal Reserve is expected go for another big rate hike of around 75 basic points, especially after inflation for September came in at 8.2 percent.

Experts foresee further weakening in the currency towards 84-85 in the coming weeks as the Fed is likely to raise interest rates to around 4.5 percent in the next couple of meetings.

The US dollar index, which measures the value of the greenback against a basket of world's leading currencies, remained at around 113 levels, rising from 112.68 in the previous week. US bond yields closed the week above 4 percent, against 3.88 percent from the previous week.

Also read: Daily Voice | Check these 5 investment themes for long-term wealth creation

Oil prices, which have remained volatile, too, will be closely watched. The benchmark Brent crude futures fell more than 6 percent during the week to settle at $91.63 a barrel on the fears that a recession may hit the demand outlook, though OPEC+ decisions to reduce supply is expected to support prices.

5) FII flow

Foreign institutional investors have been taking out their money from emerging markets including India as central banks, including Federal Reserve, raise rates to tame inflation.

They have net sold nearly Rs 10,000 crore worth of shares in October so far, but domestic institutional investors have managed to absorb the selling pressure to a large extent by buying equities worth more than Rs 8,000 crore during the period.

Given the rising US bond yields and elevated US dollar index on expectations of faster rate hikes, FII flow is expected be volatile in the short term, which may cap the upside of the market, experts said.

6) Economic data points

Data of foreign exchange reserves for the week ended October 14 will be released on October 21.

The forex reserves for the week ended October 7 were up by $204 million to $532.868 billion, the first weekly increase since August 27.

Data on bank loan and deposit growth for the fortnight ended October 7 will also be released the same day. The bank loan growth has steadily been increasing over the past two-and-half-month, while deposit growth has been largely around 9-9.5 percent during the period.

7) Technical View

The rally on October 14 helped the Nifty cut down weekly loss to seven-tenth of a percent but the closing off day's high indicates that the range-bound trade is here for some more time, experts said.

The index closed the day a percent higher at 17,186 but slipped below the crucial resistance of 17,350. Support is likely at 17 followed by 16,800.

It formed a bearish candle on the daily charts as the closing was lower than the opening level, while there was a high-wave pattern on the weekly charts.

"The Nifty, as per the weekly chart, formed a positive candle with upper and lower shadow. Technically, this pattern signals the formation of a high- wave type candle pattern. This indicates high volatility in the market," Nagaraj Shetti, Technical Research Analyst, HDFC Securities, said.

The Nifty is placed near the strong weekly support of 16,800, which is an intermediate ascending trend line and also horizontal line support as per change in polarity, Shetti said.

The decisive upmove on October 21 could have brought cheer but only a sustainable move above 17,260 will pull the Nifty towards the next important resistance of around 17,425. Immediate support is at 17,100-17,050, the market expert said.

8) F&O cues

The options data indicates that the Nifty may remain in a broader trading range of 16,800-17,700, while the immediate range could be 17,000-17,500.

The maximum Call open interest was at 18,000 strike followed by 17,500 strike, which could be resistance areas, with Call writing at 17,300 strike then 18,100 and 18,000 strikes, and Call unwinding at 17,100 strike then 17,000 strike.

On the Put side, the maximum open interest was at 17,000 strike followed by 16,000 and 16,500 strikes, with writing at 17,300 strike then 17,200 and 16,900 strikes and unwinding at 17,100 and 17,000 strikes.

"Individual strike PCR_OI (Put Call ratio-open interest) of 17,200 is just below 1, which is to be monitored closely to see if there is a sustenance or a fall now to decide on the movement for the index going ahead," Shilpa Rout–Derivatives Lead Analyst at Prabhudas Lilladher said.

She said if the Nifty sustains at 17,200, it will see a rally to 17,369-17,500, while a breach of 17,150 will see the index slide to 16,900.

The volatility index India VIX cooled below 20 levels last week, falling nearly 3 percent to 18.26 levels. A further fall may bring stability to the market.

"Volatility cooled off from its highs and it needs to further come down to 15 mark for stability in the market," Chandan Taparia, Vice President | Analyst-Derivatives at Motilal Oswal Financial Services said.

9) Primary market

Electronics Mart India will make its market debut on October 17 after closing the public issue on October 7 that was subscribed 71.93 times subscription. It will be listed in the 'B' group of securities.

The final issue price has been fixed at Rs 59 a share. Experts largely expect the listing price to be 35-45 percent higher, given the healthy IPO subscription, strong financials with consistency in margin performance and fall in debtsafter IPO.

The IPO share allotment of Tracxn Technologies is expected the same day. The share will list on October 20.

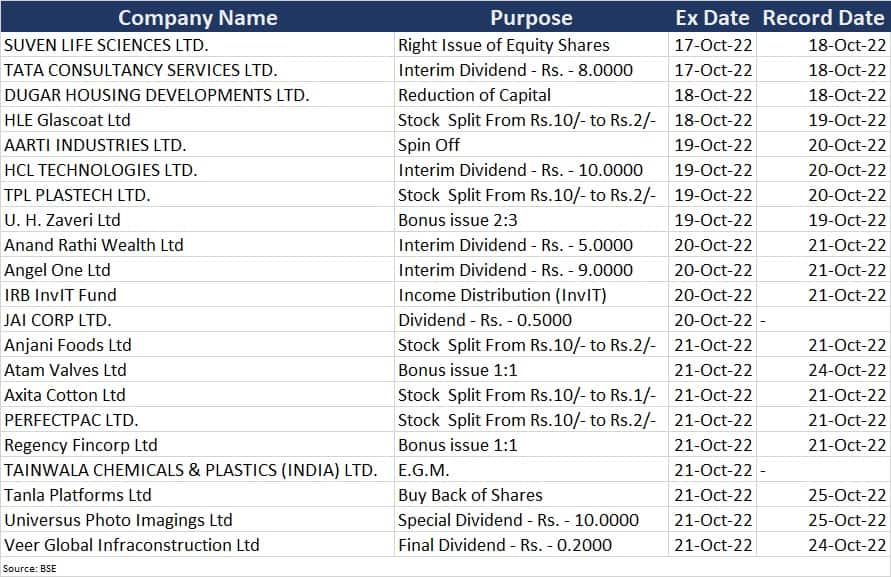

10) Corporate Action

Here are key corporate actions taking place in the coming week:

Dalal Street Week Ahead | 10 key factors that will keep traders busy next week - Moneycontrol

Read More

No comments:

Post a Comment