The easing of aggressive rate hikes concerns by the US Federal Reserve, declining inflation, rangebound oil prices, and positive mood at the FII desk lifted market sentiment in the week ended August 12. The benchmark indices gained nearly 2 percent, extending the uptrend for the fourth consecutive week.

Auto, banking and financial services, energy, metal, oil and gas and infrastructure stocks strengthened the market, whereas the selling in FMCG, select IT and pharma stocks limited upside.

The BSE Sensex rose 1,075 points to 59,463, and the Nifty50 climbed more than 300 points to 17,698, while the Nifty Midcap 100 and Smallcap 100 indices also participated in the market run, rising 1.8 percent and 1.1 percent respectively.

In the truncated week beginning tomorrow, the market participants will first react to the quarterly earnings of the Life Insurance Corporation, ONGC, and Hero MotoCorp, along with June industrial output and July CPI inflation data on Tuesday. Overall, the positive sentiment is expected to continue with focus on global cues, though given the consistent rally in the past several weeks, consolidation can't be ruled out, experts said.

"Going ahead, with earnings season behind us, the performance of global markets will be the focus for cues," Ajit Mishra, VP - Research at Religare Broking, said.

Mitul Shah, Head of Research at Reliance Securities, expects the market to remain volatile in the near term, while strong economic rebound, normalised commodity prices, inflation within targeted range and better visibility expected by 2HFY23, which would transform the Nifty valuation to close to historical average.

The market will remain shut on Monday for Independence Day.

Let's check out the 10 key factors that will keep traders busy next week.

1) FOMC Minutes

The most important factor to watch out for globally would be FOMC minutes for the July policy meeting scheduled to be released on coming Wednesday. Investors will closely watch the commentary over growth projections, inflation and recession, along with further rate hikes outlook.

In July policy meeting, the Federal Open Market Committee, as expected, raised federal funds target rate by 75 bps for the second time to arrest rising inflation. The Federal Reserve chair Jerome Powell hinted for more rate hikes going ahead, to bring the inflation down to its target of 2 percent, but the pace may get slowed down to assess its impact on economic growth and inflation.

Also read - CCI nod for merger of HDFC Bank, HDFC Ltd

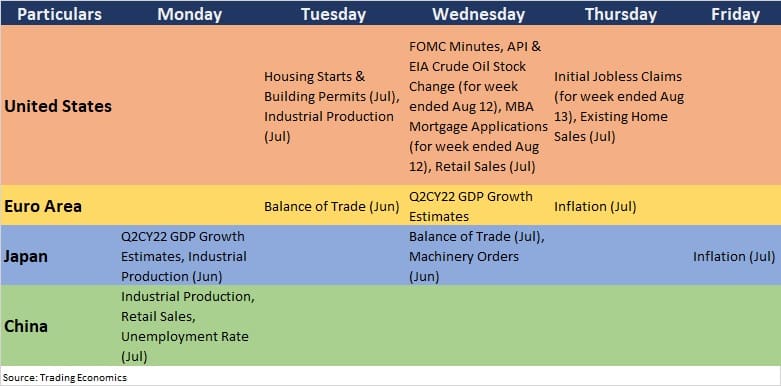

2) Global Data Points

Here are key global data points to watch out for next week:

3) Economic Data Points

India's WPI inflation print for July will be released on Tuesday, which experts feel is likely to decline against 15.18 percent in June 2022.

Foreign exchange reserves for the week ended August 12 will be released on Friday, while passenger vehicle sales for July will be announced on Monday.

One of the key drivers behind the recovery in equity markets in last several weeks is the change in mood of foreign institutional investors. They have been consistent buyers in Indian equities since July 28 and in August, recorded the highest monthly buying since February 2021.

They were net buyers for second consecutive week, pouring in more than Rs 14,800 crore in August so far, whereas DIIs have taken the advantage of market rally driven by FIIs, to book profits worth Rs 4,200 crore in current month, becoming net sellers for the first time since February 2021.

The easing of aggressive rate hikes worries, and the rising hope for declining inflation in coming months with correction in commodity prices seem to have helped FIIs to take decision of returning to India. Hence, experts expect the flow may continue in coming weeks as India is the fastest growing economy in the world.

Also read - The 22 stocks that richie rich fund managers can't part with

5) Rupee Movement

Apart from above mentioned reasons which pushed the US dollar index down from 20-year highs, the returning of FIIs to India and positive equity markets also helped the Indian rupee stabilise above 80 levels for several weeks now. Broadly the currency has been in a range of around 79.00-79.90 levels for nearly a month now, which experts feel likely to continue in coming weeks too.

"We expect Rupee to trade on mixed to negative note. Positive US Dollar and recovery in crude oil prices may mount downside pressure on Rupee while rise in risk appetite in global markets may support Rupee at lower levels," Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas said.

He further said markets participants may take cues from India’s inflation and industrial production data. "Traders may also take cues from University of Michigan consumer sentiment which is expected better than previous reading. USDINR spot price is expected to trade in a range of Rs 78.50 to Rs 80.50 in next couple of sessions."

6) Oil Prices

Crude oil prices continued to trade below $100 a barrel mark in current month amid recession fears over the demand outlook, though there was more than 3 percent rally in the passing week. International benchmark Brent crude futures settled the week at $98.15 a barrel, while the US futures were at $91.88 a barrel.

The rangebound trade and gradual correction in last two months from June highs supported the equity market sentiment and bringing the inflation gradually down on month-on-month basis. Experts expect the prices to remain around these levels given recession fears.

7) Technical View

The Nifty50 has formed small bodied bullish candle on the daily charts and strong bullish candlestick pattern on the weekly scale, continuing higher high higher low formation for fourth consecutive week. The index is gradually inching towards the resistance point of long down sloping trend line adjoining high of October 18, 2021 and January 18, 2022, which is around 17,800-17,900 levels, with support at 17,500 mark.

The significance of this trend line indicates higher possibility of reversal down from the highs, hence bulls need to be cautious, experts said.

"The short term trend of Nifty continues to be positive with range bound action. One may expect continuation of choppy movement for the early next week and Nifty could possibly reach upside of around 17,800-17,900 levels by next week," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

Having placed at the hurdle, bulls need to be cautious and long positions to be protected with proper stop-losses, he said. The immediate support is placed at 17,560 levels.

8) F&O Cues

The Option data indicated that the Nifty50 could see an immediate trading range of 17,300 to 17,800 levels, while a broader trading range may be between 17,200 to 18,000 levels in coming sessions.

On Option front, the maximum Call open interest was seen at 18,000 strike followed by 17,700-17,800 strikes with Call writing at 17,600 strike then 17,700-18,100 strikes, while the maximum Put open interest was seen at 17,500 strike followed by 17,000-16,500 strikes with Put writing at 17,600 strike then 17,700-17,400 strikes.

"From the options space, we are witnessing continued Put writing at ATM and OTM strikes with 17,600 Put holding the highest open interest while the highest Call OI base is also placed at ATM 17,700 strike Data suggest some consolidation to happen in the Nifty. However, considering continued buying interest from FIIs, long positions should remain intact till the Nifty breaches its major Put base," ICICI Direct said.

The brokerage expects the Nifty to continue its positive bias in short term till it holds above 17,500.

9) Volatility

The volatility declined further, especially after US inflation numbers that fell to 8.5 percent in July against 9.1 percent in June, making the bulls more comfortable.

India VIX, which measures the expected volatility in the market, fell by 4.07 percent to 17.61 levels on Friday, and was down nearly 7 percent for the week. The bulls may see favourable trend if the VIX falls further to around 15 levels, experts said.

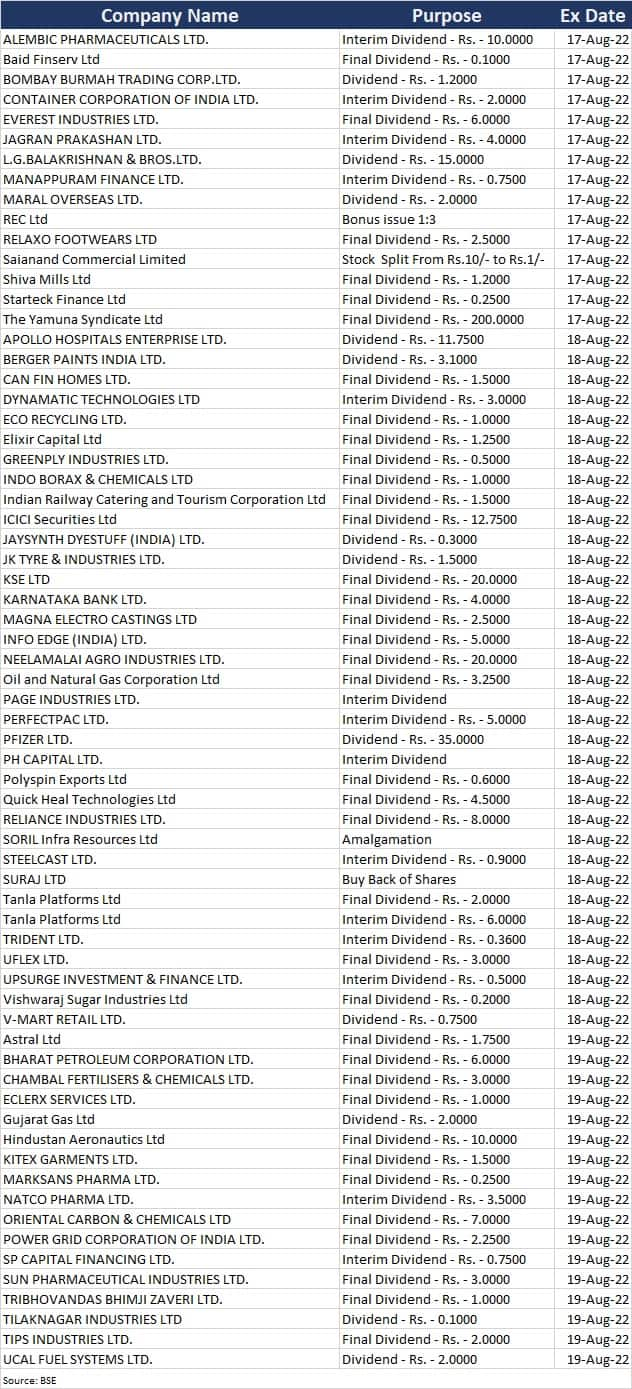

10) Corporate Action

Reliance Industries, Alembic Pharma, Container Corporation, Manappuram Finance, Apollo Hospitals Enterprise, IRCTC, Karnataka Bank, Info Edge, ONGC, Pfizer, Tanla Platforms, BPCL, Power Grid Corporation of India, and Sun Pharma will trade ex-dividend next week, while REC will trade ex-bonus.

Here are key corporate actions taking place in the coming week:

Dalal Street Week ahead | 10 key factors that will keep traders busy - Moneycontrol

Read More

No comments:

Post a Comment