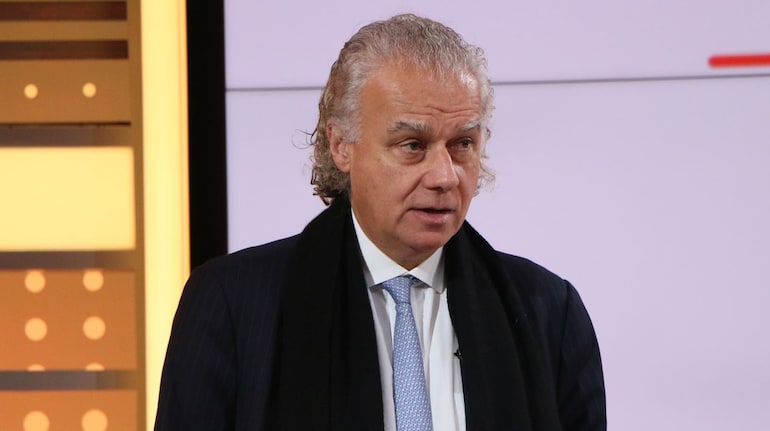

Christopher Wood, global head of equities at Jefferies, said India is by far the best structural story in Asia and the resilience shown by the country's market this year has taken him by surprise.

Wood has been bullish on India for a while now. He has given the largest 40 percent weightage to the country in his Asia (excluding Japan) long-only portfolio. Wood had said in May that he would add more if the Nifty slipped to 14,500, but that did not happen as the index rebounded from around 15,000 level.

In his weekly newsletter GREED & fear published late on August 25, he expected the Indian market to consolidate in 2022 after the strong gains recorded last year and the commencement of a monetary tightening cycle.

The RBI has raised interest rates by 140 basis points since May. Inflation has also softened though it still remains above tolerance level.

“The reality is that the Indian market has so far surprised everyone, including GREED & fear, by its resilience in the face of bearish sentiment triggered by the wave of foreign selling, prevailing high valuations and monetary tightening,” said Wood.

The Nifty Index has rebounded by 16.5 percent since mid-June, while the MSCI India Index has outperformed the MSCI AC Asia Pacific ex-Japan Index by 16.5 percent since late June, noted Wood.

Also read: India still best equity story not only in Asia but globally, says Chris Wood of Jefferies

Foreigners have also returned as net buyers of equities in the past six weeks, buying a net $7.64 billion since mid-July after having sold a net $29.7 billion worth of Indian equities in the first six and a half months of the year.

“This resilience should be viewed as reflecting the strength of the structural story. Meanwhile, China Covid suppression and the Ukraine conflict have also helped at the margin by keeping the price of oil lower than it otherwise would be while allowing India to buy Russian oil at a discounted price,” said Wood.

Russian Urals crude oil is now selling at $18 below international benchmark Brent, though the discount is now much lower than the $35 discount in June. This has also lifted outlook for many energy companies.

Though the case remains that the Nifty is now trading at 19.3x earnings on a 12-month forward basis, which makes some analysts including Jefferies head of India research Mahesh Nandurkar “tactically cautious”.

Also read: Chris Wood of Jefferies sees Sensex reaching 100,000 points by late 2026

But, Wood is not tweaking the weight of Indian stocks in his portfolio, and he is “going to stick with the structural story in terms of the Indian portfolio exposures since these are long-term portfolios not tactical benchmark tracking exercises".

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Chris Wood says India best structural story in Asia; surprised by market resilience - Moneycontrol

Read More

No comments:

Post a Comment