Indian equity benchmark indices lost 1 percent each during the week ended 15 July amid weak global cues, lower GDP data and rising inflation. Besides, falling Indian rupee and continued selling by the foreign institutional investors (FIIs) added to the woes of market participants. However, lower crude oil prices and a good monsoon provided some respite.

During the week gone by, BSE Sensex lost 721.06 points (1.32 percent) to close at 53,760.78, while the Nifty50 declined 171.4 points (1.05 percent) to end at 16,049.2.

On the sectoral front, BSE Power index added 4.5 percent and BSE Oil & Gas, Auto, and Realty indices rose two percent each. However, the Information Technology index shed six percent.

Among broader indices - BSE Small-cap index rose 0.5 percent, Mid-cap added 1 percent, while Large-cap index shed 0.5 percent.

Here are 10 key factors that will keep traders busy this week:

1) Earnings

Nearly 200 companies will announce their quarterly earnings next week including Ambuja Cements, Reliance Industries, HDFC Life Insurance Company, Hindustan Unilever, Havells India, IndusInd Bank, Wipro, CSB Bank, IDBI Bank, JSW Energy, RBL Bank, Bandhan Bank, JSW Steel, Ultratech Cement, ICICI Bank, Kotak Mahindra Bank.

Bank Of Maharashtra, AU Small Finance Bank, TV18 Broadcast, Network18 Media & Investments, Rallis India, Century Plyboards, Gland Pharma, Mastek, Tata Communications, CSB Bank, Hindustan Zinc, IDBI Bank, Mphasis, Persistent Systems, PVR, SRF, Crompton Greaves Consumer Electricals, Karnataka Bank, Uttam Galva Steels will also declare their June quarter earnings.

2) ECB Meeting

Bank of Japan and European Central Bank (ECB) are due to hold their monetary policy meetings in the coming week. Bank of Japan is expected to maintain its support for loose monetary policy stance. ECB is expected to start its rate hike cycle and this has been factored in and we may see more reaction to the pace of monetary tightening.

The euro has already slipped to a parity to the US dollar, for the first time since 2002, and we may not see much recovery unless ECB take an aggressive monetary tightening stance. Unless we see a substantial correction in the US dollar, commodities may struggle to recover.

3) FII Selling

Foreign institutional investors (FIIs) continued their selling spree in the last week also but with reduced rate, however domestic institutional investors (DIIs) provided some support as they remain net buyers.

In the last week, FIIs offloaded equities worth of Rs 5,916.01 crore. However, DIIs purchased shares worth of Rs 2,146 crore.

In the month of July so far, FIIs have sold equities worth of Rs 10,459.13 crore and DIIs have bought shares worth of Rs 7,367.04.

4) Rupee

Indian rupee continued to depreciate against the US dollar and closed near the 80 mark as the foreign investor continue the selling in the Indian markets.

During the last week, the rupee touched a fresh low of 79.96 per dollar and declined 62 paise to end at 79.87 per dollar on July 15 against its July 8 closing of 79.25.

"As dollar index traded in a range broadly the trend for dollar is positive till the time it is above 105, next hurdle for dollar can be seen around 110 hence rupee can be seen weak trend continued towards 80.50," said Jateen Trivedi, VP Research Analyst at LKP Securities.

"79.25 will act as resistance for rupee and break above 79.25 will trigger short covering for rupee. Rupee range can be seen between 79.50-80.50 for the coming week," he added.

5) Oil Prices

Investors will keep an eye on the crude oil as the prices came under pressure and tested the lowest level since February 2022. It is continued to trade below USD 100.

On Friday, a U.S. official told Reuters that an immediate Saudi oil output boost was not expected, and as investors question whether OPEC has the room to significantly ramp up crude production.

"We expect crude oil prices to trade sideways to down with resistance at USD 98 per barrel with support at USD 92 per barrel. MCX Crude oil July contract has important support at Rs 7450 and resistance at Rs 7850 per barrel," said Tapan Patel, Senior Analyst (Commodities), HDFC Securities.

6) Technical View

The Nifty50 managed to get back above psychological 16,000 mark on last day of the week and formed small bodied bullish candle which resembles a Hammer kind of pattern formation on the daily charts, which is a trend reversal pattern, while the index lost one percent during the week and formed bearish candle which resembles Inside Bar kind of pattern formation on the weekly scale, which generally indicates the loss of momentum.

Hence, experts feel the trend is expected to be uncertain and the volatility & consolidation could be seen in coming days.

If the index breaks 15,858 level, the last week's low point, then there could be sharp fall up to 15,700-15,500, but if the uptrend continues, then the index can move up to 16,275, the highest point of July month, which if gets decisively broken then there could be further rally towards 16,400-16,500 but considering the current trend that looks unlikely, experts said.

7) F&O Cues

Option data suggests a wider trading range in between 15700 to 16350 zones.

On Option front, Maximum Call Open Interest (OI) is at 16500 then 17000 strike while Maximum Put OI is at 15500 then 15000 strike.

Marginal Call writing is seen at 16400 then 16300 strike while Put writing is seen at 15600 then 15800 strike.

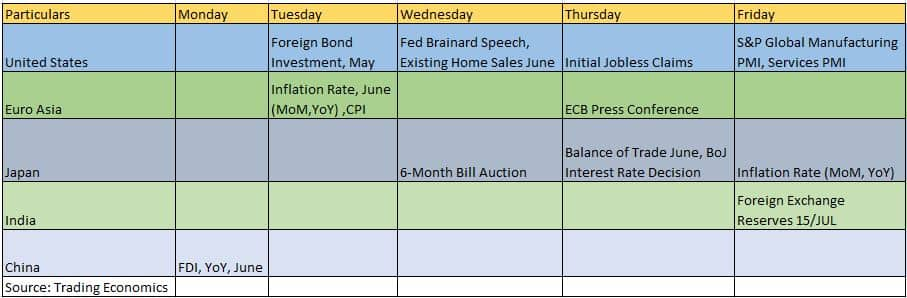

8) Global Data Points

Here are key global data points to watch out for next week:

9) India VIX

India VIX was down by 4.05% from 18.34 to 17.59 levels. Volatility has been hovering near the 18 point mark from the last four sessions and needs to sustain at lower zones for market stability.

Decrease in the IV has allayed fear in market. Further, any downtick in India VIX can push the upward move in Nifty further, experts feel.

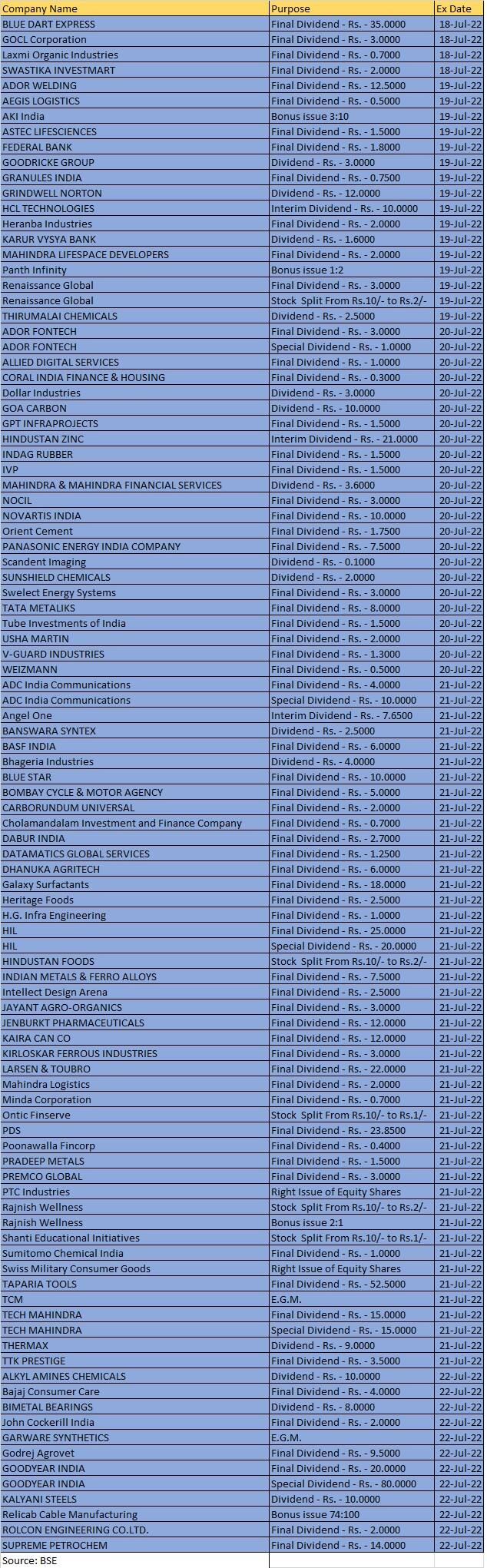

10) Corporate Action

Here are key corporate actions taking place in the coming week:

Dalal Street This Week | 10 key factors that will keep traders busy - Moneycontrol

Read More

No comments:

Post a Comment