Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities Ltd

After witnessing volatility in the first half, markets moved in southward direction in the last hour of the trade as weak global indices dampened sentiment. Despite the sell-off in recent sessions, investors are trading cautiously and not taking long bets amid recession worries in the west that could dent demand.

Also, China's decision to impose restrictions to combat virus spread is also creating nervousness amongst the investors. On daily charts, the Nifty has formed a bearish candle and after a long time closed below the 50-day SMA level.

A fresh pullback rally is possible only after Nifty crosses 16000 and above the same, the index could move up to 16100-16150 levels. On the flip side, a correction wave is likely to continue if the index trades below the 50-day SMA or 16000. Below the same, the Nifty could slip up to 15900-15850 levels. Contra traders can take a long bet near 15850 with a strict support stop loss at 15800.

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

The Nifty was facing resistance from multiple technical parameters in the last few sessions. Consequently, it was witnessing consolidation in the range of 16000-16275. On July 13, the index has broken the key support of 16000 on a closing basis. Thus the short term structure has turned in favor of the bears.

On the downside, the index is set to test lower end of a rising channel on the hourly chart, which is near 15800. Overall structure shows that the Nifty can move down towards 15500 in the short term.

On the flip side, any bounce towards 16000-16050 is expected to attract fresh round of selling.

Kunal Shah, Senior Technical Analyst at LKP Securities:

The Bank Nifty index breached the immediate support of 35,000 and witnessed continuous selling pressure throughout the day.

It remains in a sell mode and is likely to test the next support of 34,400 on the downside. The upside resistance is at 35,500 and once this level is taken out traders should place aggressive bets on the long side.

Jateen Trivedi, VP Research Analyst at LKP Securities:

Rupee traded with minor losses falling below 79.65 as the dollar index traded positive above 108; rupee range can be seen between 79.25-79.75.

Crude price falling below USD 100 can be a positive trigger for rupee but inflation numbers in the evening from the US shall give a major trigger to rupee movement against the dollar.

Sahaj Agrawal, Head of Research- Derivatives at Kotak Securities:

Nifty is expected to consolidate in the near term as there are contradictory signals across time frames. Expect 16500 to be tested in the next few weeks.

Selective particiation is expected - Banking and FMCG remain positive, while IT, Metals and Energy stocks continue to remain weak.

Rupee Close:

Indian rupee ended marginally lower at 79.63 per dollar against Tuesday's close of 79.60.

Market Close: Benchmark indices ended lower for the third consecutive session on July 13 with Nifty closing below 16,000.

At close, the Sensex was down 372.46 points or 0.69% at 53,514.15, and the Nifty was down 91.60 points or 0.57% at 15,966.70. About 1649 shares have advanced, 1584 shares declined, and 141 shares are unchanged.

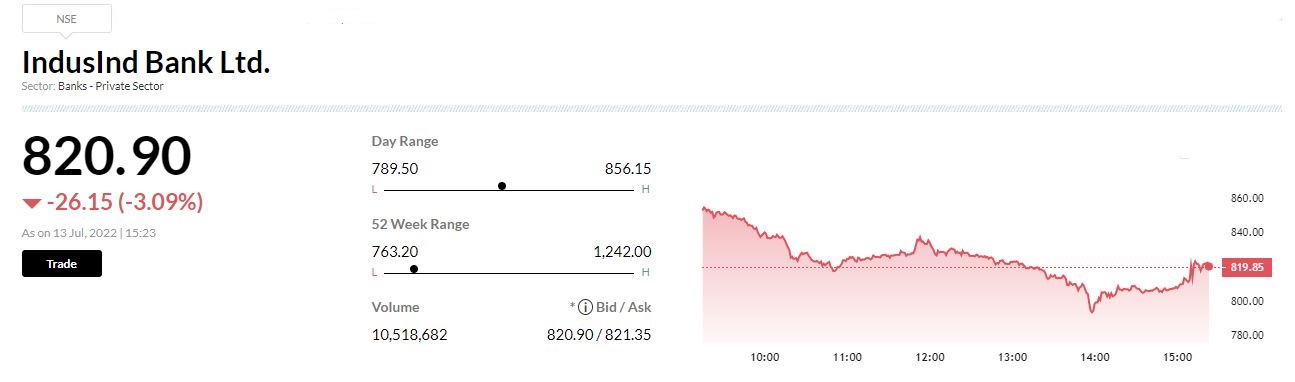

IndusInd Bank, HDFC, Bharti Airtel, HDFC Bank and Reliance Industries were among the top Nifty losers, while gainers were Divis Labs, JSW Steel, HUL, Cipla and Asian Paints.

Among sectors, FMCG, metal and pharma indices ended with nearly a percent gain, while oil & gas and power index down 1 percent each.

BSE midcap index rose 0.32 percent, while smallcap index ended flat.

RBI's desperate catch-up act on inflation will hurt economy

It isn’t an exaggeration to say the RBI let loose the inflation genie for too long, in search of a stimulus-led growth. It is now playing catch-up with steep, consecutive rate hikes

IndusInd Bank Clarifies:

The Directorate of Enforcement, Chennai Zonal Office (ED) has been investigating a few entities inter alia for certain alleged irregularities in remittances for import transactions conducted during the year 2011 to 2014.

The Bank had suo moto filed Suspicious Transaction Reports (STRs) with the regulatory authorities during the relevant period for many of these entities. The Bank had also filed complaints with the police authorities in 2015 against some of the unscrupulous entities.

Incidentally, the matter was subject of scrutiny by the RBl in October 20 15 and a penalty was levied on the Bank which was intimated to the stock exchanges vide the Bank's letter dated July 28, 2016

As part of the investigation, the ED has filed a First Information Report (FIR) dated July 9, 2022 with Chennai CCB-1 Police Station against some of those entities and few employees of the Bank, most of whom have already separated from the Bank

Euro hits parity with dollar for the first time since 2002

Fears of a recession, high inflation and worries that Russian President Vladimir Putin may cut off some key energy exports to the European Union ahead of winter are working against the euro

JPMorgan View on HCL Technologies

Brokerage house JPMorgan has kept an 'underweight' rating on HCL Technologies and cut the target price to Rs 800 per share.

The Q1 underwhelmed with sharp margin collapse and drop in FCF. The sharp cuts to net hiring suggest brakes are being put in place.

The services margin decline of 150 bps QoQ is staggering, while having several margin headwinds ahead.

Brokerage house do not expect margin coming back to guided range over FY23-25, reported CNBC-TV18.

Passenger vehicle dispatches rise 19% in June:

Passenger vehicle wholesales in India rose by 19 percent year-on-year in June on the back of improvement in semiconductor supplies, according to industry body SIAM.

As per the latest data released by the Society of Indian Automobile Manufacturers (SIAM), passenger vehicle (PV) dispatches to dealers stood at 2,75,788 units last month against 2,31,633 units in June 2021.

Similarly, total two-wheeler wholesales increased to 13,08,764 units last month compared to 10,60,565 units in the year-ago period. Total three-wheeler sales grew to 26,701 units last month against 9,404 units in June 2021.

Sales across segments rose to 16,11,300 units in June from 13,01,602 units in the same month last year.

Closing Bell: Nifty ends below 16,000, Sensex falls 372 pts; FMCG, pharma, metals shine - Moneycontrol

Read More

No comments:

Post a Comment