Key policy action by major central banks will take centrestage across global financial markets this week, after the RBI's move to hike the repo rate — the interest rate at which it lends money to commercial banks — by 50 bps as expected last week. All eyes will be on a monthly reading of consumer inflation in India due on Monday, to assess the course of rate increases in the coming months.

Data from the US last week showed consumer prices made a fresh 40-year high of 8.6 percent in the world's largest economy in May, reinforcing the view that the Fed will keep raising rates aggressively.

Central banks around the world are faced with the Herculean task of taming sticky inflation without disrupting the pace of economic growth amid resurgent COVID infections.

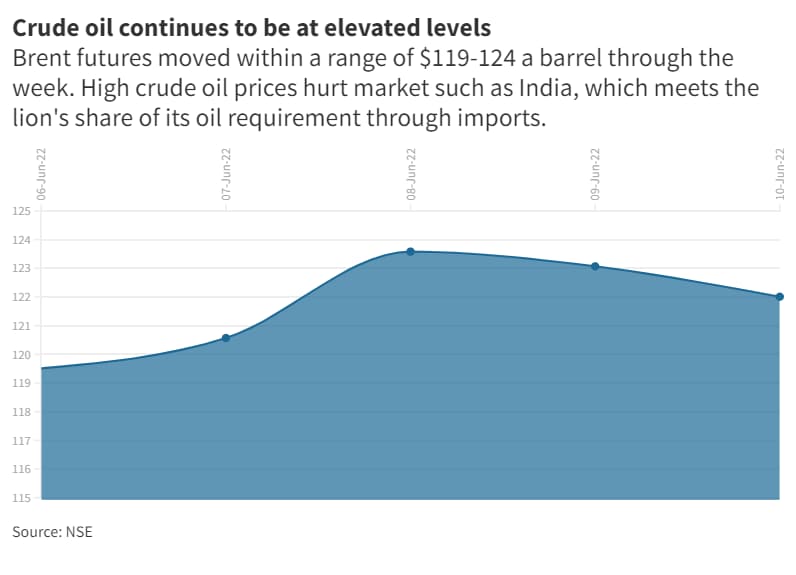

Crude oil prices will also be tracked closely.

The week that was

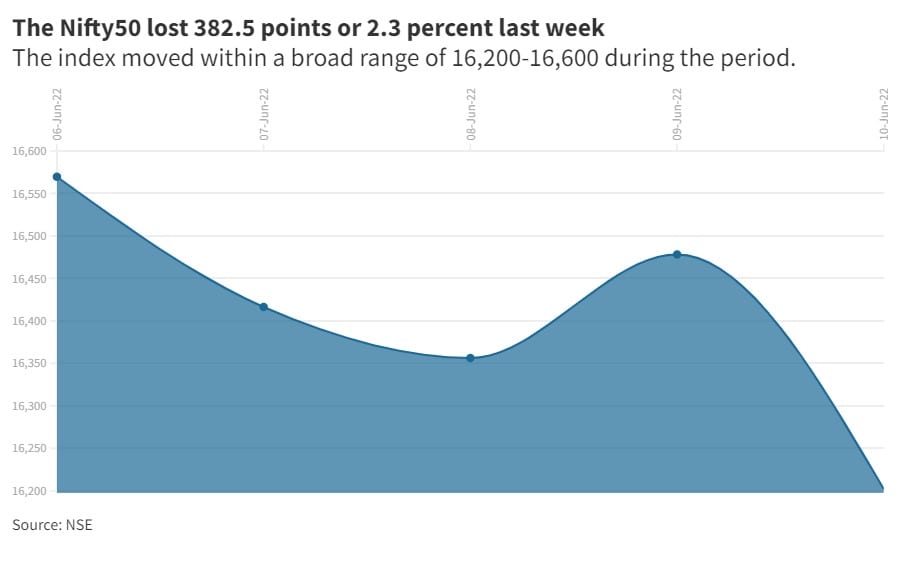

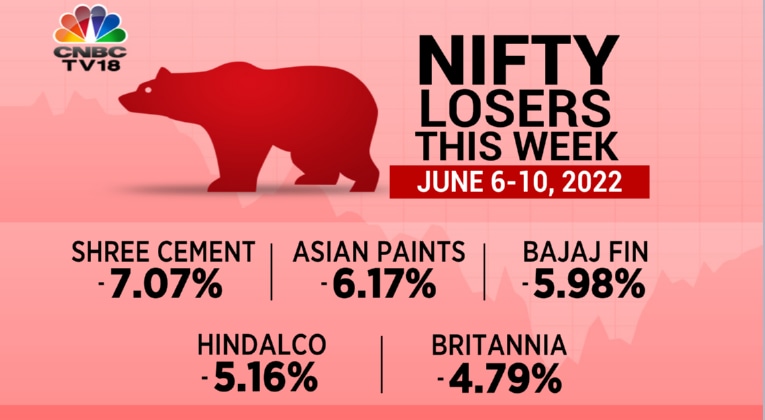

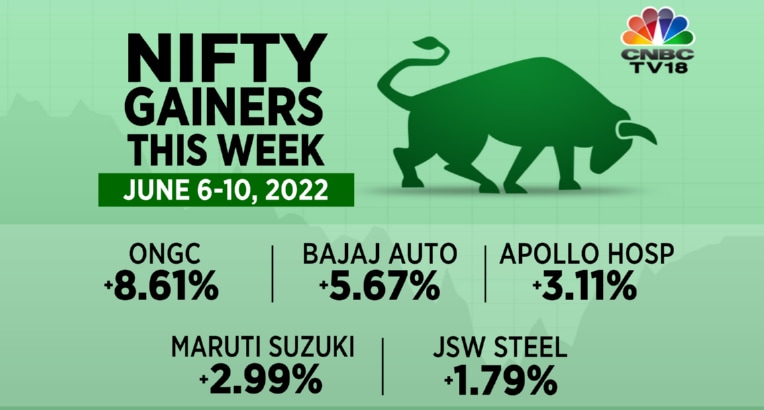

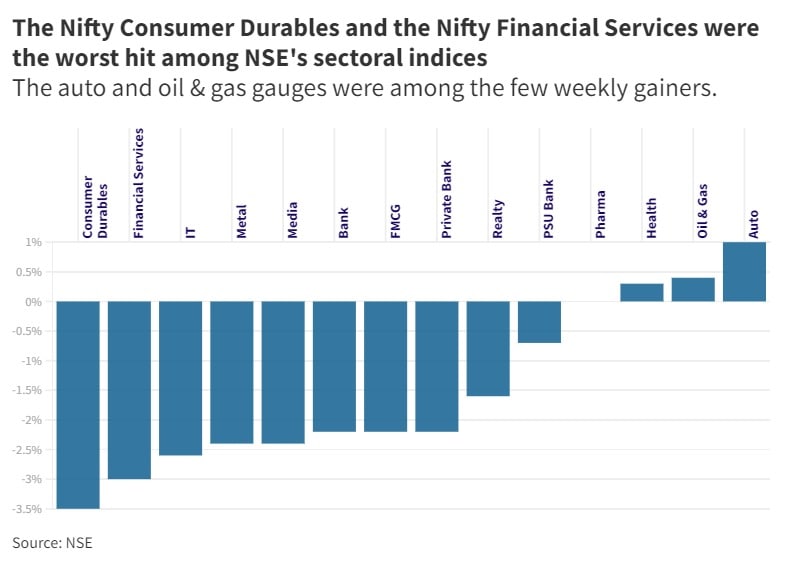

Indian equity benchmarks suffered their biggest weekly fall in a month on Friday, dragged by weakness in financial, IT and consumer durables stocks.

A total of 34 stocks suffered weekly losses.

Investors remained on the back foot over concerns about aggressive rate hikes, after the RBI — in its first bi-monthly review since its surprise move on May 4 to hike the repo rate by 40 bps — raised its inflation projections for the year ending March 2023.

However, no increase in the cash reserve ratio — the amount of cash commercial banks have to keep parked with the RBI — aided investor sentiment somewhat.

"The RBI turned realistic by withdrawing its 'accommodative' stance and increasing its inflation forecast... However, the focus of the domestic market shifted to global macroeconomics, with investors anticipating a hawkish Fed policy next week," said Vinod Nair, Head of Research at Geojit Financial Services.

Technical view

"Despite the fact that last week's trading patterns suggest additional downside, the overall bearish momentum has moderated as the Nifty is trading above the falling resistance line. As long as the index does not fall below 15,900, there is a significant chance that it can test 16,800," said Yesha Shah, Head of Equity Research at Samco Securities.

She suggests traders keep a neutral view this week and avoid aggressive trades on either side.

Here are the key factors and events that are likely to influence Dalal Street in the week beginning June 13:

GLOBAL CUES

| Date | US | Europe | Asia |

| June 13 | Fed official Lael Brainard to speak | UK GDP and industrial production data | |

| June 14 | UK unemployment data, Germany inflation data | Japan industrial production data, Hong Kong industrial production data | |

| June 15 | Fed rate decision, crude oil stockpiles data, retail sales data | Eurozone industrial production data, France inflation data | China industrial production and retail sales data |

| June 16 | Jobless claims data | BoE rate decision, minutes of last BoE meeting | Japan trade data |

| June 17 | Fed Chair Jerome Powell to speak, industrial production data | Eurozone inflation data | BoJ rate decision |

DOMESTIC CUES

Macroeconomic data

Official data on consumer inflation in India is due on Monday, June 13. Data on wholesale inflation will be released the next day.

Industry body SIAM is slated to release a monthly report on sales, production and exports on Monday.

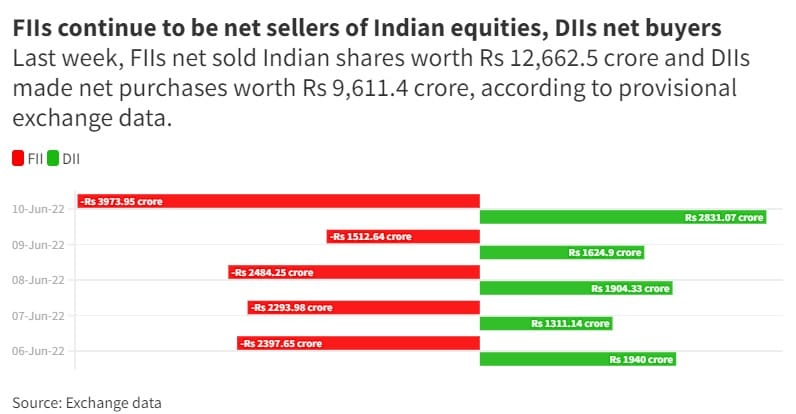

FII activity

Institutional fund flows will continue to be on investors' radar, amid sustained selling of Indian shares by foreign institutional investors.

Corporate action

| Company | Ex date | Purpose | Record date |

| Gallantt Ispat | 06-Jun-22 | Amalgamation | 07-Jun-22 |

| Apcotex Industries | 06-Jun-22 | Final dividend Rs 3 | - |

| Aurobindo Pharma | 06-Jun-22 | Interim dividend Rs 4.5 | 07-Jun-22 |

| Faze Three | 06-Jun-22 | Interim dividend Rs 0.5 | 07-Jun-22 |

| INEOS Styrolution India | 06-Jun-22 | Interim dividend Rs 105 | 07-Jun-22 |

| MM Forgings | 06-Jun-22 | Interim dividend Rs 6 | 07-Jun-22 |

| NINtec Systems | 06-Jun-22 | Bonus issue 1:2 | 07-Jun-22 |

| Rallis | 06-Jun-22 | Final dividend Rs 3 | - |

| Varun Beverages | 06-Jun-22 | Bonus issue 1:2 | 07-Jun-22 |

| Satyam Silk Mills | 06-Jun-22 | Right issue | 06-Jun-22 |

| AAR Commercial | 07-Jun-22 | Amalgamation | 07-Jun-22 |

| General Insurance Corporation | 07-Jun-22 | Interim dividend Rs 2.25 | 08-Jun-22 |

| Pearl Global Industries | 07-Jun-22 | Interim dividend Rs 5 | 08-Jun-22 |

| GG Engineering | 08-Jun-22 | Stock split from Rs 2 to Re 1 | 09-Jun-22 |

| Jagsonpal Pharma | 08-Jun-22 | EGM | - |

| Kansai Nerolac Paints | 08-Jun-22 | Final dividend Re 1 | - |

| Asian Paints | 09-Jun-22 | Final dividend Rs 15.5 | 10-Jun-22 |

| Asian Granito | 09-Jun-22 | Final dividend Re 0.7 | 10-Jun-22 |

| AU Small Finance Bank | 09-Jun-22 | Bonus issue 1:1 | 10-Jun-22 |

| Craftsman Automation | 09-Jun-22 | Dividend Rs 3.75 | - |

| Elecon Engineering | 09-Jun-22 | Final dividend Re 1 | 10-Jun-22 |

| Elecon Engineering | 09-Jun-22 | Special dividend Re 0.4 | 10-Jun-22 |

| HDFC Asset Management Company | 09-Jun-22 | Dividend Rs 42 | - |

| India Motor Parts & Accessories | 09-Jun-22 | Interim dividend Rs 13 | 10-Jun-22 |

| Mukand Engineers | 09-Jun-22 | Amalgamation | 10-Jun-22 |

| PFC | 09-Jun-22 | Final dividend Re 1.25 | 10-Jun-22 |

| Quess Corp | 09-Jun-22 | Interim dividend Rs 4 | 10-Jun-22 |

| Silver Touch Technologies | 09-Jun-22 | Interim dividend Rs 0.5 | 10-Jun-22 |

| SMC Global Securities | 09-Jun-22 | Final dividend Rs 1.2 | - |

| Tata Consumer Products | 09-Jun-22 | Final dividend Rs 6.05 | - |

| Transcorp International | 09-Jun-22 | Dividend Re 0.1 | - |

| Voltas | 09-Jun-22 | Final dividend Rs 5.5 | - |

| Welspun Corp | 09-Jun-22 | Dividend Rs 5 | 10-Jun-22 |

| CEAT | 10-Jun-22 | Final dividend Rs 3 | 13-Jun-22 |

| LKP Finance | 10-Jun-22 | Final dividend Rs 3 | - |

| LKP Securities | 10-Jun-22 | Final dividend Re 0.3 | - |

| Sadhna Broadcast | 10-Jun-22 | Stock split from Rs 10 to Re 1 | 13-Jun-22 |

| Sagarsoft (India) | 10-Jun-22 | Dividend Rs 3 | - |

| Shree Digvijay Cement | 10-Jun-22 | Final dividend Rs 2 | 13-Jun-22 |

| Tata Communications | 10-Jun-22 | Final dividend Rs 20.7 | - |

First Published: IST

D-Street Week Ahead: Fed Rate Decision, Macro Data, Crude Oil Likely To Influence Market - CNBCTV18

Read More

No comments:

Post a Comment