Rupee at close: Rupee ends at 77.71 per US dollar against June 6 close of 77.63 per US dollar

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

Investors are in a wait and watch mood ahead of the RBI's credit policy announcement, although several economists believe the MPC will hike rates further to tame inflation. The market has simply borne the brunt of unabated FII selling, which continues to desert Indian equities amid weakening rupee and strengthening dollar.

Technically, Nifty broke the important support level of 16450 and closed below the same which is largely negative. In addition, the index has also formed a bearish candle indicating short-term weakness. For traders, as long as the index is trading below 16500 the short term texture remains weak, below which the correction wave is likely to continue till 16300. Any further correction could drag the index up to 16225. On the other hand, above 16500, there are chances the index could hit 16600-16650.

Deepak Jasani, Head of Retail Research, HDFC Securities:

Nifty fell in line with most global markets for the third day in a row on June 7. The index opened gap down and fell in the morning to make an intra day bottom at 1125 Hrs. It later tried to bounce up and later went sideways. At close, Nifty was down 0.92% or 153.2 points at 16416.4.

We expect 40bps rate hike in the upcoming policy meet on June 8 and expect the RBI raising policy rates to reach 5.15% by Aug/Oct. The recent measures by the government will aid in keeping the rate hike relatively shallow, though determination of terminal rate will be much more data dependent given the flux in global conditions.

Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities:

Nifty Bears took control once again leading to a fall in the index towards the crucial support zone 16,400-16,350. The volatility is likely to continue ahead of the RBI policy and a clear-cut direction will be visible post the outcome. The upside resistance is placed at the 16,600-16,800 zone where heavy call writing is visible

Bank Nifty index continues to witness selling pressure ahead of the RBI policy and ends on a negative note. The index is stuck in a broad range between 34,500-36,000 levels and a break on either side will lead to further trending action. The undertone remains weak as long as it stays below the level of 36,000 where the highest open interest is built up on the call side.

Vinod Nair, Head of Research at Geojit Financial Services:

The volatility in the market is forcing investors to stay sidelined ahead of the RBI’s policy announcement. The market has factored a hike up to 50bps of repo rate & CRR, but any further stricter measures to clamp liquidity due to lingering inflation will have ramifications on the market trend. Apart from the monetary measures, the RBI’s guidance on growth and inflation forecast will determine the market trend.

Ashwin Patil, Senior Research Analyst at LKP Securities on defence stocks:

These companies are the front runners to gain from any positive moves from the government as it is their one of the most important sources of business. Such a move from the government entails higher revenues and order book for the coming years. It gives higher visibility of numbers going forward and comfort to investors. Given the geopolitical tensions seen on the global front, the Centre has increased its defence CAPEX outlay, which augurs well for the defence bellwether. We remain positive on Bharat Electronics Limited.

Market at close: Benchmark indices closed in the red with Sensex down 567.98 points or 1.02% at 55107.34, and the Nifty falling 153.20 points or 0.92% at 16416.30. About 1261 shares have advanced, 1954 shares declined, and 126 shares are unchanged.

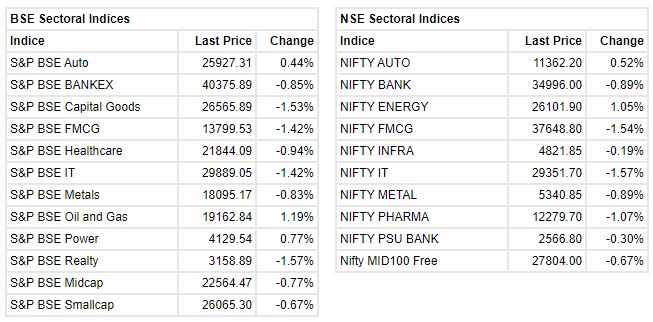

Among the sectors, realty, IT and capital goods shed over a percent each while buying was seen in oil & gas and power names. The midcap and smallcap indices shed over half a percent each.

L&T Infotech fixes July 1,2022 as the record date for payment of final dividend

L&T Infotech fixes Friday, July 1,2022 as the record date for determining entitlement of members to the final dividend for the financial year ended on

March 31, 2022,

Market at 3.00 PM

Indices trade low, Sensex trading lower by around 600 points, Nifty around 16,400

The Sensex was down 616.46 points or 1.11% at 55,058.86 and the Nifty was down 174.5 points or 1.05% at 16,395.05. About 1195 shares have advanced, 2066 shares declined, and 123 shares are unchanged.

Source: BSE

Sharad Chandra Shukla, Director, Mehta Equities Ltd.

Markets expect further tightening in the monetary policy to tackle inflation. A likely 40-50 bps increase in key rates is expected on account of higher commodity prices, high food and core inflation. With CPI hovering at highs, we expect RBI will think of revising inflation target to a more realistic based on ground realities which can be beyond 6-7% this would be attributed to the ongoing war after effects and impacts on input costs as well as disturbance on supply chain management. We assume RBI will be more focusing on controlling inflation and growth won’t be the priority at this juncture and likely to keep the GDP forecast unchanged.

HDFC Bank hikes lending rates by 0.35%; 2nd hike in two months

The country's largest private sector lender HDFC Bank on Tuesday announced a 0.35 percent hike in lending rate. The hike, which comes a day ahead of the RBI's scheduled policy review, is the second such move from the lender in as many months, taking the cumulative hike to up to 0.60 percent. HDFC Bank increased its Marginal Cost of funding based Lending Rate by 0.35 percent from June 7, as per the new rate structure published on its website. The one-year MCLR, on which a bulk of consumer loans are pegged, will be 7.85 percent after the newest review as against 7.50 percent earlier. The overnight MCLR will be 7.50 percent against 7.15 percent, while the three-year MCLR will be 8.05 percent compared to 7.70 percent.

Closing Bell: Sensex ends 550pts lower, Nifty below 16,450; realty, IT, capital goods top losers - Moneycontrol

Read More

No comments:

Post a Comment