Ajit Mishra, VP - Research, Religare Broking

Markets extended rebound for the second consecutive session and gained nearly 2%, tracking firm global cues. After the upbeat start, the benchmark moved from strength to strength for most of the day however marginal selling in the last hour trimmed some gains. Consequently, the Nifty ended with gains of 1.9% at 15,638 levels.

All the sectors participated in the move wherein media, PSU banks and metals gained maximum. The broader indices, Midcap and Smallcap, too ended higher and gained over 3.5% each.

This move has certainly eased some pressure but sustainability is the key. Participants are keenly eyeing the US Fed chair’s speech for cues and the progress of the monsoon is also on the radar.

A decisive move above 15,700 in Nifty can further fuel the rebound to the 16,000 zone else the decline would resume. Stocks, on the other hand, are offering opportunities on both sides, so traders should plan accordingly.

Anindya Banerjee, VP, Currency Derivatives & Interest Rate Derivatives at Kotak Securities:

USDINR spot closed 9 paise higher at 78.09, thanks to importer hedging and oil demand. Over the near term we expect USDINR to trade within a range of 77.80 and 78.40 with an upward bias.

With forward premium on a % of spot trading at 11 year lows, there will be more of importer demand and less of exporter selling. Carry traders may be disincentivized due such low premium.

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities

With no negative clues in the market, benchmark indices gained for the second straight day on Tuesday. Metal, state-owned banks and technology stocks witnessed bargain hunting after suffering heavy losses last week on fears that aggressive rate hikes.

On daily charts, the Nifty has formed a promising bullish candle which supports a further uptrend from the current levels. However, the medium-term trend is still on the weak side.

For the traders, the support has shifted to 15,500 from 15,250 on the Nifty (and from 51,300 to 52,000 on BSE). As long as, the Nifty is trading above 15,500, the chances of hitting 15,750 would turn bright. Further upside may also continue, which could lift the Nifty up to 15,850.

Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services:

Domestic indices were positive for second consecutive day. Nifty opened gap up and continued to gain strength throughout the day to close with handsome gains of 1.9% at 15639. Broader market too turned positive and closed with gains of more than 3% after witnessing relentless selling in Monday’s session. All sectorial indices saw renewed buying with Media, Oil & Gas, PSU Banks, Metals, IT, Consumer Durables and Realty 3-5% each.

Global markets made a comeback after last week’s intense selling. Although investors remained cautious as major central banks around the world raised interest rates.

Markets witnessed the much needed relief rally today after posting the worst weekly loss in 2 years. Positive global cues, fall in crude oil prices and short covering in derivatives segment drove the markets.

Further, value buying in beaten down sectors also helped market to gain some momentum today. Globally equity markets continue to remain worried over the expected aggressive rate hikes by central banks to curb record inflation and its impact on economic growth.

However, on the positive side, crude prices have corrected by almost 10% from its recent peak, providing some breather to the Indian market. While the overall market set up continues to remain ‘Sell on rise’ – intermittent bouts of relief rally can’t be ruled out. Given the hawkish commentaries from Central banks and record high inflation, rate hike cycle is likely to continue over the next couple of months and would keep markets jittery.

Vinod Nair, Head of Research at Geojit Financial Services:

Absence of fresh selling triggers in the domestic and global economy along with falling commodity prices relieved the heavily discounted equity market to showcase recovery.

The recovery indicates that the current uncertainties of inflation and monetary policy tightening have been factored in. However, with the highly sensitive nature of the current equity market, even the slightest inconvenience can trigger volatility.

Rupee Closes:

Indian rupee ended 10 paise lower at 78.08 per dollar on Tuesday against Monday’s close of 77.98.

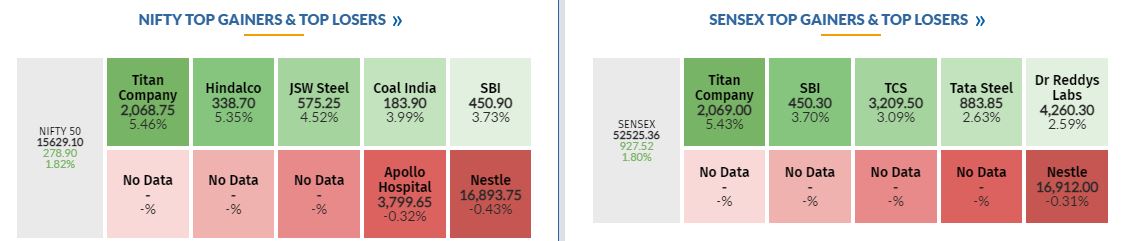

Market Close: Benchmark indices ended higher for the second consecutive session on June 21 with Nifty finishing above 15,600.

At close, the Sensex was up 934.23 points or 1.81% at 52,532.07, and the Nifty was up 288.60 points or 1.88% at 15,638.80. About 2428 shares have advanced, 819 shares declined, and 125 shares are unchanged.

Titan Company, Hindalco Industries, JSW Steel, Coal India and Adani Ports were among the top Nifty gainers. The only losers is Apollo Hospitals.

All the sectoral indices ended in the green with IT, metal, oil & gas, power, realty and PSU Bank up 3-6 percent.

BSE Midcap index jumped 2.4 percent and Smallcap index was up 3 percent.

Buzzing:

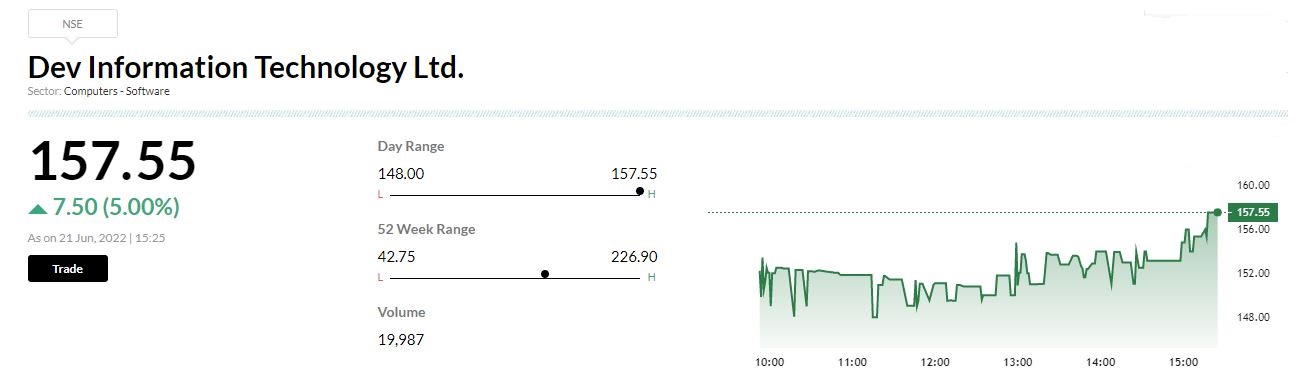

Dev Information Technology signed MoU with Department of Science and Technology, Government of Gujarat.

The MoU is indication of investment intentions worth INR 100cr in next 5 year by way of DEV IT investing in |T Infrastructure, Physical Infrastructure, Skilling-reskilling-upskilling of workforce in cloud plus data plus automation technologies, hiring of new workforce in coming years, etc such supporting various activities for DEV IT's futuristic business growth.

Citi View On Tata Steel

Research house Citi has maintained buy rating on Tata Steel and cut target to Rs 1,085 from Rs 1,800 per share.

It has cut EBITDA estimate by 32% /34% on lower realisations.

The balancesheet is strong, perhaps strongest in the last 15 years, reported CNBC-TV18.

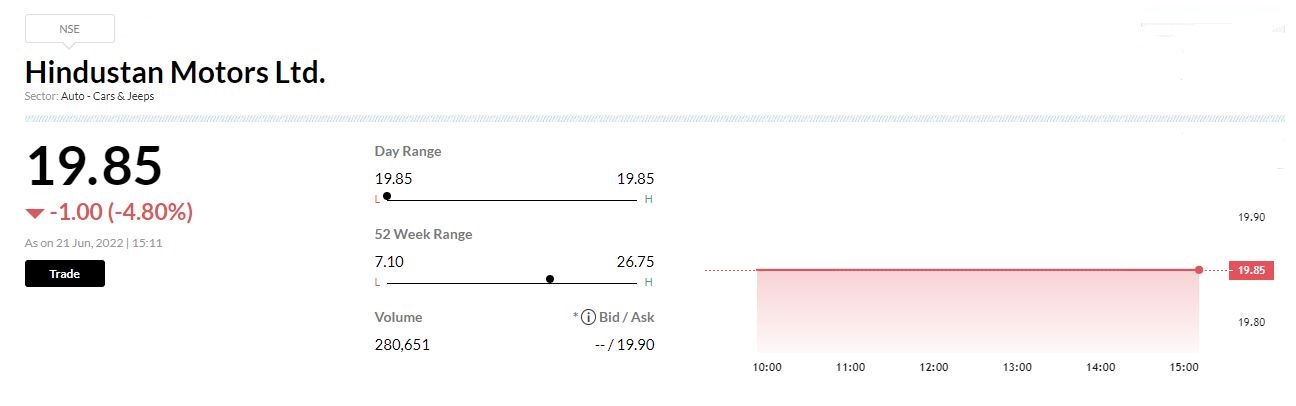

Hindustan Motors executes brand transfer agreement with SG Corporate Mobility:

Hindustan Motors has executed a Brand Transfer Agreement with S.G. Corporate Mobility Private Limited for the transfer of the Contessa Brand (including the trademarks having application number 5372807) and certain related rights.

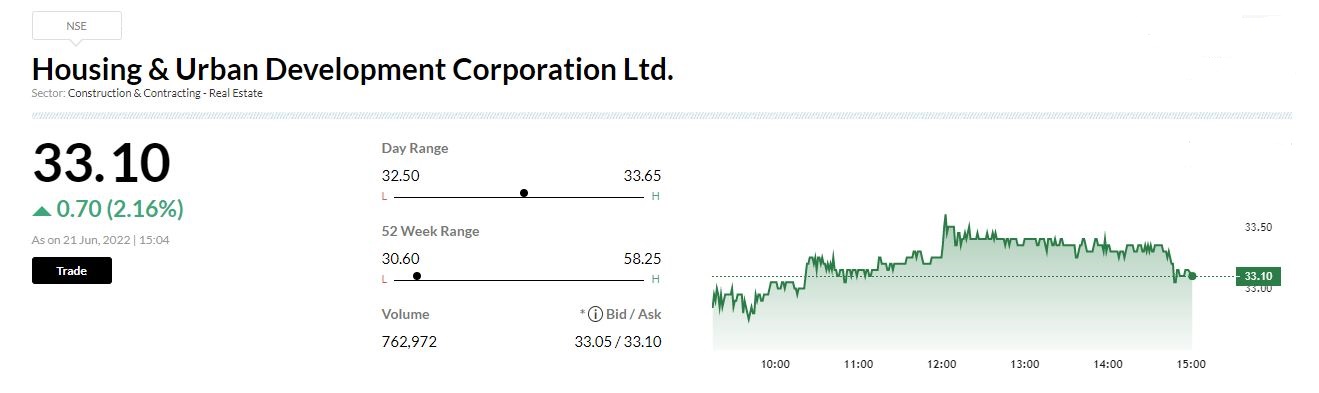

Fitch Ratings revises outlook of HUDCO to 'stable'

Fitch Ratings has affirmed the ratings of Housing and Urban Development Corporation (HUDCO) at 'BBB-' level, i.e. at the sovereign level.

At the same time, the rating agency has revised the outlook of HUDCO to 'Stable' from 'Negative'. The rating action follows the change in outlook of Government of India rating to 'Stable' from Negative’ on June 10, 2022.

Market at 3 PM

Benchmark indices erased some of the intraday gains but still trading higher with Nifty holding above 15600.

The Sensex was up 913.16 points or 1.77% at 52,511.00, and the Nifty was up 279.50 points or 1.82% at 15,629.70. About 2375 shares have advanced, 757 shares declined, and 100 shares are unchanged.

Closing Bell: Nifty ends above 15,600, Sensex jumps 934 pts; oil & gas stocks rally - Moneycontrol

Read More

No comments:

Post a Comment