Gold Price Updates:

Gold prices climbed more than 1% on Thursday after U.S. Federal Reserve Chair Jerome Powell ruled out large, aggressive interest rate hikes for the year as the central bank seeks to contain inflation without triggering an economic recession.

Rate hikes tend to lift bond yields and make zero-yield bullion less attractive by raising its opportunity cost. Gold, which is also perceived as an inflation hedge, is now up for a third straight session in what could be its best winning streak since mid-April.

Spot gold was up 1.1% at $1,901.56 per ounce, as of 0330 GMT, after rising to its highest since April 29 earlier in the session. U.S. gold futures gained 1.8% to $1,902.00.

V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services:

RBI's decision to raise repo rate and CRR by 40bp and 50bp respectively came as a surprise since the decision was taken by the MPC in an unscheduled meeting indicating that the central bank was behind the curve.

The market reaction with a 1300 point cut in the Sensex reflected concern regarding high inflation and the potential impact of high interest rate on growth and corporate earnings.

On the other hand, the Fed's clear communication triggered a sharp relief rally in the US market. There are three positive takeaways from the Fed's announcement. One, there won't be a 75% rate hike and the market can expect a 50bp rate hike in the next two meetings also. Two, there is some evidence that inflation may have peaked. Three, the US economy continues to be strong with household spending, businesses and labour markets in good shape. It remains to be seen whether the relief rally will sustain.

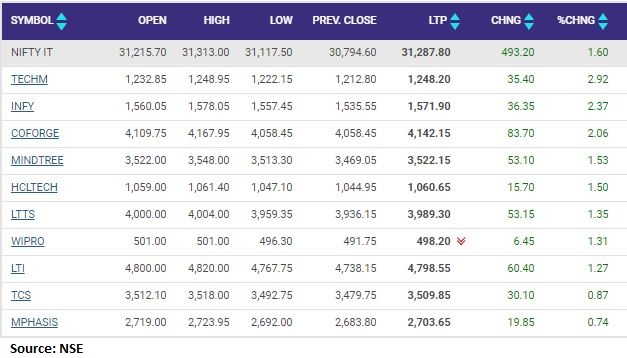

Nifty Information Technology index rose over 1 percent led by Tech Mahindra, Infosys, Coforge

Cognizant reports 10.9% revenue growth:

Nasdaq-listed Cognizant Technology Solutions Corp’s March quarter net profit rose 11.5% year-on-year to $563 million, on the back of an 11% increase in revenue in constant currency to $4.8 billion - its highest-ever quarterly revenue and fourth consecutive quarter of revenue growth. The company follows a January to December accounting year. Click To Read More

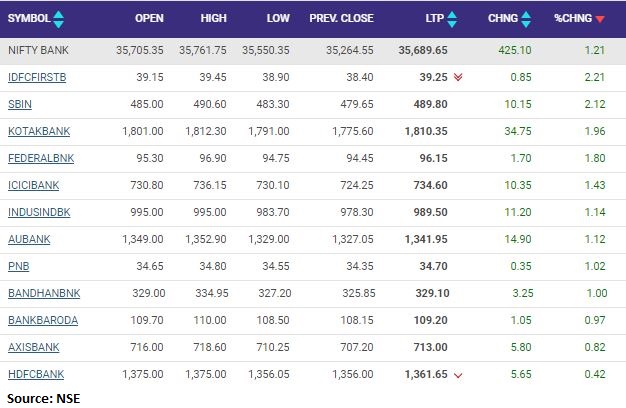

Nifty Bank index rose 1 percent supported by the IDFC First Bank, SBI, Kotak Mahindra Bank

Varun Beverages Large Trade | 43 lakh shares (1% equity) of Varun Beverages worth of Rs 473 crore change hands.

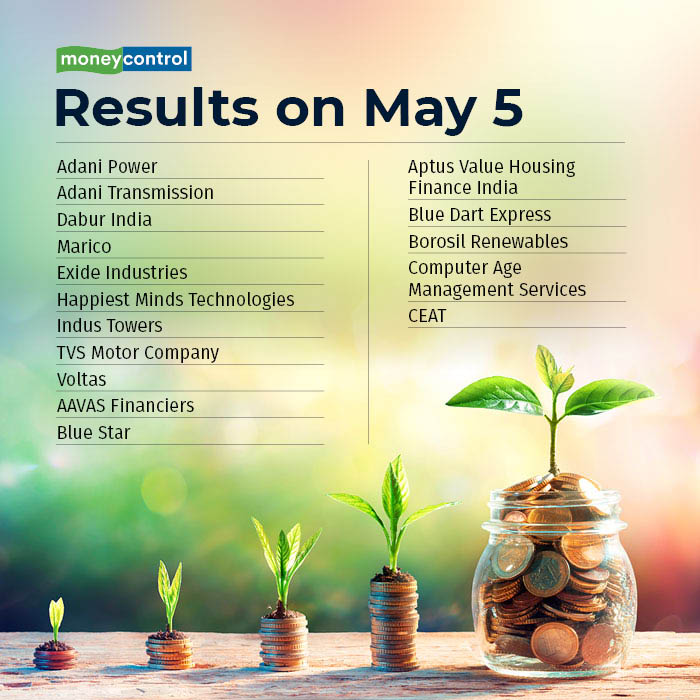

RESULTS TODAY:

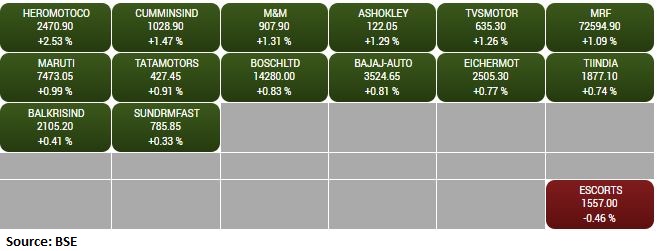

BSE Auto index rose 1 percent led by the Hero MotoCorp, Cummins India, M&M

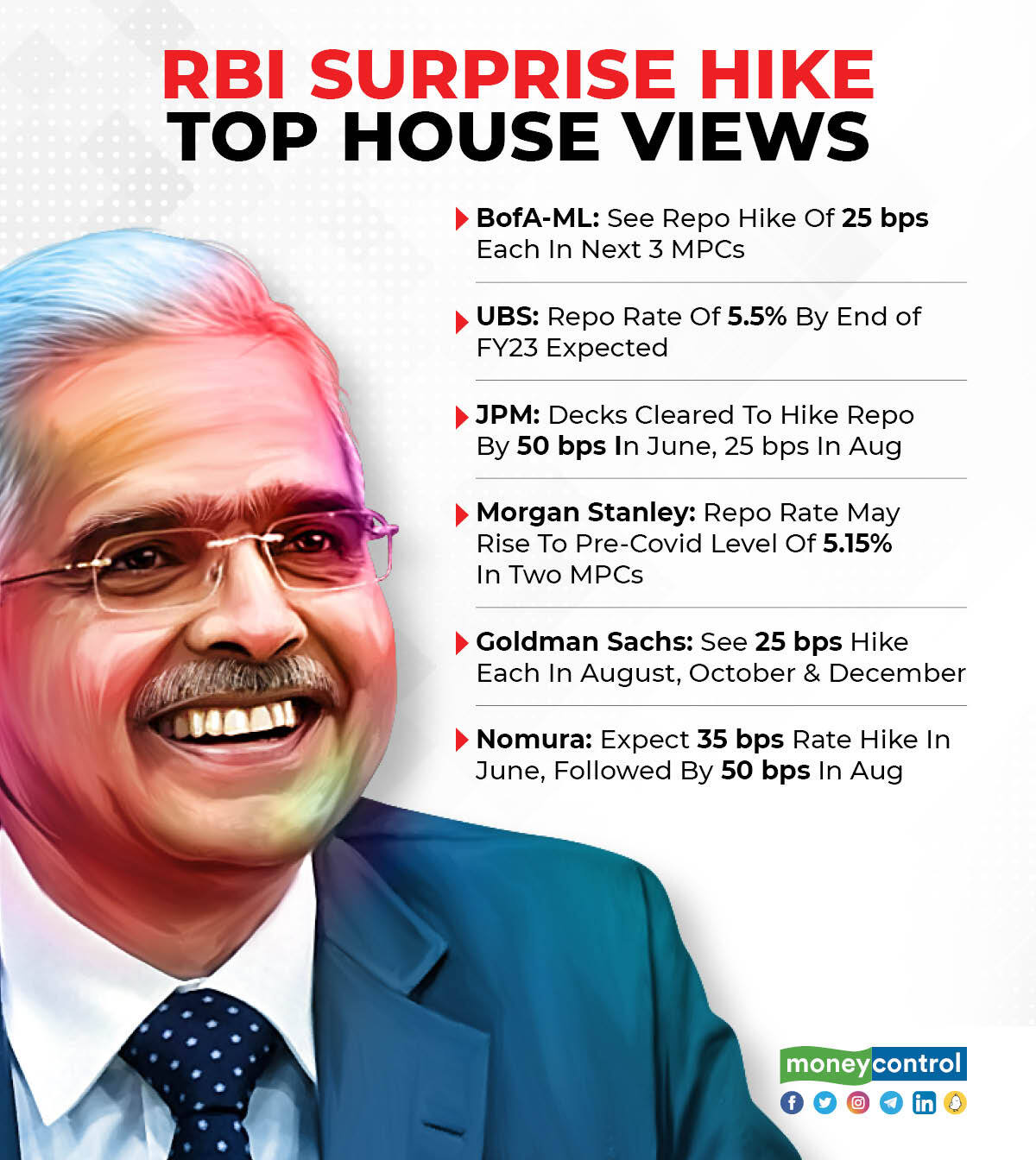

HOUSEVIEWS ON RBI RATE HIKE

Prudent Corporate Advisory prices IPO at Rs 595-630 per share

Prudent Corporate Advisory Services, an integrated wealth management service provider, has set a price band of Rs 595-630 a share for its initial public offering.

The IPO will open for subscription on 10 May and close on 12 May. Bidding for anchor investors will open on 9 May. The firm will list on exchanges on 23 May.

The issue comprises a pure offer for sale of up to 8.55 million shares by shareholders and promoters. Wagner will sell up to 8.28 million shares and Shirish Patel will sell around 2.68 million shares. Wagner holds 39.91% stake while Patel has 3.15% stake in the firm.

At the upper end of the price band, the firm will raise around Rs 538.61 crore via IPO.

ICICI Securities, Axis Capital and Equirus Capital are the lead managers to the issue.

Market LIVE Updates: Sensex gains 500 pts, Nifty above 16,800 led by auto, bank, IT, metals - Moneycontrol

Read More

No comments:

Post a Comment