Shivam Bajaj, Founder & CEO at Avener Capital on LIC:

Despite the reduction in the pre-IPO valuation of LIC, the scrip has still listed at a discount on the bourses which is in tandem with the diminution in insurance companies’ valuation and softness in the markets due to macro-economic constraints. However, given the attractive fundamentals, stability in operating metrics and expected recovery in the markets, we can potentially see some buying interest from investors'

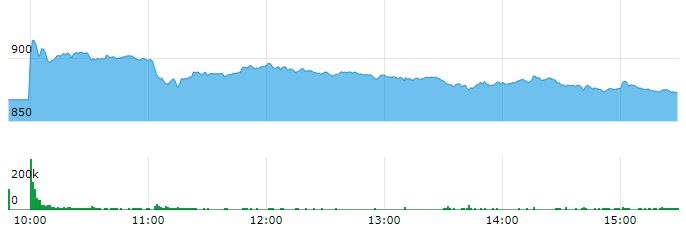

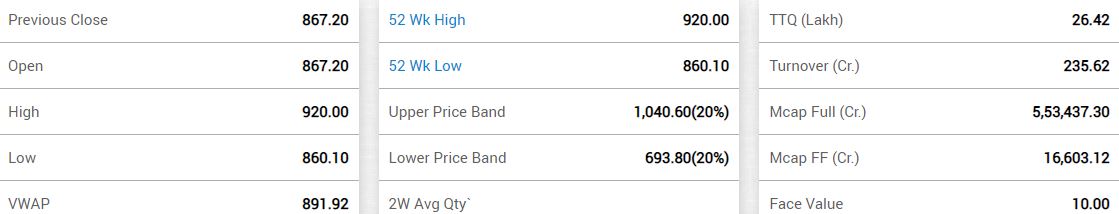

The stock ended the first day of trading at Rs 872.70, down Rs 76.30, or 8.04 percent. It has touched an intraday high of Rs 920.00 and an intraday low of Rs 860.10.

Vivek Gupta, MD, GEPL Capital

India's biggest-ever IPO, LIC finally listed its shares at a discounted rate of over 8% i.e., Rs 77 on the BSE and the NSE. This discount reduces the break-even prices for employees and retailers which stand at Rs 904 and policyholders at Rs 889.

Hold on to your shares from a medium- to long-term perspective. In fact, in case you are planning to buy today, you should accumulate by taking volatility as an opportunity. LIC is trading at a discounted rate and you might be able to accumulate more as the Mcap/EV ratio of 1.1x becomes more attractive than what it was in the primary market. We must be aware that the business of insurance in itself is long-term in nature and therefore I recommend staying vested.

At 15:15 hrs Life Insurance Corporation of India was quoting at Rs 874.95, down Rs 74.05, or 7.80 percent. It has touched an intraday high of Rs 920.00 and an intraday low of Rs 860.10.

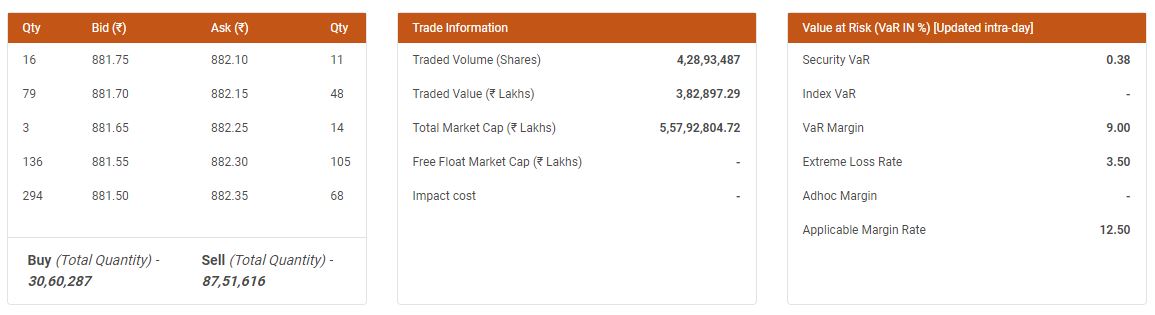

Market depth - Order Book

Vinod Nair, Head of Research at Geojit Financial Services on LIC listing:

The subdued listing of LIC is in-line with expectations in context to the drop in market dynamics from the opening of the IPO to the listing date. The listing price has fallen in tandem with the fall of insurance sector valuations, maintaining the discount of about 70% to the industry’s average. Positively, the stock was brought at the dip. We believe that LIC is a decent investment opportunity in the short to medium-term considering its strong market presence, improvement in future profitability due to the changes in surplus distribution norms and strong sector growth outlook. LIC can perform well when we have a bounce in the market and positive performance in the insurance sector.

Vinod Nair, Head of Research at Geojit Financial Services

The subdued listing of LIC is in-line with expectations in context to the drop in market dynamics from the opening of the IPO to the listing date. The listing price has fallen in tandem with the fall of insurance sector valuations, maintaining the discount of about 70% to the industry’s average. Positively, the stock was brought at the dip. We believe that LIC is a decent investment opportunity in the short to medium-term considering its strong market presence, improvement in future profitability due to the changes in surplus distribution norms and strong sector growth outlook. LIC can perform well when we have a bounce in the market and positive performance in the insurance sector

LIC IPO market debut highlights: Stock ends first trading day at Rs 872/share on BSE, down 8% from issue... - Moneycontrol

Read More

No comments:

Post a Comment