The market had a robust opening for the week as the benchmark indices rallied more than 2 percent and reclaimed key psychological levels (60,000 on the Sensex and 18,000 on the Nifty) on April 4, following the HDFC-HDFC Bank merger announcement, and positive global cues. Every sector participated in the run up with Banking and Financial Services being the top gainers with 4 percent gains.

The BSE Sensex surged 1,335 points to 60,612, while the Nifty50 jumped 383 points to 18,053 and formed bullish candle on the daily charts, hinting positive mood at Dalal Street.

"The index is moving in a higher Top and Higher Bottom formation on the daily chart, indicating a sustained uptrend. The chart pattern suggests that if the Nifty crosses and sustains above the 18,100 level, it would witness buying which would lead the index towards 18,350 levels," said Rajesh Palviya, VP - Technical and Derivative Research at Axis Securities.

However, he feels if the index breaks below 18,000 level it would witness selling, which would take the index towards 17,900-17,800.

Nifty is trading above its 20 days simple moving average, which indicates positive bias in the short term. "Nifty continues to remain in an uptrend for the short term, so buying on dips continues to be our preferred strategy," said Rajesh.

The Nifty Midcap and Smallcap indices also joined the rally, rising 1.6 percent each.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,858, followed by 17,663. If the index moves up, the key resistance levels to watch out for are 18,182 and 18,310.

Banking stocks, especially HDFC Bank, provided major support to the market as Bank Nifty climbed 1,487 points or 4 percent to close at 38,635 on April 4. The important pivot level, which will act as crucial support for the index, is placed at 37,945, followed by 37,255. On the upside, key resistance levels are placed at 39,045 and 39,456 levels.

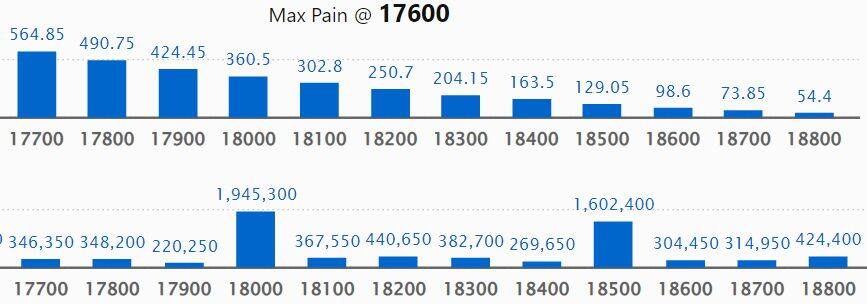

Maximum Call open interest of 19.45 lakh contracts was seen at 18,000 strike. This is followed by 19,000 strike, which holds 19.42 lakh contracts, and 18,500 strike, which has accumulated 16.02 lakh contracts.

Call writing was seen at 18,000 strike, which added 4.36 lakh contracts, followed by 19,000 strike which added 2.45 lakh contracts, and 18,500 strike which added 2.28 lakh contracts.

Call unwinding was seen at 17,500 strike, which shed 3.69 lakh contracts, followed by 17,600 strike which shed 1.4 lakh contracts and 17,200 strike which shed 65,750 contracts.

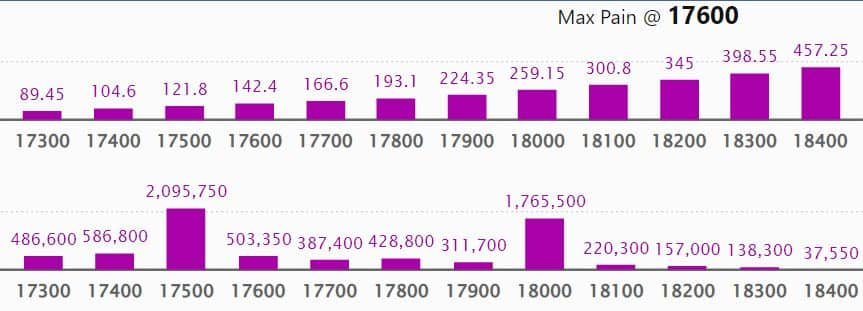

Maximum Put open interest of 20.95 lakh contracts was seen at 17,500 strike, which will act as a crucial support level in the April series.

This is followed by 17,000 strike, which holds 19.15 lakh contracts, and 18,000 strike, which has accumulated 17.65 lakh contracts.

Put writing was seen at 18,000 strike, which added 8.27 lakh contracts, followed by 17,800 strike, which added 3.17 lakh contracts and 17,900 strike which added 2.68 lakh contracts.

Put unwinding was seen at 19,000 strike, which shed 44,100 contracts, followed by 17,000 strike which shed 37,350 contracts, and 17,100 strike which shed 2,850 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Gujarat State Petronet, Tech Mahindra, Infosys, HCL Technologies, and ICICI Lombard General Insurance Company, among others on April 4.

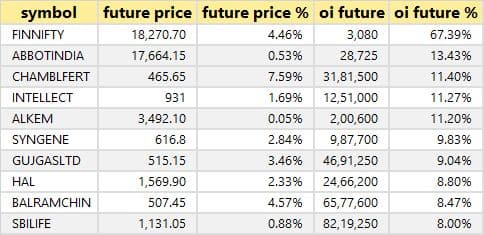

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Nifty Financial, Abbott India, Chambal Fertilizers, Intellect Design Arena, and Alkem Laboratories, in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the 8 stocks including Cummins India, Bandhan Bank, Container Corporation of India, Aditya Birla Fashion & Retail, and Indian Hotels, in which long unwinding was seen.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the 9 stocks including Mphasis, Titan Company, Infosys, Cholamandalam Investment, and Tata Communications, in which a short build-up was seen.

76 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Bank Nifty, Hindalco Industries, Lupin, HDFC Life Insurance Company, and BPCL, in which short-covering was seen.

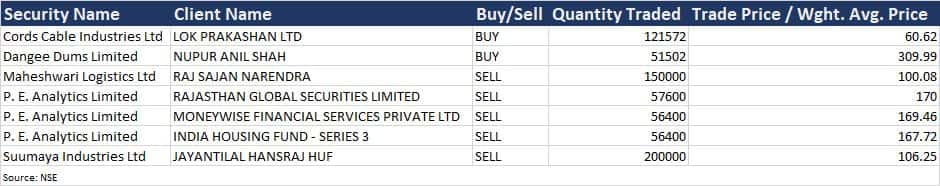

(For more bulk deals, click here)

Analysts/Investors Meetings on April 5

Tata Steel: The company's officials will meet BlackRock Investment Management.

Krsnaa Diagnostics: The company's officials will meet TATA Mutual Fund.

Ujjivan Small Finance Bank: The company's officials will meet Kotak MF, ICICI Prudential AMC, and Birla MF.

Jubilant Pharmova: The company's officials will meet Goldman Sachs Asset Management, Aviva Life Insurance, and Alchemy Capital.

Infibeam Avenues: The company's officials will attend Jefferies India Fintech Summit.

Rossari Biotech: The company's officials will attend HDFC Securities - Investor Forum for Chemical Sector.

Ajmera Realty & Infra India: The company's officials will meet Anand Rathi Securities.

Antony Waste Handling Cell: The company's officials will meet investors and analysts.

Stocks in News

Zomato: Competition Commission of India orders investigation against online food delivery platforms Zomato and Bundl Technologies, the operator of Swiggy, into some of their conduct following a complaint filed by National Restaurant Association of India that alleged contravention of rules by the two companies.

SBI Card and Payment Services: Private equity firm Carlyle Group will sell its entire stake in SBI Cards and Payments Services Ltd for as much as Rs 2,558 crore, according to deal terms seen by Moneycontrol. CA Rover Holdings, a Carlyle entity, which as of December 2021 quarter, held 29.20 million shares or 3.09 percent stake in SBI Cards will sell its entire stake in the firm, through a block trade. The shares being offered between Rs 851.50-876.75 a share, that represents around 3 percent discount to the current market price.

3i Infotech: The company has secured a cloud transformation deal for its NuRe platform, from one of the large commercial banks in Asia-Pacific region. Deal size is approximately Rs 6.04 crore.

IRB Infrastructure Developers: The project of eight lane Vadodara Kim Expressway in Gujarat under NHDP Phase - VI on Hybrid Annuity Mode implemented by its subsidiary has received a Provisional Certificate from the Competent Authority. The subsidiary received Provisional Certificate after substantial completion of the works in 22.585 km out of 23.740 km of the project highway. Consequently, the SPV is eligible for receipt of Bi-annually annuity payments from NHAI for the operation period of 15 years.

IndusInd Bank: The private sector lender said net advances of Rs 2.39 lakh crore at the end of March 2022 quarter grew by 13 percent compared to year-ago period and up 5 percent compared to previous quarter. Deposits increased by 15 percent YoY and 3 percent QoQ to Rs 2.93 lakh crore in Q4FY22.

Max Healthcare Institute: SBI Funds Management acquired more than 1 crore equity shares in the company via open market transactions on March 31. With this, its shareholding in the company stands at 9.22 percent, up from 8.19 percent earlier.

Tata Consultancy Services: The country's largest IT services firm has entered into a strategic partnership with Payments Canada, the country’s largest payment organization, to transform its payment system operations and help implement the Real-Time Rail (RTR). This new real-time payments system will allow Canadians to initiate payments and receive irrevocable funds in seconds, 24/7/365.

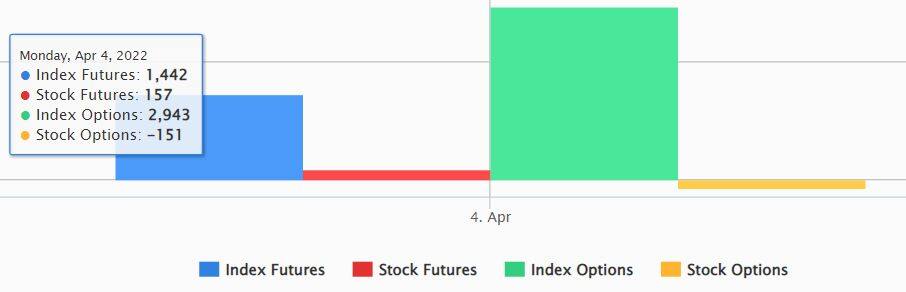

Fund Flow

Foreign institutional investors (FIIs) have continued its buying into India as they have net bought shares worth Rs 1,152.21 crore, while domestic institutional investors (DIIs) have also net purchased shares worth Rs 1,675.01 crore on April 4, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

As we are in the beginning of April series, we don't have any stock under the F&O ban for April 5. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Trade setup for today: Top 15 things to know before the opening bell - Moneycontrol

Read More

No comments:

Post a Comment