The market recouped all its previous day's losses and closed at fresh one-month high with more than one percent gains on March 22, following positive global cues.

The BSE Sensex soared 697 points or 1.22 percent to 57,989, driven by banks, auto, IT, metals stocks and Reliance Industries. The Nifty50 jumped 198 points or 1.16 percent to 17,315.50, the highest level since February 16 this year, and formed a bullish candle on the daily charts.

"A long bull candle was formed on the daily chart that has almost engulfed the long bearish candle of Monday. This is a positive indication and signal a counter attack of bulls after one session of decline. Further upside from here (above 17,355) could negate the Bearish Engulfing pattern formation of Monday," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

Shetty further added the positive sequence like higher highs and lows is intact on the daily chart and Tuesday's swing low of 17,006 levels could now be considered as a new higher bottom of the sequence.

Hence, "the overall chart pattern indicates next upside of around 17,500 in the short term and one may expect further upside targets of around 17,800-18,000 levels in the near term," he said, adding immediate support is placed at 17,200.

The broader markets failed to catch up the momentum as the Nifty Midcap and Smallcap indices gained only 0.28 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,103, followed by 16,891. If the index moves up, the key resistance levels to watch out for are 17,431 and 17,547.

The Bank Nifty also bounced back, rising 330 points to 36,348.60 on March 22. The important pivot level, which will act as crucial support for the index, is placed at 35,666, followed by 34,983. On the upside, key resistance levels are placed at 36,750 and 37,151 levels.

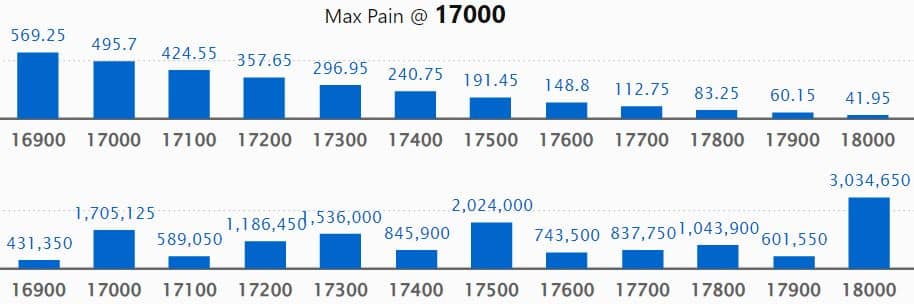

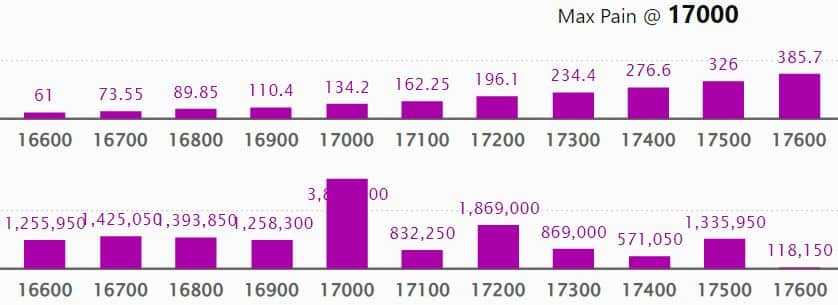

Maximum Call open interest of 30.34 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the March series.

This is followed by 17,500 strike, which holds 20.24 lakh contracts, and 17,000 strike, which has accumulated 17.05 lakh contracts.

Call writing was seen at 18,000 strike, which added 1.81 lakh contracts, followed by 18,300 strike which added 1.45 lakh contracts, and 17,900 strike which added 1.07 lakh contracts.

Call unwinding was seen at 17,200 strike, which shed 6.18 lakh contracts, followed by 17,100 strike which shed 1.08 lakh contracts and 17,300 strike which shed 59,550 contracts.

Maximum Put open interest of 47.39 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the March series.

This is followed by 17,000 strike, which holds 38.31 lakh contracts, and 16,500 strike, which has accumulated 35.31 lakh contracts.

Put writing was seen at 16,700 strike, which added 1.63 lakh contracts, followed by 16,900 strike, which added 1.6 lakh contracts, and 16,800 strike which added 1.59 lakh contracts.

Put unwinding was seen at 17,200 strike, which shed 4.53 lakh contracts, followed by 16,200 strike which shed 98,800 contracts, and 17,100 strike which shed 43,150 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in HDFC, Dr Reddy's Laboratories, Alkem Laboratories, M&M, and Escorts among others on Tuesday.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen including Birlasoft, GNFC, Oberoi Realty, Intellect Design Arena, and Indian Hotels.

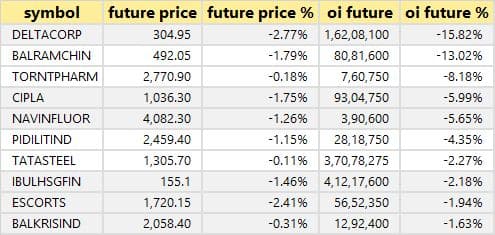

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen including Delta Corp, Balrampur Chini Mills, Torrent Pharma, Cipla, and Navin Fluorine International.

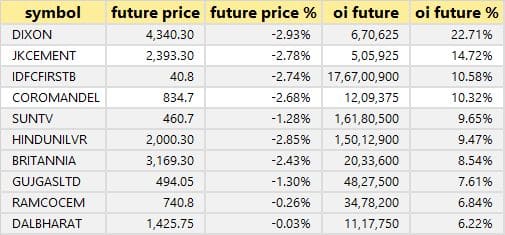

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen including Dixon Technologies, JK Cement, IDFC First Bank, Coromandel International, and Sun TV Network.

56 stocks witnessed short-covering

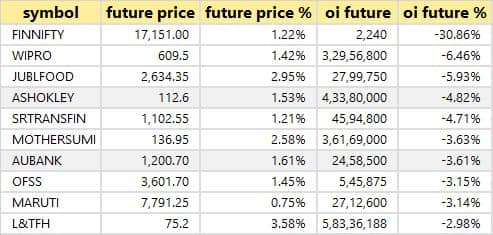

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen including Nifty Financial, Wipro, Jubilant Foodworks, Ashok Leyland, and Shriram Transport Finance.

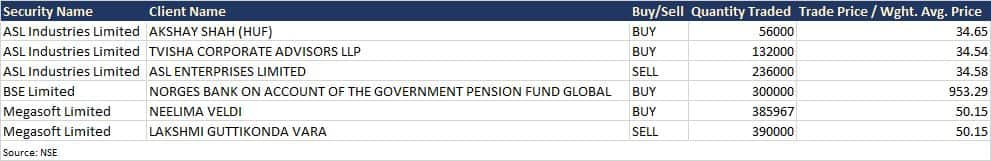

BSE: Norges Bank on account of the Government Pension Fund Global acquired 3 lakh equity shares in the company via open market transactions at Rs 953.29 per equity share.

(For more bulk deals, click here)

Analysts/Investors Meetings on March 23

Tata Elxsi: The company's officials will meet Alchemy Capital.

Globus Spirits: The company's officials will attend Motilal Oswal Ideation Conference - 2022.

Pidilite Industries: The company's officials will meet Blackrock Asset Management (HK).

Aditya Birla Sun Life AMC: The company's officials will attend Motilal Oswal Ideation Conference - 2022.

Tata Consumer Products: The company's officials will participate I-Sec Consumption Conversations.

Arvind: The company's officials will meet attend “SpinScape” - Elara Capital Textiles and Retail conference.

Himatsingka Seide: The company's officials will attend Elara Capital's Textile and Retail Conference.

Tarsons Products: The company's officials will attend Investec Conference.

UltraTech Cement: The company's officials will meet BlackRock Investment Management, and Dymon Asia.

Meghmani Organics: The company's officials will meet Abakkus Asset Manager, Veto Capital, Aym Enterprize, Whitestone Capital, Cask Capital, Equipolis, Gormal One, Elara Capital, Haitong Securities, Sunidhi Securities (Institutional Equities), and Pioneer Investcorp.

Chambal Fertilisers and Chemicals: The company's officials will attend Motilal Oswal Ideation Conference 2022.

Rajratan Global Wire: The company's officials will attend Motilal Oswal Securities investor conference.

Inox Leisure: The company's officials will attend Investec Promoter Conference.

Tata Motors: The company's officials will meet LIC.

Orient Electric: The company's officials will meet Dalal & Broacha Portfolio Managers.

Stocks in News

Bhansali Engineering Polymers: The company has received consent, from the MP Pollution Control Board, for expansion of high rubber graft - HRG (rubber rich acrylonitrile butadiene styrene) from 15000 TPA to 50000 TPA for Satnoor plant at Chhindwara in Madhya Pradesh.

Adani Ports and Special Economic Zone: Its cargo volumes accelerated to 300 million metric tonnes. The largest transport utility is on course to achieve 500 MMT by 2025.

Kirloskar Pneumatic Company: The company has converted about 5.58 lakh square metres Government Grant land at Eklahare, Nashik Road, Maharashtra, to Freehold Land at a cost of approximately Rs 58 crore as per the order of Nashik Collector, to meet its future growth requirements.

Brigade Enterprises: The south-based real estate company has entered into the plotted development space with a 66-acre residential project in Devanahalli, Bangalore. The project is a strategic joint development that will offer plot sizes ranging from 1,200 square feet to 2,400 square feet.

RailTel Corporation of India: The company has received work order from Rail Vikas Nigam (RVNL) for installation of RailTel's MPLS-VPN services for 5 years. The work order is worth Rs 11.57 crore.

Infosys: The country's second largest IT services company will acquire oddity, a Germany-based digital marketing, experience, and commerce agency. Oddity will become part of WONGDOODY, an Infosys company, and join its network of studios across Seattle, Los Angeles, New York, Providence, Houston, and London, and design hubs in five cities in India.

Tata Consultancy Services: The buyback issue of the company will close on March 23. It was opened on March 9. The company had planned to buy back up to 4 crore equity shares from eligible shareholders.

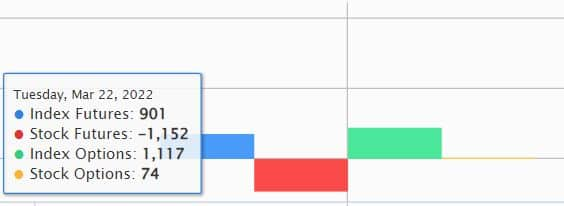

Fund Flow

Foreign institutional investors (FIIs) have net bought shares worth Rs 384.48 crore, while domestic institutional investors (DIIs) have net sold shares worth Rs 602.05 crore on March 22, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Five stocks - Balrampur Chini Mills, Delta Corp, GNFC, Indiabulls Housing Finance and Sun TV Network - are under the F&O ban for March 23. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Trade setup for Wednesday: Top 15 things to know before Opening Bell - Moneycontrol

Read More

No comments:

Post a Comment