The market snapped a five-day winning streak and lost more than one percent on March 15, weighed by selling in banking and financials, metals, FMCG, technology stocks, and index heavyweight Reliance Industries. The market had rallied more than 6 percent in the previous five straight sessions. Weak global cues and increasing COVID cases in Europe and China hit market sentiment.

The BSE Sensex plunged more than 700 points to 55,777, while the Nifty50 corrected over 200 points to 16,663 and formed a bearish candle on the daily charts, while the Nifty Midcap 100 index was down 0.9 percent and Smallcap 100 index declined 1.4 percent.

"Technically, this pattern formed on the Nifty50 indicates a formation of Bearish Dark Cloud Cover type formation at highs. Normally, the formation of such dark cloud cover patterns after a reasonable upmove or at the hurdle more often results in a reversal pattern post-confirmation. Hence, one may expect further weakness in the coming session," says Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He further says, "The sharp downward reversal of Tuesday from near the crucial resistance zone of 16,800-17,000 indicate chances of a further downward correction in the market for the short term."

The overall chart pattern signals chances of higher bottom formation around 16,400-16,250 levels in the next few sessions, before showing another round of upmove, he adds.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 16,503, followed by 16,342. If the index moves up, the key resistance levels to watch out for are 16,875 and 17,088.

Banking stocks also saw correction as the Nifty Bank fell 289.50 points to 35,023. The important pivot level, which will act as crucial support for the index, is placed at 34,604, followed by 34,186. On the upside, key resistance levels are placed at 35,542 and 36,062 levels.

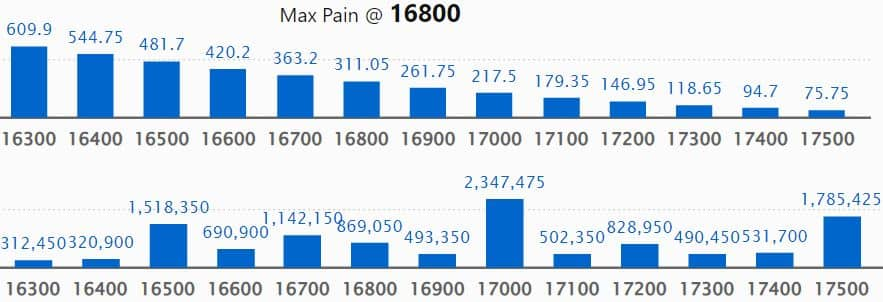

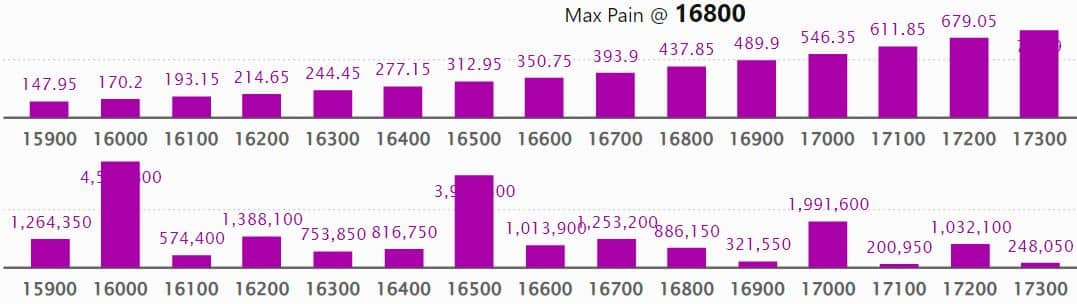

Maximum Call open interest of 24.24 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the March series.

This is followed by 17,000 strike, which holds 23.47 lakh contracts, and 17,500 strike, which has accumulated 17.85 lakh contracts.

Call writing was seen at 17,000 strike, which added 4.23 lakh contracts, followed by 16,800 strike which added 1.19 lakh contracts, and 16,700 strike which added 1.07 lakh contracts.

Call unwinding was seen at 17,100 strike, which shed 1.79 lakh contracts, followed by 17,600 strike which shed 47,500 contracts and 16,000 strike which shed 27,550 contracts.

Maximum Put open interest of 45.26 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the March series.

This is followed by 16,500 strike, which holds 39.28 lakh contracts, and 15,500 strike, which has accumulated 29.13 lakh contracts.

Put writing was seen at 15,700 strike, which added 1.27 lakh contracts, followed by 16,300 strike, which added 74,400 contracts, and 16,900 strike which added 68,550 contracts.

Put unwinding was seen at 16,000 strike, which shed 1.21 lakh contracts, followed by 15,800 strike which shed 67,500 contracts, and 15,500 strike which shed 61,050 contracts.

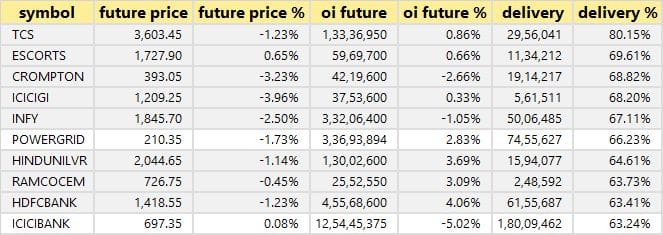

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in TCS, Escorts, Crompton Greaves Consumer Electricals, ICICI Lombard General Insurance Company, and Infosys among others on Tuesday.

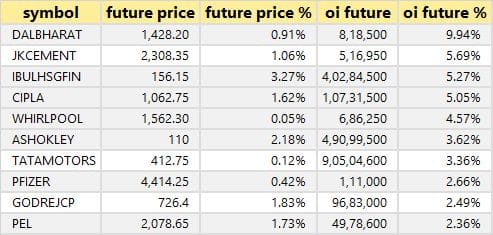

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen including Dalmia Bharat, JK Cement, Indiabulls Housing Finance, Cipla, and Whirlpool of India.

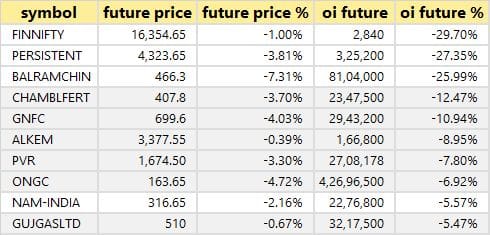

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen including Nifty Financial, Persistent Systems, Balrampur Chini Mills, Chambal Fertilizers, and GNFC.

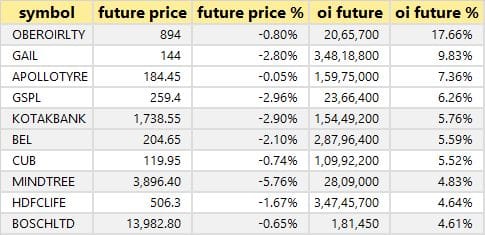

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen including Oberoi Realty, GAIL India, Apollo Tyres, GSPL, and Kotak Mahindra Bank.

36 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen including Coromandel International, AU Small Finance Bank, Shree Cements, Voltas, and ICICI Bank.

(For more bulk deals, click here)

Analysts/Investors Meetings on March 16

UltraTech Cement: The company's officials will meet Millennium Capital.

Birlasoft: The company's officials will attend AMSEC Investor Conference.

Heranba Industries: The company's officials will meet Equirus Securities, Svan Investments Managers LLP, Ashmore Group, Birla Sunlife Insurance, & IDFC AMC.

Krishna Institute of Medical Sciences: The company's officials will attend Jefferies' investor conference.

Puravankara: The company's officials will meet Jefferies India, Edelweiss Financial Services, and Antique Stock Broking.

Crompton Greaves Consumer Electricals: The company's officials will meet Amansa Capital, and Aberdeen Standard Investments.

India Pesticides: The company's officials will meet Dalal & Broacha.

Orient Electric: The company's officials will meet ICICI Securities.

RITES: The company's officials will meet L&T Mutual Funds, Abacus, DSP Mutual Funds, and HDFC Mutual Funds.

Trent: The company's officials will meet Jefferies India.

Stocks in News

One 97 Communications (Paytm): Munish Ravinder Varma resigned as non-executive, non-independent director of the company due to personal commitments and other pre-occupations.

Infibeam Avenues: The board has approved the appointment of Sunil Bhagat as Chief Financial Officer of the company, in place of Hiren Padhya.

Zomato: The food delivery giant acquired a 16.66 percent stake in Mukunda Foods Private Limited, a food robotics company, for cash consideration of $5 million. The board also approved a loan of up to $150 million to Grofers India in one or more tranches. The loan to Grofers is in line with its stated intent of investing up to $400 million cash in quick commerce in India over the next 2 years.

EKI Energy Services: The firm is in advanced discussions with some of the European oil and gas majors, to launch an initiative to supply free improved cook stoves to rural households to reduce carbon footprint and generate carbon offsets.

Shyam Metalics and Energy: The company announced a fresh round of Rs 990 crore capital expenditure plans to further expand the capacity by 2.85 MTPA. This capital expenditure will be over and above the ongoing capital expenditure expansion of Rs 3,000 crore.

Genus Paper & Boards: The company has successfully commenced production of duplex paper from one of the production lines at a new unit in Muzaffarnagar, Uttar Pradesh. The Muzaffarnagar unit has manufacturing facilities for the production of kraft paper and duplex paper.

ITC: The company has acquired 1,040 compulsorily convertible preference shares of Rs 10 each of Mother Sparsh Baby Care. With this, its shareholding in Mother Sparsh stands at 16 percent.

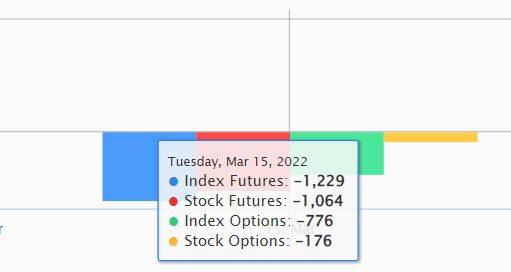

Fund Flow

Foreign institutional investors (FIIs) continue selling in India as they have net offloaded shares worth Rs 1,249.74 crore on March 15. However, domestic institutional investors (DIIs) have bought shares worth Rs 98.25 crore on the same day, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - Balrampur Chini Mills - is under the F&O ban for March 16. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Trade setup for Wednesday: Top 15 things to know before Opening Bell - Moneycontrol

Read More

No comments:

Post a Comment