Bulls continued to dominate Dalal Street for the fifth consecutive session, helping the benchmark indices register around one-and-half-percent gains on March 14, as falling oil prices and reduced FII selling pressure lifted market sentiment. It was a strong start to the truncated week.

The buying in banking and financials, auto and technology stocks aided the rally. The BSE Sensex climbed 936 points or 1.68 percent to 56,486, while the Nifty50 jumped 241 points or 1.45 percent to 16,871 and formed a bullish candle on the daily charts.

"Technically, this indicates a strength of an upside momentum in the market," says Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

Shetti believes that the short term trend of the Nifty continues to be positive. "The market is now showing early signs of a decisive upside breakout of cluster resistance of around 16,800-17,000 levels. A strong upside breakout could bring upper levels of 17,500 in a quick period of time," he observed.

However, he says any failure to sustain above 16,800 levels in the next 1-2 sessions could trigger another round of downward correction from the highs. Immediate support is placed at 16,750 levels.

There was underperformance in the broader space as the Nifty Midcap 100 and Smallcap 100 indices gained 0.2 percent each.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 16,689, followed by 16,507. If the index moves up, the key resistance levels to watch out for are 16,971 and 17,070.

Banking stocks showed strong strength, helping the Nifty Bank outperform benchmark indices as well as broader space. The index jumped 766 points or 2.2 percent to 35,312.

The important pivot level, which will act as crucial support for the index, is placed at 34,813, followed by 34,314. On the upside, key resistance levels are placed at 35,623 and 35,934 levels.

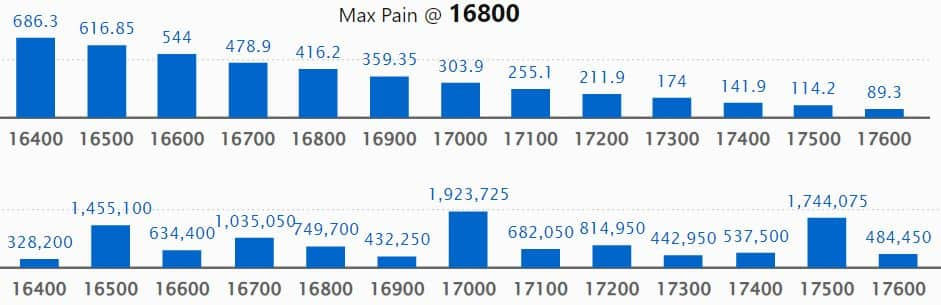

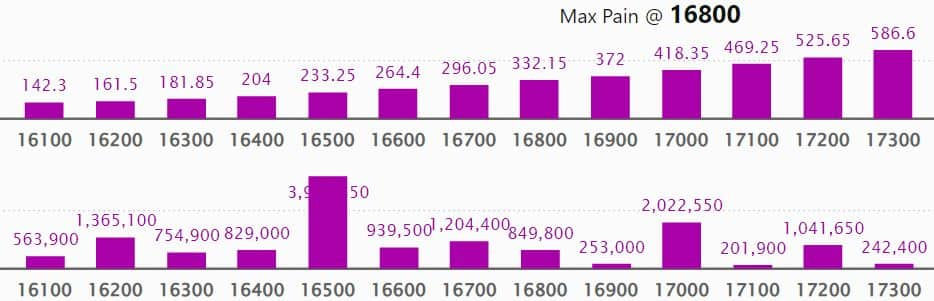

Maximum Call open interest of 23.27 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the March series.

This is followed by 17,000 strike, which holds 19.23 lakh contracts, and 17,500 strike, which has accumulated 17.44 lakh contracts.

Call writing was seen at 17,100 strike, which added 2.97 lakh contracts, followed by 17,500 strike which added 1.29 lakh contracts, and 17,700 strike which added 85,400 contracts.

Call unwinding was seen at 16,800 strike, which shed 1.7 lakh contracts, followed by 16,500 strike which shed 1.23 lakh contracts and 16,700 strike which shed 1.18 lakh contracts.

Maximum Put open interest of 46.48 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the March series.

This is followed by 16,500 strike, which holds 39.51 lakh contracts, and 15,500 strike, which has accumulated 29.74 lakh contracts.

Put writing was seen at 16,000 strike, which added 4.51 lakh contracts, followed by 16,700 strike, which added 3.41 lakh contracts, and 16,800 strike which added 1.64 lakh contracts.

Put unwinding was seen at 15,500 strike, which shed 1.6 lakh contracts, followed by 18,000 strike which shed 22,500 contracts, and 16,100 strike which shed 13,800 contracts.

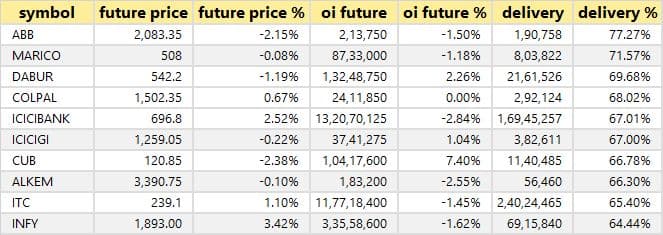

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in ABB India, Marico, Dabur India, Colgate Palmolive, and ICICI Bank among others on Monday.

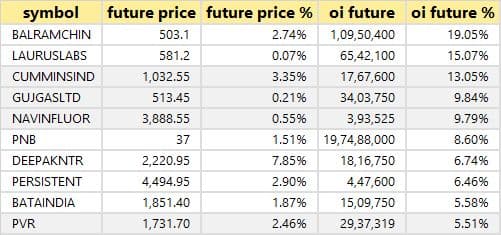

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen including Balrampur Chini Mills, Laurus Labs, Cummins India, Gujarat Gas, and Navin Fluorine International.

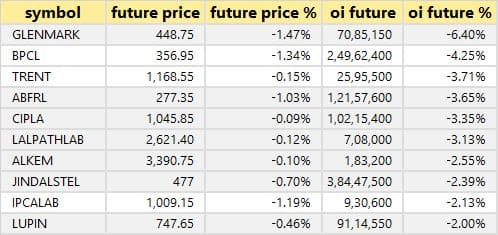

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen including Glenmark Pharma, BPCL, Trent, Aditya Birla Fashion, and Cipla.

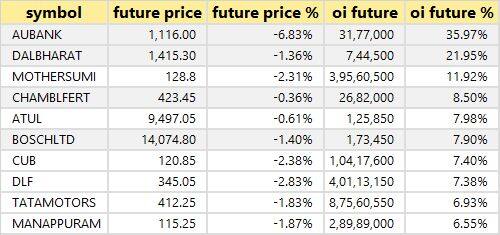

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen including AU Small Finance Bank, Dalmia Bharat, Motherson Sumi Systems, Chambal Fertilizers, and Atul.

55 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen including Nifty Financial, Mahanagar Gas, GNFC, Indraprastha Gas, and Escorts.

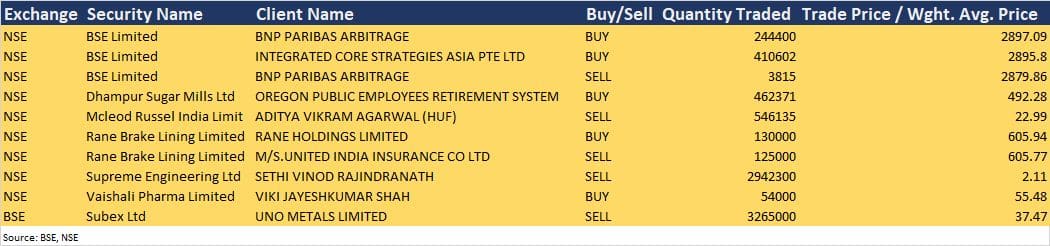

BSE: BNP Paribas Arbitrage have net bought 2,40,585 equity shares in the exchange via open market transactions at an average price of Rs 2,897.09 per share, and Integrated Core Strategies Asia Pte Ltd acquired 4,10,602 equity shares at an average price of Rs 2,895.8 crore per share.

Dhampur Sugar Mills: Oregon Public Employees Retirement System purchased 4,62,371 equity shares in the sugar company via open market transactions. These shares were bought at an average price of Rs 492.28 per share.

Rane Brake Lining: Promoter Rane Holdings bought 1.3 lakh shares in the company via open market transactions at an average price of Rs 605.94 per share; however, United India Insurance Company offloaded 1.25 lakh shares of the company at an average price of Rs 605.77 per share.

(For more bulk deals, click here)

Analysts/Investors Meetings on March 15

Tata Consumer Products: The company's officials will meet Wellington Management, Singapore.

Sheela Foam: The company's officials will attend Valorem Advisors' Investors Conference.

Heranba Industries: The company's officials will meet Prudent Value Partners, Quantum Advisors, TCG Advisory Services, Rockstud Capital LLP, AV Fincorp, Moneybee Investment Advisors, Kitara Capital, Arihant Capital Markets, Omkara Capital, Oculus Capital Advisors LLP, Lucky Investment Managers, Vasuki India Fund, and JPM Capital

Jubilant Pharmova: The company's officials will meet Theleme Partners.

Krsnaa Diagnostics: The company's officials will attend the second Jefferies India Mid-Cap Summit.

Manappuram Finance: The company's officials will attend Jefferies Conference.

Metropolis Healthcare: The company's officials will attend Jefferies Conference.

Vijaya Diagnostic Centre: The company's officials will meet UTI Asset Management.

UltraTech Cement: The company's officials will meet DSP Mutual Fund.

Hindalco Industries: The company's officials will meet DSP Investments.

Sapphire Foods India: The company's officials will meet Cooper Investors and will participate in JP Morgan - India QSR Day – Hungry for More.

Jubilant Ingrevia: The company's officials will attend the second Jefferies India Mid-Cap Summit.

Stocks in News

Anupam Rasayan India: The firm said Afzal Malkani has resigned from the post of Chief Financial Officer of the company due to personal reasons. The company has appointed Amit Khurana as the Chief Financial Officer, with effect from March 15.

Reliance Industries: Subsidiary Reliance New Energy has acquired assets of Lithium Werks BV. The company acquired Lithium's assets for $61 million including funding for future growth. The assets include the entire patent portfolio of Lithium Werks, manufacturing facility in China, key business contracts and hiring of existing employees as a going concern.

Avantel: The company has received a supply order of loco devices for implementation of RTIS phase - 2 (Real Time Train Information system). The order is valued at Rs 125.68 crore.

RITES: The company has declared a third interim dividend of Rs 7.50 per share. The record date has been fixed as March 25 for the payment of dividend.

Marsons: The board has approved the purchase of advanced thermoelectric technology to generate cheap sustainable power from waste heat and to reduce global CO2 emissions). The technology will be acquired from US-based company Micro Power Global Limited in lieu of equity shares to be allotted on a preferential basis. The board has also approved the plans for venturing into EPC for setting up electric vehicle charging stations.

Wipro: The IT services company has bagged a contract from Speira which has operations in Germany and Norway. Over the next five years, Wipro will work to strengthen the technology infrastructure and cybersecurity requirements of Speira.

Fund Flow

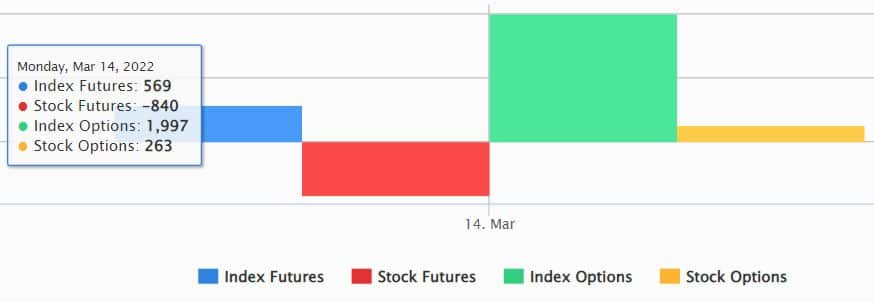

Foreign institutional investors (FIIs) continue selling in India as they have net sold shares worth Rs 176.52 crore on March 14, the lowest offloading in a single day in the last one month. However, domestic institutional investors (DIIs) have bought shares worth Rs 1,098.62 crore on the same day, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - Balrampur Chini Mills - is under the F&O ban for March 15. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Trade setup for Tuesday: Top 15 things to know before Opening Bell - Moneycontrol

Read More

No comments:

Post a Comment