The market curtailed some losses in late trade amid oil prices hitting a fresh eight-year high after the war between Ukraine and Russia intensified further. Finally the benchmark indices ended with more than a percent loss on March 2, weighed by banking and financials, auto, pharma, and select IT stocks.

The BSE Sensex fell 778 points to 55,469, while the Nifty50 plunged 188 points to 16,606 and formed a Doji kind of pattern on the daily charts as the index recovered losses and closed near opening losses.

"Normally, a formation of such candles after a reasonable upmove or down move could signal impending trend reversals. Having formed this candle within a high low range, the predictive value of this candle pattern could be less. Hence, this could be a part of narrow range movement at the hurdle of 16,800 levels," says Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

According to Shetti, the formation of lower tops is intact on the daily chart and Monday's high of 16,815 could now be considered as a new lower top of the sequence. "The crucial overhead resistance around 16,800-17,000 levels is intact as per the concept of change in polarity and this area is going to be a make or break for the market ahead. A sustainable buying could emerge only above the 17,000 mark."

However, a decisive move below the immediate support of 16,480 could open further weakness towards 16,200 levels in the short term.

There was a mixed trend in broader space as the Nifty Midcap 100 index fell 0.02 percent and the Nifty Smallcap 100 index gained half a percent.

The volatility continued to be elevated with the India VIX rising 2.3 percent to 29.2 percent, indicating continuity of volatile swings in coming sessions until it gets stabilised below the 20 mark.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 16,497, followed by 16,388. If the index moves up, the key resistance levels to watch out for are 16,697 and 16,787.

Banking stocks were the main culprits for Wednesday's correction as the Nifty Bank declined 832 points or 2.3 percent to 35,373. The important pivot level, which will act as crucial support for the index, is placed at 34,996, followed by 34,618. On the upside, key resistance levels are placed at 35,652 and 35,931 levels.

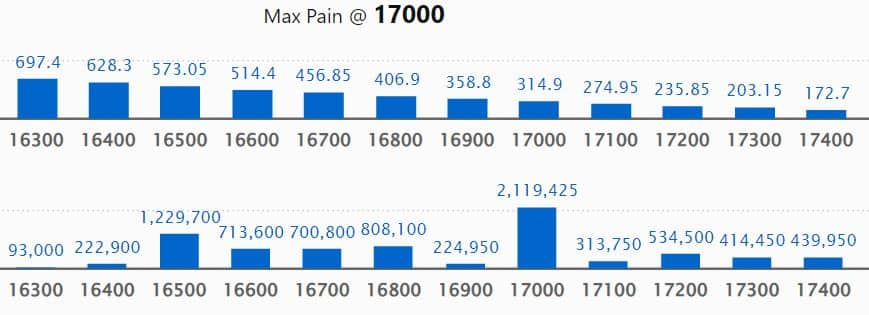

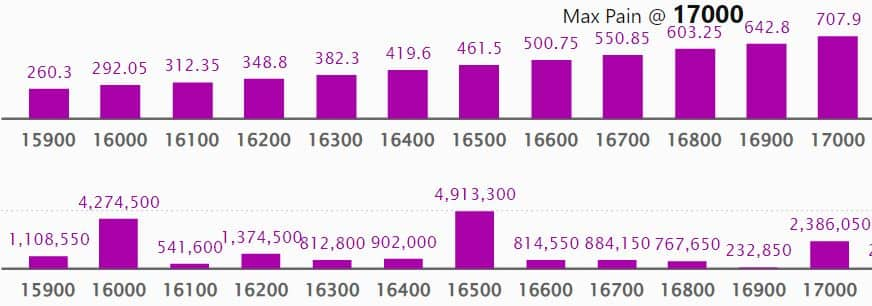

Maximum Call open interest of 22.9 lakh contracts was seen at 18000 strike, which will act as a crucial resistance level in the March series.

This is followed by 17000 strike, which holds 21.19 lakh contracts, and 17500 strike, which has accumulated 20.04 lakh contracts.

Call writing was seen at 16800 strike, which added 4.07 lakh contracts, followed by 16500 strike which added 3.91 lakh contracts, and 16600 strike which added 2.82 lakh contracts.

Call unwinding was seen at 17300 strike, which shed 25,850 contracts, followed by 17600 strike which shed 9,700 contracts, and 17400 strike which shed 7,250 contracts.

Maximum Put open interest of 49.13 lakh contracts was seen at 16500 strike, which will act as a crucial support level in the March series.

This is followed by 16000 strike, which holds 42.74 lakh contracts, and 15500 strike, which has accumulated 35.45 lakh contracts.

Put writing was seen at 16600 strike, which added 1.4 lakh contracts, followed by 16000 strike, which added 82,800 contracts, and 15500 strike which added 73,200 contracts.

Put unwinding was seen at 15700 strike, which shed 53,900 contracts, followed by 17000 strike which shed 24,150 contracts, and 16300 strike which shed 23,950 contracts.

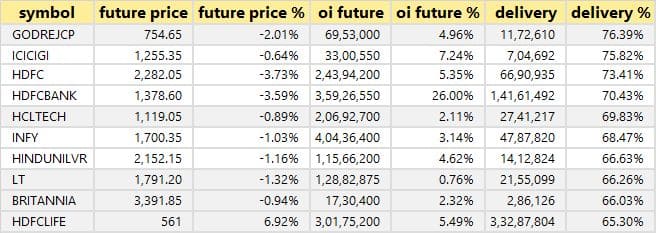

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Godrej Consumer Products, ICICI Lombard, HDFC, HDFC Bank, and HCL Technologies on March 2.

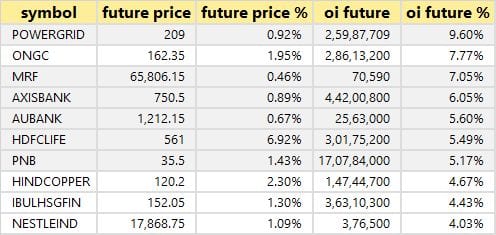

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen including Power Grid Corporation, ONGC, MRF, Axis Bank, and AU Small Finance Bank.

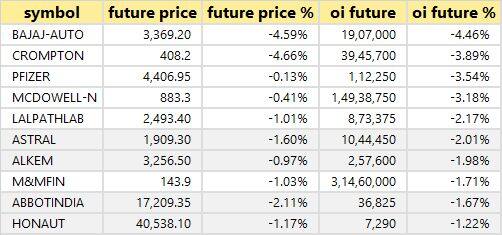

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen. Bajaj Auto, Crompton, Pfizer, United Spirits, and Dr Lal PathLabs witnessed the highest long unwinding on March 2.

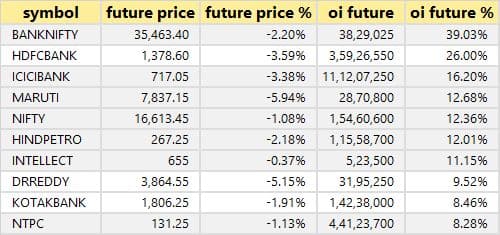

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the 10 stocks in which a short build-up was seen including Bank Nifty, HDFC Bank, ICICI Bank, Maruti Suzuki, and Nifty.

37 stocks witnessed short-covering

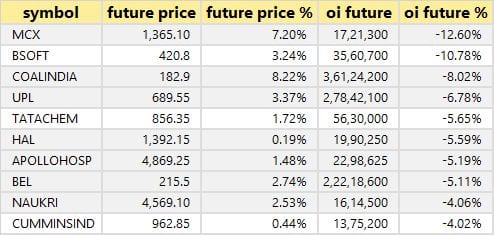

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen. MCX India, Birlasoft, Coal India, UPL and Tata Chemicals witnessed higher short-covering among 37 stocks on March 2.

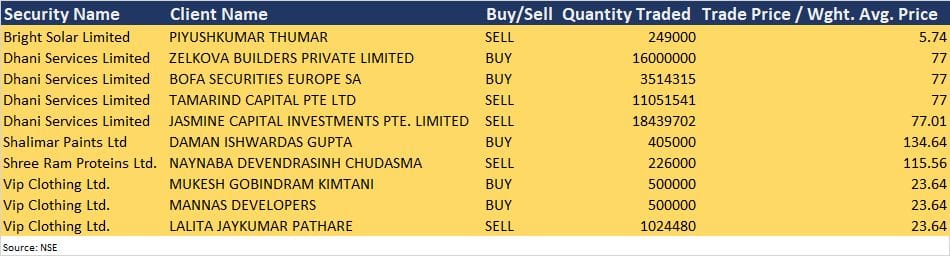

Dhani Services: Promoter Zelkova Builders acquired 1.6 crore equity shares and investor BofA Securities Europe SA bought 35,14,315 equity shares in the company via open market transactions on the NSE. These shares were bought at an average price of Rs 77 per share. However, investor Tamarind Capital Pte Ltd sold 1,10,51,541 equity shares at the same average price, and another investor Jasmine Capital Investments Pte Limited offloaded 1,84,39,702 shares at an average price of Rs 77.01 per share. As of December 2021, Tamarind held 10.08 percent shareholding in the company and Jasmine Capital had 5.39 percent stake.

(For more bulk deals, click here)

Analysts/Investors Meetings

Hindalco Industries: The company's officials will meet UBS Global Asset Management, Singapore on March 3.

Eicher Motors: The company's officials will meet Alchemy Capital Management on March 3; and East Bridge Advisors on March 4.

IIFL Finance: The company's officials will meet Omkara Capital on March 3.

CARE Ratings: The company's officials will meet Briarwood Capital on March 3.

Kirloskar Pneumatic Company: The company's officials will meet Habrok Asset Management and Ventura Securities on March 3.

SJS Enterprises: The company's officials will meet Birla Sun life Mutual Fund, IIFL Asset Management, Max Life insurance, Famy Group, Birla Sun Life Insurance, and BOI Axa Mutual Fund on March 3.

Cummins India: The company's officials will meet Birla Sunlife AMC on March 3; and Bank of America on March 14.

Computer Age Management Services: The company's officials will meet Wellington Management on March 4; Arun Swaminathan of Capital World on March 8; and Westwood Global Investments on March 24. They will attend IIFL Caravan conference on March 10-11; 2nd Jefferies India Mid-Cap Summit on March 16; and Equirus Connect on March 22.

Allcargo Logistics: The company's officials will meet Capital World Group on March 4.

Gujarat Mineral Development Corporation: The company's officials will meet Invexa Capital, Sunidhi Securities One-Up Financial Consultants, Capri Global Advisory Services, Valium Capital, and Edelweiss Financial Services on March 4.

Trent: The company's officials will meet UBS Global Asset Management, Singapore on March 4.

Crompton Greaves Consumer Electricals: The company's officials will meet DSP Mutual Fund, HDFC Mutual Fund, and IIFL AMC on March 4.

UTI AMC: The company's officials will meet Victory Capital Management on March 3; and Dymon Asia on March 24. They will attend Elara Capital Conference on March 7.

Sun Pharmaceutical Industries: The company's officials will participate in Goldman Sachs India Pharma & Healthcare Tour 2022 on March 8.

Stocks in News

Vedanta: The board has approved a third interim dividend of Rs 13 per equity share for the financial year 2021-22. The total outflow for dividends will amount to Rs 4,832 crore. The record date for payment of dividends is fixed as March 10.

Swan Energy: The firm said the board on March 5 will consider fundraising of up to Rs 2,000 crore.

Tantia Constructions: The company has bagged a Rs 42.2 crore contract from South Eastern Railway for the construction of a major bridge between Basta and Rupsa.

Hind Rectifiers: The electrical equipment manufacturer has received orders worth Rs 57.32 crore in February 2022.

Valiant Communications: Investor Duane Park acquired 1.21 percent equity shares in the company via open market transactions. With this, its shareholding in the company stands at 10.35 percent now, against 9.14 percent earlier.

ABB India: The company completed the sale of its turbocharger business to Turbocharging Industries and Services India, as a going concern, on a slump sale basis to its wholly owned subsidiary for Rs 310 crore. In January this year, it had incorporated a wholly owned subsidiary - Turbocharging Industries and Services India.

Mukand: The stainless steel company has sold its land in Thane for Rs 806.14 crore. It has executed an agreement for the sale of said land of 47 acres.

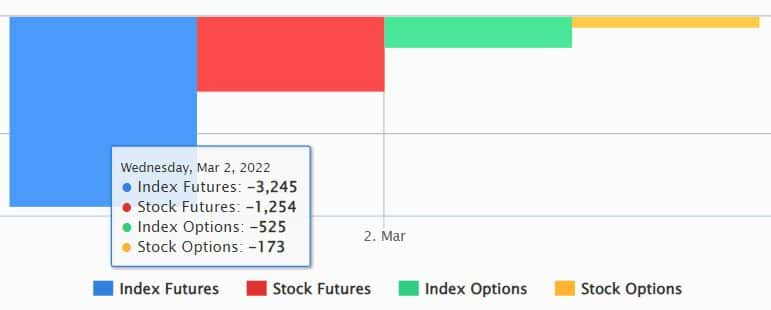

Fund Flow

The selling by foreign institutional investors (FIIs) seems unstoppable given the rising geopolitical tensions between Ukraine and Russia, as they have net sold shares worth Rs 4,338.94 crore. However, domestic institutional investors (DIIs) have tried to compensate the FII outflow by purchasing shares worth Rs 3,061.70 crore on March 2, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

As we are at the beginning of the March series, we don't have any stock that is under the F&O ban for March 3. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Trade setup for Thursday: Top 15 things to know before Opening Bell - Moneycontrol

Read More

No comments:

Post a Comment