It was yet another consolidation day for the market on March 25 with the Nifty50 closing lower but strongly held its crucial support 17,000 mark as well as 200-day moving average (17,036) for sixth consecutive session, indicating the positive bias likely to remain.

IT, FMCG, pharma, and select banking & financials and auto stocks weighed down the market, whereas the buying in Reliance Industries capped downside.

The BSE Sensex fell 233 points to 57,362, while the Nifty50 shed 70 points to 17,153 and formed bearish candle on the daily as well as weekly charts. It corrected 0.8 percent for the week after 6.4 percent rally in previous two straight weeks.

"The Nifty50 appears to be in a consolidation mode, after two consecutive strong closes on weekly charts, as the trading range for the current week remained only 435 points," said Mazhar Mohammad, Founder & Chief Market Strategist at Chartviewindia.

As long as the Nifty doesn't go below the psychological support of 17,000, which coincides with the 200-day moving average, the probability of the resumption of upswing remains high, though it will be confirmed on a close above 17,450 levels.

For the time, for long positions, a close below 17,000 can be the better stop-loss, Mohammad said.

The broader markets also saw moderate correction with the Nifty Midcap 100 and Smallcap 100 indices declining 0.12 percent and 0.5 percent respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,055, followed by 16,957. If the index moves up, the key resistance levels to watch out for are 17,273 and 17,393.

The Bank Nifty declined 117 points to close at 35,410 on March 25. The important pivot level, which will act as crucial support for the index, is placed at 35,170, followed by 34,930. On the upside, key resistance levels are placed at 35,684 and 35,957 levels.

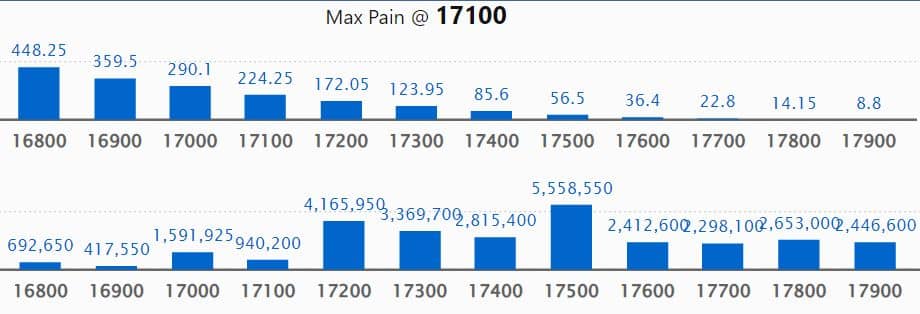

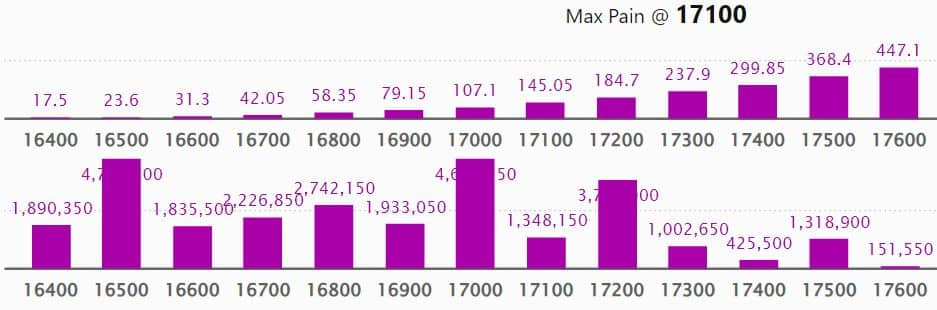

Maximum Call open interest of 79.39 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the March series.

This is followed by 17,500 strike, which holds 55.58 lakh contracts, and 18,100 strike, which has accumulated 50.19 lakh contracts.

Call writing was seen at 18,100 strike, which added 34.02 lakh contracts, followed by 18,000 strike which added 23.10 lakh contracts, and 17,500 strike which added 13.58 lakh contracts.

Call unwinding was seen at 18,300 strike, which shed 12.09 lakh contracts, followed by 18,400 strike which shed 2.59 lakh contracts and 16,000 strike which shed 16,700 contracts.

Maximum Put open interest of 72.83 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the March series.

This is followed by 16,500 strike, which holds 47 lakh contracts, and 17,000 strike, which has accumulated 46.77 lakh contracts.

Put writing was seen at 16,000 strike, which added 17.84 lakh contracts, followed by 17,000 strike, which added 8.93 lakh contracts, and 16,500 strike which added 6.06 lakh contracts.

Put unwinding was seen at 17,300 strike, which shed 3.79 lakh contracts, followed by 17,500 strike which shed 74,350 contracts, and 16,600 strike which shed 53,400 contracts.

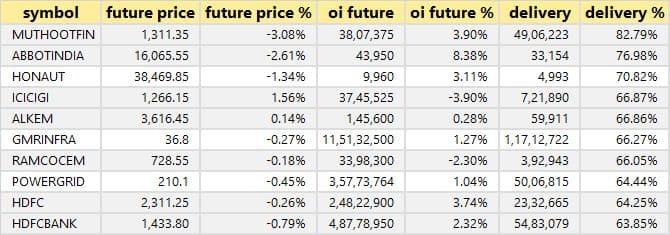

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Muthoot Finance, Abbott India, Honeywell Automation, ICICI Lombard General Insurance Company, and Alkem Laboratories among others on Friday.

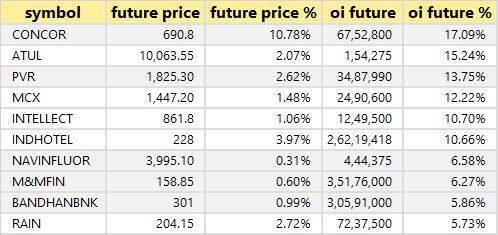

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen including Container Corporation of India, Atul, PVR, MCX India, and Intellect Design Arena.

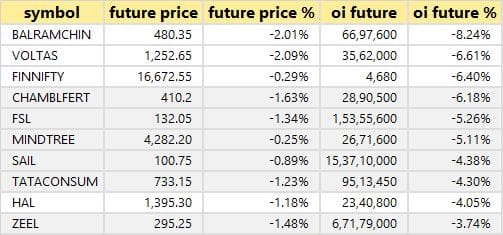

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen including Balrampur Chini Mills, Voltas, Nifty Financial, Chambal Fertilizers, and Firstsource Solutions.

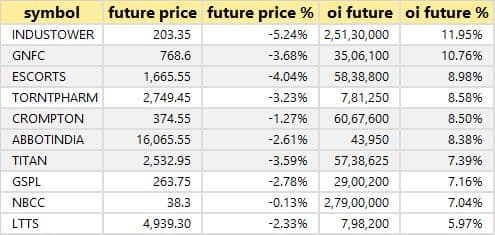

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen including Indus Towers, GNFC, Escorts, Torrent Pharma, and Crompton Greaves Consumer Electricals.

27 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen including L&T Finance Holdings, Delta Corp, Biocon, Dr Reddy's Laboratories, and Havells India.

BSE: Poonawalla Constructions LLP sold 2,30,820 equity shares in the company via open market transactions. These shares were sold at an average price of Rs 891.88 per equity share.

Butterfly Gandhimathi Appliances: Crompton Greaves Consumer Electricals acquired 98,33,754 equity shares in the company via open market transactions at an average price of Rs 1,403 per share. However, promoters LLM Appliances, Seshadri V M, Viswanatha Murugesa Balasubramaniam, Viswanatha Murugesan Gangadharam, V M Chettiar & Sons India LLP, Viswanathan Murugesa Kumaresan, and Viwanathan Murugesachettiar Lakshminarayanan were the sellers in this block deals.

Vijaya Diagnostic Centre: Fidelity Investment Trust Fidelity Series Emerging Markets Fund bought 18,50,800 equity shares in the company via open market transactions at an average price of Rs 445 per share. However, India-focussed private equity firm Kedaara-owned Karakoram offloaded 25,32,270 equity shares at same price.

Lemon Tree Hotels: JPMorgan Indian Investment Trust Plc bought 42,71,589 equity shares in the company via open market transactions at an average price of Rs 60 per share, however, promoter Spank Management Service sold 1 crore equity shares at same price.

MTAR Technologies: Aditya Birla Sun Life Mutual Fund bought 1,76,400 equity shares in the company, UTI Mutual Fund acquired 2.2 lakh shares, Abu Dhabi Investment Authority Way purchased 1.56 lakh shares, and Segantii India Mauritius acquired 2.11 lakh shares via open market transactions at an average price of Rs 1,795 per share. BNP Paribas Arbitrage bought 2.77 lakh shares at an average price of Rs 1,797.13 per share. However, Solidus Advisors LLP sold 4,89,530 equity shares in the company at an average price of Rs 1,796.41 per share, and Fabmohur Advisors LLP offloaded 19,42,382 shares at Rs 1,793.44 per share.

(For more bulk deals, click here)

Analysts/Investors Meetings on March 28

Nirlon: The company's officials will attend Valorem Advisors investors conference.

Crompton Greaves Consumer Electricals: The company's officials will meet Wellington Management and HDFC Life Insurance Company.

Mahindra Lifespace Developers: The company's officials will attend Investec Real Estate Day.

Oriental Aromatics: The company's officials will attend Axis Capital India Chemicals Conference 2022.

Globus Spirits: The company's officials will meet GIC Private Limited.

IIFL Finance: The company's officials will meet Mirae AMC.

Stocks in News

GAIL (India): The state-owned natural gas distribution company on March 31 will consider the proposal of buy back of the fully paid-up equity shares.

Fino Payments Bank: The Reserve Bank of India has granted approval for referring customers of Fino Payments Bank to Finwizard Technology (FISDOM) for mutual fund distribution, and 5paisa Capital for demat & trading services under referral arrangement.

Adani Enterprises: Subsidiaries Mahanadi Mines and Minerals Private Limited, and MP Natural Resources Private Limited are declared as successful bidders for coal blocks - Bijahan and Gondbahera Ujheni East coal block in Odisha and Madhya Pradesh respectively, by Government of India. The revenue sharing with government will be 14 percent for Bijahan coal block and 5 percent for Gondbahera Ujheni East coal block.

Bharti Airtel: The telecom operator will acquire around 4.7 percent stake in Indus Towers from Euro Pacific Securities, an affiliate of Vodafone Group Plc, at a price of Rs 187.88 per share. The total transaction cost stands at Rs 2,388.06 crore.

G R Infraprojects: The company has emerged as L-1 bidder for road project comprising upgradation to four lane with paved shoulder of NH-341 from Bhimasar to Anjar - Bhuj in Gujarat on Hybrid Annuity Mode. The bid cost of the project is Rs 1,085 crore and the said project is going to be completed within 730 days from appointed date.

Emami: The company has acquired "Dermicool", one of the leading brands in prickly heat powder and cool talc category, from Reckitt Benckiser Healthcare (India). The acquisition cost stood at Rs 432 crore which is funded through internal accruals.

Sagar Cements: The board has approved the issuance of 1,32,07,548 equity shares to PI Opportunities Fund, an affiliate of Premji Invest, an investment arm of Azim Premji's endowment and philanthropic initiatives, at an issue price of Rs 265 per share. This transaction will fetch the company Rs 350 crore which will be largely utilised towards meeting the organic and inorganic expansion plans of the company along with funding its general corporate purposes.

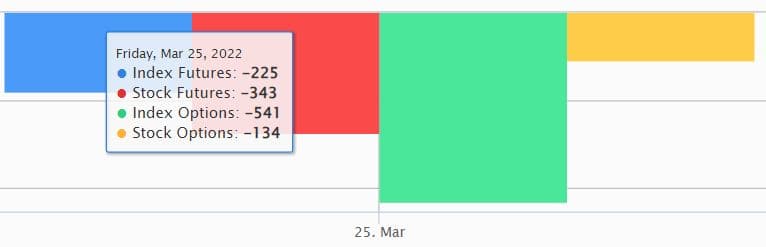

Fund Flow

Foreign institutional investors (FIIs) have net sold shares worth Rs 1,507.37 crore, while domestic institutional investors (DIIs) have net bought shares worth Rs 1,373.02 crore on March 25, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Five stocks - Indiabulls Housing Finance, Vodafone Idea, L&T Finance Holdings, SAIL, and Sun TV Network - are under the F&O ban for March 28. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.?

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Trade setup for Monday: Top 15 things to know before Opening Bell - Moneycontrol

Read More

No comments:

Post a Comment