The market saw consolidation on March 11 but managed to close higher for the fourth consecutive session with modest gains, as traders monitored the Ukraine-Russia war that is expected to worsen as the Russian forces close in on Kyiv.

The Sensex rose 86 points to 55,550. The Nifty was up 36 points to 16,630 to form a bullish candle on the daily charts. The index had a good week in which it gained 2.4 percent and formed a strong Bullish Engulfing pattern on the weekly scale.

In the last two trading sessions, the Nifty tested the 200-day exponential moving average (16,693) before getting into the consolidation phase, said Mazhar Mohammad, Founder & Chief Market Strategist at Chartviewindia.

“Hence, going forward it remains critical for this counter to sustain above the bullish gap zone present between 16,447 – 16,418 levels,” he said.

If the index sustains above the gap zone, the bulls will make another more attempt to get past critical hurdles in the 16,700 – 16,800 zone.

"Once the Nifty manages to close above 16,800 then a breakout on the upsides will be confirmed, which may hint at a bottom in place at recent lows of 15,671," he said.

In that scenario, a sustainable rally can be expected with an initial target of 17,025, Mohammad said.

If the index closes below 16,400, then profit booking can sharpen. Therefore, if some positional trader is long, they should place a stop-loss below 16,400.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given are the aggregates of three-month data and not of the current month only.

Key support and resistance levels for Nifty

As per the pivot charts, the key support level for the Nifty is at 16,503, followed by 16,375. If the index moves up, the key resistance levels to watch out for are 16,726 and 16,822.

The Nifty Bank also traded in line with benchmarks as the index was up 70.65 points at 34,546 on March 11. The important pivot level, which will act as crucial support for the index, is placed at 34,134, followed by 33,721. On the upside, key resistance levels are placed at 34,919 and 35,293.

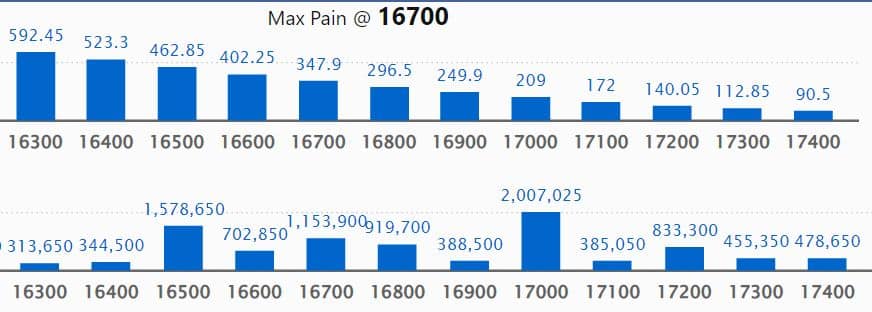

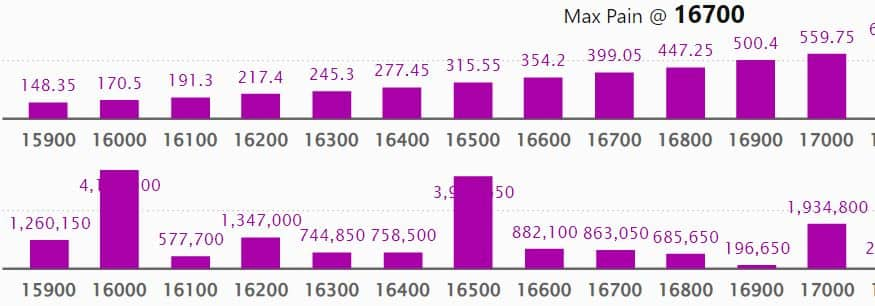

Maximum Call open interest of 22.46 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the March series.

This is followed by 17,000 strike, which holds 20.07 lakh contracts, and 17,500 strike, which has accumulated 16.14 lakh contracts.

Call writing was seen at 17,600 strike, which added 1.02 lakh contracts, followed by 18,000 strike, which added 82,450 contracts, and 16,700 strike, which added 70,500 contracts.

Call unwinding was seen at 17,500 strike, which shed 86,950 contracts, followed by 16,000 strike, which shed 35,925 contracts, and 16,300 strike, which shed 34,100 contracts.

Maximum Put open interest of 41.96 lakh contracts is seen at 16,000 strike, which will act as a crucial support in the March series.

This is followed by 16,500 strike, which holds 39.59 lakh contracts, and 15,500 strike, which has accumulated 31.35 lakh contracts.

Put writing seen at 16,000 strike, which added 2.17 lakh contracts, followed by 16,500 strike, which added 1.82 lakh contracts, and 15,800 strike, which added 1.15 lakh contracts.

Put unwinding was seen at 15,500 strike, which shed 1.18 lakh contracts, followed by 17,500 strike, which shed 31,450 contracts, and 16,200 strike, which shed 20,650 contracts.

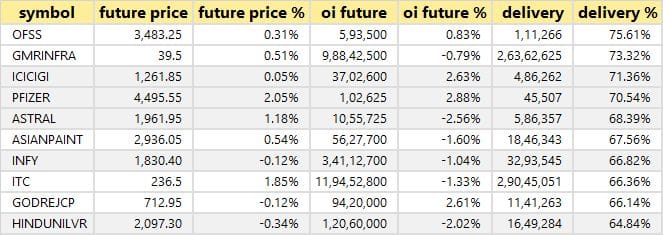

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Oracle Financial Services Software, GMR Infrastructure, ICICI Lombard General Insurance Company, Pfizer, and Astral among others on March 11.

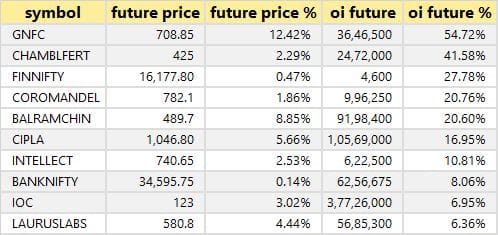

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

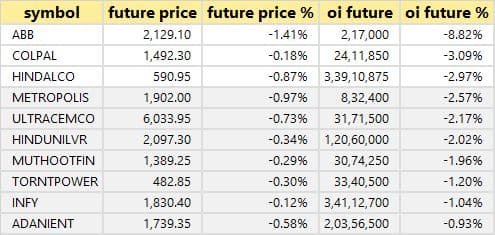

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, ABB India, Colgate Palmolive, Hindalco Industries and UltraTech Cement are among the top 10 stocks in which long unwinding was seen.

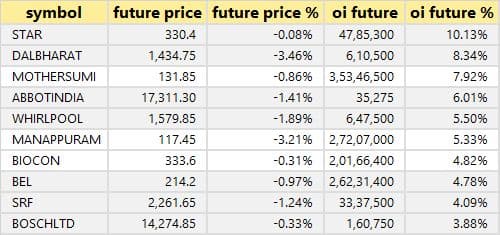

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen:

76 stocks witnessed short-covering

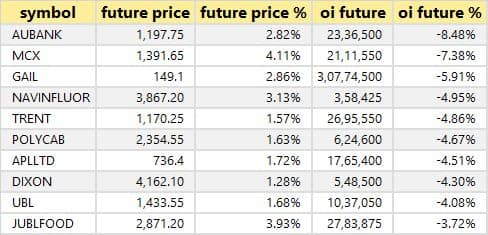

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, AU Small Finance Bank, MCX India, GAIL India and Navin Fluorine International are the top 10 stocks in which short-covering was seen.

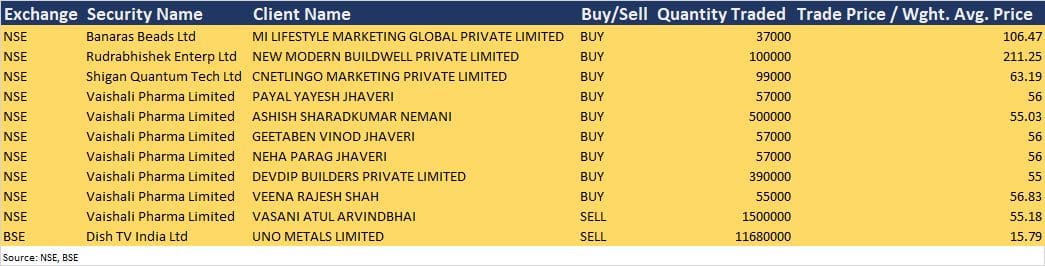

(For more bulk deals, click here)

Analysts, investors Meetings

Tata Motors: The company's officials will meet American Century Global Investment Management Inc, Aperture Investors Llc, Axiom International Investors Llc, Bank Pictet And Cie Asia, and Graticule Asia Macro Advisors LLC on March 14.

Dabur India: The company's officials will attend ICICI Consumption Conversion-Webinar series on March 14.

Carborundum Universal: The company's officials will attend a capital goods virtual conference of Prabhudas Lilladher on March 14.

Gland Pharma: The company's officials will meet Amundi Asset Management, Gemway Assets SAS, Edmond de Rothschild Asset Management, and Jefferies India on March 14.

Kotak Mahindra Bank: The company's officials will attend Nomura Virtual India 'New Economy' Corporate Day 2022 on March 14.

Mahindra & Mahindra: The company's officials will attend Nomura Virtual Investor Conference on March 15.

Mindtree: The company's officials will attend Jefferies India Mid-Cap Summit on March 15.

CRISIL: The company's officials will meet C WorldWide Asset Management, Copenhagen on March 15.

Metro Brands: The company's officials will meet Sparx Asia, I-Wealth Management LLP, and Jefferies India on March 15.

Emami: The company's officials will attend Jefferies second Mid-Cap Summit on March 16.

Kajaria Ceramics: The company's officials will attend the second Jefferies India Mid-Cap Summit on March 15-16.

CEAT: The company's officials will attend Jefferies second India Mid-Cap Summit on March 16 and Motilal Oswal Ideation Conference 2022 on March 23.

Crompton Greaves Consumer Electricals: The company's officials will meet Quantum Mutual Fund, & Unifi Capital on March 14 and attend the second Jefferies India Mid-Cap Summit on March 15.

Stocks in News

Hindalco Industries: ICICI Prudential Mutual Fund through its various schemes sold 11.81 lakh equity shares in the company via open market transactions on March 9. With this, its shareholding in the aluminium major stands at 3.01 percent, down from 3.07 percent earlier.

Dhanvarsha Finvest: The board approved raising Rs 88.65 crore by issuing equity shares and warrants to non-promoters on a preferential basis.

CESC: The firm said transactions for sale and transfer of 100 percent shareholding in Surya Vidyut to Torrent Power have been completed. The company and its six subsidiaries entered into a share-purchase agreement with Torrent Power for the sale of 156 MW power plants operated by Surya Vidyut in Gujarat, Rajasthan and Madhya Pradesh, in September 2021. Surya Vidyut was a wholly-owned subsidiary of CESC.

Gail (India): The board has approved the payment of the second interim dividend of Rs 5 a share for the financial year FY21-22. The record date for eligibility of shareholders for payment of dividend has been fixed as March 22.

Anupam Rasayan India: The company acquired a 24.96 percent stake in the company via off-market transactions on March 11. The stake was acquired by Anupam at Rs 595 a share from sellers. With this, Anupam Rasayan has become a promoter of Tanfac along with Tamil Nadu Industrial Development Corporation (TIDCO). Anupam had entered into a share-purchase agreement with sellers—Birla Group Holdings, Pilani Investment & Industrial Corporation and Askaran Agarwala in February.

Lupin: The pharma major has received approval from the US FDA for the abbreviated new drug application Vigabatrin for oral solution USP. This drug is a generic equivalent of Sabril owned by Lundbeck Pharmaceuticals, LLC. Vigabatrin had estimated annual sales of $275 million in the US as per IQVIA MAT data of December 2021.

Jubilant FoodWorks: Pratik Rashmikant Pota has resigned as the CEO and whole-time director of the company.

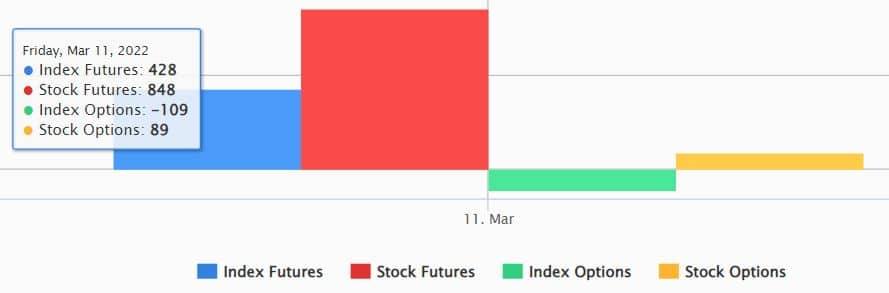

Fund flow

Foreign institutional investors (FIIs) continue selling in India. They net sold shares worth Rs 2,263.90 crore on March 11, while domestic institutional investors (DIIs) bought equities worth Rs 1,686.85 crore, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

NSE has not put any stock under the F&O ban for March 14. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Trade setup for Monday: Top 15 things to know before the Opening Bell - Moneycontrol

Read More

No comments:

Post a Comment