Follow our LIVE blog for the latest updates on the Russia-Ukraine and its impact

HDFC Securities on Jubilant Foodworks:

The CEO of Jubilant FoodWorks, Pratik Pota, announced his resignation. After he became the CEO in 2017, he addressed several challenges and boosted confidence in growth longevity. His exit is quite surprising since he was instrumental in turning around Domino’s SSG (9% during FY18-FY22E vs. ~1% during FY14-FY17), improving unit economics, implementing successful strategies from Domino’s US and Australia, expanding multi-year growth drivers by launching various new QSR formats and expanding operating margin (10% when he joined to ~18% pre-IND AS now). His exit (along with past exits of many members of senior management) is certainly adding several risks. Apart from the fact that his execution expertise would be missed (quite essential from long-term growth perspective), the timing of his exit is also quite odd; it comes at a time when Jubilant has been guiding for massive store expansion (across brands/geographies) over the next 3-5 years.

Although we remain positive on the longevity of QSR industry and Jubilant’s superior business model, rich valuation remains a concern for us. We cut our EPS estimate by 6% and 4% for FY23 and FY24, owing to steep RM inflation, and macro headwinds. We also cut our target P/E multiple to 45x (earlier 60x) on FY24 EPS, due to uncertainty around various aspects post the exit. Our revised target price is Rs 2,400, based on 45x P/E on Mar-24E EPS for Domino’s India and Rs 150 per share (earlier Rs 300 per share) for ex-Domino’s India. We maintain reduce rating on the stock. The stock was trading at Rs 2,535.40, down Rs 328.70, or 11.48 percent. It has touched a 52-week low of Rs 2,444. It has touched an intraday high of Rs 2,700 and an intraday low of Rs 2,444.

S&P 500 index could drop to 3,600: John Roque

S&P 500 index could drop to 3,600 - which is a 14% decline from present levels - as investors have scope to become more bearish, according to 22V technical analyst John Roque.

Roque in a research note cited the CBOE Volatility Index's failure to breach 40 suggests investor fear is yet to peak.

Rupee Opens:

Indian rupee opened flat at 76.61 per dollar on Monday against previous close of 76.59.

The rupee is expected to depreciate today amid firm dollar. Moreover, a surge in crude oil prices will weigh on the rupee, said ICICIDirect.

Further, market participants will remain cautious ahead of consumer price inflation reading from India. USDINR (March) is expected to move further towards 77.0 for the day, it added.

Manish Hathiramani, Index Trader & Technical Analyst at Deen Dayal Investments:

The Nifty is feeling the heat at higher levels - 16800 is a resistance zone. We need to close above this level for a couple of sessions in order to surmise that the short term trend is shifting.

Until then any up move can be a trading opportunity on the short side. The weekly support is upgraded to 16400-16500 and until these do not break on a closing basis, the market is still finding its direction.

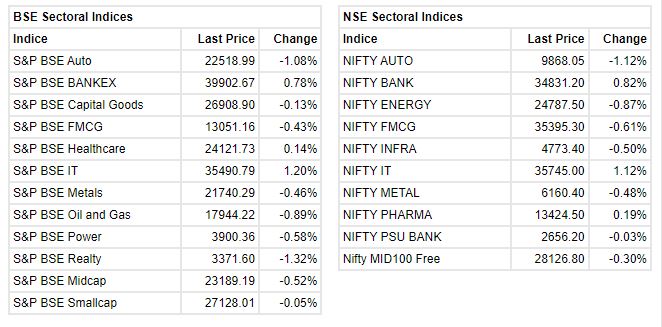

BSE Auto index shed nearly 1 percent dragged by the Tata Motors, Ashok Leyland, Eicher Motors

Likhita Chepa, Senior Research Analyst, Capitalvia Global Research:

On Friday, Indian markets concluded a lethargic day with modest gains, as advances in pharma and select banking equities were offset by losses in auto stocks. The markets opened flat today on fears of escalating geopolitical tensions following Russian missiles striking a huge Ukrainian base near NATO member Poland's border on Sunday.

The February WPI statistics, as well as the retail inflation estimates due later in the day, will be closely watched by investors.

Traders may be concerned since Reserve Bank of India deputy governor Michael Patra recently stated that India's economic story remains as weak as it was during the 2013 taper tantrum, and that recent geopolitical tensions in Ukraine and Russia are likely to stymie a recovery.

Buzzing:

The Reserve Bank of India on March 11 banned Paytm’s payments bank from onboarding new customers and asked the company to undertake an IT systems audit to review gaps in the fintech company’s technology in what is a fresh blow to investors of the company.

The company in a statement said that it is taking immediate steps to comply with the directions from the central bank.

Shares of One 97 Communications, parent of Paytm, have given away two-thirds of their value from the initial public offering price of Rs 2,150. On March 14, shares nosedived another 13 percent to Rs 675 on the National Stock Exchange.

Market at 10 AM

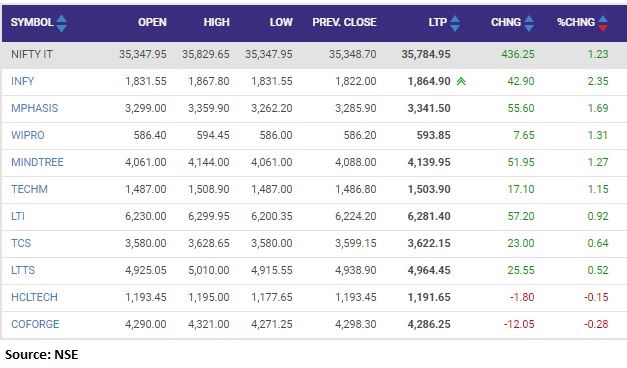

Benchmark indices were trading higher with Nifty around 16700 led by the IT stocks.

The Sensex was up 220.44 points or 0.40% at 55770.74, and the Nifty was up 39.90 points or 0.24% at 16670.40. About 1523 shares have advanced, 1415 shares declined, and 136 shares are unchanged.

Nifty Information Technology index added 1 percent supported by the Infosys, Mphasis, Wipro

Prabhudas Lilladher on Gujarat Gas:

We cut our FY22-24E estimates by 8-17% to factor in lower margins and volumes, given sustained high spot LNG prices. Recent EU decision to cut reliance on Russian gas (which accounted for 40% of gas supplies) will keep spot LNG at elevated levels.

Also GGAS has cut supplies to industrial customers by ~ 1mmscmd to reduce dependence on spot LNG, which accounts for 21% of FY22E supplies. To tide over tight market conditions, recently GSPC (parent of GGAS) won tenders to secure 0.58mmscmd (5% of FY23E GGAS demand) at ~22% of Brent or USD24/mmbtu, thereby giving a pricing flexibility.

We continue to like GGAS’s resilient business model that remains well placed to benefit from any resolution in geopolitical conditions.

Our estimates factor in 14.1% CAGR volume growth over FY22-24E and margins of Rs5.0/scm (Rs 5.6 earlier). Reiterate ‘BUY’ with a DCF based price target of Rs 675 (Rs 764 earlier).

Gujarat Gas was quoting at Rs 509.35, down Rs 1.15, or 0.23 percent on the BSE.

Market LIVE Updates: Indices trade higher amid volatility; IT stocks gain, auto, realty drag - Moneycontrol

Read More

No comments:

Post a Comment