The government has decided to maintain the status quo on interest rates of small savings instruments for the April-June quarter. Interest rates on small saving schemes are reset on a quarterly basis, in line with the movement in benchmark government bonds of similar maturity.

The move to not change the interest rates assume significance in the light of a sharp reduction in interest rate that was recommended by the Central Board of Trustees of the Employees’ Provident Fund Organisation (EPFO) earlier this month.

Typically, small savings rates are linked to yields on benchmark government bonds but despite the movement in g-sec yields, the government has not reduced the interest rates over the last two years.

What are the various rates applicable on small savings instruments?

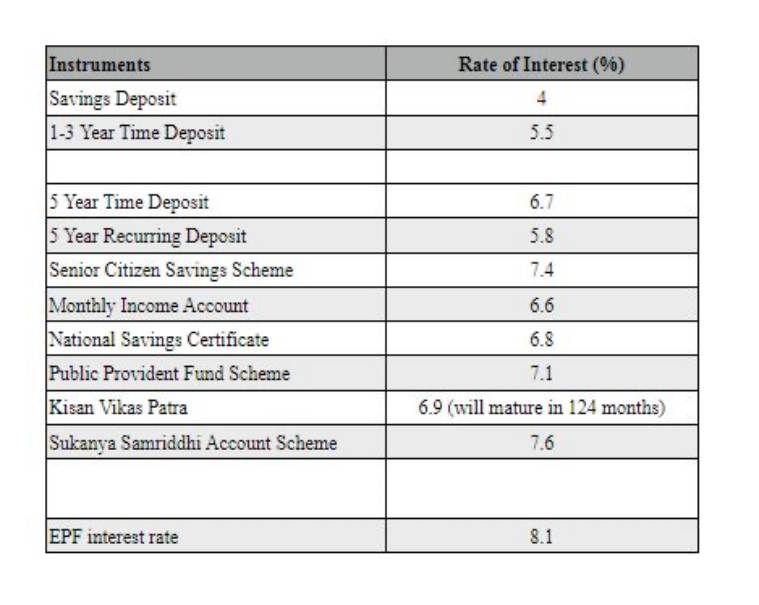

Public Provident Fund (PPF), which is among the most popular fixed income products, fetches 7.1 per cent. National Savings Certificate (NSC) yields 6.8 per cent. The rate on the girl child savings scheme Sukanya Samriddhi Yojana is 7.6 per cent.

The interest rate on savings deposits will continue to be 4 per cent per annum. Term deposits of one to five years will fetch an interest rate in the range of 5.5-6.7 per cent, to be paid quarterly, while the interest rate on five-year recurring deposits will earn a higher interest of 5.8 per cent.

When was the last time these rates were cut?

The interest rates were revised for the first quarter of 2021-22 (April-March), and reduced sharply by 40-110 basis points, but the decision was later rolled back, with the Finance Minister saying that the “orders issued by oversight shall be withdrawn”.

The reduction of interest rates and the subsequent withdrawal had happened in the run-up to the West Bengal Assembly elections. Prior to that, the interest rates were revised two years ago for the first quarter of 2020-21.

Why is the status quo on small saving interest rates significant?

The decision to retain the rates assumes significance on account of the recent reduction in interest rate on EPF deposits. The rates were reduced on March 12 to 8.1 per cent – the lowest in four decades.

Speaking in Rajya Sabha last week, Finance Minister Nirmala Sitharaman had said that the revision was dictated by the realities of current times. “The fact remains these are rates which are prevailing today, and it (EPFO interest rate) is still higher than the rest,” Sitharaman had said, adding that EPFO’s rates had remained unchanged for 40 years, and that the revision now reflected “today’s realities”.

Further, in its state of the economy report released last week, the Reserve Bank of India had called for a reduction in small savings rate in the 9-118 basis points range.

Newsletter | Click to get the day’s best explainers in your inbox

“The existing rates of interest on SSIs need to be reduced in the range of 9-118 bps for Q1 of 2022-23 to align them with the formula-based rates,” the RBI noted in its report.

Interest rates on small savings schemes unchanged for first quarter of FY23: Here’s what you will earn - The Indian Express

Read More

No comments:

Post a Comment