The market has continued its uptrend for a third consecutive session with the benchmark indices rising a percent on March 30 ahead of the expiry of March derivative contracts, driven by banking and financials, auto, and IT stocks. The peace talks between Russia and Ukraine, which raised hopes of de-escalation of the war, also supported sentiment.

The BSE Sensex rallied 740 points to 58,684, while the Nifty50 climbed 173 points to 17,498 and has broken its consolidation range seen last week, forming a small-bodied bullish candle on the daily charts.

"On the daily chart, the index has formed higher tops and bottoms indicating a positive trend. This consolidation is also supported by the 200-Day SMA (17,060) which remains a crucial support zone," says Rajesh Palviya, VP - Technical and Derivative Research at Axis Securities.

He advised short-term traders to remain long with a stop-loss of 17,300 levels on a closing basis. "The short-term bias remains bullish with expected upsides towards 17,600-17,700 shortly. The daily strength indicator RSI (relative strength index) continues to remain bullish, indicating sustained strength," he says.

The participation in the rally was also seen from a broader space. The Nifty Midcap 100 index gained 0.85 percent and Smallcap 100 index rose 0.97 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,416, followed by 17,334. If the index moves up, the key resistance levels to watch out for are 17,551 and 17,605.

Nifty Bank

The Bank Nifty rallied 487 points to 36,334 on March 30. The important pivot level, which will act as crucial support for the index, is placed at 36,130, followed by 35,925. On the upside, key resistance levels are placed at 36,480 and 36,625 levels.

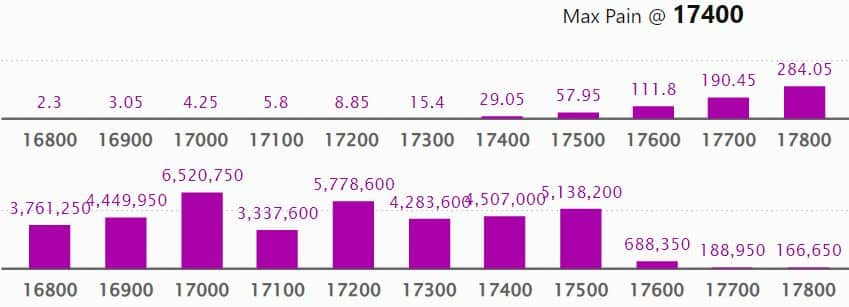

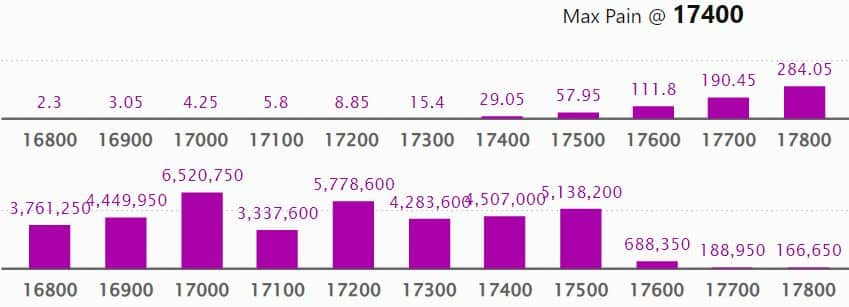

Call option data

Maximum Call open interest of 1.01 crore contracts was seen at 18,000 strike, which will act as a crucial resistance level in the March series.

This is followed by 17,500 strike, which holds 56.25 lakh contracts, and 17,800 strike, which has accumulated 55.51 lakh contracts.

Call writing was seen at 17,600 strike, which added 10.14 lakh contracts, followed by 18,000 strike which added 9.31 lakh contracts, and 17,700 strike which added 5.65 lakh contracts.

Call unwinding was seen at 17,300 strike, which shed 28.04 lakh contracts, followed by 17,400 strike which shed 24.61 lakh contracts and 17,500 strike which shed 10.84 lakh contracts.

Put option data

Maximum Put open interest of 65.20 lakh contracts was seen at 17,000 strike, which will act as a crucial support level in the March series.

This is followed by 16,500 strike, which holds 60.52 lakh contracts, and 17,200 strike, which has accumulated 57.78 lakh contracts.

Put writing was seen at 17,500 strike, which added 38.16 lakh contracts, followed by 17,400 strike, which added 33.49 lakh contracts, and 16,900 strike which added 9.47 lakh contracts.

Put unwinding was seen at 16,600 strike, which shed 33.04 lakh contracts, followed by 16,400 strike which shed 6.02 lakh contracts, and 16,500 strike which shed 5.57 lakh contracts.

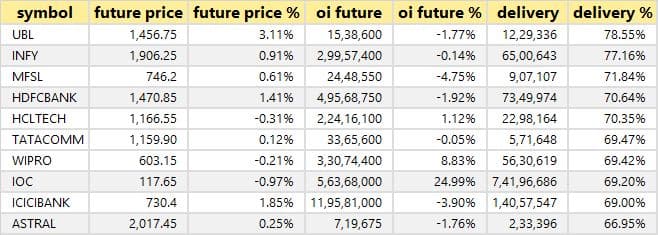

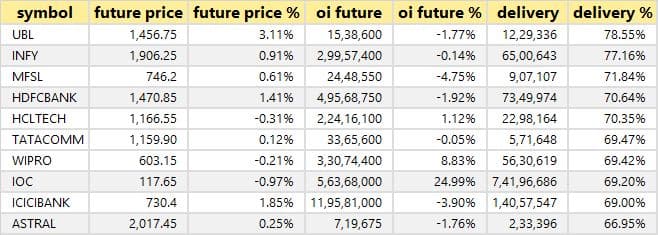

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in United Breweries, Infosys, Max Financial Services, HDFC Bank, and HCL Technologies among others on Wednesday.

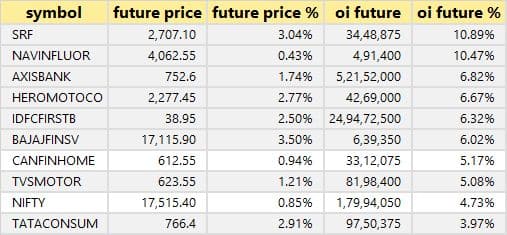

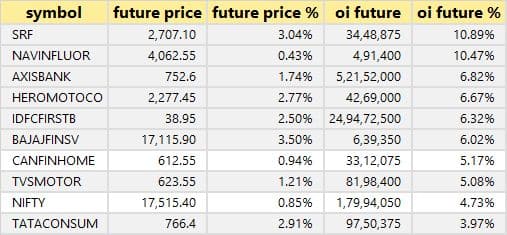

32 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen including SRF, Navin Fluorine International, Axis Bank, Hero MotoCorp, and IDFC First Bank.

45 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen including Alembic Pharmaceuticals, Crompton Greaves Consumer Electricals, City Union Bank, Cummins India, and Indian Energy Exchange.

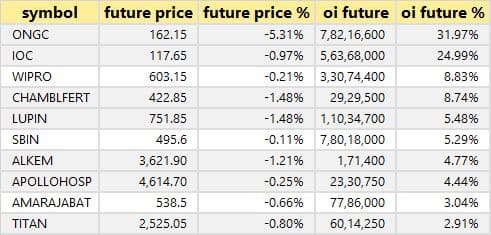

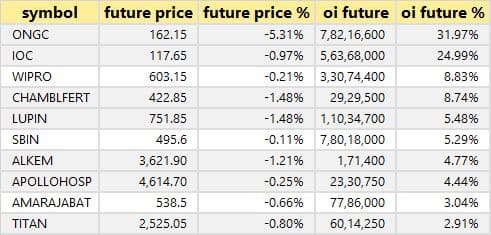

23 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen including ONGC, IOC, Wipro, Chambal Fertilizers, and Lupin.

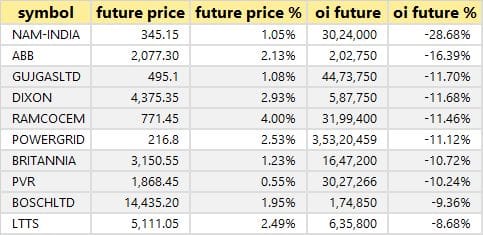

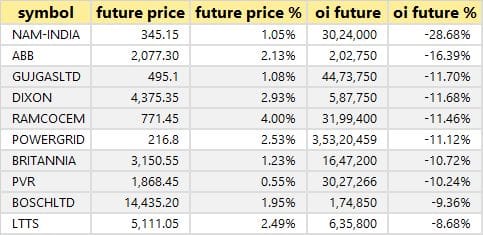

101 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen including Nippon Life India Asset Management, ABB India, Gujarat Gas, Dixon Technologies, and Ramco Cements.

Bulk deals

Orient Green Power Company: Janati Bio Power sold 50 lakh equity shares in the company via open market transactions, at an average price of Rs 12.55 per share.

RBL Bank: Integrated Core Strategies (Asia) Pte Ltd bought 40,36,189 equity shares in the bank via open market transactions, at an average price of Rs 129.37 per share. However, Nippon India Mutual Fund sold 51,02,574 equity shares in the bank at an average price of Rs 129.03 per share.

Virescent Renewable Energy Trust: Larsen & Toubro sold 20 lakh equity shares in the company via open market transactions at an average price of Rs 95 per share.

Stylam Industries: Abakkus Growth Fund-2 bought 3,13,896 equity shares in the company via open market transactions at an average price of Rs 900 per share. However, Lighthouse Emerging India Investors sold 4.25 lakh shares at a price of Rs 900.18 per share.

(For more bulk deals, click here)

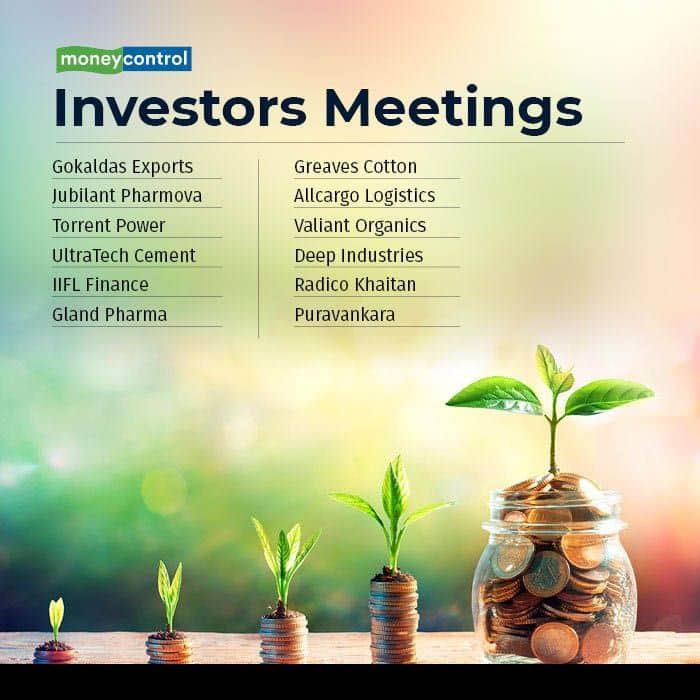

Analysts/Investors Meetings on March 31

Gokaldas Exports: The company's officials will meet NT Asset Management and SBI Mutual Fund.

Jubilant Pharmova: The company's officials will meet BNP Paribas MF, PPFAS MF, Kotak PMS, UTI MF, Lucky IM, Alchemy, and Exide Life.

Torrent Power: The company's officials will meet UTI Retirement Solutions.

UltraTech Cement: The company's officials will meet Theleme Partners.

IIFL Finance: The company's officials will meet Motilal Oswal.

Gland Pharma: The company's officials will meet Fiera Capital and Capital Group.

Greaves Cotton: The company's officials will meet Ward Ferry and Jefferies India.

Allcargo Logistics; The company's officials will meet Sell Side Analysts.

Valiant Organics: The company's officials will meet ICICI Securities.

Deep Industries: The company's officials will meet Sarath Capital Management LLP.

Radico Khaitan: The company's officials will meet Ashmore Group.

Puravankara: The company's officials will meet Sharekhan.

Stocks in News

Nazara Technologies: Subsidiary Nazara Pte Ltd (Nazara Singapore) will invest $2.5 million in BITKRAFT Funds. Out of which $0.875 million will invest upfront while the balance investment amount of $1.625 million will be deployed over a period of three years.

Tata Steel: Tata Steel transferred its entire stake in Tata Steel Special Economic Zone Limited to Tata Steel Utilities and Infrastructure Services for consideration other than cash. The company has executed an asset transfer agreement for the acquisition of itemised assets from Stork Ferro and Mineral Industries Private Limited to produce ferro alloys.

ONGC: The two-day offer for sale issue will close on March 31. The Government of India has decided to exercise the oversubscription option to the extent of additional 9.4 crore equity shares, in addition to 9.4 crore equity shares of the company. Accordingly, the total offer size for sale will be up to 18.8 crore shares or 1.5 percent of the total paid-up equity.

Axis Bank: The bank has acquired Citibank's India consumer business from Citibank N.A. and the NBFC consumer business from Citicorp Finance (India), as going concerns, without values being assigned to individual assets and liabilities to either business. The bank has executed business transfer agreements with Citibank N.A. and Citicorp Finance (India) on March 30. The cost of acquisition is Rs 12,325 crore.

Mangalam Cement: Promoter Vidula Consultancy Services acquired 2.26 lakh equity shares in the company via open market transactions. With this, its shareholding in the company stands at 9.92 percent, up from 9.1 percent earlier.

Godrej Properties: The real estate developer has acquired a nine-acre land parcel in the residential micro-market of Pimpri-Chinchwad in Pune. The development will primarily be for a group housing project.

Quess Corp: The board has approved the transfer of digital business undertaking of the company comprising Qjobs, Worq, and Dash as a going concern on a slump sale basis to the company's subsidiary Billion Careers Private Limited (BCPL), for Rs 5.04 crore. The company has signed the First Addendum Agreement with Stellarslog Technovation (Taskmo), Naveen Ramachandra and Prashant Janadri (Founders), under which it will make an additional investment of Rs 3.84 crore. The board also approved the re-designation of Executive Chairman Ajit Isaac to Non-Executive Chairman (Non-Executive Director) with effect from April 2022.

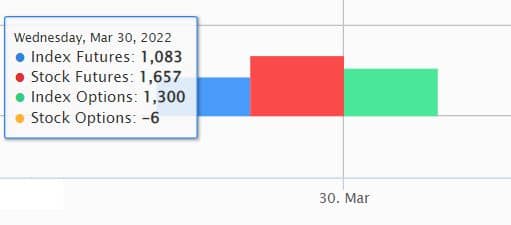

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) have net purchased shares worth Rs 1,357.47 crore, while domestic institutional investors (DIIs) have net bought shares worth Rs 1,216 crore on March 30, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - Vodafone Idea - is under the F&O ban for March 31. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Adblock test (Why?)

Trade setup for Thursday: Top 15 things to know before Opening Bell - Moneycontrol

Read More

/cloudfront-us-east-2.images.arcpublishing.com/reuters/VM6BEMA225PJDLN4EZN7WZDEIM.jpg)