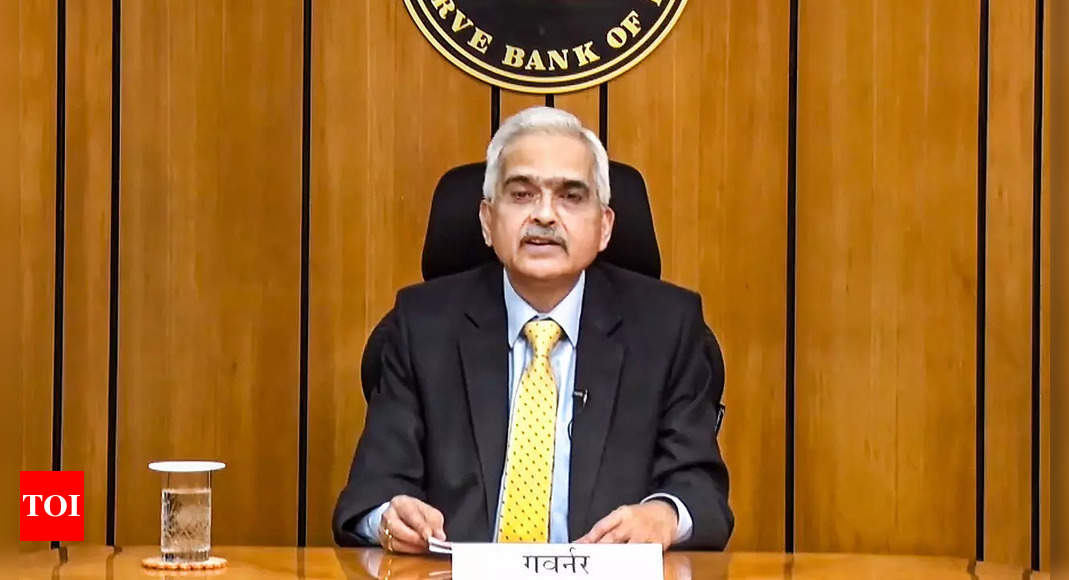

Announcing the bi-monthly monetary policy outcome, Das cautioned investors by invoking the 17th century 'tulip mania' -- which is widely considered to be the first financial bubble.

The RBI governor said that investors must remember that cryptocurrencies have no underlying, not even a tulip.

The central bank has always maintained a strong stance against private digital currencies. It had banned the banking system from aiding such trades, which was struck down by the Supreme Court in 2020.

Das said it is his "duty" to caution investors, and told them to keep in mind that they are investing at their own risk.

What is 'tulip mania'

The 'tulip mania' of the 17th century is often cited as a classic example of a financial bubble where the price of something goes up, not due to its intrinsic value but because of speculators wanting to make a profit by selling a bulb of the exotic flower.

It is also known as the Dutch tulip market bubble and occurred in Holland during early to mid 1600s. It was one of the most famous market bubbles and crashes of all times.

Speculations drove up the value of tulip bulbs and they traded for an extensively higher price.

In today's context, it serves as a parable for the pitfalls that excessive speculation can lead to.

Cryptocurrencies are said to originate or 'mined' using complex algorithms built on the blockchain platform but critics say it lacks the 'value' of legal tender whose supply is regulated.

After getting mined by running a programme, units of cryptocurrencies are traded in the secondary markets where their value has been very volatile.

Hence, the RBI governor used this parable to caution the investors.

'Cautiously progressing to introduce digital currency'

Shaktikanta Das said that the central bank does not want to rush and is carefully examining all aspects before introduction of the Central Bank Digital Currency (CBDC).

He, however, declined to give any timeline for the launch of the CBDC.

"This (CBDC) is one thing where we do not want to rush. We are carefully and cautiously examining and progressing ahead as there are multiple risks. The biggest risks are related to cyber security and possibility of counterfeiting," Das said in a post-policy presser.

In her budget 2022-23 speech, finance minister Nirmala Sitharaman had announced that the RBI will introduce a digital currency in the next financial year beginning April 2022 to boost the digital economy and for more efficient currency management.

(With inputs from agencies)

Warning Indians against cryptocurrencies, RBI chief says tulips have more value - Times of India

Read More

No comments:

Post a Comment