The selling pressure amid volatility, in the benchmark indices, continued for the fourth consecutive session on February 21; however, it was the broader market that took the deep cuts as the Nifty Midcap 100 index declined 1.24 percent while Smallcap 100 index slumped 2.73 percent.

The BSE Sensex slipped 149 points to 57,684, while the Nifty50 declined 70 points to 17,207 and formed Doji kind of indecisive pattern on the daily charts as the closing was near opening levels.

"A small body of positive candle was formed on the daily chart with long upper and lower shadow. Technically, this pattern indicates a formation of high wave type candle pattern and this displays high volatility in the market," says Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He further says, normally, such formations after a reasonable declines indicate bottom reversal in the market. But, "having formed this pattern at the high, within a narrow range movement, the chances of any important bottom reversal is ruled out."

He feels the short term trend of Nifty continues to be choppy with rangebound action. "Still there is no strong evidence of Nifty forming bottom reversals around the support of 17,100 levels. Further weakness from here could open a next downside target of 16,800 in the near term. Immediate resistance is placed at 17,350 levels," says Nagaraj Shetti.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support levels for the Nifty are placed at 17,068, followed by 16,929. If the index moves up, the key resistance levels to watch out for are 17,348 and 17,490.

The Nifty Bank outperformed frontline as well as broader markets again, climbing 86 points to settle at 37,685 on February 21. The important pivot level, which will act as crucial support for the index, is placed at 37,210, followed by 36,735. On the upside, key resistance levels are placed at 38,108 and 38,530 levels.

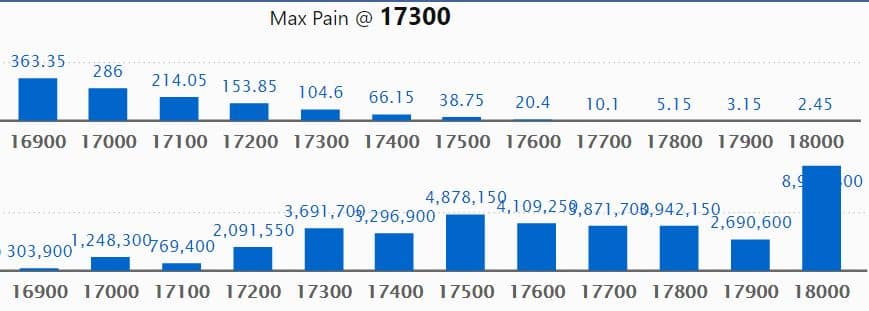

Maximum Call open interest of 89.82 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the February series.

This is followed by 17,500 strike, which holds 48.78 lakh contracts, and 17,600 strike, which has accumulated 41.09 lakh contracts.

Call writing was seen at 18,000 strike, which added 18.29 lakh contracts, followed by 17,600 strike which added 9.94 lakh contracts, and 17,200 strike which added 9.75 lakh contracts.

Call unwinding was seen at 16,700 strike, which shed 3,900 contracts, followed by 16,600 strike which shed 750 contracts.

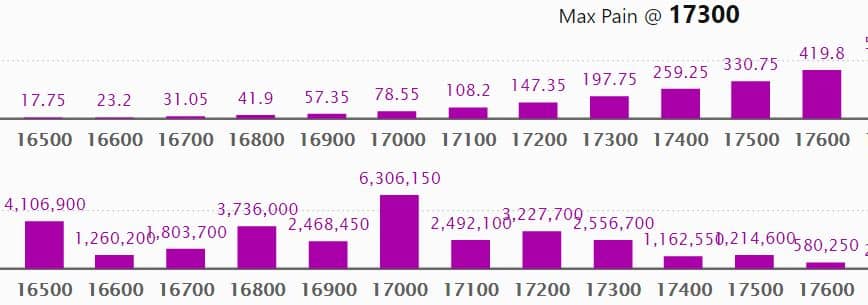

Maximum Put open interest of 63.06 lakh contracts was seen at 17,000 strike, which will act as a crucial support level in the February series.

This is followed by 16,500 strike, which holds 41.06 lakh contracts, and 16,800 strike, which has accumulated 37.36 lakh contracts.

Put writing was seen at 17,100 strike, which added 6.34 lakh contracts, followed by 17,000 strike, which added 5.08 lakh contracts, and 17,200 strike which added 4.72 lakh contracts.

Put unwinding was seen at 17,300 strike, which shed 8.53 lakh contracts, followed by 17,500 strike which shed 5.02 lakh contracts, and 17,400 strike which shed 4.83 lakh contracts.

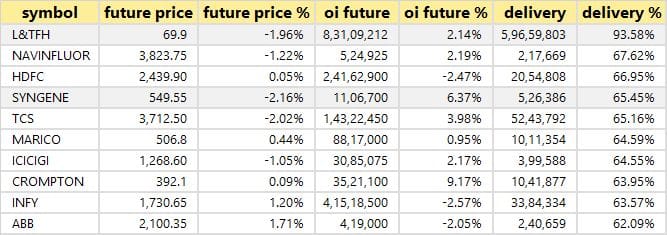

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

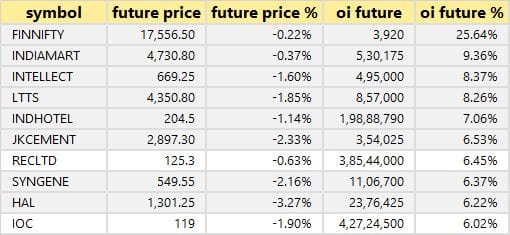

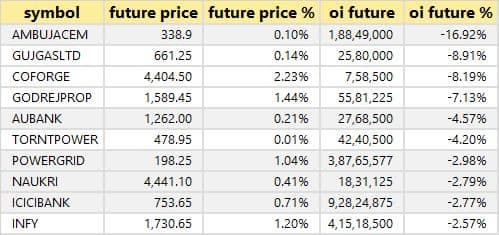

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

23 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here is the top 10 stocks in which short-covering was seen.

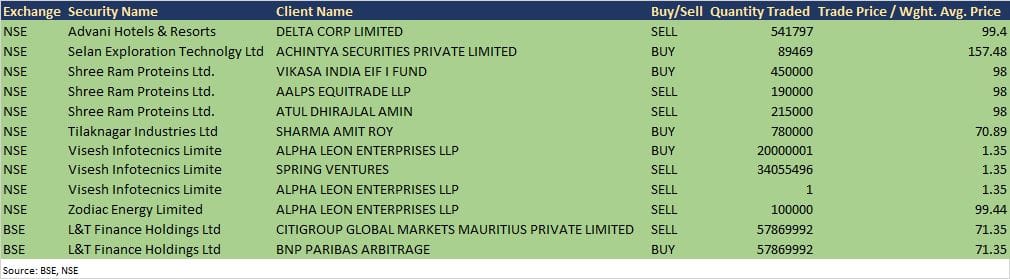

Advani Hotels & Resorts: Delta Corp sold 5,41,797 equity shares in the company via open market transactions at an average price of Rs 99.4 per share on the NSE, as per the bulk deal data.

L&T Finance Holdings: Citigroup Global Markets Mauritius sold 5,78,69,992 equity shares in the company; however, BNP Paribas Arbitrage was the buyer for same number of shares via open market transactions at an average price of Rs 71.35 per share on the BSE, as per the bulk deal data.

(For more bulk deals, click here)

Analysts/Investors Meetings

UltraTech Cement: The company's officials will meet OMERS on February 22.

Dr Lal PathLabs: The company's officials will attend Kotak Chasing Growth conference 2022 on February 22, and will meet Hill Fort Capital & Arihant Capital on February 23.

Ambuja Cements: The company's officials will attend Kotak Conference on February 22 & February 24.

Eicher Motors: The company's officials will attend Kotak Institutional Equities Investor Conference on February 22.

Computer Age Management Services: The company's officials will meet Kotak, SBI Life Insurance & Mondrian Investment on February 22.

Transport Corporation of India: The company's officials will attend Antique Stock Broking Investor conference, and will meet HDFC Mutual Fund on February 22.

Tata Consumer Products: The company's officials will meet Enam Asset Management Company, and will attend Kotak - Chasing Growth 2022 conference on February 22.

Siemens: The company's officials will meet ICICI Prudential Asset Management Company on February 22.

Angel One: The company's officials will meet UBS Securities on February 22; and Motilal Oswal Financial Services on February 22-24.

Ramco Cements: The company's officials will meet White Oak Capital on February 22.

Indian Energy Exchange: The company's officials will meet SBI Life Insurance, UTI AMC, & Skerryvore Asset Management on February 22; Ashmore UK on February 23; and Dalal Broacha on February 24.

Metropolis Healthcare: The company's officials will meet analysts on February 22.

KEC International: The company's officials will meet HDFC Securities on February 22; and Kotak Securities on February 25.

CRISIL: The company's officials will meet IIFLCAP on February 22.

Home First Finance Company: The company's officials will meet analysts on February 22.

Tata Chemicals: The company's officials will attend Antique's Investor Conference on February 23.

Neogen Chemicals: The company's officials will participate Ambit's Chemicals CXO Conclave on February 23.

Trident: The company's officials will meet Philip Capital on February 23.

TTK Prestige: The company's officials will meet investors on February 23.

Gland Pharma: The company's officials will meet Wasatch Advisors on February 23.

JK Cement: The company's officials will attend Kotak Institutional Equities Investor Conference on February 24.

Happiest Minds Technologies: The company's officials will attend Kotak Institutional Equities: Chasing Growth 2022 on February 24.

Allcargo Logistics: The company's officials will attend Antique Annual Investor Conference on February 24.

Nazara Technologies: The company's officials will attend Kotak Conference on February 25.

Can Fin Homes: The company's officials will meet Marcellus Investment Managers on February 28.

Stocks in News

7NR Retail: The company informed exchanges that it has approved the sub-division of equity shares from face value of Rs 10 each to face value of Re 1 each.

NHPC: The firm said its 120 MW Sewa-II power station in Mashka in Union Territory of Jammu and Kashmir has resumed power generation. The power station was under complete shutdown from September 25, 2020 due to damage of the Head Race Tunnel (HRT).

Vedanta: The firm announced it has made an oil discovery in its exploratory well in Rajasthan's Barmer district. In a regulatory filing, the company said it has notified the Directorate General of Hydrocarbons (DGH) and the Ministry of Petroleum and Natural Gas about the oil discovery in a block that was awarded to it under the Open Acreage Licensing Policy (OALP). This is the third hydrocarbon discovery notified by the company under the OALP portfolio.

Krsnaa Diagnostics: Himachal Pradesh gave an order to Krsnaa Diagnostics for providing diagnostic and laboratory services in the state. Krsnaa will install, operate and maintain Routine and Advance Laboratory testing facilities at selected Public Health Institutions (PHIs) which includes Government Medical Colleges, Districts / General Hospitals owned by Government and Community Health Centers.

Shankara Building Products: Flowering Tree Investment Management Pte Ltd sold 36,000 shares in the company via open market transactions on February 18. With this sale, Flowering Tree now holds 4.85 percent stake from 5.01% earlier.

Ducon Infratechnologies: The company said its board will meet on February 25 to consider the proposal for issue of bonus shares.

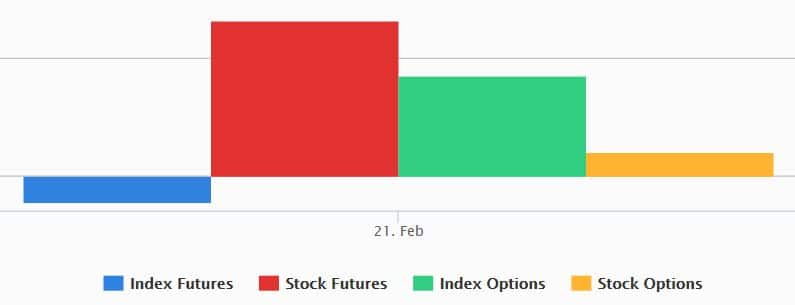

Fund Flow

Foreign institutional investors (FIIs) have net sold Rs 2,261.90 crore worth of shares, whereas domestic institutional investors (DIIs) have net bought Rs 2,392.85 crore worth of shares in the Indian equity market on February 21, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - Escorts, and Punjab National Bank - are under the F&O ban for February 22. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Trade setup for Tuesday: Top 15 things to know before Opening Bell - Moneycontrol.com

Read More

No comments:

Post a Comment