The market extended losses, amid volatility, for second consecutive session and closed with moderate losses on February 4 as elevated oil prices and rising US bond yields after hawkish stance by Bank of England & European Central Bank dented sentiment.

The BSE Sensex fell 143.20 points to 58,644.82, while the Nifty50 declined 43.90 points to 17,516.30 and formed bearish candle on the daily charts. The index gained 2.4 percent during the week and formed bullish candle which resembles Shooting Star kind of pattern formation on the weekly scale.

"The Nifty50 registered a Shooting Star kind of formation on weekly charts with a long upper shadow hinting that pull-back attempt from the lows of 16,836 to a recent high of 17,794 levels is weakening. Moreover, despite the recent upsurge, most of the momentum indicators remained in the sell mode," said Mazhar Mohammad, Founder & Chief Market Strategist at Chartviewindia.

If the Nifty doesn’t stabilise above 17,462 in the next couple of sessions, it can slip to 17,244 levels. If it closes below 17,244, it will confirm the end of the pullback rally.

Contrary to this, if the index sustains above 17,462, it can lead to sideways consolidation, Mohammad said.

The broader markets also fell further with the Nifty Midcap 100 index declining 0.76 percent and Smallcap 100 index down 0.92 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,446.66, followed by 17,377.03. If the index moves up, the key resistance levels to watch out for are 17,601.87 and 17,687.43.

The Nifty Bank was down 220.70 points to close at 38,789.30 on February 4. The important pivot level, which will act as crucial support for the index, is placed at 38,475.13, followed by 38,160.87. On the upside, key resistance levels are placed at 39,191.13 and 39,592.87 levels.

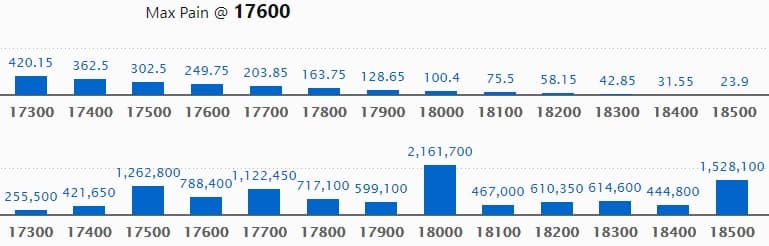

Maximum Call open interest of 21.61 lakh contracts was seen at 18000 strike, which will act as a crucial resistance level in the February series.

This is followed by 18500 strike, which holds 15.28 lakh contracts, and 17500 strike, which has accumulated 12.62 lakh contracts.

Call writing was seen at 17500 strike, which added 1.46 lakh contracts, followed by 18100 strike which added 1.24 lakh contracts, and 18500 strike which added 84,400 contracts.

Call unwinding was seen at 17800 strike, which shed 84,200 contracts, followed by 18000 strike which shed 67,900 contracts and 17000 strike which shed 47,200 contracts.

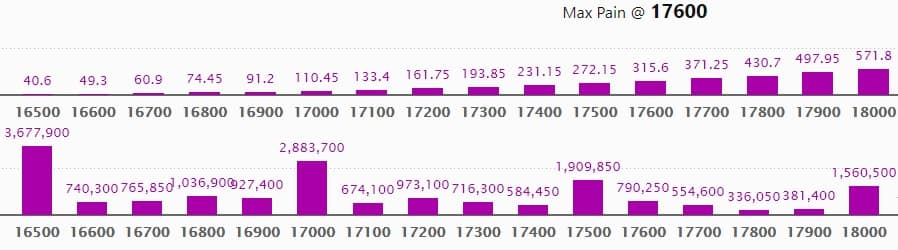

Maximum Put open interest of 36.77 lakh contracts was seen at 16500 strike, which will act as a crucial support level in the February series.

This is followed by 17000 strike, which holds 28.83 lakh contracts, and 17500 strike, which has accumulated 19.09 lakh contracts.

Put writing was seen at 17000 strike, which added 1.47 lakh contracts, followed by 16800 strike, which added 1.15 lakh contracts, and 17600 strike which added 75,750 contracts.

Put unwinding was seen at 16500 strike, which shed 2.69 lakh contracts, followed by 17700 strike which shed 1.68 lakh contracts, and 17800 strike which shed 77,900 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

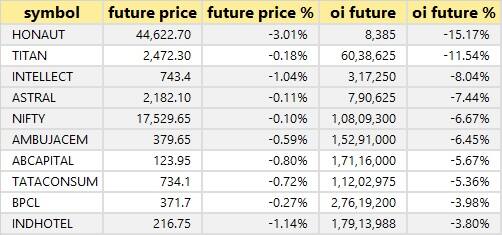

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

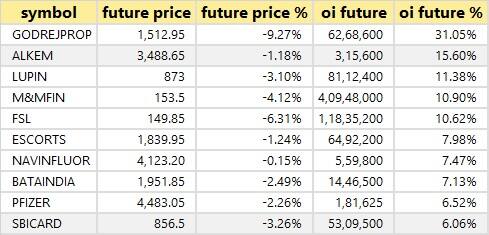

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

34 stocks witnessed short-covering

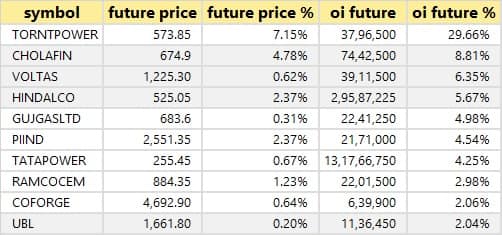

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

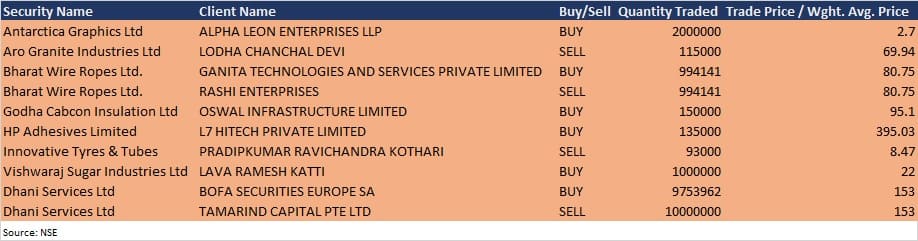

Dhani Services: BofA Securities Europe SA bought 97,53,962 equity shares in the company at Rs 153 per share on the BSE, whereas Tamarind Capital Pte Ltd sold 1 crore equity shares at Rs 153 per share, the bulk deals data showed.

Vishwaraj Sugar Industries: Promoter Lava Ramesh Katti bought 10 lakh shares in the company at Rs 22 per share on the NSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting; and Results on February 7

Results on February 7: Union Bank of India, TVS Motor Company, NALCO, Borosil, Camlin Fine Sciences, Castrol India, Chemcon Speciality Chemicals, Clean Science and Technology, Fortis Malar Hospitals, Future Supply Chain Solutions, Gabriel India, Glaxosmithkline Pharmaceuticals, Indo Count Industries, Indian Bank, JM Financial, Jindal Stainless, Lasa Supergenerics, Likhitha Infrastructure, Nucleus Software Exports, Paisalo Digital, Peninsula Land, The Phoenix Mills, PB Fintech, Punjab & Sind Bank, Sansera Engineering, S H Kelkar and Company, Talbros Engineering, Tarsons Products, Texmaco Infrastructure, Texmaco Rail, Tube Investments of India, and Zodiac Energy will release quarterly earnings on February 7.

Quess Corp: The company's officials will attend Edelweiss India Conference 2022 – India 2025: The New Edge on February 7.

Sudarshan Chemical Industries: The company's officials will meet Kotak Investments on February 7.

Max Healthcare Institute: The company's officials will meet New Vernon Capital, Neuberger Berman, Graticule Asset Management Asia, and Briarwood Chase Management on February 7.

Macrotech Developers: The company's officials will attend Edelweiss India Virtual Conference 2022 — India 2025 on February 8, and Antique’s Annual Investor Conference on February 9.

Blue Star: The company's officials will meet analysts and investors on February 8.

L&T Infotech: The company's officials will attend PL Tech Tonic Conference on February 8.

PCBL: The company's officials will participate Antique's Annual Investor Conference on February 9.

Mahindra & Mahindra: The company's officials will meet several funds, investors and analysts on February 10, to discuss financial results.

Gulf Oil Lubricants India: The company's officials will meet analysts and investors on February 11, to discuss financial results.

Schneider Electric Infrastructure: The company's officials will meet investors on February 11 to discuss financial results.

Stocks in News

City Union Bank: The bank reported higher profit at Rs 196.11 crore in Q3FY22 against Rs 169.93 crore in Q3FY21, net interest income rose to Rs 489.97 crore from Rs 489.05 crore YoY.

Minda Corporation: The company reported higher profit at Rs 69.9 crore in Q3FY22 against Rs 49.5 crore in Q3FY21, revenue fell to Rs 738.3 crore from Rs 739.8 crore YoY.

Shree Cement: The company reported lower profit at Rs 482.70 crore in Q3FY22 against Rs 631.58 crore in Q3FY21, revenue rose to Rs 3,637.11 crore from Rs 3,557.21 crore YoY.

Tata Steel: The company reported sharply higher profit at Rs 9,572.67 crore in Q3FY22 against Rs 3,697.22 crore in Q3FY21, revenue jumped to Rs 60,783.11 crore from Rs 41,935.21 crore YoY.

CMS Info Systems: The company clocked strong profit at Rs 60.24 crore in Q3FY22 against Rs 40.7 crore in Q3FY21, revenue climbed to Rs 403.65 crore from Rs 332.53 crore YoY.

InterGlobe Aviation: The company recorded profit at Rs 129.78 crore in Q3FY22 against loss of Rs 620.14 crore in Q3FY21, revenue jumped to Rs 9,294.77 crore from Rs 4,909.98 crore YoY.

Cipla: Kedar Upadhye has resigned from the position of Global Chief Financial Officer of the company to pursue his professional aspirations beyond pharmaceutical and healthcare sector.

FDC: The company on February 9, will consider the proposal for buyback of shares.

Fund Flow

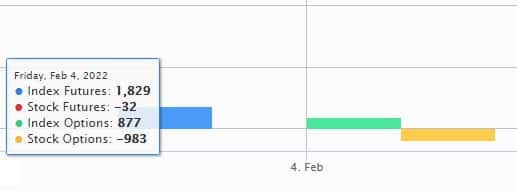

Foreign institutional investors (FIIs) net sold shares worth Rs 2,267.86 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 621.98 crore in the Indian equity market on February 4, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Not a single stock is under the F&O ban for February 7. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Trade setup for Monday: Top 15 things to know before Opening Bell - Moneycontrol.com

Read More

No comments:

Post a Comment