The Maruti Suzuki India share price gained over 2 percent in the morning session on January 17 after the auto major announced a price hike across models owing to increase in various input costs.

"In continuation to our earlier communication dated December 2, 2021, the company announced price change across models owing to increase in various input costs. The weighted average price increase in ex-showroom prices (Delhi) across models is 1.7 percent. The new prices are effective from January 15, 2022," the company said in an exchange filing.

The stock was trading at Rs 8,300, up Rs 217.85, or 2.70 percent, at 10:37am. It has touched an intraday high of Rs 8,369 and an intraday low of Rs 8,101.

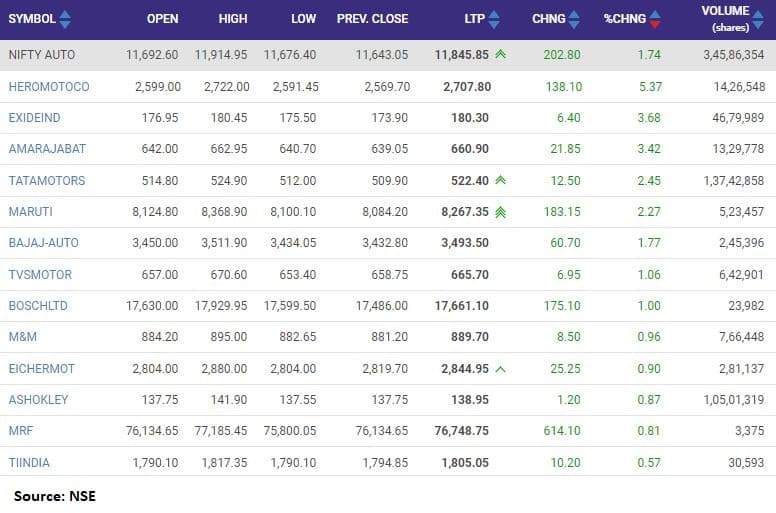

The Nifty Auto index gained more than a percent on expectations of strong inflows from a passive fund in the coming days. Dealers said that the recently launched Nippon India Mutual Fund Auto ETF is likely to start deploying its fund in the coming days, which will drive buying in many of the Nifty Auto index stocks.

Given Maruti Suzuki’s 19.5 percent weight in the Nifty Auto index it is expected to attract the maximum amount of the passive money, which helped the stock gain up to 3.2 percent intraday. Others such as Tata Motors, Ashok Leyland and Hero MotoCorp were up 2-5 percent each.

The Hero MotoCorp share price gained 5 percent in the early trade after the company announced a new investment of up to Rs 420 crore in Ather Energy. Hero MotoCorp's board has approved the investment in one or more tranches in Ather Energy, the company said in its release.

Prior to the proposed investment, Hero MotoCorp’s shareholding in Ather Energy was 34.8 percent (on a fully diluted basis). After the investment, the shareholding will increase and the exact shareholding will be determined upon completion of capital raise round by Ather, it said.

According to research and broking firm ICICI Securities, major recovery in earnings is expected in the space on a benign FY22E base, majority of personal mobility space players are closer to their steady state earning multiples, leaving limited upside.

"Relatively, we prefer the CV cyclical plays, where we foresee scope for upgrade in earnings and subsequent re-rating. The key upside risk is major commodity cost deflation while the key downside risk is continued pressure on semiconductor chip supply impacting production recover," it said.

Improved operating leverage and stability in raw material cost will drive profitability. In FY19-22, around 20-40 percent cumulative decline in volume across sub-segments and major commodity cost inflation led to an EBITDA margin decline of 300-800bps. This is expected to reverse, spread across FY23-24 led by revival in demand and gradual price hikes amid stable raw material cost basket, the brokerage firm said.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Nifty Auto vrooms on the back of Hero MotoCorp; Maruti Suzuki zooms on price hikes - Moneycontrol.com

Read More

No comments:

Post a Comment