BSE Sensex

It was a healthy start to the new year 2022 with bulls holding their fort firm for yet another week.

The market clocked 2.6 percent gains backed by positive global cues and buying binge by foreign institutional investors, though the indication of faster tightening of monetary policy and expected rate hikes after recent US Fed minutes caused selling pressure in later part of week ended January 7.

The BSE Sensex rallied 1,490.83 points to 59,744.65, and the Nifty50 jumped 458.65 points to 17,812.70, continuing an uptrend for the third straight week, supported largely by banking and financials, though IT and pharma underperformed during the week. The broader markets also joined the party with the BSE Midcap and Smallcap indices gaining 2 percent each.

The coming week is going to be crucial for the market as quarterly numbers will start flowing in with IT companies leading the pack. All eyes will also be on the economic data and the evolving COVID situation globally.

“We believe earnings will dictate the market trend now and participants are hopeful of an encouraging start by the IT heavyweights. Though the markets are overlooking the rise in COVID cases for now, the extension of strict restrictions imposed by several states might dent the sentiment,” says Ajit Mishra, VP – Research at Religare Broking.

“We reiterate our positive-yet-cautious view and suggest focusing more on risk management as volatility is likely to remain high,” he says.

Let’s check out the 10 key factors that will keep traders busy through the next week.

The corporate earnings season will begin next week with 68 companies releasing their quarterly as well as nine-month scorecard. Key earnings to watch out for would be Infosys, TCS, Wipro, HCL Technologies and HDFC Bank, which have around 25 percent weightage in the Nifty50.

Mindtree, Tata Metaliks, 5paisa Capital, Metro Brands, GNA Axles, Vikas Lifecare, Delta Corp, Earum Pharmaceuticals, Virinchi, Aditya Birla Money, CESC, GTPL Hathway, Plastiblends India, Onward Technologies, Tinplate Company of India, and Urja Global will also release their numbers next week.

IT Stocks

The IT sector is expected to rule Dalal Street in the coming week as four IT large-caps – Infosys, TCS, Wipro (January 12), and HCL Technologies (January 14) – and one midcap – Mindtree (January 13) – will announce their quarterly numbers.

The Nifty IT index, which is one of defensive sectors, corrected 3.5 percent in previous two sessions, after rising 10 percent in a mostly one-way rally from December 21, reacting to strong outlook by Accenture and ahead of the earnings season. Overall numbers are expected to be strong with the revenue rising in the range of 2.5-4.5 percent QoQ in constant currency terms, with Infosys likely to raise the full-year forecast.

“In recent weeks, IT stocks in India have outpaced the benchmark, fuelled by expectations of an increase in deals and a resultant stellar growth momentum. The sector’s major monitorables will be margin projection, revenue guidance, and attrition figures,” says Yesha Shah, Head of Equity Research at Samco Securities.

Economic Data

On the macroeconomic front, CPI inflation data for December and industrial output for November will be released on Wednesday evening, while WPI inflation will be released on Friday.

CPI inflation had inched up to 4.91 percent in November 2021, from 4.48 percent in October, but still within the RBI’s target range of 4 percent (+/- 2 percent), while industrial output had grown 3.2 percent in October 2021.

Apart from that, deposit and bank loan growth for the fortnight ended December 24, foreign exchange reserves for the week ended January 7, and balance of trade for the month of December will also be declared on Friday.

Omicron Scare

The COVID-19 infections are spiralling around the world, led by the Omicron variant of corona virus. India added around 1.6 lakh COVID cases on Saturday, nearly six times higher than the previous Saturday, but the street seems to be not worried as medical experts say the hospitalisation and mortality rates are very low and Omicron is less severe than the Delta variant.

They say the recovery is also faster and the impact of Omicron is low on people who are vaccinated. Though the cases are increasing rapidly now, they are expected to fall sharply after hitting a peak, given the trend in South Africa where the Omicron variant was first detected.

More than 148 crore COVID vaccine doses (for 18+ population) were administered so far in the country, of which 42 percent have completed the second dose.

The news of ‘no lockdown’ across the country and only strict COVID restrictions imposed by states supported the market sentiment. Nations like the US, UK, France, Turkey, Spain, Italy, Argentina, Mexico, Colombia and Canada also saw elevated cases.

Oil Prices

Oil prices spiked 14 percent in the last three weeks with the Brent crude futures rising to $81.75 a barrel on January 7, up from $71.52 a barrel on December 20. In the passing week, prices increased more than 5 percent, largely due to supply concerns after unrest in Kazakhstan and drop in Libya production partly amid maintenance work.

Any further spike in oil prices is a concern for a country like India which is a net oil importer, though experts feel the rising COVID cases could cap the upside in crude.

Foreign investors turned net buyers after several weeks, which was one of key factors that supported the market last week. They net bought more than Rs 1,000 crore worth of shares last week, against more than Rs 75,000 crore of selling in previous two months.

Domestic institutional investors continued their support to the market, as they have made nearly Rs 3,300 crore of buying last week against more than Rs 61,000 crore of net purchases in previous two months.

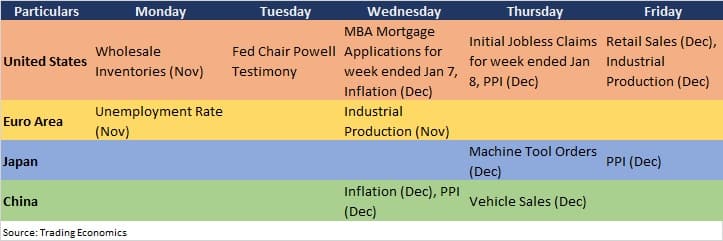

Global Cues

Investors will keep an eye on inflation numbers from the US and China next week, while the US bond yields, which jumped to 1.76 percent from 1.51 percent last week amid expectations of faster policy tightening and rate hikes after recent FOMC minutes, will also be keenly watched.

Here are key global data points to watch out for next week:

Technical View

The Nifty50 registered a bullish candle on the weekly charts and there was Doji kind of a pattern formation on the daily charts as the index gained 2.6 percent for the week and 0.4 percent on Friday, respectively, indicating a positive trend in the short term. Experts feel 17,600 is expected to be a crucial support level and 18,000 on the upside which, if crossed, there could be a sharp uptrend in the coming sessions.

“The Nifty on the weekly chart formed a long bull candle as per week's close and registered gains for the third consecutive week. The present weekly market action indicates a negation of a bearish weekly pattern of lower highs and lower lows. This is a positive indication,” says Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He feels the underlying short-term trend of the Nifty remains positive with high volatility. “The uptrend strength remains intact and we are unlikely to see any sharp trended decline from here. Any weakness from here could be a buying opportunity around the crucial support of 17,600 levels and we expect further upside from the lower levels. Immediate resistance is placed at 17,900,” he says.

F&O Cues

The option data indicated that the Nifty50 could trade in the range of 17,500-18,000 in the coming week, while the earnings season could increase volatility in the market, experts feel.

Maximum Call open interest was seen at 18,000 strike, followed by 18,500 and 18,400 strikes. Call writing was seen at 18,300, 17,900 and 18,400 strikes with Call unwinding at 17,700 strike. Maximum Put open interest was seen at 17,500 strike, followed by 17,600 and 17,800 strikes, with Put writing at 17,600, 17,500 and 17,800 strikes.

“While the Nifty almost tested 18,000 last week, for the coming weekly settlement we believe these levels will remain crucial resistance as significant Call writing is visible at this strike. On the downsides, the highest Put base is placed at 17,500 strike, which should act as important support,” says ICICI Direct.

Hence, consolidation is likely to be seen in the index ahead of results season with support near 17,500, the brokerage feels.

On the volatility front, India VIX has not subsided below 16 levels despite the move and finally closed the week at 17.6, up from 16.22 on week-on-week basis. “With technology heavyweights’ results next week, we expect volatility to remain higher. We believe positive bias should be maintained till it is below 18 levels,” says ICICI Direct.

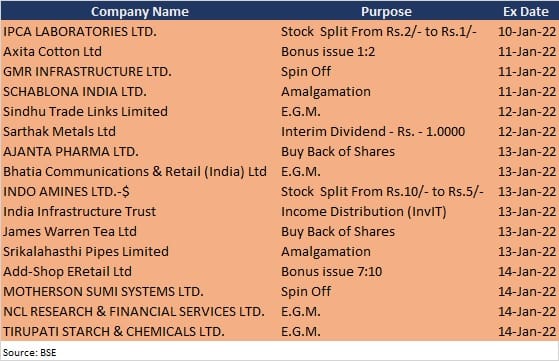

Corporate Action

Here are key corporate actions taking place in the coming week:

Dalal Street Week Ahead | 10 key factors that will keep traders busy - Moneycontrol.com

Read More

No comments:

Post a Comment