The debt crunch at one of the biggest real estate firm's in the country, Evergrande, has also spilled over to the property sector and unsettled global financial markets.

If unresolved, the company will face what could be one the country's largest-ever restructuring.

Some experts believed it to be a 'Lehman moment' and said that a replay of the bankruptcy of Wall Street titan Lehman Brothers during the 2008 global financial crisis was on the cards.

China is also feeling the heat of rising oil, gas, coal and power prices which are feeding inflationary pressures worldwide.

Here are some of the key things to know about China's economy:

Evergrande crisis

The Evergrande debt crisis has outweighed positive cues from the global markets as well.

The real estate giant is drowning under the debt of worth more than $300 billion and has roiled markets in recent weeks on fears that its failure could spill over into the wider Chinese economy and possibly further.

On Monday, the company suspended trading of its shares in Hong Kong pending an announcement related to a merger or takeover.

In a statement, the firm said: " The suspension was pending release of announcement(s) in relation to a major transaction of the company under which the company agreed to acquire the shares of a company...listed on the stock exchange."

The company has been struggling to avoid defaulting on billions of dollars of debt as it owes to banks, customers and contractors.

It has already defaulted on two back-to-back bond payments and needs to make a payment within 30 days of the due date.

Energy crunch

China is in the grip of a power crunch as coal supply shortages combined with strong power demand from manufacturers, industry and households has pushed coal prices to record highs and triggered widespread curbs on usage.

The power crisis has severely impacted all sectors of its economy, as nearly 60 per cent of the Chinese economy is powered by coal.

The government has been rationing electricity to businesses whose activities are based on power as a crunch in coal supply has led to soaring prices.

Consequently, coal plants that are struggling with increased costs have been forced to shut operations.

China urged railway companies to strengthen coal transportation and asked local governments to closely monitor coal supply, demand and inventories at power plants.

There was a two-fold rise in the price of thermal coal as compared to the same period last year, exhausting the interest margin of the power plant operators.

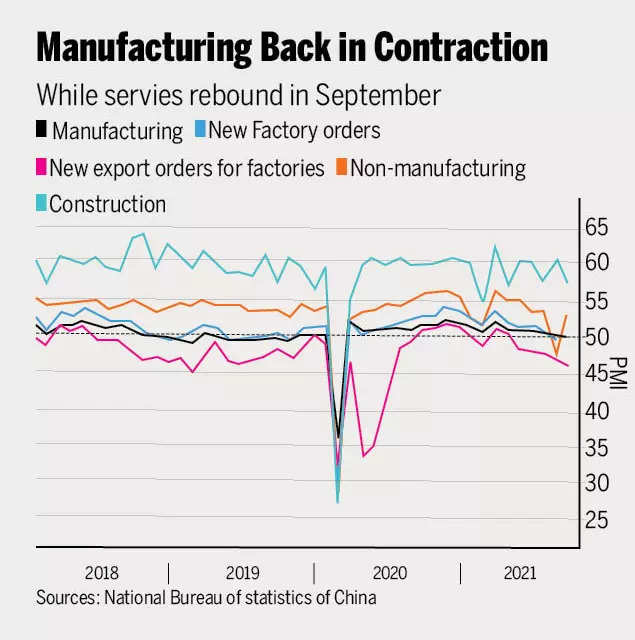

Slump in manufacturing

The power crisis has forced manufacturing firms to curb production as shortage of coal, tougher emission standards and strong demand pushed coal prices to record highs.

Factory owners say the next few weeks are critical as workers rush to meet Christmas export orders, which have already been troubled by the sky-high cost of shipping goods around the world.

"We have many delivery deadlines that have been extended," Lam Cheong Leung, a director at a home goods manufacturer, told AFP. "But even with that we don't know how to resolve the situation," Lam added.

Manufacturing and property investments were the main drivers of growth since the Covid pandemic. However, a crisis in both sectors has forced experts to lower the country's growth projection.

Lowered economic forecast

Restrictions in energy use in the recent months have battered the economy.

Goldman Sachs, in a report, has slashed the country's growth projection from the previous 8.2 per cent to 7.8 per cent for this year.

The report noted that major industrial output cuts caused by power outages add "significant downside pressures".

It also estimated as much as 44 per cent of China's industrial activity has been affected, news agency BBC reported.

Further, a report in the State-run China Daily attributed the shortage of electricity in China to the increase in demand at a faster pace, rise in the price of coal and attempts by local governments to fulfil their emissions cut quotas.

Soaring international debt levels

China has used debt rather than aid to establish a dominant position in the international development finance market, a report by AidData revealed.

Over 40 low and middle income countries now have debt levels of debt exposure to China higher than 10 per cent of their national gross domestic product (GDP).

The country's Belt and Road Initiative (BRI) has left scores of such countries burdened with hidden debts worth $385 billion.

The report noted that China has used debt rather than aid to establish a dominant position in the international development finance market.

Since its launch in 2013, over 13,000 infrastructure projects have been financed through such loans across 165 countries. The total of all such loans comes out to be more than $843 billion.

The loans demanded higher interest rates with shorter repayment periods, AidData report found.

Stock market falls

Stock markets in China have also been struggling under losses as widening power crunch prompted investors to exit sectors that are most likely to shut down operations.

Already under pressure owing to concerns about China's crackdown on a range of industries including tech firms and casinos, Hong Kong stocks sank more than 2 per cent on Monday.

The slowdown in stock markets was also fuelled by real estate firm Evergrande's decision to suspend trading pending an announcement related to a merger or takeover. Shares of the company plunged over 80 per cent this year.

(With inputs from agencies)

Power crisis, manufacturing slump: Key things to know to know about China’s economy - Times of India

Read More

No comments:

Post a Comment