File image

PB Fintech, the operator of Policybazaar and Paisabazaar, will be among three companies that will open its maiden public offering in the coming week, along with SJS Enterprises and Sigachi Industries.

Here are 10 key things to know about the company and the issue:

1) IPO Dates

Investors can start putting in bids for the public issue on November 1. The offer will close on November 3, 2021.

2) Price Band

The price band for the offer has been fixed at Rs 940-980 per equity share.

3) Offer Details

The company is planning to raise Rs 5,700 crore through its IPO that comprises a fresh issue of Rs 3,750 crore and an offer for sale of Rs 1,960 crore by the shareholders that are selling their stake.

The offer for sale consists of sale of Rs 1,875 crore worth of shares by investor SVF Python II (Cayman) and Rs 85 crore worth of shares cumulatively by Yashish Dahiya, Alok Bansal, founder United Trust, Shikha Dahiya and Rajendra Singh Kuhar.

PB Fintech has already raised Rs 2,569 crore from anchor investors on October 29, ahead of IPO.

4) Objectives of Issue

The company will utilise net proceeds from fresh issue for enhancing visibility and awareness of its brands (Policybazaar and Paisabazaar) (Rs 1,500 crore), new opportunities to expand consumer base including offline presence (Rs 375 crore), strategic investments and acquisitions (Rs 600 crore), and expanding presence outside India (Rs 375 crore), besides general corporate purposes.

The offer for sale money will go to selling shareholders including SVF Python II.

5) Lot Size and Investors' Reserved Portion

Investors can bid for a minimum of 15 equity shares and in multiples of 15 equity shares thereafter. Accordingly retail investors are allowed to invest a minimum of Rs 14,700 per lot and maximum investment by them would be Rs 1,91,100 for 13 lots.

Seventy five percent of the total offer is reserved for qualified institutional buyers, 15 percent for non-institutional buyers, and the remaining 10 percent for retail investors.

6) Company Profile and Industry

PB Fintech has built the India's largest online platform for insurance (Policybazaar) and lending products (Paisabazaar) leveraging the power of technology, data and innovation. It provides convenient access to insurance, credit and other financial products and aim to create awareness amongst Indian households about the financial impact of death, disease and damage.

In FY20, Policybazaar was India's largest digital insurance marketplace among all online insurance distributors with 93.4 percent market share based on number of policies sold, and constituted 65.3 percent of all digital insurance sales in India by number of policies sold (including online sales done directly by insurance companies and by insurance distributors).

PB Fintech, which has an asset-light capital strategy, launched Paisabazaar in 2014 to provide lending products (personal loans and credit cards). It was India's largest digital consumer credit marketplace with a 53.7 percent market share, based on disbursals in FY21. Paisabazaar is also widely used to access credit scores, with approximately 22.5 million consumers cumulatively having accessed their credit score through the platform as of June 2021.

The company primarily generates revenues from commission and additional services, and from providing online marketing, consulting and technology services to insurer and lending partners.

7) Financials

The company posted a consolidated loss of Rs 150.24 crore for the financial year FY21, much lower compared to a loss of Rs 304.03 crore seen in FY20. On the other side, revenue from operations had also shown strong growth, rising to Rs 886.66 crore in FY21, up from Rs 771.3 crore in FY20, registering a 15 percent growth.

In the quarter ended June 2021, loss stood at Rs 110.84 crore, increasing from loss of Rs 59.75 crore in June 2020 quarter. Revenue in the same period grew by 35.8 percent to Rs 237.73 crore from Rs 175.02 crore YoY.

Also read - Sigachi Industries IPO opens on November 1: 10 things to know about the issue, company

8) Risks and Concerns

Choice Broking highlighted some risks and concerns including unfavourable government policies and regulations, withdrawal of products from business partners, lower commission from business partners, difficulty in acquiring and retaining customers, declining operational efficiencies, and competition from business partners, which may affect the company's business.

KRChoksey also pointed out some risks, saying any harm to the brand, failure to maintain and enhance its brand recognition or reputation, or failure to do so in a cost-effective manner may materially and adversely affect company’s business and results of operations. "Policybazaar has a history of losses and the company anticipates increased expenses in the future."

9) Promoters and Management

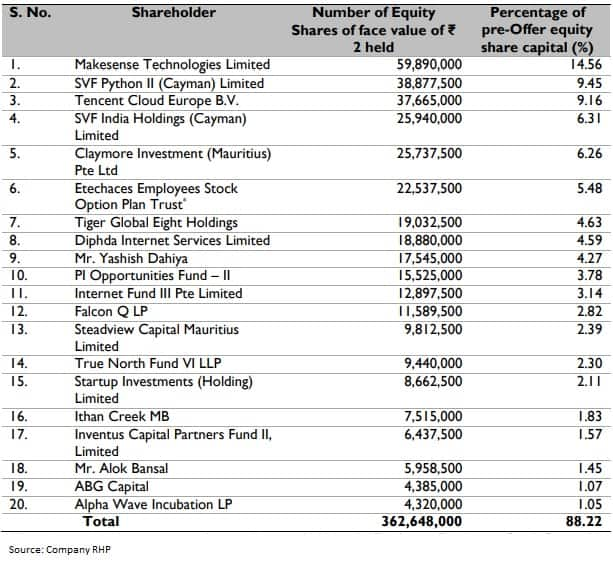

PB Fintech is a professionally managed company and does not have an identifiable promoter. Key shareholders in the company are Makesense Technologies with 14.56 percent stake, SVF Python II (Cayman) with 9.45 percent stake, Tencent Cloud Europe BV (9.16 percent), SVF India Holdings (6.31 percent), Claymore Investment (6.26 percent), Etechaces Employees Stock Option Plan Trust (5.48 percent), and Tiger Global Eight Holdings (4.63 percent).

Yashish Dahiya is the Chairman, Executive Director and CEO of the company, and Alok Bansal is the Whole-time Director and CFO of the company.

Kitty Agarwal, Sarbvir Singh, and Munish Ravinder Varma are Non-executive Directors on the board. Kaushik Dutta, Veena Vikas Mankar, Lilian Jessie Paul, Nilesh Bhaskar Sathe, and Gopalan Srinivasan are independent directors.

10) Allotment & Listing Dates and Grey Market Premium

The IPO share allotment will get finalised on November 10. Investors who turn unsuccessful will get refunds by November 11, and eligible investors will get shares in their demat account by November 12.

The trading in equity shares will commence with effect from November 15. Equity shares will debut on the NSE and BSE.

In the grey market, PB Fintech shares traded at Rs 1,070 and Rs 1,130, a premium of Rs 90 and Rs 150 or 9.2 percent and 15.3 percent respectively over upper price band of Rs 980, as per IPO Central and IPO Watch data.

Kotak Mahindra Capital Company, Morgan Stanley India Company, Citigroup Global Markets India, ICICI Securities, HDFC Bank, IIFL Securities and Jefferies India are the book running lead managers to the offer.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Policybazaar IPO Opens Tomorrow: 10 Key Things To Know About The Issue, Company - Moneycontrol.com

Read More

No comments:

Post a Comment